The Difference Between APY and APR in Crypto Explained

APR (annual percentage rate) and APY (annual percentage yield) are key concepts used in the calculation of interest from a variety of investments or loans. These investments may include the provision of funds to liquidity pools on exchanges, staking, yield farming, crypto savings accounts and more.

Some of these investments may pay you interest based on the APR rate, while others use the APY method of calculating the payout. For any investor, it’s imperative to know the difference between APR and APY in order to allocate your funds to the most profitable income sources.

Key Takeaways:

The core difference between APR and APY lies in compounding interest rates. APY takes compounding interest into account, while APR does not.

Compounding interest involves the calculation of the principal plus the interest paid on the principal amount. The compounding effect always yields higher accumulated interest over time.

APR is typically used in the context of the cost of borrowing by interest rate, while APY refers to the interest payout for investors who lend or save their money in an account.

The Difference Between APY and APR

Compounding is the only difference when you calculate the return of APR and APY. With all other things being equal (the initial investment, the quoted interest rate and the period of investment), APY will always result in a higher final amount due to the compounding effect.

In practical terms, if you borrow money it’s better to do so using APR interest rates as a base. However, if you invest in funds, APY interest rates will yield higher total returns.

Annualized Percentage Rate (APR) | Annualized Percentage Yield (APY) |

No compounding interest | Interest is compounded |

Mostly applicable for borrowers | Mostly applicable for lenders |

Annualized yields are lower and usually fixed | Yields higher payouts through compounding |

What Is APR?

Many people are familiar with the interest rate paid on a savings account or charged for loans by traditional financial institutions. When you’re quoted a 5% annual interest rate for your investment of $100, it will yield $5 in profit in exactly one year from the time you invested. Alternatively, if you borrow $100 at the same interest rate, you’ll have to pay back your borrowed amount plus $5 in interest a year later.

How to Calculate APR in Crypto

This simple interest rate calculation is based on the APR interest rate. Whether in traditional banking or the crypto world, APR refers to the ordinary (simple) interest applied to the principal amount of an investment, deposit account or loan. It doesn’t take into account the concept of compounding interest.

APR is an annualized figure. If the principal balance on an investment, loan or credit card interest is held for less than a year, the interest applies on a pro rata basis. For example, a half-year investment with an APR of 5% will earn you exactly half the interest, 2.5%, on your principal amount.

Let’s say you invest 1ETH in a lending pool on a decentralized finance (DeFi) platform to earn interest, and the interest rate in APR is 24%. If you lock your funds in the pool for exactly 365 days, your total investment will grow to 1.24 ETH. This includes your principal of 1 ETH and the 0.24 ETH (based on the 24% APR) that accrued as interest.

Below is the basic formula for calculating a total final amount based on the annual percentage rate:

A = [P × (1 + R × T)]

where:

A ﹦ total final amount

P ﹦ principal, i.e., the initial investment or loan amount

R ﹦ interest rate used

T ﹦ time in years

Using our 1 ETH as the principal for the investment, the figures in the formula are:

1 ETH × (1 + 0.24 × 1) = 1.24 ETH

This assumes an investment period of exactly one year. If you hold the investment for a three-month period, i.e., one quarter (0.25) of a year, then the formula yields:

1 ETH × [1 + (0.24 × 0.25)] = 1.06 ETH

What Is APY?

APY measures the interest rate applicable to an investment or loan that takes into account compounding (or compound) interest. The interest can be compounded over any set period — continuously, daily, weekly, monthly or annually. The inclusion of compounding interest makes calculating APY slightly more complex, as it includes the number of periods at which the amount is adjusted (based on the adjusted interest rate).

How to Calculate APY in Crypto

The formula for the final amount based on the annual percentage yield is as follows:

A = (1 + r/n)n – 1

where

A ﹦ total final amount

R ﹦ interest rate used

N ﹦ number of compounding periods

The important part of the formula is the N value — the number of compounding periods. It’s what makes APY and APR different. The number of compounding periods is the number of times the investment amount is recalculated, based on the quoted nominal interest rate.

During each recalculation, the interest is added to an amount that includes the initial investment plus all the previously accrued interest earnings.

Let’s imagine you invest 1 ETH for a year at the APY rate of 24%, and your investment has two recalculation periods, at 6 months and 12 months, respectively. In this scenario, how much interest in APY you'll get is calculated according to the formula as follows:

(1 + 0.24/2)2 = 1.2544 ETH

APY vs. APR: The Differences in Compound Interest

APY yields a higher payout due to compounding. Compound interest in periodic recalculations can significantly increase the total final amount, as compared to APR-based interest.

Hence, the same initial investment (1 ETH) over the same period (1 year) with the same quoted interest rate (24%) produces the final payouts of 1.24 ETH using the APR interest rate and 1.2544 ETH using APY's rate. As you can see, with compounding interest, your APY interest is magnified over time.

The more compounding periods used during the investment period, the higher your final amount. For instance, if your 1 ETH yearly investment at a fixed APY of 24% is compounded on a monthly basis, i.e., 12 times during the period of investment, then the final payout will be as follows:

[1 ETH × (1 + 0.24/12)12] = 1.2682 ETH

Do APY and APR Rates Change?

APR and APY rates fluctuate depending on the terms and conditions of the lender and the different types of loans you sign.

A fixed rate refers to a promised APR or APY throughout the term, disregarding market fluctuations or product performance. But if the rate is variable, the APY for your deposit accounts may be subject to different APY yields, depending on the market's demands.

How Are APY and APR Used?

In traditional finance, APR rates are widely advertised, particularly for loan products, while APY rates are more often used to market investment products. In the world of crypto, both APR and APY are used extensively on DeFi protocols, centralized exchanges (CEXs) and other finance-related crypto platforms for a variety of lending and borrowing opportunities, liquidity pools, staking services, yield farms and more. Most large DeFi and centralized crypto finance providers have products with both APR and APY rates.

Staking Pools With Investment Opportunities in APY and APR, as Advertised on the World’s Most Popular DeFi Platform ― PancakeSwap

When borrowing funds or investing on platforms using APY rates, pay close attention to the mechanism of compounding, i.e., how many times and at what intervals your investment or loan will be compounded.

APY vs. APR: Which Is Better?

Naturally, APR rates are better for borrowing money, while APY is more beneficial for investing. The effect of compounding can work wonders for you when investing crypto for yield.

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

— Warren Buffett

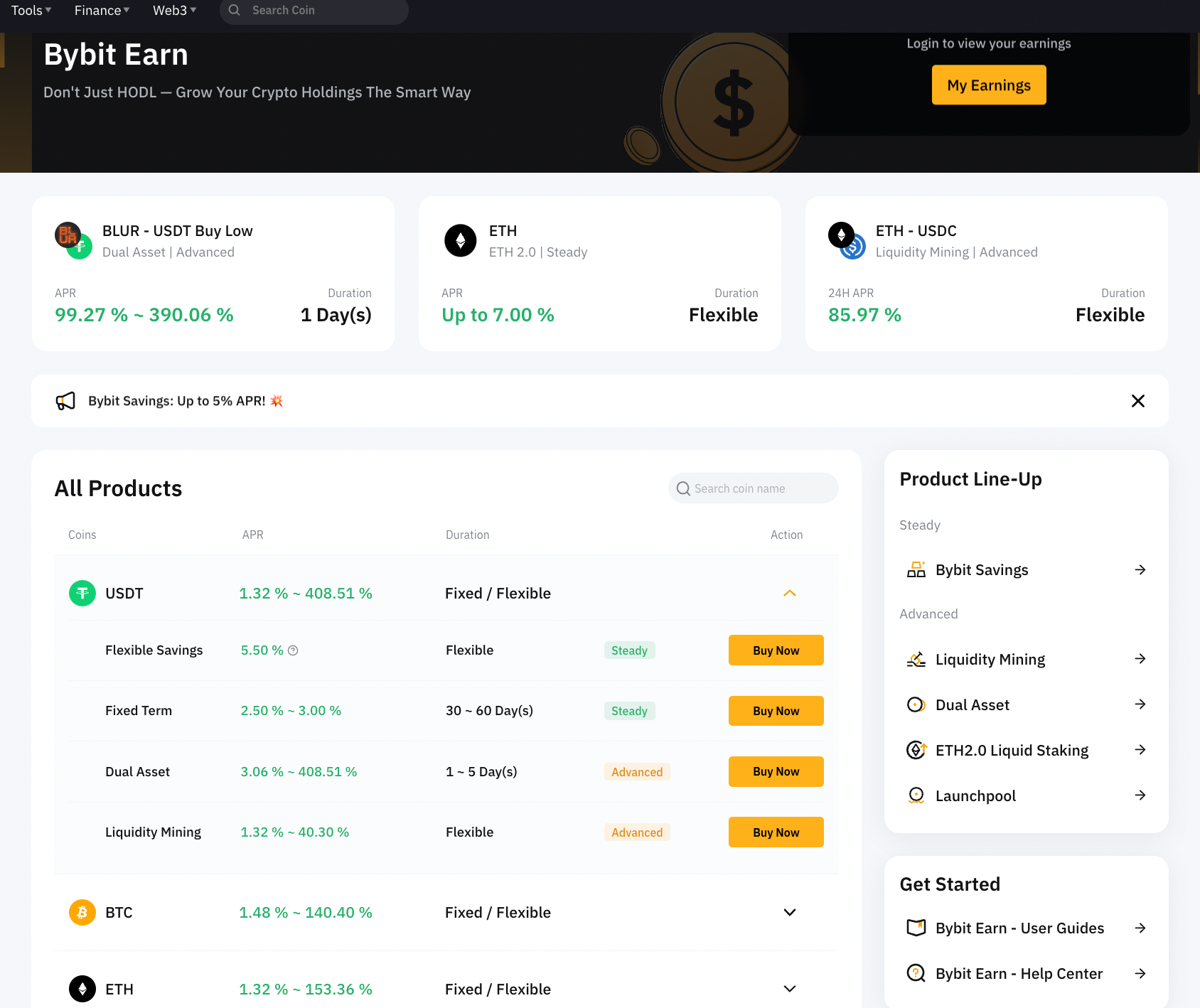

For example, the Bybit Savings product suite allows you to stake a variety of popular coins with interest paid in APY in a low-risk, guaranteed-withdrawal environment. You can choose between flexible and fixed-term investment periods. The platform currently offers an APY rate of ≥ 5% for some stablecoins, one of the highest APY rates in the industry for stablecoin investments.

Some of the Current Offers on Bybit Savings

Learn more: What Is Bybit Savings?

Other Investment Factors Besides APY and APR

When researching crypto investment opportunities on DeFi and centralized platforms, comparing APR and APY (and looking at the advertised interest rates) is only one factor in making a decision. Additional factors to take into account include the following.

Fees and Costs

Various fees usually accompany crypto investment opportunities, including those for transactions, withdrawals, closing costs and gas, which are charged by the underlying blockchain on decentralized platforms. Always take these additional fees into account when calculating your overall final returns. An opportunity with a high APY or APR but an unfavorable fee structure may work out worse than you initially expected.

Variable vs. Fixed APY and APR Rates

Make sure you understand whether the advertised APR or APY rates are variable or fixed. Fixed rate opportunities apply the advertised interest rate for the duration of the investment, while variable rates are subject to fluctuations depending upon market conditions.

Additional Benefits and Rewards From the Investment

In some cases, in addition to earning interest on your investment you may get side benefits, such as liquidity provider (LP) tokens. These tokens may be reinvested on the same platform or other ones for further yields.

Invested Coin’s Current Performance and Future Outlook

Some DeFi farms and pools advertise eye-popping APY and APR rates. However, these opportunities are often based on highly volatile coins with an unstable future outlook. These coins might also feature high inflation rates and/or volatility, which can lead to future depreciation in value.

While your investment is earning a high return, based on attractive APY or APR rates, the coin you’ve chosen may be depreciating on a wider scale in the market. For instance, an APY or APR of 300% will be of little value if the cryptocurrency you’ve used drops in price by 400% during the year of your investment.

Platform’s Reputation and Size

Larger and more established platforms, such as PancakeSwap andUniswap, are time-tested and usually have ample liquidity. It’s best to stick with such providers, even if you’ve spotted those great APR and APY rates on a smaller platform. In an industry awash with scams, rug pulls and project failures, this point is of great importance to any crypto investor.

The Bottom Line

The crypto industry offers a vast array of investment and borrowing opportunities that are based on APY and APR rates. Due to the nature of the crypto market, APY and APR rates are often a few magnitudes higher than those you may encounter in the traditional finance industry. This opens up more lucrative return opportunities, but also carries more risks.

When investing or borrowing based on these rates, make sure that you understand whether you’ll earn or pay based on APY or APR. If the latter is applicable, pay close attention to the compounding periodicity that will apply to your investment or loan.