How to Earn Interest on Crypto With High Yields

Part 1: The Basics of Earning Crypto Interest

Cryptocurrency markets are well-known for their inherent volatility. While this poses nontrivial risks, it also opens up unique opportunities to earn yields and returns that the traditional stock market investor may not even dream of.

These substantial yield opportunities have grown larger and more accessible with the development of the decentralized finance (DeFi) industry. The real game changer has come about with the boom of crypto centralized exchanges (CEXs) and decentralized exchanges(DEXs), both striving to give customers a diversity of financial products.

In this article, we’ll show you how to earn interest on crypto and, more importantly, how to choose investment opportunities that will optimize your yields.

Key Takeaways:

Some vital considerations in maximizing returns on crypto include investing with stablecoins for more stable income, sticking to one platform for higher long-term interest and understanding the type of interest rate.

Understanding your country’s stance on crypto regarding taxes is crucial, as it may impact your total gain.

Bybit offers you seven products for earning interest on crypto: Bybit Savings, Liquidity Mining, Dual Asset, Wealth Management, On-Chain Earn, Discount Buy, and Fixed Rate Loan.

Jargon to Know to Help You Earn Interest on Crypto

Before diving into the best opportunities to earn interest on crypto, let’s cover some of the most important terms used in the crypto finance industry.

Annual Percentage Yield (APY)

Annual percentage yield (APY) is yearly interest that accrues to your investment, taking into account the effect of compounding.

Market Capitalization

Market capitalization is the measure of a crypto’s market value, which is derived by multiplying its current market price by its circulating supply.

Total Value Locked (TVL)

Total value locked (TVL) refers to the total market value of all the crypto funds currently locked in a DeFi platform’s smart contracts.

Bear Market

A bear market refers to a substantial and usually prolonged market decline. Bear markets are characterized by the dominance of selling rather than buying among market players. Blockchain

A blockchain is a decentralized digital network that stores transactions in chains of blocks. Transactional activity on a blockchain is controlled collectively by all of the network’s participants/users. Most of the activity on a blockchain network — exchange of funds between users, confirmation of transactions, and business operations — involves the use of crypto coins.

Proof of Stake

Proof of stake (PoS) is a consensus mechanism used on some blockchain networks for validating block transactions. In PoS blockchains, network users lock a certain amount of their crypto assets on the platform for the right to validate transactions and receive staking rewards.

Crypto Staking

In a broad sense, crypto staking refers to locking crypto funds, both on centralized and decentralized platforms, in order to generate income.

Liquidity Mining

Liquidity mining is a process whereby you deposit your crypto assets in a DEX’s liquidity pool in order to receive rewards in tokens and fees.

Impermanent Loss

Impermanent loss occurs when the price of a deposited asset in a liquidity pool decreases from the time when you deposited it.

How to Earn Interest on Your Crypto

The primary methods through which you can earn interest on crypto are staking and lending. Staking involves locking your funds on a blockchain to help validate transactions, in return for which you earn crypto rewards from the platform. Additionally, some centralized platforms — such as CEXs and liquid staking service providers like Lido — also offer staking opportunities.

Staking, however, has moved beyond its original intent and now often refers to a plethora of investment products on CEXs and DEXs, in which funds aren’t specifically used for blockchain validation.

Lending refers to depositing your funds to lending pools (and sometimes to other types of pools as well) with DeFi lending and borrowing protocols, as well as with centralized crypto lending platforms.

Crypto Lending vs. Staking

When considering lending and staking crypto, of key interest to investors are the security and investment risks involved.

Security

Staking is often viewed as a safer option than lending. After all, staking is a fundamental process on a blockchain network, and is thus well-protected by the overall blockchain security model. If staking fails on a blockchain, the entire blockchain fails, along with all of its decentralized apps (DApps). Due to this critical importance of staking, its safety is secured against all but the most severe hacks.

DeFi lending also takes place on DApps residing on top of the underlying blockchain, which introduces an additional layer of vulnerability. Furthermore, DeFi lending presents some very specific security risks, such as flash loan attacks and rug pulls.

Therefore, staking generally poses comparatively fewer security threats to your funds as compared to lending.

Risk vs. Return Difference

The risk-vs.-return between staking and lending, however, may not be as clear-cut. In general, established lending protocols such as Aave or Compound Finance offer lower interest rates for large-cap, popular cryptocurrencies, as compared to standard staking interest rates. However, some smaller lending platforms might offer extremely high-interest rates, usually for highly volatile, small-cap coins.

As with everything in the world of finance, the higher the rate offered, the more risk the investment carries. The downside risks of investing in very new, “dark horse” cryptos available on some lending platforms might be extremely high. Furthermore, when you use DeFi lending protocols, you’ll also face the potential for impermanent loss, due to the volatility of crypto assets. Nevertheless, protocols usually assist with mitigating the losses by distributing a portion of the trading fees to liquidity providers.

Collateralization

Another important factor in the staking vs. lending comparison is collateralization. On lending and borrowing platforms, borrowers are first required to lend funds to the protocol as collateral for their borrowed amounts. Staking, on the other hand, involves no collateral.

| Staking | Lending |

Security | Relatively more secure (only one point of vulnerability — blockchain) | Relatively less secure (two points of vulnerability — blockchain and the lending DApp) DeFi lending susceptible to flash-loan attacks and rug pulls |

Risk returns | Similar risk, but often higher returns as compared to conservative lending options | Rate of risk-vs.-return depends on the lending platform used Added risk of impermanent loss when using DeFi lending platforms |

Collateralization | No collateral required | Borrowers provide collateral to the protocol |

Staking on Exchanges vs. Staking on Blockchains

If you decide to stake your crypto funds, your two main options will be via CEXs, and/or participation on a blockchain platform, which can be done directly by running a validator node or by joining a staking pool.

Blockchain Staking

Running a blockchain validator node lets you earn staking rewards directly. However, the technical setup and minimum investment requirements are often significant. For example, to run a validator node on Ethereum, you’ll need to download the entire blockchain, be online at all times to avoid “slashing” penalties and run all the requisite software.

Financial requirements for validator nodes are also far from trivial. For instance, Ethereum validators must stake at least 32 ETH (around $89,787 as of Feb 4, 2025).

As an alternative to direct staking, you may join a staking pool such as Lido or Rocket Pool for ETH staking. These staking pool solutions allow users to stake with significantly lower technical and financial commitments. Many ETH staking pools also offer stakers a liquid staking derivative token that represents the staked ETH and its associated rewards, which can be used for various DeFi purposes. However, unlike direct blockchain staking, participating in a staking pool makes you dependent on that pool’s operator.

Staking on CEXs

Instead of staking on a blockchain, whether individually or via a pool, you might consider staking via a CEX. For many crypto investors and users, the CEX route is more affordable, less risky and less technically complicated.

This is largely due to two key factors — the security of your funds, and customer support. Major CEXs are the largest crypto trading platforms in the industry. Their security setups and customer support provide key advantages over blockchains and DApps.

Any potential hacker attacks on a blockchain could lead to potential loss of funds. At the same time, you may use a custodial wallet on a major CEX so that your funds are at lower risk of being hacked. Naturally, CEXs aren’t immune to hacker attacks. However, the larger ones feature cybersecurity as a critical part of their business model. Following the insolvency of one of the world’s leading exchanges, FTX, many major CEXs such as Bybit also include proof of reserves (PoR) to make their holdings entirely transparent to the public. Thus, custodial wallets on these CEXs are relatively more secure as compared to noncustodial blockchain wallets.

Staking on a CEX may also help you access investment products with more stable and predictable rates and terms. For novice investors, it could also be a less complicated way to enter the world of crypto staking.

Additionally, staking on CEXs allows you to use coins that are normally not “stakeable” via a blockchain platform. Blockchain staking only works with cryptocurrencies based on PoS networks. For instance, the world’s largest crypto, Bitcoin (BTC), isn’t based on a PoS network, so it can’t be staked on a blockchain.

| Staking on CEX | Staking on a Blockchain |

Security | More secure, due to the importance of security on established CEXs | Less secure, due to higher risk of hacker attacks |

Customer Support | Readily available | Virtually nonexistent — you’re on your own in case of any problems or inquiries |

Choice of Coins | Wider choice, with the ability to stake coins that normally can’t be staked | More limited choice, as some very popular coins (BTC, DOGE, BCH) can’t be staked |

Best Crypto Staking Coins for Highest Interest

The volatility of the crypto market means that there’s dynamic change when it comes to the best coins for earning interest. Regardless, the best interest rates in the staking game are normally available via CEX staking. Since CEXs offer a wide array of coins and products, there are often great deals available.

CEXs also offer staking for popular stablecoins — such as USDT, USDC, DAI and more — that can’t normally be staked on a blockchain. In addition, some of these coins have great rates on offer. For example, Bybit’s current interest rate for USDT staking is 555%, one of the highest rates in general for staking.

The table below shows the top five coins available for staking on Bybit.

Coin | Current Best APR | Current Market Cap |

USDT | 555% (Limited time only) | $139.51 billion |

GMT | 66.4% | $188.79 million |

ENA | 30.18% | $2.07 billion |

ATH | 21.57% | $251.4 million |

CORE | 5.8% | $507.05 million |

Coins are listed in descending order by interest rates. Interest rate and market cap data are valid as of Feb 4, 2025. (Data source — Bybit.com; Market cap data source — Coingecko.com)

How to Earn Higher Interest on Crypto

Given the volatility of the crypto industry, the key to earning the best crypto interest rates is to keep an eye on the market and source the best deals as they arise.

Invest in Stablecoins

One way to deal with the inherent volatility of crypto markets is to invest using stablecoins. The leading stablecoins — USDT, USDC and DAI — are readily available for staking on exchanges, though not directly on a blockchain.

Stick With One Platform

Some crypto investors, in chasing the best possible rates, move their funds in and out of centralized and decentralized staking and lending opportunities. However, this strategy might backfire, especially with smaller investment amounts, due to the fees involved in withdrawing and depositing your funds on some platforms.

Thus, to earn a higher interest rate in the long term, it’s best to choose a trusted platform in which to stake and hold your crypto, instead of moving your assets around.

Simple Interest vs. Compound Interest

Another important consideration for maximizing your returns is the type of interest rate applicable to a staking or lending product. Some of these pay interest based on APY, while others use the APR calculation method.

The key difference is that APR is a simple interest rate calculation that doesn’t take compounding into account. On the other hand, APY is based on compounding interest. All other things being equal, an APY-based investment will earn you higher total returns as compared to an APR product with the exact same numeric interest rate.

Do Crypto Interest Rates Vary Over Time?

Interest rates on crypto investments do change over time. These changes can be abrupt, and quite substantial. This is particularly true for DeFi lending investments on platforms like Compound, which has algorithmic interest rates that can change within a single day. On the other hand, staking interest rates are comparatively less volatile.

Are You Eligible to Earn Crypto Interest?

Before making your first investment, check your eligibility, as requirements may vary from platform to platform. As the first, obvious requirement, you need to have some actual cryptocurrency funds on hand.

On most established centralized platforms, you also need to satisfy Know Your Customer (KYC) and residency requirements. The residency requirement is particularly relevant for Americans, as some CEXs outside of the U.S. don’t provide service to U.S. residents.

Additionally, you must, of course, do your own research (DYOR) so that you understand the risks and technicalities involved in crypto staking and lending.

Part 2: How to Start Earning Crypto Interest on Bybit

Bybit is one of the leading crypto trading and investment platforms in the world, offering a wide range of interest-bearing products. To start investing with Bybit, you’ll first need to open an account. You can register your new account with Bybit via email and mobile.

How to Buy Crypto on Bybit

Bybit offers you three primary ways to buy crypto on its platform easily. The most straightforward way is the One-Click Buy option, which provides a way to purchase cryptocurrency within seconds, and allows you to pay for cryptocurrency using a range of supported fiat currencies. Accepted payment methods for One-Click Buy include bank card payments and third-party payment channels. The latter option includes a range of third-party providers, such as Mercuryo, MoonPay and others.

Alternatively, you can buy crypto using the Auto-Invest option, which lets you set up a regular investment plan based on the popular dollar-cost averaging (DCA) strategy. When setting up your Auto-Invest options, you can choose the fiat currency used for the payment, the cryptocurrency of your choice, the total purchase amount and the frequency of regular DCA allocations — daily, weekly, bi-weekly or monthly. A great benefit of Auto-Invest is the ability to start your Bybit journey with a defined, conservative and highly popular trading strategy.

You can also choose the P2P Trading option to buy your crypto at zero fees. Bybit’s P2P Trading platform allows two users to enter a transaction to buy or sell crypto and supports over 60 payment currencies. Transactions are between two users, with Bybit simply acting as the mediator during the P2P order execution.

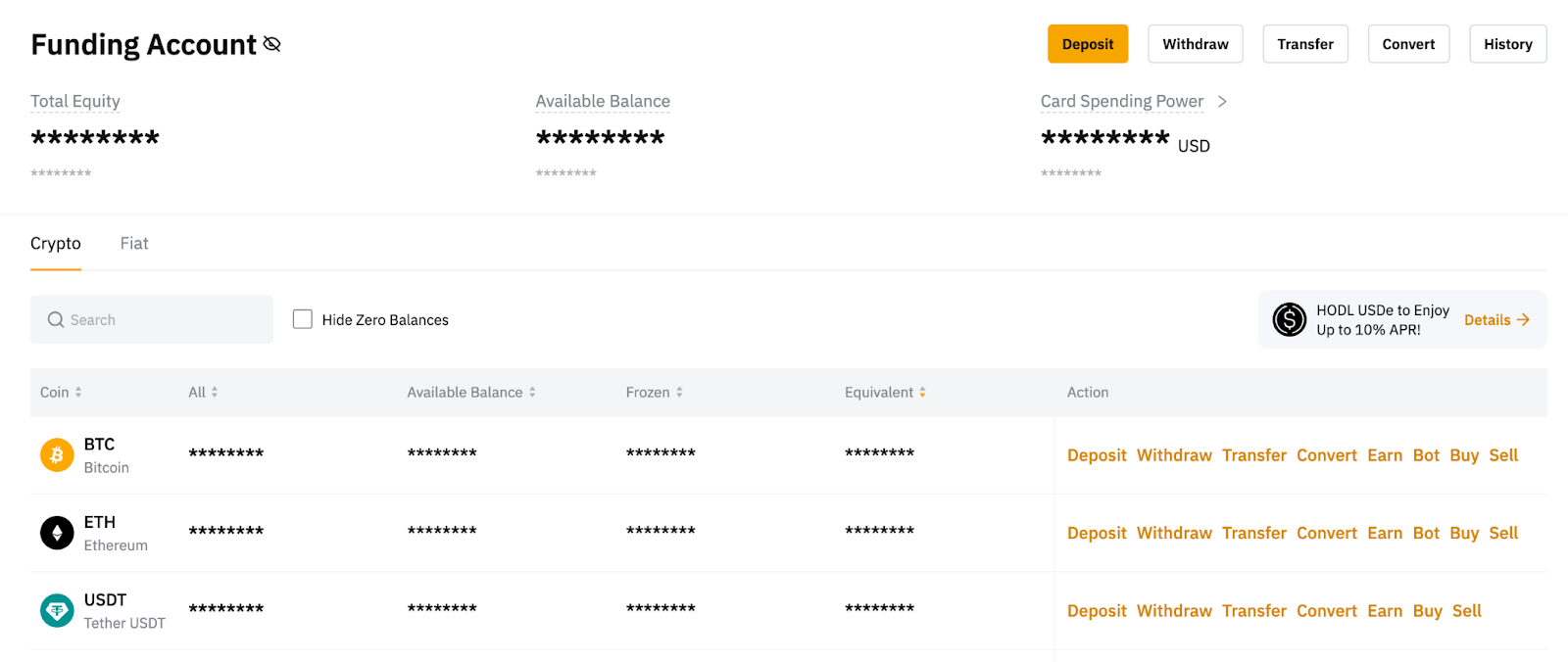

How to Deposit Crypto on Bybit

Besides the abovementioned methods for buying crypto, you can also directly deposit crypto funds into your Bybit account from a variety of centralized and decentralized sources — for instance, accounts on other exchanges, cold or hot wallets, and multisig wallets. To do so, head over to the Assets page on your Bybit account’s homepage. From there, choose the Funding Account section. The available cryptocurrencies will be shown in this section. Click on Deposit next to the crypto you’d like to transfer to Bybit. Note that you’ll need to specify the asset being deposited and the decentralized network — for example, Bitcoin (BTC), Ethereum (ETH) or TRON (TRX) — from which the funds are being sent.

When you click on Deposit, you’ll see Bybit’s deposit address for the chosen crypto. Simply use this as the destination wallet address in your wallet or account on another exchange.

Part 3: 7 Ways to Earn Interest on Crypto With Bybit

There are seven key ways to earn interest or income on your crypto with Bybit. Let’s take a closer look at each one.

1. Earn Interest on Crypto with Staking (Bybit Savings)

Bybit Savings is a crypto staking product that lets you earn competitive APRs over either fixed or flexible investment periods in a range of popular cryptocurrencies, including BTC, ETH and USDT. For flexible-term investments, the hourly interest accrued is distributed to you once a day at 12:30 AM UTC. You can unstake your funds at any time, making this a very flexible option for investors. APRs are determined by the type of coin used and the existing market conditions.

For fixed-term investments, APRs are determined on the day you start staking, and depend upon the type of coin and the chosen investment tenure. Bybit doesn’t charge any management fees for this product.

Bybit Savings users with a VIP1 or higher membership designation are also frequently offered special deals for these investments, such as high APRs on popular Spot trading pairs and region-specific campaign offers.

Staking crypto via Bybit Savings is suitable for those who would like to have guaranteed yields from popular coins, and — in the case of the flexible-term alternative — would like to retain the ability to get their funds back quickly. This is an excellent product for various types of investors, particularly beginners who are seeking guaranteed returns, and those who prefer secure, passive forms of deriving crypto income.

Earn crypto interest with Bybit Savings now!

Pros and Cons of Bybit Savings

Pros | Cons |

|

|

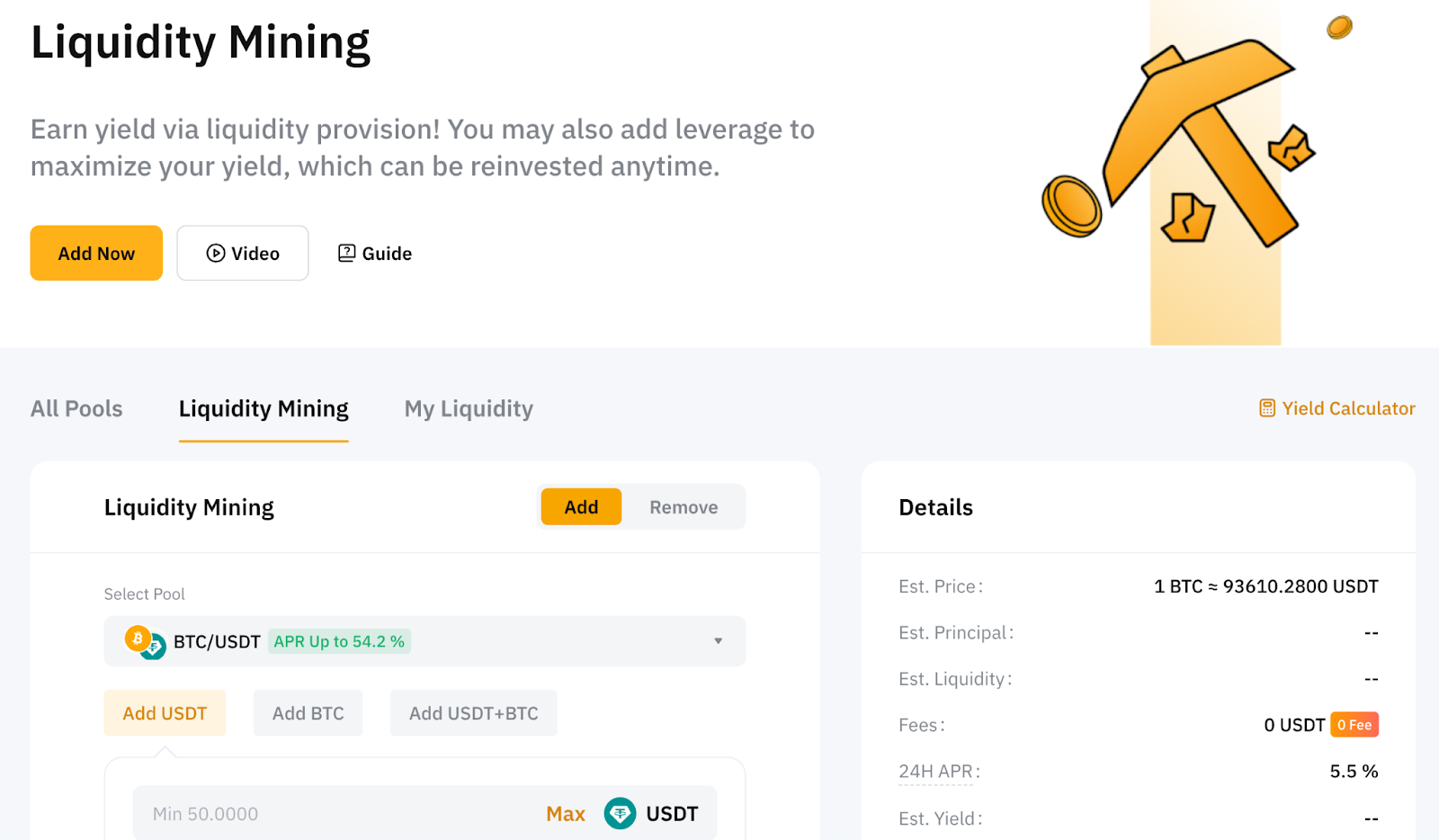

2. Earn Interest on Crypto With Liquidity Mining

Liquidity Mining allows you to invest crypto with Bybit via platform-managed automated market maker (AMM) liquidity pools. These pools represent certain trading pairs, mostly those involving USDT or, in some cases, USDC, and a second asset. The asset paired with the stablecoin is either a high-cap popular cryptocurrency — such as BTC, ETH, XRP or DOGE — or a smaller coin — such as GMX, CATI or similar mid-cap asset.

The lists of available pools and APRs change from time to time. However, high-volume, popular pairs, such as BTC-USDT, ETH-USDT and XRP-USDT, are nearly always on offer.

No transaction fees are charged for adding or removing liquidity, making Liquidity Mining ideal for active multi-pool trading aficionados.

Liquidity mining can be a great way to earn excellent APRs. You can also use leveraged trading to maximize your returns. The product is highly flexible, allowing you to contribute and withdraw liquidity to the pools of your choice at any time.

Bybit’s Liquidity Mining is a suitable product for users familiar with the AMM trading model, and also those who would like to become proficient in this type of decentralized trading in a lower-risk environment.

Earn crypto interest on Bybit Liquidity Mining now!

Pros and Cons of Bybit Liquidity Mining

Pros | Cons |

|

|

3. Earn Interest on Crypto With Dual Asset

Bybit’s Dual Asset product allows you to capitalize on price movements between two assets over short-term periods. It offers superb flexibility and potential for healthy returns, both in low-volatility markets and during times of sudden rate spikes. You’re given a choice of 21 asset pairs and three investment periods: one, three and five days.

There are two product types for Dual Asset: Buy Low and Sell High. For the former option, you can subscribe using the USDT stablecoin, while the latter requires subscription via a non-stablecoin crypto, e.g., BTC or ETH. After your investment period, you’ll earn a return either in USDT or the crypto paired with it, depending upon whether the settlement price reaches a specified target price.

If the settlement price is equal to or above the target price, you’ll earn a return and a principal payout in USDT. If the settlement price stays below the target price, your principal and yield will be distributed to you in the non-stablecoin crypto asset.

Dual Asset is a valuable product for short-term investors who would like to speculate on asset price movements during times of low volatility — when returns elsewhere are going to be limited — and during periods of market downturns, when you might expect crypto assets to lose ground against stable benchmark assets such as USDT.

Earn crypto interest with Bybit Dual Asset now!

Pros and Cons of Bybit Dual Asset

Pros | Cons |

|

|

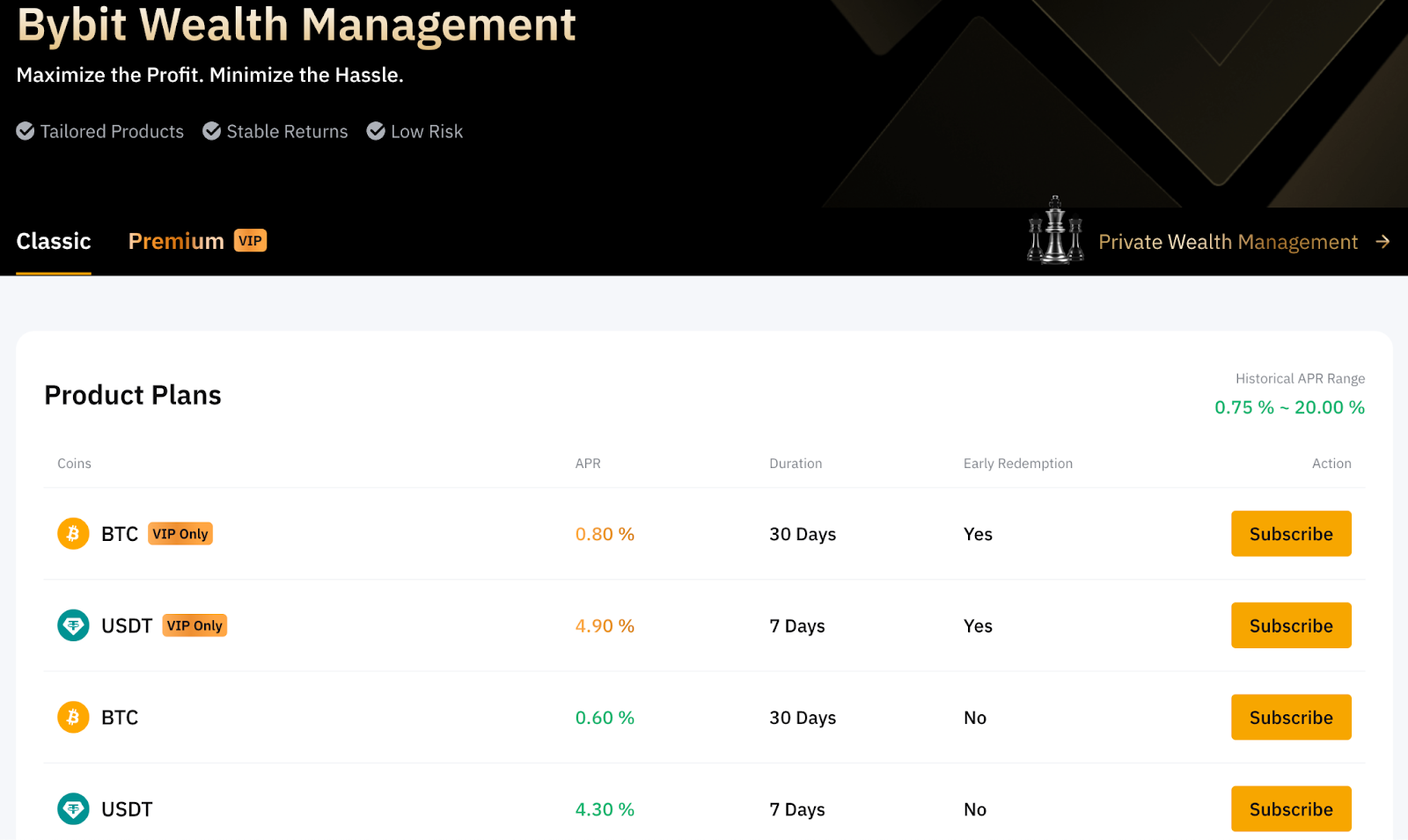

4. Earn Interest on Crypto With Wealth Management

If you have a substantial amount to invest, and would like your crypto funds to be professionally managed for optimal returns, Bybit offers a range of investment options under its Wealth Management services.

At its core, Bybit Wealth Management allows investors to access the services of professional fund managers and enjoy secure investment strategies to earn yields over various short- and long-term periods.

Your funds are managed by strictly vetted third-party fund management providers via investment strategies on Bybit’s Spot and Derivatives markets. High–Net Worth Individuals (HNWIs), VIP customers and asset managers who would like to optimize crypto fund management are the parties who can primarily benefit from Bybit’s Wealth Management plans.

Bybit Wealth Management

Under the standard Wealth Management option, you can select a high-cap cryptocurrency or stablecoin for 7-day or 30-day investment periods. Note: the range of asset options and investment terms may change in the future. Bybit VIPs can further enjoy earlier redemption periods and higher APRs than those of regular users. Third-party fund management entities vetted by Bybit optimize your investment(s) on the Spot and Derivatives markets. All funds stay on the Bybit trading platform, without any transaction moved on-chain.

Earn crypto interest with Bybit Wealth Management now!

Premium Wealth Management

Premium Wealth Management products are also available to Bybit’s VIP-grade clients, and to HNWIs with significant investment amounts. Similar to the classic Wealth Management option, your investment is actively managed by professional fund managers, exclusively within Bybit’s trading environment. Premium Wealth Management products typically offer more diverse and longer-term investment tenure options for up to 180 days. There’s also a higher degree of customization for investment plans, and there are no capacity limits for these products.

Private Wealth Management

Private Wealth Management offers HNWIs personalized service and tailored investment strategies. Fund managers carefully select the best strategies to fit your specific investment needs and maximize returns. As a client, you also get access to exclusive investment opportunities and leading market insights.

The table below outlines the comparative pros and cons of the three investment sections within Bybit Wealth Management.

Earn crypto interest with Private Wealth Management now!

| Pros | Cons |

Classic Wealth Management |

|

|

Premium Wealth Management |

|

|

Private Wealth Management |

|

|

5. Earn Interest on Crypto With On-Chain Earn

On-Chain Earn lets you stake crypto funds directly on blockchain, with Bybit handling all the complexities and technicalities involved in on-chain staking. Staking funds on blockchains supporting the proof of stake (PoS) block validation method can be an excellent way to earn yield while contributing to network security. However, setting up a staking operation on-chain, paying gas fees and taking care of unstaking can all lead to complexities and issues, particularly for users not intimately familiar with blockchain staking.

On-Chain Earn allows you to derive competitive staking yields without the need to manage all of these issues. With just a few clicks, you can start staking popular PoS coins like ETH, SOL, SUI and others. And the best part is that you can unstake at any time, with most of the coins on offer, giving you a degree of flexibility that direct staking on blockchains often lacks, due to various unstaking locking periods.

Earn crypto interest with On-Chain Earnnow!

Pros and Cons of Bybit On-Chain Earn

Pros | Cons |

|

|

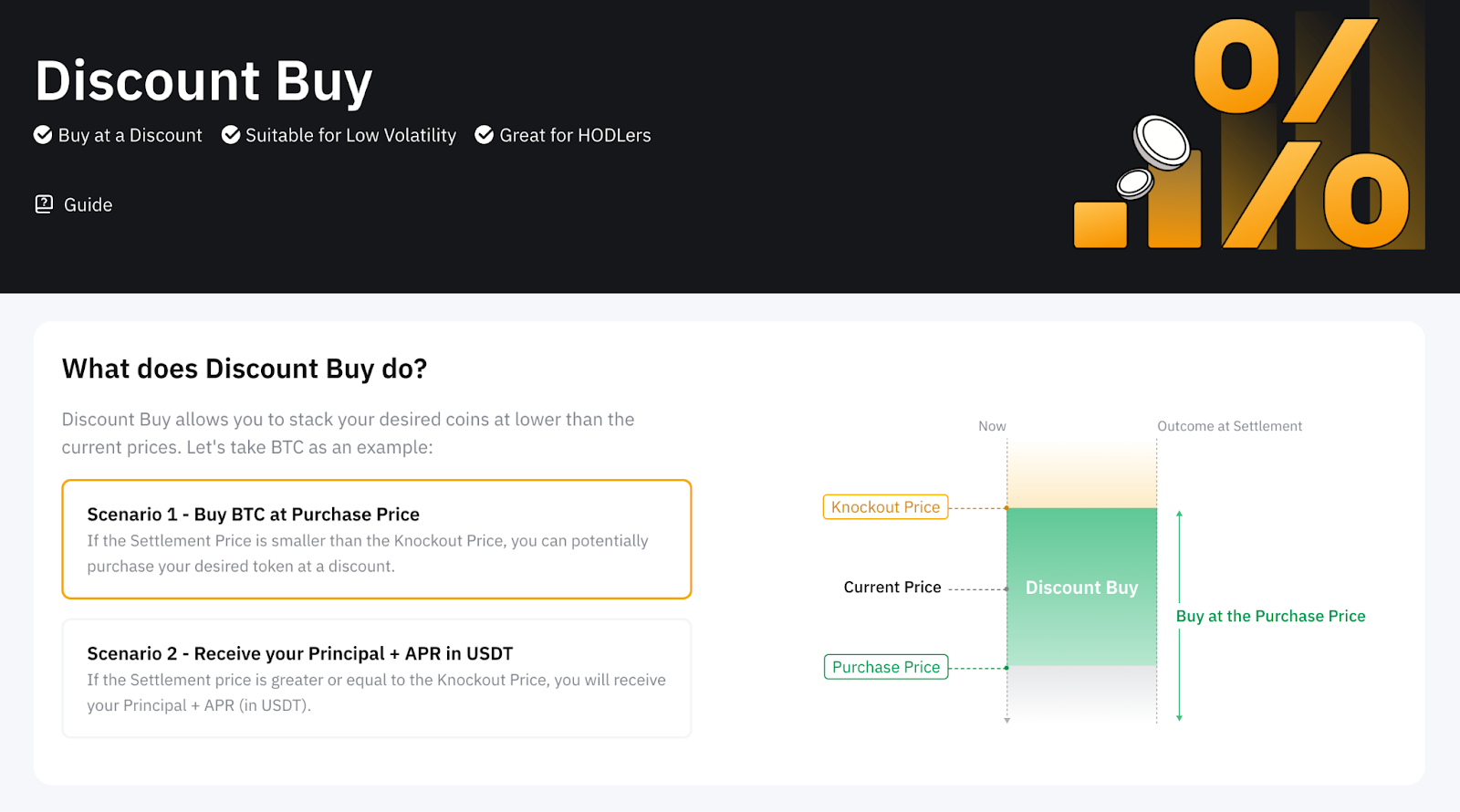

6. Earn Interest on Crypto With Discount Buy

Discount Buy is a product that allows you to purchase popular coins — BTC, ETH or SOL — at a potentially discounted price. You can lock your preferred coin for a specific term determined by each product on offer — typically, for a few days to a month. At the end of the term, if the asset’s settlement price is below the Knockout Price, a price point determined by an algorithm, you can purchase the asset at a discounted rate. If the settlement price is equal to or higher than the Knockout Price, you’ll get your investment principal and a competitive APR in USDT.

Discount Buy is an excellent product for speculating on a high-cap asset price in a low-volatility market.

Earn crypto interest with Discount Buy now!

Pros and Cons of Bybit Discount Buy

Pros | Cons |

|

|

7. Earn Interest on Crypto With Fixed-Rate Loan

You can also earn crypto income by supplying funds on Bybit’s P2P lending and borrowing platform via a fixed-rate loan. The lending and borrowing platform is designed to match crypto borrowers and suppliers, with each one able to set their own preferred borrow or supply interest rates, respectively.

As a supplier, you can lend your funds via the platform for different terms — from seven days to sux months. You can also set your preferred lending rate, though it must be within a certain range set by Bybit. After setting the duration and rate of your loan, you can float it on the P2P platform for a willing borrower to select. Alternatively, you can select from the existing borrow orders. All the loans are overcollateralized to protect suppliers in the case of borrower default.

Supplying funds via a fixed-rate loan can be a useful way to earn secure and predictable APRs while enjoying the stability of Bybit’s trading environment.

Earn crypto interest on Fixed-Rate Loan now!

Pros and Cons of Fixed Rate Loan

Pros | Cons |

|

|

Part 4: Dealing With Your Crypto Interest Taxes

Which Countries Allow You to Earn Tax-Free Interest on Crypto?

Due to its novelty as a financial asset class, many countries around the world haven’t yet introduced taxes on crypto. This applies to the majority of jurisdictions. Unless your country’s taxation authority specifically addresses the issue of crypto income, you may enjoy, at least for now, tax-free crypto income. Some of the most crypto-friendly countries in the world include Germany, Portugal, Singapore, Hong Kong, Malaysia, Switzerland, El Salvador, Malta and Cyprus.

Note, however, that in some of these jurisdictions, crypto income might be taxable if crypto trading is determined to be your principal business activity.

Which Countries Require You to File Crypto Interest Taxes?

Many OECD countries — as well as some of the largest economies outside of the OECD — have explicitly legislated crypto taxes. Below, we’ll briefly cover the current state of affairs in this area as applicable to four economies — the United States, Australia, India and Japan. Crypto taxation laws in these countries are among the least forgiving on the planet.

United States

U.S. authorities tax cryptocurrency capital gains, as well as any non-capital income from crypto, which includes crypto interest income. In the land of the free, your crypto interest income is generally treated as ordinary income and is subject to income tax rules. There are also instances where it may be treated as capital gains — for example when you trade crypto assets, such as NFTs — in which you’ll be taxed accordingly.

Australia

Similar to the U.S., Australia treats your crypto interest earnings as ordinary income, unless you swap assets, in which case you’ll be subject to capital gains tax.

India

Since April 1, 2022, the Indian government charges a 30% flat tax rate on all crypto gains and income. The government applies this tax rule broadly, regardless of the nature of the crypto income. As such, crypto interest is likely to fall under this rule.

Japan

For Japanese tax residents, crypto interest is classified as “miscellaneous income” and forms part of your total taxable income. As a Japanese taxpayer, you’re required to pay income tax on crypto interest earnings at your corresponding tax bracket rate.

Part 5: Pros and Cons of Earning Crypto Interest

Benefits of Earning Interest on Crypto

Earning crypto interest carries numerous benefits. The main ones are as follows:

The ability to generate passive income without having to dedicate time to active trading

Income diversification away from overreliance on stocks, bonds and fiat currencies

Some products — such as Bybit Savings (staking) and Wealth Management (Classic) — are especially suitable for novice investors, as they require minimal monitoring

Products like Bybit Savings and Fixed-Rate Loan offer low-risk, high-yield returns, unlike trading, which typically carries higher risk and market volatility

Ability to earn during bear markets with products like Dual Asset and Discount Buy

Risks Involved in Staking Crypto

Despite its benefits, crypto staking (and crypto investing in general) is certainly not a completely risk-free activity. The key risks include:

Potential price declines for the coin(s) you own. Due to the volatility in the crypto market, your high yields might be offset by a coin’s price decline, leaving you in the red as a result.

Some staking platforms, particularly decentralized ones, have lock-up periods lasting weeks or months, a significant amount of time by the standards of the fast-changing crypto market.

Part 6: Recap of How to Earn High Interest on Crypto

Bybit Checklist: Finding the Best Product to Earn Interest on Crypto

As a recap of our discussion, the following is a summary of the seven key products on Bybit that let you earn crypto income.

Bybit Savings: A low-risk, principal-guaranteed investment with customizable investment periods, particularly suitable for beginning and risk-averse investors.

Liquidity Mining: Provides good long-term yields, with the ability to add leverage to maximize yields. Ideal for experienced traders familiar with leverage and the liquidity mining process.

Dual Asset: Earn one of two different coins, depending upon the market’s direction, by betting on the rate movements of a chosen crypto asset against USDT. Suits short-term, focused swing traders.

Wealth Management: A range of products for HNWIs to earn yields via professionally managed strategies on Bybit’s Spot and Derivatives markets. The classic Wealth Management products are great for shorter-term yields from established coins, while Premium Wealth Management options provide access to longer-term investment tenures, more customization and VIP rates.

Private Wealth Management: Premium yields from professionally managed strategies highly tailored to the specific needs of HNWIs.

On-Chain Earn: Yields from hassle-free on-chain staking for popular PoS coins.

Discount Buy: A great way to buy high-cap assets at discounted rates, particularly in times of low market volatility.

Fixed-Rate Loan: Secure, predictable APRs from supplying crypto funds to borrowers via Bybit’s P2P lending and borrowing platform. Loan overcollateralization — securely managed via Bybit — protects lenders from borrower defaults.

FAQs: Crypto Interest Earning

1. What’s the best way to earn interest on crypto?

The best way to earn crypto interest will be highly dependent on your risk appetite. Naturally, higher yield opportunities come with higher risks. Among the Bybit products detailed above, the highest potential yields are often found in Liquidity Mining (with leverage) and Dual Asset. On the other end of the risk/reward spectrum is Bybit Savings, a product with guaranteed yields for the most risk-averse investors.

2. How do I calculate interest earned on crypto?

APR and APY are the two primary methods of interest calculation. While APR is a straightforward, simple interest calculation method, the formula for APY is more complex. You can use an online crypto APY calculator to calculate APY.

3. Which crypto pays the most interest?

Aside from highly volatile or new coins, the best interest rates are often offered for established stablecoins, such as USDT and USDC.

4. Are crypto staking rewards taxable?

This depends entirely upon your country of residence. Specifically, for U.S. residents, it’s safe to assume that the Internal Revenue Service (IRS) will apply income taxes to your staking earnings, just as it does for crypto interest income. The prevailing consensus is that the IRS is keen to tax anything in sight that has the word “crypto” on it.

#LearnWithBybit