Crypto vs. Stocks: Which Is Better For Investing?

Over the past few years, cryptocurrencies have become a popular and commonly traded asset class. Although the crypto market is still well behind the stock market by size and trade volumes, it has achieved impressive growth in recent years, with many investors increasingly appreciating the unique benefits that this young asset class may deliver. Among these benefits are higher potential returns, with Bitcoin (BTC) having vastly outperformed stocks in recent years; low barriers to entry; diverse choice of assets; and independence from a central controlling authority.

Despite these benefits, many investors are concerned about levels of regulation for both cryptocurrencies and their trade. Having grown accustomed to the tightly regulated stock market, some investors find crypto too risky for their taste. Yet, over the last few years, the levels of regulatory control and oversight applied to cryptocurrency have grown substantially, increasingly blurring the lines between crypto and stocks.

While cryptocurrencies are still less regulated than traditional asset classes, such as stocks, bonds, commodities and forex, they now operate under a much more defined and rigorous regulatory system that allows more investors — including those who have traditionally stuck with the stock market — to take advantage of crypto's unique benefits.

With crypto becoming increasingly accepted as a viable form of investment, many investors and traders are now wondering if trading cryptocurrencies can provide an edge over trading stocks, or any advantages as an accompaniment to trading stocks. In this article, we look at these two major asset classes of modern finance — crypto and stocks — to help you answer these questions with more clarity.

Key Takeaways:

Cryptocurrencies and stocks are major asset classes, each offering their own unique benefits to investors. To diversify your portfolio, it's generally advisable to invest in both asset classes at proportions aligned with your risk tolerance and trading style.

Among the advantages of crypto are higher potential returns, lower barriers to entry and its flexible 24/7 market.

The key advantages of stocks include lower volatility, higher levels of regulation and familiarity for many investors.

What Is Cryptocurrency?

Cryptocurrencies are digital assets issued generally circulated on blockchains — networks whose operations and security are enforced by a decentralized consensus among many (often thousands) of independent network nodes. On these networks, cryptocurrencies are used as the asset directly utilized for facilitating decentralized consensus and on-chain security.

Additionally, cryptocurrencies act as digital currencies for value exchange and storage within individual blockchains. In addition to its on-chain uses, crypto is also utilized beyond blockchain networks as a digital currency available for trading on both centralized exchanges (CEXs) and decentralized exchanges (DEXs).

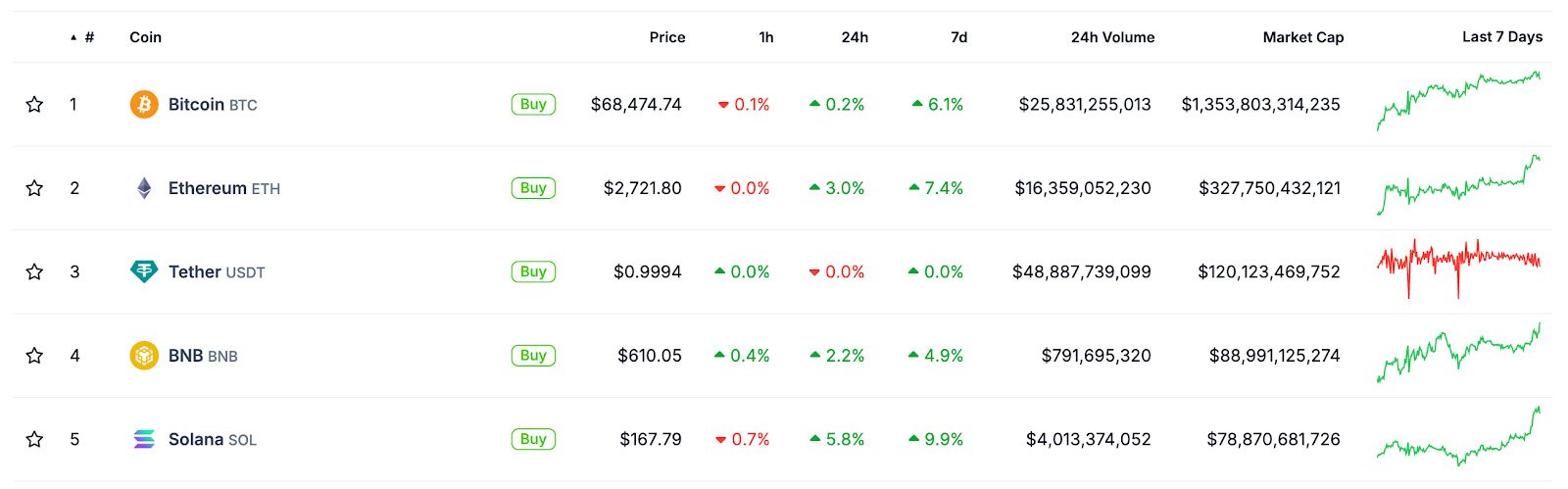

In fact, trading crypto via CEXs has become a major activity for many traders and investors, due to its use of an order book system that greatly resembles that of traditional stock markets. This structure has created a new and vibrant market within the overall finance ecosystem. As of the time of this writing (Oct 21, 2024), the overall market capitalization of all cryptocurrencies stands at over $2.48 trillion, a figure that makes the crypto market hard to ignore.

The Big Two: Bitcoin and Ethereum

The world's first and still largest cryptocurrency asset — BTC, more frequently referred to simply as Bitcoin — was launched in early 2009. While thousands of cryptocurrencies have been introduced in the years following Bitcoin's birth, none has managed to topple the pioneer of the cryptocurrency world. Bitcoin still holds slightly over half (54%) of the $2.48 trillion market cap that makes up the entire crypto market. Native to the Bitcoin blockchain, BTC is used to secure the network's operations, pay for on-chain transaction fees and to store and transfer value.

With close to 13% of the total market cap share, Ethereum (ETH) is the crypto market's second-largest asset. ETH, often referred to as Ether, performs exactly the same essential functions on its own blockchain, Ethereum, as BTC does on the Bitcoin chain — securing the network's operations, acting as a means of payment for on-chain transfer fees and being used to store and transfer value. However, the Ethereum blockchain has an additional functionality that Bitcoin largely lacks — the ability to support decentralized apps (DApps), blockchain-based applications powered by complex programmable logic via smart contracts. ETH, along with the many cryptocurrencies native to these applications, can generally be used for transaction fee payments within the DApps.

The Bitcoin and Ethereum duo dominate the cryptocurrency market cap rankings, together holding nearly two-thirds of the entire crypto market's capitalization.

What Are Stocks?

Stocks are regulated financial assets that grant holders the right to a share of public company ownership. They’re traded on highly regulated stock exchanges, such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE) and Nasdaq-100 (NDX). In the U.S., the primary regulator for stock exchanges is the Securities and Exchange Commission (SEC).

Stock ownership may entitle you to receive dividends distributed by a company, of which you’re a partial owner. However, dividend payments aren't an obligation for a public company, and in many cases, investors don't get this perk for years, if ever. Just ask any stock owner of Tesla (TSLA), a business well-known to have never paid dividends.

Many stock market investors, however, aren't relying on or even expecting dividends from their assets. The typical stock owner is counting on their stocks’ price appreciation to turn a profit.

Stock ownership can also act as an indirect way to invest in a particular commodity. For instance, some investors who want to include gold-linked assets in their portfolios may choose stocks of gold mining companies, such as Newmont Corporation (NEM), Barrick Gold Corporation (GOLD), Gold Fields Limited (GFI) and more.

Crypto vs. Stocks: Similarities and Differences

Similarities

Transactions

Both cryptocurrencies and stocks are traded mostly on dedicated order book-based exchange platforms — stock exchanges in the case of stocks, and CEXs in the case of crypto. A small volume of stock trade does occur outside of exchanges, on both private and over-the-counter (OTC) markets. However, the majority of trade volume in stocks occurs on exchanges. Likewise, a modest proportion (usually around 10 to 15%) of crypto trade takes place on blockchain-based DEXs, with the remaining trade flowing through CEX platforms.

Diversification

Both crypto and stocks can be valuable assets for the purpose of diversifying portfolios. In fact, a popular strategy is to combine these two asset classes to form a well-diversified investment position. Additionally, both markets offer a wide variety of choices for investors. As of mid-October 2024, there are around 60,000 publicly traded company stocks in existence, with the world's largest exchange by market cap (NYSE) listing close to 2,300 of those companies. Meanwhile, the number of cryptocurrencies is far from trivial — approximately 15,000, per data from CoinGecko.

Scams

Both cryptocurrencies and stocks can involve scams and underhanded tactics on the part of the companies and entities behind them. Within crypto markets, rug pulls are the most publicized form of fraud. In a typical rug pull, the cryptocurrency issuer quickly withdraws all liquidity and support for the asset, leaving investors with worthless coins. In the stock market, insider trading — whereby certain investors and groups trade the stock using non-public information that gives them an unfair advantage over other market participants— is a common problem.

Doing your own research before investing in a stock or crypto token is imperative for all investors who wish to avoid falling victim to such scams.

Differences

Risk and Volatility

On average, cryptocurrencies feature a markedly higher level of volatility than stocks. While this reality makes crypto a relatively riskier asset type, it also means higher potential returns. However, that's not necessarily the case in all scenarios. For example, for extended periods of time, certain stocks — particularly in the technology sector — may exhibit greater volatility than the more stable cryptocurrencies, such as Bitcoin.

Regulation

The stock market is heavily regulated, while cryptocurrencies currently operate in an environment with much lower regulatory oversight. It should be noted, however, that in recent years, the level of regulation in crypto markets has gradually increased. Regulatory authorities such as the U,S, SEC are increasingly turning their attention to crypto.

While some decentralization purists in the crypto industry dislike this development, the fact is that increased regulation has allowed cryptocurrencies to enter the financial mainstream via products such as Bitcoin Spot ETFs and futures contracts.

Underlying Assets

Stocks entitle each of their holders to a share of company ownership. The company, including its assets, is the underlying entity owned by the stockholder. In contrast, most cryptocurrencies don't confer part-ownership of the blockchain platform or app from which the crypto is issued. The exceptions to this generality are security tokens, which may mimic the utility of stocks by providing ownership rights with regard to their native crypto projects. However, the full regulatory status of security tokens is still a gray area as of late 2024.

Market Maturity

Stock markets are much older and more mature than crypto markets. The first stock exchanges appeared centuries ago, with the oldest exchange — the Amsterdam Stock Exchange (AEX, now referred to as Euronext Amsterdam)— established in 1602. Since at least the 19th century, trading stocks has been a major component of the world’s overall financial system. In contrast, the first (and now defunct) platforms that facilitated trade in crypto assets — Bitcoinmarket.com and Mt. Gox — emerged only in 2010, about a year after the launch of Bitcoin.

Pros and Cons of Investing in Crypto vs. Stocks

Pros and Cons of Investing in Crypto

The key advantages of investing in crypto include the generally higher potential for returns, crypto’s 24/7 markets and the ability to diversify away from overreliance on stocks. The last point is particularly relevant for investors who tend to concentrate their asset allocations exclusively on stocks and bonds, increasing their dependence upon these markets. Some crypto investors also greatly value the ability to own and trade assets independent of a centralized authority's control.

Among the disadvantages of crypto investment are higher risk/volatility levels, lack of full regulation, and the potential vulnerability of some blockchains to technology hacks. Due to their lower trading volumes than those of stock markets, crypto markets might also be influenced by whales — market participants who control large shares of a certain crypto asset, giving them more leverage to manipulate its prices. The influence of whales is more of a concern for smaller-cap coins than for assets like Bitcoin, Ether or other major cryptos that feature significant trading volumes.

Pros and Cons of Investing in Stocks

Investing in stocks provides advantages such as lower volatility/risk, more regulatory protection, familiarity (for many investors) and a lower incidence of outright scams. The stock market is also solidly established, with a long history of data. This allows investors and traders to apply time-tested trading strategies and approaches.

The primary disadvantages to investing in stocks include their lower potential for returns, their limited trading hours and higher barriers to entry for smaller investors. While you can start trading crypto with minimal investment (literally a few dollars), trading stocks involves higher initial investment requirements, often comes with a plethora of setup and brokerage fees, and may have more stringent identification and qualification requirements, particularly when trading stocks internationally.

Crypto vs. Stocks: Which Investment Is Better for You?

Reasons to Trade Crypto

You can trade crypto to benefit from the potentially high return rates, low barriers to entry and potential to diversify a stock-heavy portfolio. To start your crypto trading, it's recommended you open an account at an established exchange with significant trading volumes and a sufficient variety of assets on offer. As one of the largest CEX platforms in the world, Bybit offers you various ways to trade crypto assets, including spot trade and various derivatives products, such as standard futures contracts, perpetual futures and options.

Reasons to Trade Stocks

You can trade stocks if you prefer the protections offered by a highly regulated market, and would like to stay within the confines of a familiar environment. Note that most investors who believe in the power of portfolio diversification allocate their funds to different asset classes, including stocks, crypto, commodities, forex, bonds and more. Thus, it's rarely a choice of one asset class versus another.

For investors interested in trading various asset classes and using a unified environment, Bybit offers the MT5 account, which allows you to use the USDT stablecoin to invest in commodities such as gold, forex and various stock market opportunities, including gold mining stocks and popular indices like the FTSE China A50, Dow Jones, Nasdaq-100 and Hang Seng. USDT investments under an MT5 account are structured in the form of CFDs (contracts for difference).

Through Nov 8, 2024, opening an MT5 account and trading just 100 USDT will qualify you to participate in Bybit's Gold&FX Quest for a chance to win over 1,000 USDT.

The Bottom Line

Both cryptocurrencies and stocks are highly popular asset classes, with each offering their own unique benefits. Which one you choose largely depends largely upon your risk tolerance, starting capital, understanding of crypto and blockchain technology, trading style and willingness to go beyond familiar investment environments. At the same time, for a savvy investor it's unlikely to be the choice of one or the other. To benefit from risk hedging offered by portfolio diversification, it's always advisable to use both — and perhaps even more — asset classes. At the end of the day, it’s not about which one to choose, but what proportion to allocate to each.

#LearnWithBybit