How Much Should You Invest in Crypto? 7 Factors to Consider

If you keep up with financial news, it can often feel like you’re hearing a story about a self-made crypto millionaire every other day. However, smart investors know that the reality is a little more nuanced. The crypto market comes with high rewards, but it also has high risks. To be successful, you need to be willing to do research and make wise choices. This guide will explore one of the most basic things you’ll need to decide on before choosing to jump into the world of crypto — how much you should invest in crypto.

Key Takeaways:

- Crypto refers to an emerging asset class of digital currency stored in a decentralized, cryptographic system. Most types of crypto tokens rise and fall in value based on market demand.

- Figuring out how much to invest in crypto can be even more important than deciding which specific coins you want to purchase.

- Factors to consider when deciding how much to invest in crypto include risk tolerance, profit tolerance, diversification and investment period.

What Is Crypto?

Crypto is short for cryptocurrency, a type of digital asset stored in a decentralized, cryptographic system. Most types of crypto tokens rise and fall in value based on market demand, so they're a popular form of investment.

How Much Should You Invest in Crypto?

Figuring out how much to invest in crypto can be even more important than deciding which specific coins you want to purchase. Not only does the amount you invest in crypto impact your other finances, but it also determines which strategies you can afford to use.

The simple answer to how much you should invest in cryptocurrency is based on your net worth. Someone with millions of dollars can easily risk a lot more than, for instance, a college student without any savings. Traditional investment advice from financial expert Douglas Feldman asserts that people shouldn't invest more than 1% to 5% of their total net worth in cryptocurrency. However, some crypto enthusiasts, such as Erik Finman, suggest it might be wise to invest up to 10% of your income in cryptocurrency.

Factors to Consider When Deciding How Much to Invest in Crypto

There's a lot of variation in guidelines for how much to invest in crypto. To find the right amount to invest for your specific situation, you'll need to stop and consider these essential factors.

Risk Tolerance

One of the most important factors in determining how much to invest in crypto is the level of risk you’re willing to consider, or your risk appetite. If you have a high risk tolerance, you can invest more. Risk tolerance is partially a matter of personal preference. Some people are naturally cautious, while others are more comfortable making risky moves. However, it’s also wise to factor in your age. A high risk tolerance can work well when you're young because gradual market growth over the years will help balance losses. However, if you're older and closer to retirement age, a lower risk tolerance is advisable.

Profit Tolerance

When planning to invest in crypto, it's a good idea to consider the best-case scenario as well as the worst. Ask yourself: What will happen if my crypto assets suddenly skyrocket in price and I make thousands of dollars overnight? If you're the type of person who would throw in more money or keep holding onto your crypto until the bubble bursts, it might be smart to reduce the portion of your money that you invest in crypto. The flashy profits associated with crypto can lead to overly emotional decisions that can cause problems for certain types of crypto investors.

Diversification

Since there's so much variety in cryptocurrency, the types of coins you're holding make a big difference. Not all types of crypto have the same level of risk. If you intend to go for a risky investment portfolio with nothing but meme coins, you probably shouldn't take all your assets and invest them in crypto. However, if you intend to invest in a broad range of reliable coins, especially blue chip cryptocurrencies, allocating more of your assets toward crypto is a reasonable choice.

Investment Period

Things change fast in the crypto world, so the same advice doesn't always work in different situations. Any time you’re going to invest in crypto, you need to take a look at crypto market conditions. In a bull crypto market, prices are consistently high, so you may want to invest less. Meanwhile, in a bear cryptocurrency market, prices are low, and you can often get big returns by putting extra into crypto investing.

Liquidity

Your liquidity refers to the amount of easily accessible cash you have at hand. Crypto markets are fairly liquid, since you can remove your funds at any time. However, since crypto is a volatile asset class, trying to remove your funds during a bear market can lead to considerable losses. Before putting large sums into crypto investing, think about when you'll need liquid cash. For instance, if you're going to need a large lump sum for a house deposit or another big purchase soon, you need to invest less money in crypto.

Personal Budget

Keep in mind that a lot of the recommendations to invest between 1% to 10% of your money in crypto are based on income. However, the reality is that different people have different budgets. Some may need almost all of their income for things like food and housing, so it's not smart to take all your money and invest in crypto. However, others who have more disposable income left over after managing other budgetary needs can invest in crypto more often.

Level of Research

The cryptocurrency market as a whole does follow certain trends, but crypto investments always fare better if you actually understand projects before you invest. It's a poor decision to put a large portion of your assets into obscure crypto you know nothing about. Informed investors only put significant investment into specific cryptocurrencies if they take the time to check out the project, understand its real-world utility, explore its pricing history and see how well it performs on crypto exchanges.

What Is a Good Allocation for a Well-Balanced Crypto Portfolio?

Once you figure out how much money you want to invest in crypto altogether, you need to consider how much money to put into each specific crypto. It's important to have a diversified portfolio, so a single coin running into issues won't tank your entire crypto investment portfolio. There are a lot of different ways to invest in crypto.

The simplest investment advice, as suggested by Techopedia, is simply to put 60% of your money into Bitcoin and 40% into Ethereum. That's a decent choice if you know nothing about crypto assets but still want to invest in crypto. However, if you're willing to research individual coins and pick your favorites, try this asset spread:

- 60% into highly established, non-volatile cryptos like Bitcoin (40%) and Ethereum (20%)

20% into popular cryptos with a market capitalization from $100 billion to $200 billion, such as Solana and XRP

10% into new, trendy cryptos with a market capitalization of less than $1 billion

10% into stablecoins to hedge against volatility and take advantage of yield opportunities through staking and lending

If you are open to some speculative exposure, consider allocating a small percentage (2 - 3%) to emerging sectors like artificial intelligence (AI) and real world assets (RWA).

How Risky Is Crypto?

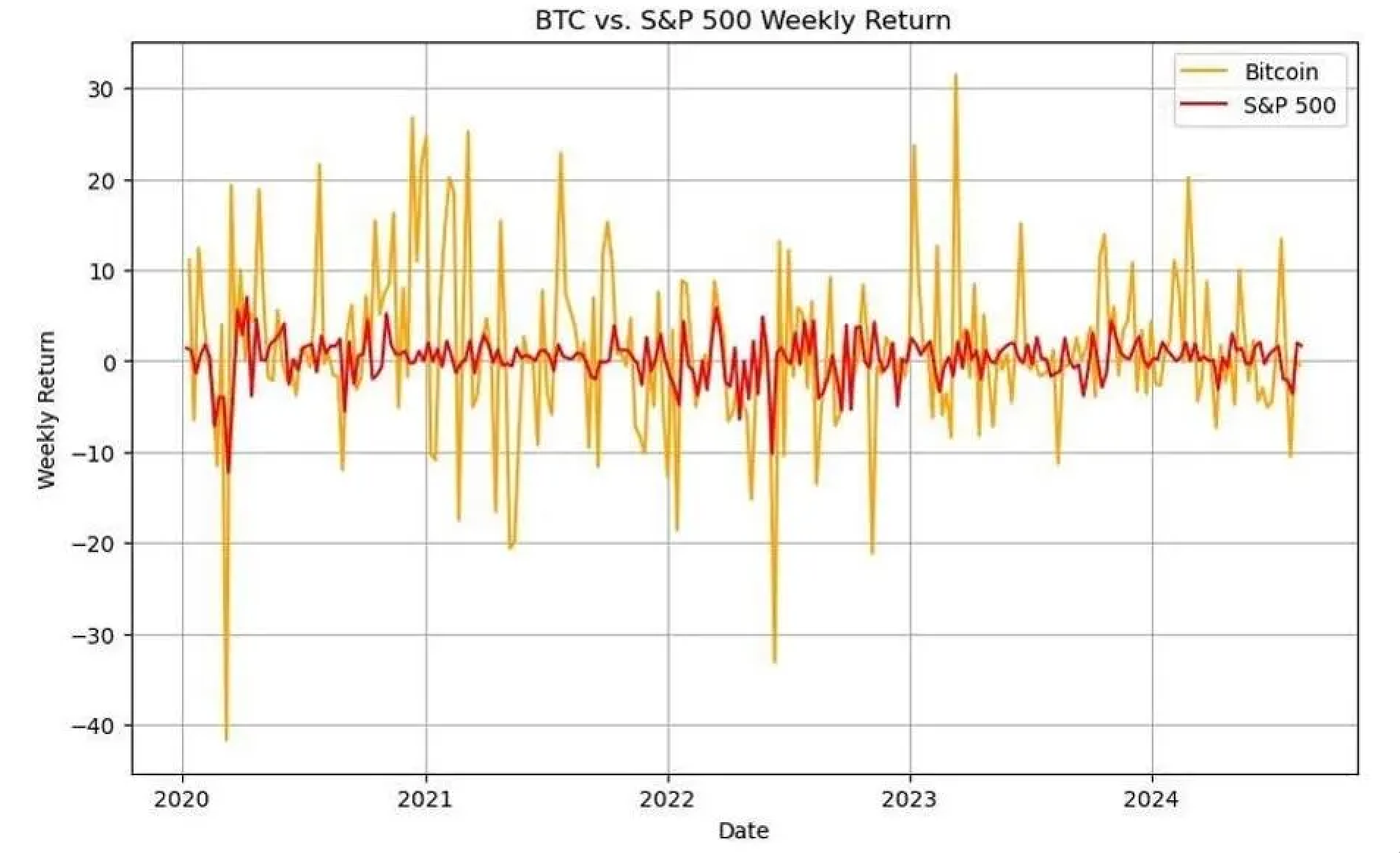

Compared to some other investments, such as bonds, cryptocurrency is considered risky. The 2020 - 2024 chart below, detailing Bitcoin and S&P's weekly returns, reveals the relatively drastic peaks and troughs of Bitcoin in comparison to S&P 500. Notably, Bitcoin recorded a weekly drop of over 40% and nearly 30% rise in 2020, thugh its volatility has declined over the years. In contrast, S&P 500's gains and losses rarely exceeded 10% throughout the entire period.

Despite Bitcoin's drop in volatility, it is still considered relatively risky to invest in crypto because of the market’s significant price fluctuations and the proliferation of altcoins. Additionally, there are countless examples of people who invest in crypto, jumping onto trends and losing their money when prices on the crypto exchange drop. One teacher's story illustrates these dangers: he became interested in crypto during the pandemic and quickly got hooked upon seeing his portfolio values rise. He invested $50,000 into crypto, and eventually built an impressive portfolio worth $300,000. Following a crash, he had only $5,000 left in his account.

Furthermore, crypto markets are still not fully understood by the public, and are less regulated than traditional investments, so it's easier for malicious actors to take advantage of naive investors. For example, crypto-lending company Celsius promised to store customers' assets, but when the company went bankrupt, many users found that the company refused to return their invested funds. A similar issue arose when FTX collapsed, and investors could no longer withdraw funds from their accounts.

Is Crypto a Good Investment?

Despite its risk, cryptocurrency fills an excellent niche in the financial world. When you invest in crypto, it can ensure your portfolio is diversified and insulate you from stock market crashes and other issues with traditional investments. Deciding to invest in crypto is also a valid option when you want to work with some higher-risk investments. Even beginning traders can find it useful to place a small portion of their investment funds into some reliable cryptos.

Furthermore, cryptocurrency allows people with tech expertise to make highly informed decisions. Finding your niche is always a useful investment strategy. Those who don't keep up with manufacturers and foreign currency exchange rates might find that they can specialize by choosing to invest in crypto. If you enjoy learning about the latest tech news and following online memes, crypto investments can be a great way to turn your knowledge into profits.

However, even though it often works well to invest in crypto, you still need to exercise some caution before working with crypto exchanges. If you want to invest in crypto, it's essential to follow the classic rule of, "Only invest the money you can afford to lose." Those who take out loans to buy puts or throw their entire retirement account into crypto can end up losing it all if the markets take a turn for the worse. Like any other volatile asset class, crypto needs to be approached with some common sense.

The Bottom Line

Deciding how much money to invest in crypto is an essential part of your investment strategy. By considering things like risk tolerance and liquidity, you can create an investment portfolio that addresses your unique needs. When you have the right amount of money invested in crypto, you have the potential to make impressive profits without risking all your savings.

#LearnWithBybit