How to Analyze a Cryptocurrency Using Fundamental Analysis

Investing in cryptocurrencies requires careful research and evaluation of all available metrics. Most projects provide ample information about the purpose of the cryptocurrency, token economics, the team behind the project, and its development to date. Using a combination of quantitative and qualitative factors, you can derive a view of cryptos using fundamental analysis.

A myth among new entrants is that cryptocurrencies cannot be valuated based on fundamental analysis due to high market volatility. However, even though the asset may be subject to the whims of global traders, one can still form an educated opinion on its value.

Understanding fundamental analysis helps you evaluate whether a crypto is worth buying or selling. In this article, we’ll show you how to analyze cryptocurrency using fundamental analysis, including the key factors to consider, and look at how cryptocurrency analysis is different from traditional asset analysis.

Key Takeaways:

Fundamental analysis determines the intrinsic value of an asset. Evaluating underlying information about a crypto project provides guidance on whether it’s undervalued or overvalued as an asset.

When analyzing crypto fundamentally, you should pay attention to various factors such as blockchain metrics, fees, financial metrics and project metrics.

Note: While a cryptocurrency is a digital token issued by a blockchain project, for this article’s purposes, the terms cryptocurrency, project and token are used interchangeably.

What Is Fundamental Analysis?

Fundamental analysis determines the intrinsic value of an asset, or in other words an objective measure of its worth. Evaluating underlying information about a cryptocurrency project provides guidance on whether it’s undervalued or overvalued as an asset. A cryptocurrency that’s undervalued may present a buying opportunity, whereas one that’s overvalued may indicate it’s time to take profits.

Crypto markets are notoriously volatile. Even established currencies like Bitcoin and Ethereum are subject to sudden fluctuation. Investing in newer cryptocurrencies comes with significant risk unless you understand what you’re investing in.

Performing fundamental analysis enables non-technical investors and seasoned traders alike to trade market movements with confidence. Armed with fundamental analysis, traders can create informed strategies with better odds of profitability.

Fundamental analysis is distinct from technical analysis, which is typically used by traders and investors who have an interest in forecasting a cryptocurrency’s market direction through the use of technical indicators such as RSI, MACD and Bollinger Bands®.

How Is Crypto Fundamental Analysis Different?

In 1934, Benjamin Graham and David Dodd published Security Analysis, which is often considered the bible for securities valuation. To this day, investors analyze financial assets using the metrics explained in this classic book. For example, when evaluating stocks quantitatively, you can use earnings per share (EPS) or the price-to-earnings ratio (PE ratio) to determine the intrinsic value of a share.

So far, cryptocurrency isn’t subject to international regulation when it comes to reporting requirements, unlike publicly listed companies that often have to issue quarterly reports using recognized accounting standards. Traditional business metrics, such as liquidity ratios that look at the solvency of conventional companies, are thus irrelevant in the cryptocurrency market. As a result, crypto markets can’t be assessed using the same traditional fundamental analysis indicators used for traditional businesses.

Within crypto markets, all transactions can be publicly “audited” on a blockchain, and the founding team must keep the community informed of their road map. Conceptually, though, investors still need to develop insights into each underlying project. Hence, a different framework has to be set up, with metrics utterly distinct from those used for analyzing traditional markets.

Factors to Consider When Analyzing Crypto Fundamentally

The main goal of cryptocurrency fundamental analysis is to reduce investor risk and evaluate the profit potential of the asset.

Fundamental analysis can be applied in three broad categories.

Blockchain Metrics (On-Chain Metrics)

Blockchain is a valuable resource, providing users with on-chain metrics, or data provided by the blockchain. However, pulling information manually from raw blockchain data can drain time and resources. Fortunately, a range of application programming interfaces (APIs) provide tools to empower investment decisions. Leading crypto exchanges have developed reporting tools that provide an abundance of actionable information, such as the number of active users, total transactions and transaction value.

The most fundamental metrics to a cryptocurrency’s fundamental analysis are hash rate, number of active addresses and transaction count, as well as transaction values and fees.

Let’s take a closer look at how this data grants trading insights.

Hash Rate

Blockchain’s architecture plays a significant role in securing a network, and diving into its data proves to be valuable for cryptocurrency fundamental analysis.

Bitcoin is an example of a cryptocurrency that runs on a proof of work (PoW) consensus. PoW blockchains require crypto miners to solve computational puzzles that verify each transaction while preventing malicious attackers from gaining 51% majority control of the blockchain. Should there be a 51% attack, the controlling entity (the network attacker) would have the power to alter or halt other transactions that don’t belong to them, or to double-spend their own currency.

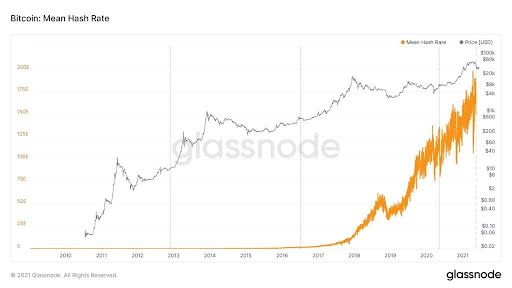

Hash rate is the combined computational power used in mining to perform calculations on a PoW blockchain. It’s estimated based on publicly accessible data, although a true hash rate is never actually known.

Hash rate is viewed by many crypto investors as an indicator of the health of the cryptocurrency in question. The higher the hash rate, the more miners are incentivized to mine for profits and the greater the security of the network. Calculating a personal hash rate can also help miners determine their own profitability.

However, when hash rate begins to decline, miners might begin to find a cryptocurrency unprofitable, leading to “miner capitulation,” which often takes place when markets spiral lower, creating pressure for miners to sell off their hardware. Lower hash rates indicate a loss of interest on the part of investors.

A cryptocurrency’s current price, transaction volume and fees paid are examples of variables that might affect a mining operation's overall expenses. Direct mining costs, like electricity and computing power, must also be taken into account.

Amount Staked

While hash rate is a valid indicator of the health of PoW blockchains, for proof of stake (PoS) blockchains (such as Ethereum) the amount of crypto staked is the metric to look at.

PoS blockchains rely on staked tokens for block validations. Hence, a higher number of staked tokens translates to greater blockchain security.

Active Addresses

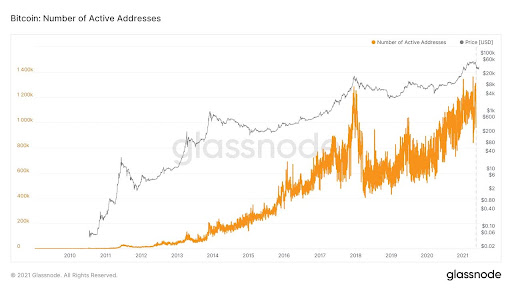

Active addresses measures the number of transacting blockchain addresses over a period of time. One of the simplest approaches is to total the number of sending and receiving addresses over various periods. Tallying active addresses over a period of days, weeks or months compares growth and decline to gauge activity and interest in a coin or token.

Another approach is to total the number of unique addresses within predefined periods, and then evaluate the results.

This metric gives investors a good overview as to whether a cryptocurrency is being consistently used.

Transaction Count

A network's activity can be measured by its transaction count. Investors may observe how activity changes over time by plotting the number of transactions for predetermined intervals (or by using moving averages).

Please note that this metric needs to be used with caution. We cannot rule out that only one party is transferring money between their own wallets to artificially inflate the on-chain activity, as we’re unable to ascertain the identity of certain active addresses.

Transaction Value

Transaction value is a metric that tells investors how much value has been transacted over a certain period of time. For example, if there were five Bitcoin transactions of $250 each, all on the same day, the daily transaction value would be $1,250.

A consistently high transaction value indicates that the cryptocurrency is in steady circulation, while comparisons reveal data concerning potential future market movements.

Within a particular vertical, for example Layer 1s, we might see transaction value reducing for one cryptocurrency, but increasing for another. This is a sign that the market is shifting its attention elsewhere, and could signal a potential increase in the cryptocurrency’s price given the demand and activity on it.

Fees

Fees reflect the demand on a given blockchain, or how many transactions are paying to be added to the blockchain as quickly as possible. Paid fees can be thought of as bids at an auction: users have to compete with each other to have their transactions executed and included on the blockchain. Those who pay higher fees have their transactions confirmed sooner. Hence, higher fees typically indicate a greater demand from users for their transactions to be included on the blockchain.

Ethereum’s gas is an example of fees paid, but every crypto has its own transaction fees.

Fees can also give an idea of how secure a cryptocurrency network is. PoW blockchains typically provide a block reward to miners, who help process transactions and maintain the security of a chain. These block rewards are usually made up of the transaction fees. With cryptocurrencies that have a decreasing emission schedule, such as Bitcoin, block rewards are reduced periodically, in an event known as Bitcoin halving.

When block rewards are reduced, it makes sense to increase transaction fees in order to help miners maintain their profitability. Should the rate of increase in transaction fees not catch up with the reduction in rewards, miners may begin to operate at a loss and choose to drop off the network. This could reduce the security of the cryptocurrency network.

Financial Metrics

Financial metrics of a cryptocurrency gives a good overview of how well the cryptocurrency might be performing as compared to the past, and also gives insights as to its potential future growth.

Market Capitalization (Market Cap)

Market capitalization is the representation of a network’s value. It can be calculated by multiplying the current price by the supply of the cryptocurrency in circulation. However, market capitalization can offer misleading valuations if you fail to factor in other metrics, such as liquidity.

In general, market cap can be used to approximate the growth potential of a cryptocurrency. Some investors believe that cryptocurrencies with lower market cap have greater opportunity for growth compared to those with higher market cap, while others deduce that larger market cap translates to a stronger network effect and infrastructure, which will attract the market’s demand.

Even though forgotten currency, lost wallets and irretrievable keys mean that we’ll never really know precisely how many coins of a given crypto are in circulation, market capitalization offers an approximation for a coin’s network value.

Liquidity and Trading Volume

Liquidity is a measure of how easy it is to buy and sell a cryptocurrency. If a cryptocurrency can be bought or sold quickly without drastically altering its market value, its liquidity is considered strong. A liquid cryptocurrency has many buyers and sellers’ orders waiting to be filled. This, in turn, narrows the bid-ask spread, which is a good measure of liquidity.

With illiquid markets, the problem faced by investors is an inability to sell the cryptocurrency at a “fair” price. This is because there are hardly any buyers willing to make the trade, which will result in two choices for the investors: they can either lower the price at which they’ll sell the cryptocurrency, or wait for its liquidity to increase. However, note that HODLing the cryptocurrency might reduce return on investment over the long term if the price doesn’t increase.

Trading volume is a useful indicator of a cryptocurrency’s ability to sustain momentum. It shows how many units of the cryptocurrency have changed hands over a specific period. If an upward trend in value is backed by a high trading volume, it’s likely that the crypto’s price will continue to increase. Conversely, price fluctuations without significant trading volume may just be blips on the radar.

Circulating Supply

The circulating supply of a cryptocurrency refers to the total number of units in active supply that are publicly accessible. Different from the total supply or the maximum potential supply, the circulating supply isn’t static and can change over time, since cryptocurrencies can be burned or minted.

The emission schedule is something investors can look at in order to make informed decisions. Some cryptocurrencies are deflationary, with supplies that decrease over time. This is attractive to some investors, as they believe that the reduced supply coupled with increased demand from the market will lead to a price increase.

On the other hand, cryptocurrencies that may be highly inflationary, leading to a high circulating supply, might make investors wary because the excessive supply could lead to a decrease in price.

Project Metrics

Project metrics are used to take a qualitative approach to evaluating the performance of a cryptocurrency. They focus on internal and external factors, such as the purpose of the cryptocurrency and how the project operates.

Team

Project websites typically include a list of their team members, whose collective experience can shed light on whether the group possesses the necessary expertise to see the project through to completion.

Some of the things that investors may seek from a project’s team include the following:

Have members ever successfully launched a cryptocurrency?

Have they previously worked on reputable projects — and do they possess the knowledge necessary to meet their anticipated milestones?

Have they participated in any dubious endeavors or frauds? The last point is particularly important, given the number of rug pulls in the crypto market, in which team members run away with funds that have been raised.

Are there any significant or reputable backers or advisors of the project? This can help in assessing the credibility of its team.

Background checks can be conducted through networking platforms, such as LinkedIn.

Should a team insist on remaining anonymous, investors have to exercise discretion as to whether they’re deemed sufficiently trustworthy. It’s extremely difficult to track an anonymous team in terms of their developments and background.

White Paper

The white paper is a technical document that outlines the purpose and operation of a project. It’s the most important of the project’s documents, and should ideally contain the following information:

Blockchain technology solutions

Use cases for the cryptocurrency

Road map, which entails future features and upgrades

Token economics (supply and distribution scheme for the cryptocurrency)

Team Information

Examine the white paper with a good dose of skepticism, and look out for third-party reviews about the project that can be shared through platforms such as Discord or Twitter.

Competitor Comparison

Identifying a project’s competitors within its vertical is critical to evaluating the project’s potential. A project may initially seem to be appealing, but this might not be the case when its’ compared to projects of competitors who might have a better team, differentiating product features or higher level of community engagement.

Product Road Map

Most cryptocurrency projects have a road map for the future, with a timeline for test nets, releases and newly planned features. The road map should offer a clear outline of future developments. Investors can use it to measure the achievement of milestones, and to determine whether the team is performing according to their plans.

Tokenomics and Utility

Tokenomics is the economics of token supply and demand, which drive the value and price of a cryptocurrency. The higher the demand relative to supply, the higher the price. By looking at the token distribution, investors may be able to identify any potential risks. For instance, if only a few people own the vast majority of the supply, they could eventually manipulate the market by dumping all their holdings, causing the crypto’s price to crash.

Tokenomics also includes the incentive structure used to motivate behavior on a network. For example, one prominent tokenomic model that’s been gaining attention is the vote escrow model, in which rewards are used to incentivize crypto users who lock up their cryptocurrency for a period of time. This translates to reduced circulating supply, which plays a part in increasing prices.

The vesting period of a cryptocurrency’s supply must be taken into account. A short vesting period for early investors could result in a situation where they dump a large number of tokens onto the market for profit, leading to the cryptocurrency’s price declining over time.

The utility of a token is something that investors should pay attention to. Some projects create tokens which don’t have much utility. In such cases, the market demand for the token will be low, given that it doesn’t serve a practical purpose. Without market demand for the token, its price is less likely to appreciate.

Development Activity

The team’s development activity can shed light as to whether they’re actively working on the project and are hitting their milestones. Check to see how many contributors there are, and how much activity there is on the project's public GitHub, if it has one. A cryptocurrency whose repository hasn't been updated in two years, or one that gives inconsistent updates, may not be as appealing as one whose development has been consistent.

What Else for Cryptocurrency Analysis?

Quantitative analysis is also a great method for analyzing a cryptocurrency. However, it’s not as helpful in determining its risks, or for aspects that aren’t measurable by a number

Other factors that can come into play in terms of fundamental analysis include government policies, social politics and user behavior.

Government Policies

There have been stricter regulations around cryptocurrencies over the past year amid some of the biggest black swan events, such as the fall of FTX and 3AC’s bankruptcy. Some other prominent examples include Ripple’s (XRP) lawsuit and the sanction of Tornado Cash (TORN). This has caused the prices of XRP and TORN to vary significantly based on the ongoing regulatory changes.

As the U.S. government has taken a more active role in clamping down on certain cryptocurrency verticals, an investor will have to evaluate whether the cryptocurrency they wish to invest in might be affected by any negative regulations.

Sociopolitical Environment

The Covid-19 pandemic gave investors a taste of a truly global crisis and its impact on financial markets. As the pandemic unfolded, all assets, including cryptocurrencies, sold off. Bitcoin crashed 58% from Mar 7–13, 2020. Investors took a risk-averse attitude and fled from speculative assets.

In response to this crisis, governments around the world passed trillions of dollars in stimulus packages. As central banks flooded the system with fiat currencies, investors turned to cryptocurrencies as a store of value and an inflation hedge.

User Behavior

Investor behavior is one of the most difficult factors to evaluate. However, recent times have seen users investing based on key opinion leaders (KOLs), typically individuals with a large following on social media platforms including Twitter, Instagram and TikTok.

Hence, should a cryptocurrency have partnerships with some of these major KOLs, it could be a huge push for their marketing and attract more investors. It’s thus critical for investors to pay attention to the project’s follower count on social media and the amount of interaction they can achieve with their community.

One prominent example of this occurrence is Dogecoin and Elon Musk. Just by tweeting about this crypto (DOGE), Musk is able to send the price of DOGE skyrocketing due to the number of followers he has.

Community

Another metric to look at is a cryptocurrency community’s activity. Successful cryptocurrencies typically have an active community helping each other out in understanding the cryptocurrency. For example, an investor can gain increased knowledge via the community through their Discord or Telegram chat.

Analytical Tools

As the cryptocurrency market has grown, there’s been a proliferation among the analytical tools available for investors to access data.

Charting tools like TradingView, news aggregators, portfolio rebalancing and block explorers such as Etherscan all help in building a data-rich cryptocurrency landscape.

Every Last Drop

With fundamental analysis, investors gain valuable insights into cryptocurrencies. Despite its differences from fundamental analysis employed in traditional markets, the resources available for the cryptocurrency market have been expanding.

Other than fundamental analysis, investors can also use technical indicators to determine opportunities for and monitor investments.