What Do the Market Cycles in Crypto Tell You?

Financial markets follow certain patterns and trends. Regardless of the asset class — stocks, bonds or cryptocurrencies — price action depends upon market sentiment, the number of investors who wish to buy or sell the assets and how investors make their investment decisions based on their emotions toward the market.

Due to the unpredictability of markets, it’s difficult to foresee how they’ll act. However, investors may be able to make sense of market fluctuations over time, spot opportunities and make wiser and more informed investment decisions by studying and comprehending past patterns and cycles.

In this article, we’ll be going through the crypto market cycle to see how an investor can spot investment opportunities during the different phases of the cycle.

Key Takeaways:

Market cycles refer to particular trends and patterns that are influenced by the psychology of investors as well as the overall state of the economy.

There are four phases in a crypto market cycle — accumulation phase, markup phase, distribution phase and markdown phase.

What Is the Crypto Market Cycle?

Market cycles are particular trends and patterns that are influenced by the psychology of investors as well as the overall state of the economy. As implied by the name, cycles repeat. Every market experiences this occurrence naturally, and the cryptocurrency market is no different. However, compared to the stock market, cycles in crypto can be significantly shorter due to the rapid price movements.

There are four distinct phases in a crypto market cycle: Accumulation, Markup, Distribution and Markdown. Each phase can be differentiated by sentiments of the market participants and the market activity itself. In each cycle, the price of an asset will move from an all-time low to an all-time high, and vice versa.

Broadly speaking, crypto market cycles start with little market interest. As more interest and demand arise, crypto prices begin to increase. At some point, prices reach a peak and start to plateau before starting to drop. The drop occurs when market interest declines and supply outweighs the demand. At the end of each cycle, a new cycle begins.

Bear in mind that projection models for the cryptocurrency market aren’t ideal or deterministic. Furthermore, pinpointing the beginning and end points of a market cycle is extremely challenging. Cryptocurrency market cycles, however, can be utilized by investors as a tool for analysis, or as supplementary information to better understand market dynamics. You may participate in the market more intelligently if you’re aware of the traits of each stage, and how a typical user might approach each of them.

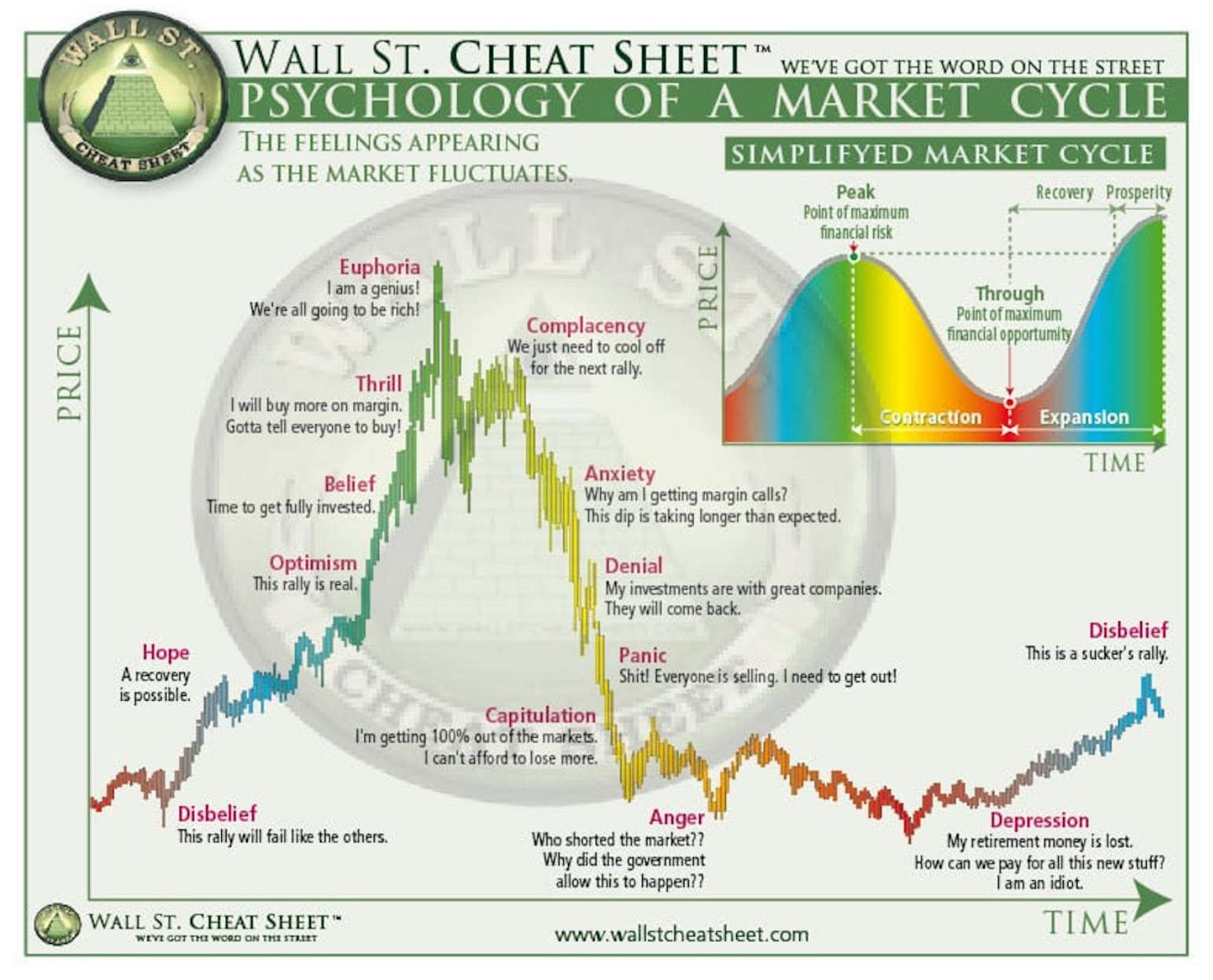

Source: The Cheat Sheet

Accumulation Phase

Each market cycle begins with the accumulation phase. It’s sometimes regarded as the conclusion of the previous cycle, because it begins soon after the market experiences a significant crash when prices are at their lowest. There’s decreased overall market interest and lower trading volume, which usually results in a stable market.

During this phase, many long-term HODLers of investment positions are looking to exit their positions and are likely to set their asset prices low to reflect their lack of confidence in the market. At this point, market trailblazers — corporate insiders, value investors, market pioneers, experienced traders and whales — begin to buy again. The general sentiment is that the worst is over, and that they stand a decent chance of making good on any trade. This group of investors believes that the market will rebound soon, and seizes the opportunity to invest. This is also known as “buying the dip.”

At this point it’s unlikely that retail investors will enter the market, as the sentiment is still neutral and there’s no clear trend. However, positive news about the general state of the market can now draw participants' attention, and possibly move the market into the next stage, the markup phase, as market sentiment begins to transition from negativity to hopeful neutrality.

Characteristics of the accumulation phase are as follows:

Assets are being purchased by a group of investors (usually long-term holders) or whales who think the market has already found its bottom

Due to the difficulty in predicting whether assets will continue to trend lower, some market participants may still view it as a risky moment to invest

There’s no clear pattern emerging, due to continued low levels of investor interest, minimal price volatility and low trading volume

Market sentiment is generally skeptical and uncertain

Markup Phase

During this stage, price action transitions into a consistent upward trend. The market's trend has become clear at this point, and is frequently referred to as the bull market phase.

Media attention, especially positive headlines surrounding crypto, begins to draw interest to the market while reeling in the majority of early adopters. Skilled investors begin to enter, leveraging on their technical analysis skills to identify the increasing number of higher lows and higher highs. With the market demand for crypto growing, crypto prices begin to appreciate in value.

Since upward price movement is much easier to spot during the markup phase, it might be a good time for new participants to enter the market. Additionally, many investors view dips or pullbacks during the markup phase as buying opportunities, rather than as warning signs of declining price action.

The greater fool theory kicks in at this point. As a crypto’s price skyrockets, greed is predominant, with common sense and rationality taking a back seat. FOMO incentivizes novice investors and newcomers. The entrance of these investors into the market will create a significant uptick in market volume, and market valuations will become excessive. At the same time, experienced traders are beginning to take their profits.

Prices soon start to level off or slow down. The last wave of investors, typically the undecided, see this as a golden opportunity to buy, jumping in en masse. This typically causes crypto prices to skyrocket within a very short period of time. Prices are peaking, and market sentiment has gone from neutral and boring to euphoric.

Characteristics of the markup phase are as follows:

Investor confidence increases as the market's sentiment shifts toward optimism and excitement

The Crypto Fear & Greed Index will be close to 100, on the far right of the spectrum

Large growth in trading volume occurs when new investor groups enter the market

Price chart continues to rise, frequently reaching all-time highs (ATHs)

As the phase comes to an end, FOMO investors begin to gather and buy near the top

Distribution Phase

The distribution phase marks the end of the bull run or markup phase.

Market prices plateau as buyers and sellers in the market are at equilibrium. On the one hand, there are market players still looking to buy because they believe the bull market remains strong. On the opposing side are sellers who want to secure their profits because they think "the best is over." These are typically investors who have purchased crypto at the start of the markup phase or even earlier, and are anticipating the markdown phase, the bear market, to come soon.

Although there’s still a lot of trading during this stage of the market, asset prices typically fluctuate within a specific range as the bulls and bears are in tension. Since it’s uncertain whether the uptrend will continue or if a bear market is on the horizon, this phase may cause overall market sentiment to change from optimism to uncertainty. Analysts frequently use the Crypto Fear & Greed Index to measure changes in the general mood of the market.

More negative sentiment, adverse news stories and uncertainty among traders may finally be sufficient to affect prices and trigger a sell-off. At the very least, as uncertainty begins to set in that the bull market might be coming to an end, market fear grows over time.

At the end of this phase, the market will move in the opposite direction. Technical patterns indicating peak pricing — such as double and triple tops, or head and shoulders — are likely to occur in the distribution phase.

This phase can take weeks to several months (or in some cases, years) as fundamental factors take root. Typically, the higher the extreme highs, the quicker the prices fall. Investors who’ve missed selling earlier at a profit now settle to break even — or take a slight loss.

Characteristics of the distribution phase are as follows:

Investors who’ve entered the markets early will begin taking profits and exiting their positions. Those who think prices will keep growing keep buying, or at the very least hold their positions

Uncertainty and other negative emotions are beginning to surface, but overconfidence and greed are still prevalent

Pricing varies within a comparatively tight range

Trading volume increases with low price volatility

The Markdown Phase

The bubble finally collapses during the markdown phase, starting a downward price trend.

For the majority of market participants, the bear market's "markdown period" is the most terrifying. It begins as soon as the supply of crypto in the distribution phase outpaces the demand, and it’s a time when the market is driven by anxiety as the outlook darkens.

Selling pressure increases as participants' fears about the future state of the market grow. In some cases, this cascade effect has the potential to drive asset prices to heights unseen since the markup period. During this phase, there won't be any new capital entering the market or any buying interest. Even positive news may fail to reverse a downward price trend during this time, since investors are taking precautions to limit losses in the challenging market environment.

The markdown phase is psychologically the most challenging one for investors, who are either unaware of the permanence of market cycles or choose to ignore them. They’ll either be stuck with selling too late or not selling at all. Those who don’t sell at all will be holding onto their crypto assets, which might lower their long-term return on investment (ROI).

This phase is, however, a short-seller's paradise, and the markdown phase is the time when they stand to profit from the market decline.

When the market concludes that "the worst is past" and prices can’t fall any lower than they are, the markdown phase will continue. Asset prices will then stabilize and move within a tighter range.

Some investors will return to the market and purchase assets at "discounted" prices once market conditions have stabilized. This indicates that the price decline phase has ended. Returning investors are also an indication that the accumulation phase has begun again.

Understanding the Market Cycle Trends

Essentially, a market cycle progresses from greed to fear and then back from fear to greed again. Every cryptocurrency market begins at a point of relative starting value that cycles up and down. The greed and euphoria that follow a new crypto asset’s launch move prices upward until uncertainty arises concerning the blockchain’s value, growth or tangible, practical applications. At this point, the market becomes doubtful, causing more and more traders to sell their assets and spurring a downtrend. Once the price falls to a point where potential profits become possible, greed once again takes over, starting a whole new cycle over again.

Having looked at the main market cycles, here’s a more detailed explanation for understanding and identifying market cycle trends in crypto, using Bitcoin as an example.

At the start of the accumulation phase, smart money, institutional investors and early adopters buy assets low. During this period, bottoming prices accumulate as those who’ve held from the last high experience some anger and depression.

The price of Bitcoin starts to climb. There are elements of hope and disbelief. However, smart investors HODL, buying the dip at support. This happens at the beginning of the markup phase.

As the markup phase progresses, investors buzz with excitement, which drives up the market faster. A bit of greed enters in as FOMO buyers jump in, buying from those who got in earlier (who now sell at a markup). The market sentiments are thrill, belief and euphoria. It would be wise to sell or HODL at this point.

Bitcoin now enters the distribution phase of the cycle, where it’s distributed high. This is the best time to sell.

Bitcoin lowers at the markdown phase. There’s a mixture of anxiety and denial. This is your last chance to sell if you haven’t already. You can also short and play bounces as the Bitcoin price tumbles.

Bitcoin plummets further and more quickly as sentiment moves from anxiety to panic. As people panic sell, you may continue to short the market. Play bounces, and start closing shorts at this point.

At the end of the markdown phase, Bitcoin bottoms out. There’s a lot of anger and depression. It’s also the signal for another cycle. Smart money and early investors start to accumulate again.

Factors That Affect the Crypto Market Cycle

Macroeconomics

Whether crypto assets are going through a bullish or bearish phase can be strongly influenced by the state of the overall economy, as well as different government policies. Crypto prices may fall if the economy is struggling, and vice versa.

Bitcoin Halving

Bitcoin halving takes place approximately every four years (after every 210,000 blocks) and reduces by half the rewards that miners receive. At the same time, the amount of new Bitcoin that’s created is limited, reducing the supply of bitcoins that come into circulation.

This reduced supply may drive up the price if demand for Bitcoin remains high. A markup phase has historically followed a Bitcoin halving, making it a significant event to watch. This is yet another effect of Bitcoin correlation. Bitcoin accounts for 48.6% of the total crypto market capitalization (at the time of writing). As a result, if there are no significant catalysts, the market cycles of smaller crypto assets are probably going to follow that of Bitcoin.

Best Strategy for Investing With the Market Cycle

Understanding each stage of the crypto market cycle will help investors plan their investments for the best possible returns. The best course of action is to invest in crypto assets during their accumulation phase, and then sell them during their distribution phase. Investors can do this to get the best deals on crypto assets, and then sell them at a higher price. Here are some tools that an investor can use to acquire a better understanding of the market cycles.

On-Chain Analysis

On-chain analytical tools like IntoTheBlock, Glassnode, Nansen, CoinMarketCap and Dune can aid in the identification of these market phases by giving information on supply, demand, market psychology and whale activity.

Crypto Fear & Greed Index

It's crucial for investors to keep tabs on the sentiment in the cryptocurrency market by following business news and using the Crypto Fear & Greed Index. Lower scores indicate greater fear, and higher numbers indicate greater greed on this scale of 0 to 100. It’s based on variables including market momentum, volatility and social media activity.

The media and word of mouth are reliable sources for determining market sentiment and its tone. It may be a smart idea to sell if everyone in the sector is screaming to purchase with a euphoric tone (markup phase), since this suggests that the market is ready to turn lower once more.

On the other hand, it might be a good choice to buy when the market is entering a capitulation phase and even seasoned traders are considering selling. The rule of thumb is to buy when others are selling and sell when others are feeling euphoric. A quote attributed to Warren Buffett goes like this: "Be fearful when everyone is greedy and be greedy when everyone is fearful."

Closing Thoughts

Learning to identify the phases of crypto market cycles is vital for trading profitably. The best time to buy is the accumulation phase, because prices have stopped falling, and investors are still afraid. When the market picks up steam during the markup phase, the smart investor HODLs and waits for excited investors to drive the price higher. In the distribution phase, which signals the end of the markup stage (when sentiments are most bullish), the smart money starts to sell their position to lock in their profits.

Armed with a good understanding of the different stages of the crypto market cycle, you’ll be better positioned to take advantage of these stages to make a profit. Keeping tabs on market cycles helps decrease the chance that you’ll buy high or sell low.