Winning in Any Weather: How to Earn Crypto During Market Uncertainties

In the world of crypto trading, market conditions can change as quickly as the weather. But just like a seasoned sailor who knows how to navigate through either calm or stormy seas, traders can always capitalize on market swings with the right strategies.

Understanding the market landscape and diversifying your trading strategies are key to thriving in both bull and bear markets.

Key Takeaways:

Knowing when to enter and exit the market can make or break your trading career.

It’s important to diversify your trading strategies to mitigate risks.

Learn how Bybit can be your go-to platform for all your trading needs, regardless of market conditions.

Understanding Market Momentum

Before diving into trading strategies, it’s crucial to understand market momentum, the force behind asset prices moving in a particular direction. Traders often use technical indicators to gauge this momentum. Following are some of the most commonly used trading tools.

Moving Averages: There are different types of moving averages, such as simple moving average (SMA) and exponential moving average (EMA). In general, moving averages smooth out price data to create a single flowing line, making it easier to identify the direction of the trend.

Relative Strength Index (RSI): RSI measures the speed and change of price movements, ranging on a scale from 0 to 100. Generally, an RSI above 70 indicates that an asset may be overbought, while an RSI below 30 suggests it may be oversold.

MACD (Moving Average Convergence Divergence): MACD consists of two moving averages. When the MACD line crosses above the signal line, it’s a bullish signal, and when it crosses below, it’s a bearish signal.

The Dynamics of Bull and Bear Markets

Bull Market

A bull market, also known as a bull run, is characterized by an extended period of rising asset prices.

Learn more: When Is the Next Crypto Bull Run? (2023)

Bear Market

A bear market is essentially the opposite of a bull market. It’s a period during which asset prices experience a significant and prolonged decline.

Bull Market vs. Bear Market

To better navigate the complexities of the crypto market and adapt your strategies to the prevailing market conditions, you’ll need to understand the differences between a bullish market and a bearish market.

| Bull Market | Bear Market |

Market Sentiment | Driven by optimism and confidence | Driven by pessimism and lack of confidence |

Investment Strategies | Buying and holding can yield significant returns | Diversification and hedging are used to mitigate losses |

Trading Volume | Higher volume of trades, more buying than selling | Decreased trading volume, indicating caution among investors |

Technical Indicators | Patterns of higher highs and higher lows | Patterns of lower highs and lower lows |

Emotional Factors | Characterized by FOMO (fear of missing out) | Characterized by FUD (fear, uncertainty and doubt) |

Opportunities for Profit | Chance for significant gains through long positions | Chance for profits through short positions, albeit with higher risk |

Learn more: Bullish vs. Bearish Markets: How Are They Different?

Bear Market: The Best Time to Accumulate Wealth

Contrary to popular belief, bear markets offer multiple avenues for accumulating wealth. While many investors shy away from the market during downtrends, savvy traders see this as a prime time to buy.

Lower entry points: Assets are often undervalued, providing a golden opportunity to buy the dip.

Comprehensive risk evaluation: Unlike FOMO-driven bull markets, bear markets offer time for thorough risk and reward assessments.

Accumulation phase: During bear markets, long-term investors typically buy at low prices, anticipating a market rebound.

Portfolio diversification: Reduced asset prices in bear markets enable diversification, which is crucial in the volatile crypto market.

Emotional discipline: Investing in bear markets requires emotional resilience, preparing you for future market volatility.

Learn more: Understanding the Future: Will Crypto Recover?

How to Ride the Market Momentum

Riding the market momentum involves effectively timing your entry and exit points.

News and Events: Keep an eye on major news events that could impact market sentiment.

Sentiment Analysis: Use tools to gauge the mood of the market. Positive sentiment often indicates a bullish trend, while negative sentiment can signal a bearish trend.

Market Trends: Identify the market trend using technical indicators and align your trading strategy accordingly.

While these methods are essential for riding the market momentum, they’re just the tip of the iceberg. Depending upon current market conditions, there are specific strategies you can employ to manage your crypto assets effectively.

Thrive in Volatility: Managing Crypto in Bull Markets

Thriving in the volatility of bull markets requires a nuanced approach that builds upon the foundational strategies used for riding market momentum. Bull markets offer unique opportunities for substantial gains, but they also come with increased volatility that can be both an opportunity and a challenge. For traders who are risk tolerant, Bybit offers a range of products designed to capitalize on the high-reward prospects of a bullish market.

Bybit Derivatives (Leverage & Margin): Ideal for those who understand the risks and rewards of leveraged trading.

Bybit Launchpad: Get early access to new tokens before they hit the market.

ByStarter: A token sale platform that allows you to participate in new project launches.

Bybit Web3 IDO: A decentralized fundraising mechanism that allows you to invest in new projects in the Web3 space.

Bybit Liquidity Mining: rovide liquidity to earn rewards.

Bybit Dual Asset 2.0: Earn returns by holding two different assets.

Survive Through the Winter: Accelerating Crypto Wealth in the Bear Market

A bearish market is characterized by falling prices, and the general sentiment can be negative. However, this doesn’t mean that opportunities for profits don’t exist. In fact, some of the greatest trading victories have been won in bearish markets.

With such reasoning, Bybit offers a plethora of products to help traders and investors accumulate wealth, providing a sense of warmth to brace through the coldest winter.

Bybit Savings: Get guaranteed yields at the most competitive APR in the industry and withdraw your stakes anytime.

Bybit Wealth Management: Bybit helps users manage, plan and invest their digital assets with professional investment strategies for the best investment outcome.

Bybit Options: Industry-led USDC options trading on Bybit offers users Portfolio Margin and Position Builder, designed to lower the margin requirements on hedged positions.

Bybit Spot: Buy and sell over 200 cryptocurrency trading pairs at current market prices.

Bybit Copy Trading: Simply subscribe, automate and copy the Master Trader’s trading strategies to reap profits from the crypto market, even without prior trading experience.

Bybit Trading Bot: Utilize Bybit’s Spot Grid Bot, DCA Bot and Futures Grid Bot to automate buy and sell orders based on preset trading strategies.

Still unsure about your trading strategies? Ask your TradeGPT for recommendations about technical indicators, price movements, market trends and more.

Trading Strategies That Apply Regardless of Market Sentiment

Market sentiment is the backbone of every investment decision, and plays a significant role in determining whether a trader will realize profits or suffer losses.

However, understanding market sentiment alone isn’t enough to ensure success in trading. It forms just one part of the puzzle. The other crucial aspect is adapting trading techniques to align with market sentiment.

The following are the most widely used trading strategies.

Buy and Hold: HODL

This strategy implies that you buy an asset intending to hold onto it for long-term gains. Regardless of price fluctuations, you continue to accumulate the asset. Investors usually deploy the dollar-cost averaging (DCA) strategy to make a consistent investment (rather than a large lump-sum investment) to average out market volatility exposure.

This is one of the most popular trading strategies, not only because it's beginner-friendly but because it applies to all market sentiments — bullish, bearish or even in a neutral market.

Options Trading

Traders use options to hedge their positions so they can open multiple positions and offset risks with a more capital-friendly strategy. Essentially, options traders invest in a contract to sell or buy underlying assets, based on a predetermined price and within a specific time.

Traders favor options mainly for their versatility in most market sentiments, even in a sideways market. Following is a list of how options trading can work in diverse situations.

Bullish Market (Upward Trend)

Call Options: In a bullish market, investors often use call options. A call option gives the holder the right to buy the underlying asset at a predetermined price (strike price) before or on the expiration date.

Bearish Market (Downward Trend)

Put Options: In a bearish market, investors might turn to put options. A put option gives the holder the right to sell the underlying asset at a predetermined price before or on the expiration date.

Neutral Market (Sideways Trend)

Straddle and Strangle: When the market is expected to remain relatively stable or trade within a narrow range, investors can use techniques such as straddles and strangles. These strategies profit from significant price movements in either direction, irrespective of whether the market is moving up or down.

Iron Condor: Another neutral strategy, in which an investor simultaneously sells an out-of-the-money call option and an out-of-the-money put option, while also buying a further out-of-the-money call option and put option. This strategy aims to benefit from low volatility and range-bound price movement.

Learn more: How to Own the World’s No. 1 Crypto for Less

Scalp Trading

Scalping is one of the more traditional yet effective trading methods. Scalpers buy and sell assets for profit with a fast turnaround. This method of trading encapsulates the idea of maximizing profits on smaller trades, and earning quick profits on bid-ask spreads through minor discrepancies in the market.

The scalping strategy applies well in all markets since traders can profit in tight spreads. Because the crypto market is volatile and moves quickly and 24/7, scalping at a high frequency can yield relatively sustainable profits if it's done correctly.

Learn more: 5 Best Profitable Crypto Scalp Trading Strategies

Accelerate Wealth With Bybit Campaigns

Trading campaigns offer traders the benefits of accumulating wealth and exclusive access to events and perks. Let's explore some of the top campaigns currently active on Bybit.

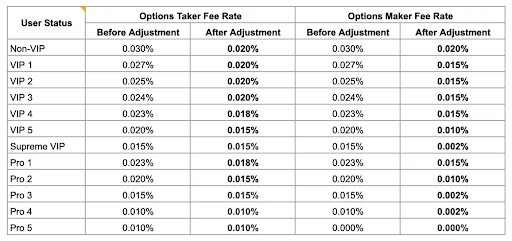

Bybit Options Fees

Enjoy Bybit’s newly optimized Options fees, with maker and taker fees as low as 0.02%. Applies to all USDC Options contracts on Bybit for users of all VIP levels.

Upcoming Events:

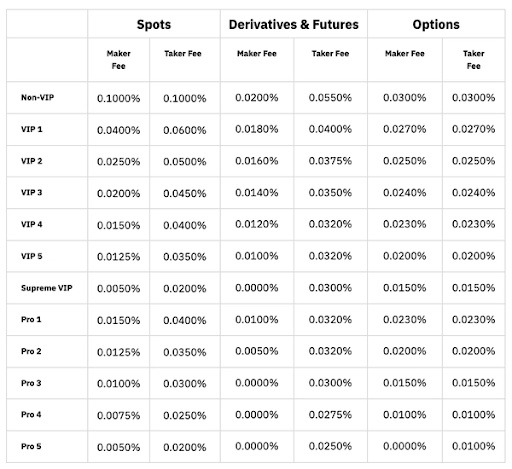

Bybit VIP Rebates

VIP traders can enjoy competitive maker-and-taker trading fees and maximize their net profits on each trade, regardless of trading volume. They can also unlock rebates, higher withdrawal limits and access to exclusive events.

Ongoing Events:

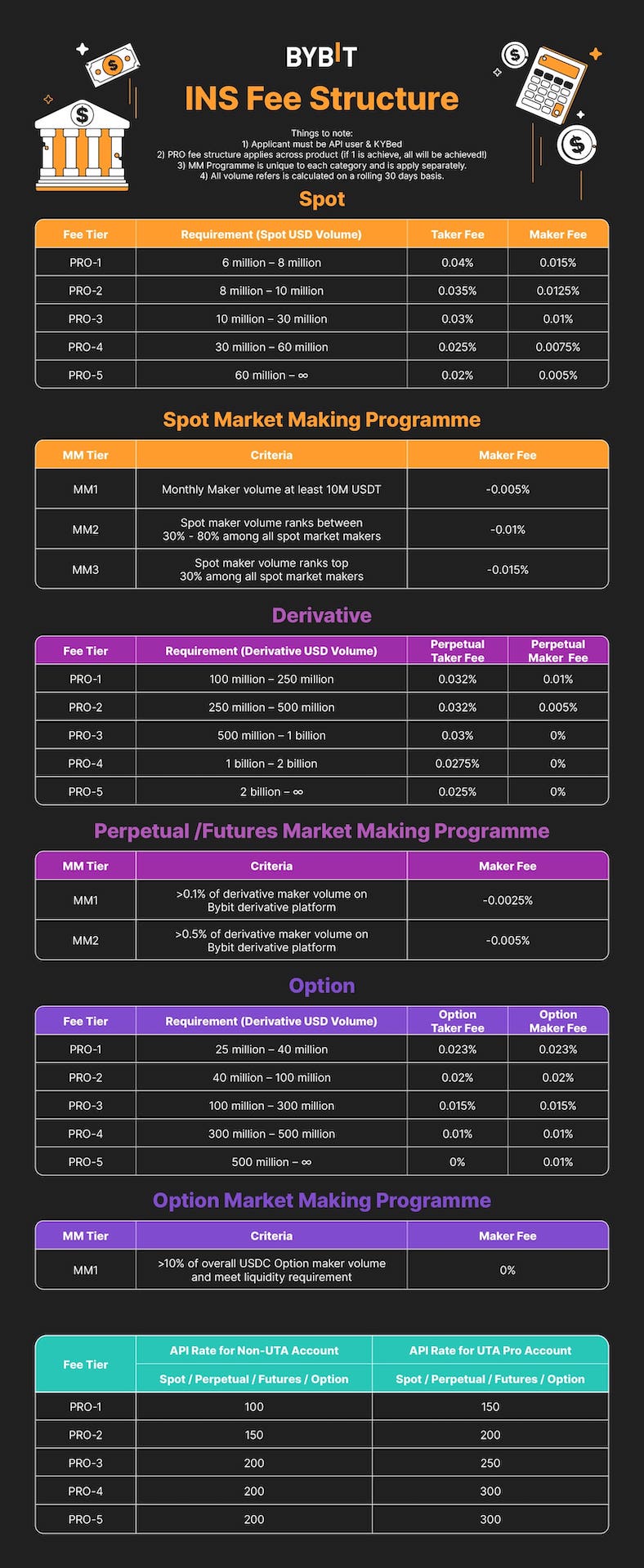

Bybit Institutional Services, Fees and Rebates

All institutional traders enjoy 24/7 real-time security alerts and failproof security strategies, which ensure a safe and reliable trading experience. Bybit features robust liquidity, 99.99% system uptime with a high-frequency trading engine, and industry-leading minimal latency for enhanced trading performance. The newly revamped trading fees for institutional traders aim to provide tailor-made solutions for any trading need.

Bybit Fiat and P2P

Easily and conveniently get your hands on crypto in a safe environment with the most competitive trading fees.

Ongoing Events:

Bybit Card

Maximize your earnings while you spend. Integrate your life with cryptocurrencies to fund your spending on the go seamlessly.

Ongoing Events:

Special Events

Bybit aims to give back to our users and help them accelerate their wealth.

Ongoing Events:

Bybit Community Prediction Draw: Predict MNT Price and Win 400 USDT!

Trade & Win With Derivatives Power Tools: Up to 40% Off Trading Fees

The Bottom Line

Adaptable trading techniques hold the key to ensuring success in trading, regardless of market sentiment. As crypto markets continue to evolve, traders who can quickly adapt their trading techniques to align with market sentiment will be well-positioned to thrive.

Flexibility and versatility help fuel modern traders, who need to navigate the increasingly complex and volatile trading environment. As such, we hope this content provides insights to help you navigate the market’s hurdles.

#Bybit #TheCryptoArk

.jpeg)

.png)

.png)