Top 13 Crypto Passive Income Strategies of 2025

Cryptocurrency has increasingly gained acceptance by investors as an alternative financial instrument for wealth building, particularly as it becomes more regulated and, in turn, less volatile. While many may still associate crypto with active market trading, the growing maturity of the market has led to the proliferation of innovative ways to earn passive income from cryptocurrency.

Let’s take a look at the top 13 cryptocurrency passive income strategies, ranked in terms of their difficulty.

Key Takeaways:

Maximize your profits by employing various strategies to earn crypto passive income.

Among the easiest ways to earn passive income from crypto include PoS staking, crypto savings accounts and crypto asset management.

1. PoS Staking

Difficulty Level: Easy

Staking is a term that usually refers to locking your funds with a proof of stake (PoS) blockchain platform to help validate transaction blocks. In exchange for staking your funds, PoS blockchains pay you rewards in their native cryptocurrency.

Staking is one of the most basic and popular ways to earn passive cryptocurrency income. By staking your funds, you not only earn passive income but also help secure the network against spam and malicious threats.

On many PoS chains, you don’t have to run a full validator node to participate in staking. On chains which use a delegated proof of stake (DPoS) consensus mechanism, any node may use their cryptocurrency to delegate their staking rights to a full validator of their choice through transparent voting and stake allocation.

Your delegated full validator node will process transaction blocks and share the staking rewards with you based on the proportion of your contribution. The delegated mode is a very affordable way for just about any crypto user to derive passive income from staking.

Which Blockchains Support DPoS and Delegated Staking?

Some chains that use DPoS are Tron (TRX) and EOS.IO (EOS).

On some blockchains, delegated staking isn’t supported. Direct staking on these platforms is only possible by setting up a full validator node, with the minimum amount you have to stake often substantial. For example, in order to set up a full validator node, Ethereum requires a minimum commitment of 32 ETH (close to $107,139 as of Jan 26, 2025).

However, depending upon the specific chain, there might be service providers who can help you participate in staking even on platforms without the delegation option. Decentralized apps (DApps) such as Lido (LDO) and Rocket Pool (RPL) offer Ethereum staking services without the onerous requirements of running a full validator node on the chain. These providers let you participate in Ethereum staking beginning with minimal amounts, and even allow you to maintain capital efficiency with access to liquid staking derivatives (LSDs) so you can continue to participate in decentralized finance (DeFi) markets.

2. Crypto Savings Accounts

Difficulty Level: Very Easy

Several CEXs and other platforms specializing in financial crypto services offer interest-bearing crypto accounts, which are quite similar to standard interest-bearing fiat accounts at banks. Basically, the crypto funds that you deposit will be used by the platform to lend, stake or invest, with the profits earned paid to you as interest.

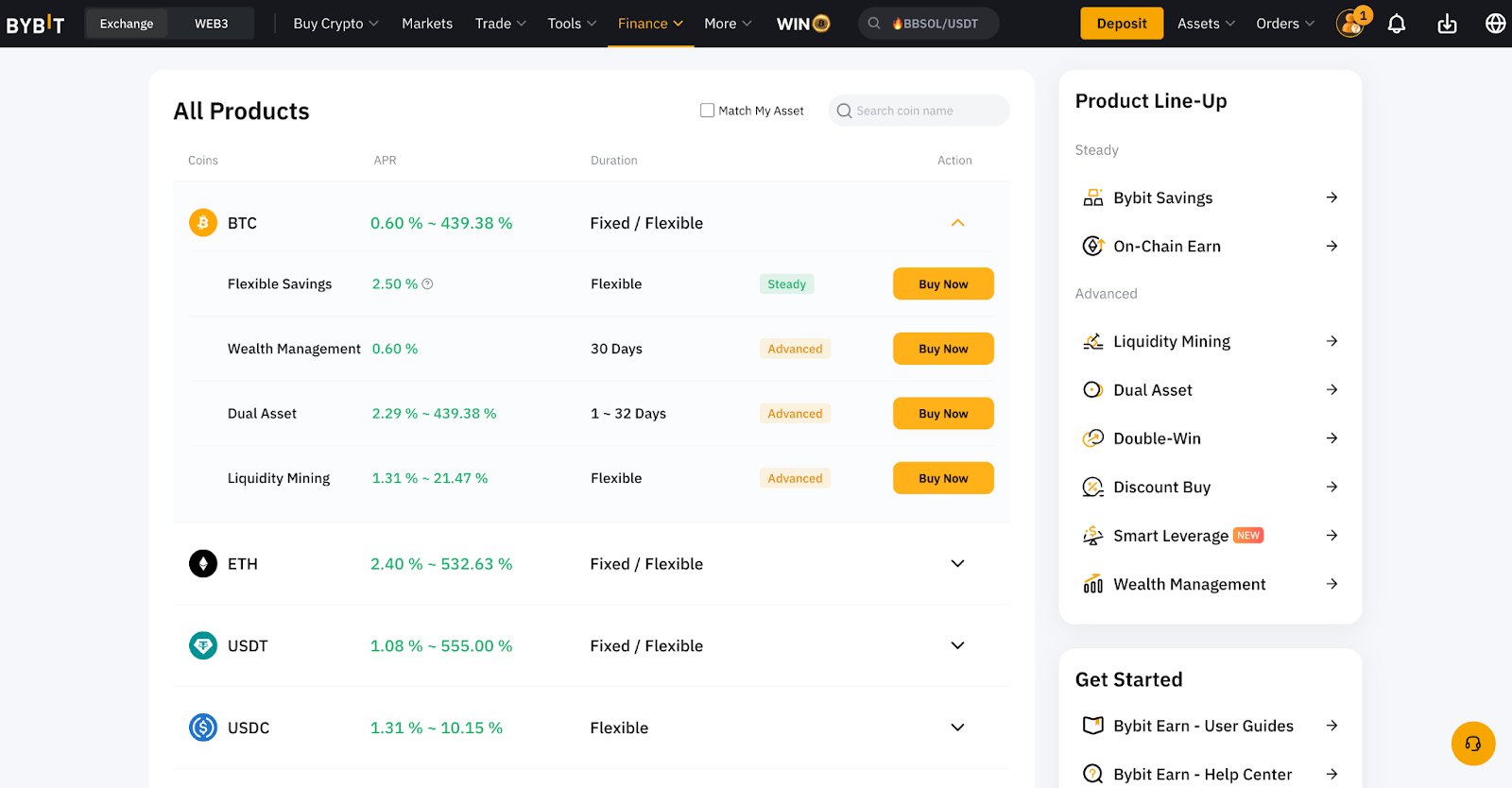

Bybit offers a crypto interest account, Bybit Savings, which provides great staking rewards as well as seasonal exclusive offers.

3. Crypto Asset Management Services

Difficulty Level: Very Easy

With the vast numbers of cryptocurrencies and the complexity of crypto, it’s natural that asset management services will also spring up to cater to investors looking for a more professional approach to their investments. Crypto asset management platforms can help you manage your crypto investments in a single portfolio, without the need to monitor your assets across multiple wallets and platforms. In addition to having your crypto assets managed by professional asset managers, some platforms also offer tools to help automate your asset management process.

Bybit offers three types of crypto asset management services for different investors:

Bybit Wealth Management is a low-risk service that helps you stake your assets on the platform and grow your wealth within periods as short as seven days, via risk-neutral strategies employed by trusted third-party traders.

Premium Wealth Management is an exclusive feature for Bybit VIPs, offering stable long-term, fixed-interest investment options of up to 180 days. VIPs also enjoy customized wealth plans and institutional-level risk management features with Premium Wealth Management.

High–net worth clients can enjoy even more exclusivity with Private Wealth Management, which features tailored investment allocation, greater flexibility and professional guidance to maximize profits.

4. Bybit Earn

Difficulty Level: Very Easy to Hard

Bybit Savings and Bybit Wealth Management are just some of the many cryptocurrency investment products from Bybit Earn, a great resource for earning passive cryptocurrency income. Some of the additional ways you can earn passive crypto income from Bybit include the following:

Depositing your funds for flexible periods to earn interest (Bybit Savings)

Liquidity Mining

Management of your crypto asset portfolio (Wealth Management)

Blockchain staking (On-Chain Earn)

Bybit Earn helps you access all of these cryptocurrency income generation opportunities in one place. The services within Bybit Earn are tailored to the needs of all types of investors, from beginners to hardened yield farmers sporting calluses from years of crypto harvests. So don’t worry if you’re a beginner in the cryptocurrency space — because Bybit Earn offers a simple onboarding experience for you to kick-start your journey.

5. Airdrops

Difficulty Level: Very Easy

An airdrop is the distribution of a protocol's native cryptocurrency to its community. One prominent example would be the recent Sonic SVM (SONIC) airdrop in late December 2024, in which the SONIC token was distributed to users who have interacted with Sonic SVM, a gaming-focused Layer 2 network on Solana, via TikTok (including the SonicX tap-to-earn game).

By completing just a few steps, users may qualify for an airdrop. To track upcoming airdrops, use resources such as Airdrops.io and Airdrop Alert.

For a user-friendly way to earn airdrops, check out Bybit Web3 Airdrop Arcade, an airdrop aggregator that gives you easy access to airdrops from promising crypto projects. Simply create a Bybit Wallet so you can participate in airdrop programs and complete simple tasks to win exclusive airdrops at no cost.

6. Dividend-Earning Tokens

Difficulty Level: Very Easy

Dividend-earning tokens are cryptocurrencies that have some regular dividend rewards for their holders built into the token’s functional mechanism. For example, the largest dividend-earning crypto by market cap, VeChain (VET), generates dividends in the form of another token on a related platform, Thor (VTHO). The more VET you hold, the more VTHO rewards you earn.

Another example would be KuCoin Shares (KCS), whose KCS holders receive a share of the transaction fees earned by the KuCoin exchange. Distribution is proportional to the amount of KCS held by users.

7. Play-To-Earn

Difficulty Level: Easy to Medium

A fun way to earn passive income is through web3 games. Play-to-earn games first sprang into the limelight in 2022 with the introduction of Axie Infinity, whose players can earn crypto through in-game activities.

Web3 gaming has experienced a resurgence with the rise of tap-to-earn games, popularized by viral Telegram-based titles like Hamster Kombat and Notcoin in 2024. These games streamline web3 game mechanicsby addressing the criticisms of earlier titles that heavily relied on earning potential at the expense of engaging gameplay — often resulting in a dull and tedious gaming experience. Tap-to-earn games not only allow users to easily earn crypto by tapping on the screen, but also offer more engaging gameplay by incorporating many side quests and interactive tasks.

8. Cloud Mining

Difficulty Level: Easy

Mining cryptocurrency on blockchain platforms is a great way to earn crypto income. However, the typical mining operation requires you to purchase expensive hardware to mine crypto profitably. Cloud mining allows you to participate in crypto mining without the need for such equipment. This removes the technical expertise associated with mining and allows the broader market to participate, earning themselves a passive income.

With cloud mining, you pay a regular monthly or yearly fee to a service provider for the opportunity to “rent” their mining resources. In exchange for this fee, the service provider mines crypto using the resources you’re renting and pays you a proportion of the mining rewards. One of the most popular cloud mining service providers is Genesis Mining.

9. Crypto Lending

Difficulty Level: Medium

Crypto lending is another popular avenue for users who want to earn passive income. You simply deposit your cryptocurrencies into protocols to be loaned to borrowers. In return, this loan will be rewarded in the form of interest. Two main types of protocols lenders can interact with are decentralized lending and real-world asset (RWA) lending.

Decentralized Lending

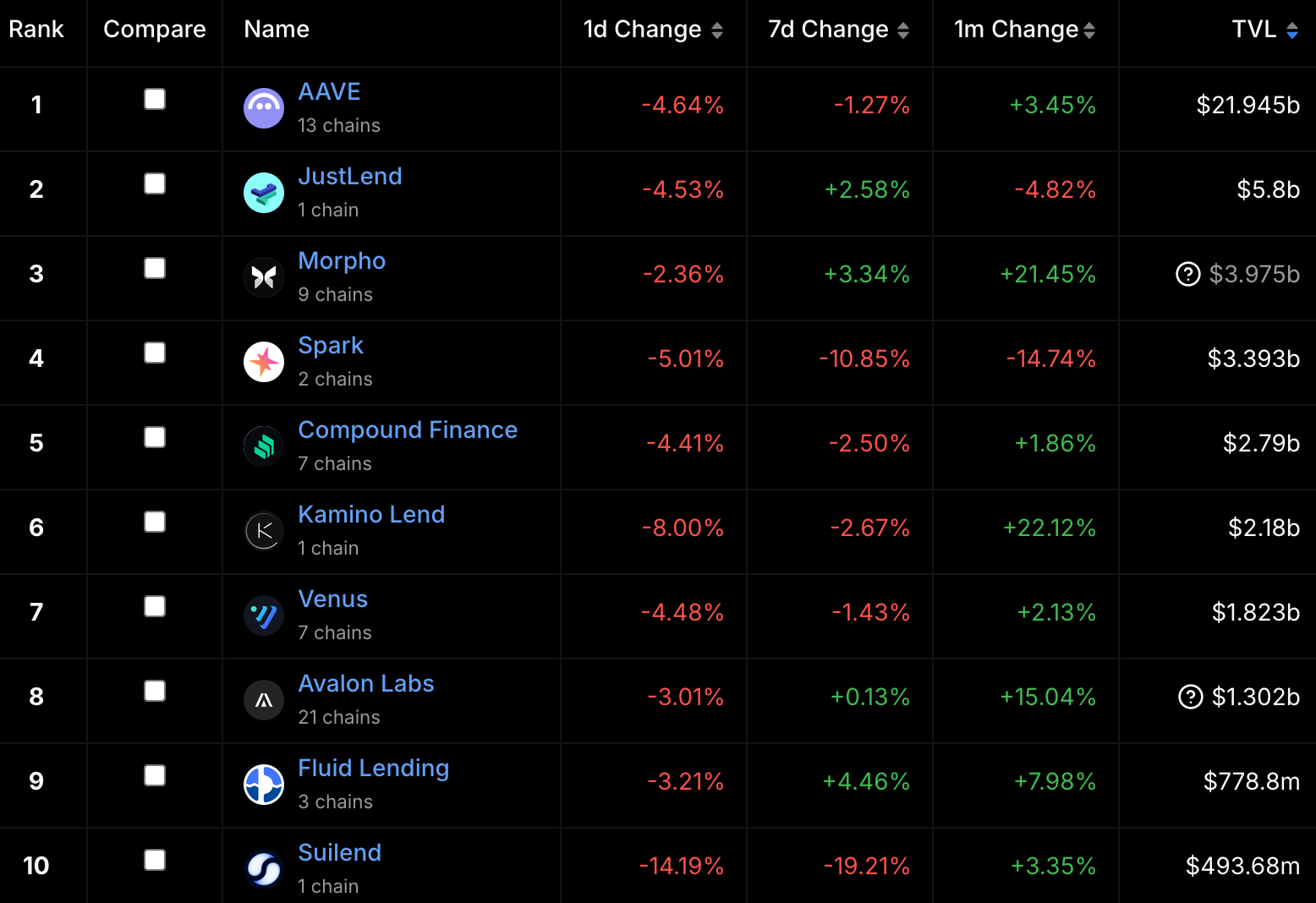

Let’s start off with the most common type of pool: Decentralized lending and borrowing protocols. You deposit your funds into these pools as a lender to the protocol, and earn interest from your investment. The leading protocols in this niche include Aave (AAVE), JustLend (JST) and Morpho (MORPHO).

Below are the top 10 lending and borrowing platforms by TVL as of Jan 27, 2025:

Most of the well-known decentralized lending platforms algorithmically maintain enough liquidity on their platforms, based on the amounts loaned and borrowed and collateral provided for the borrowed funds. With proper transparency, this ensures that the funds users have lent to the protocol are safe, and that the decentralized lender always has enough liquidity to meet its loan obligations.

Tokenized Real-World Assets (RWA) Lending

Users can also choose RWA lending protocols where their deposits will be borrowed by real-world businesses that generate cash flow. These businesses are typically whitelisted by a team of auditors to ensure their credibility before they can qualify as borrowers. Hence, lenders have more assurance, given that the risk of default is reduced through such checks. Similarly, lenders are rewarded with the interest fee.

Prominent protocols within this vertical are Goldfinch (GFI), Maple Finance (MPL) and Centrifuge (CFG).

10. Crypto Affiliate Programs & Crypto Referral Programs

Difficulty Level: Medium

Affiliate programs have been an important part of companies’ marketing strategies for decades and have received a significant boost with the arrival of the internet. Now, a variety of websites and crypto platforms have adopted the affiliate marketing model based on crypto. By referring a user to these websites and platforms you can earn crypto income.

If you run a blog with a good number of regular visitors, or if you’re a social media influencer in your niche, crypto affiliate programs might be a great way for you to earn passive income. Some of the most popular crypto affiliate programs in the industry are offered by Bybit, Paxful and CoinLedger.

Other protocols have also kick-started their referral programs, allowing users to receive discounts, rebates and rewards. Examples include Bybit, GMX (a spot and perpetual DEX) and Transak (an on-ramp protocol).

11. Liquidity Mining

Difficulty Level: Medium to Hard

A popular form of cryptocurrency passive income among DeFi users is liquidity mining, in which users provide liquidity to cryptocurrency swap pools on DEXs. Once they’ve provided liquidity, users are known as liquidity providers (LPs) and are issued an LP token, typically a synthetic asset which may be reinvested to other platforms to earn even higher yield.

Users who participate in liquidity mining are depositing their cryptocurrencies into pools that represent a pair of cryptocurrencies (e.g. ETH/DAI). These pools make it possible for users to swap their cryptocurrencies.

In most cases, you’ll deposit an equal value of both cryptocurrencies to become an LP (e.g., $1,000 worth of ETH and $1,000 worth of DAI), which in turn helps to maintain adequate liquidity for automated market maker (AMM) DEX operations.

When the exchange has deeper liquidity, those using the AMM DEX may receive the cryptocurrency of their choice at better rates. To reward LPs for this, a proportion of the swap fees paid by users are rewarded to LPs, to be distributed based on the share of funds in the pool contributed by each LP. It’s crucial to note, however, that liquidity providers are subject to risks, such as impermanent loss and slippage.

How to Earn Passive Income Through Liquidity Mining

Keen on earning passive income from liquidity mining, but not familiar with the DeFi market? Bybit Liquidity Mining is a good way to learn more about this unique DeFi process, while enjoying the security of a centralized exchange (CEX). Bybit’s liquidity pools are based on the AMM model provided by Bybit itself. Simply add liquidity to a pool and become a liquidity provider in order to earn yield from Bybit’s trading fees.

The largest AMM DEX to help popularize the liquidity pool model (as well as one of the oldest) is Uniswap (UNI). Other prominent platforms on which you can earn passive income from swap pools include Curve (CRV), PancakeSwap (CAKE) and Aerodrome (AERO).

Below is a graphic of the top 10 DEXs by total value locked (TVL) as of Jan 27, 2025:

12. Yield Farming

Difficulty Level: Medium to hard

Another popular way to earn passive crypto income among DeFi users is Yield farming, the practice of depositing your cryptocurrencies into yield-generating pools on DeFi platforms to earn interest. However, given the wide variety of DeFi protocols and pools, it may require more research and active management of funds as compared to staking because the returns given by such protocols tend to fluctuate based on the number of participants. Hence, at times it may not be too profitable for yield farmers (individuals that participate in yield farming).

Yield farming may sometimes require users to participate more actively to select the kind of protocols they wish to farm. Alternatively, users can choose to participate in liquidity pools run by various yield protocols. These are known as yield aggregators, automatically investing users’ deposits across a variety of income-generating DeFi sources. Aggregators remove the need for users to actively shift and allocate their funds across different yield protocols, while still being able to earn interest for depositing funds. Examples of such yield aggregator protocols are Yearn Finance (YFI) and Convex Finance (CVX).

13. Masternodes

Difficulty Level: Hard

A more advanced way to earn passive income while helping to secure a blockchain network is through running a masternode, a server that provides operational support to the network. Besides helping maintain the security of its blockchain, masternodes participate in governance, facilitate instant transactions and enhance the privacy of transactions.

However, to successfully operate a masternode, you’ll need technical expertise (to set up the node), and you’ll also be required to stake a substantial amount of crypto within the network. Furthermore, while you may not need to constantly be involved in maintaining the network, you’ll still need to occasionally monitor the network’s conditions and maintain the node’s uptime.

Advantages of Earning Crypto Passive Income

The opportunities above are great ways for a cryptocurrency investor to generate passive income. Primary advantages include:

A hands-off approach to wealth generation. These opportunities, when used correctly, can help you grow your crypto wealth mostly in an “autopilot” mode, with minimum time commitment. At the very least, they should take considerably less time than any form of active trading.

Risk mitigation during bear markets: Earning passive crypto income is a great way to offset losses many investors incur during market downturns.

Opportunities to invest in future stars of the crypto world. As you research and allocate your funds to a variety of passive income streams, you have a great chance of spotting promising new projects. Unlike established coins, these future star cryptos have the potential for significant returns on investment.

Income stream diversification: As you may have already deduced, there’s a great variety of passive crypto income opportunities available. Most prudent investors allocate their funds to multiple streams, which will (at least indirectly) lead to portfolio diversification, a useful strategy so often overlooked by many investors.

Disadvantages of Earning Crypto Passive Income

In addition to the advantages of earning passive cryptocurrency income, it comes with some risks and disadvantages as well. These include:

Risk of scams and rug pulls. As with anything related to the crypto world, investors looking for passive income in this field have to watch out for unscrupulous operators involved in scams and rug pulls.

Risk of project failures and liquidations. Unlike traditional finance instruments, which are often safeguarded by regulations, the crypto industry is inundated with early-stage crypto projects, making them highly susceptible to volatility — with some even turning out to be complete scams. A prominent example is the Terra (LUNA) project, which crashed in 2022 when its algorithmic stablecoin lost its peg against the U.S. dollar, leading to the long crypto winter that erased billions of dollars from the market.

Fast pace of change in the industry. The investment landscape in the crypto world changes frequently. New coins emerge, interest rates fluctuate wildly and existing coins’ performance can make wild U-turns. Keeping up with the pace of change can be challenging for some investors. Accordingly, in the world of crypto, even passive opportunities aren’t as passive as in traditional finance.

Final Thoughts

The advantages of passive cryptocurrency income are clear, as the maturing crypto market offers diverse opportunities for all kinds of investors to earn passive income. In fact, even those who prefer to be actively involved in crypto trading would do well to try and allocate some of their capital to passive income streams. However, when considering any potential opportunity, carefully research the market and the specific platforms you’re considering. The nontrivial number of scams and project liquidations make this due diligence an important aspect of your overall passive crypto investment strategy.

#LearnWithBybit