Spark (SPK): The yield and liquidity layer DeFi has been waiting for

Decentralized finance (DeFi) has rapidly evolved, but not without its share of persistent challenges. Fragmented liquidity across protocols, volatile and unsustainable yield mechanisms and vast amounts of idle capital in the form of stablecoins have hindered the ecosystem’s efficiency and long-term viability. While innovation has been abundant, few platforms have effectively addressed these core issues in a unified way.

Enter Spark.

This purpose-built DeFi layer has been designed to consolidate liquidity, deliver sustainable yield opportunities and activate dormant stablecoin capital. By combining native integrations with Sky’s (formerly MakerDAO) robust risk management and composable infrastructure, Spark introduces a new standard for capital efficiency and accessibility in DeFi.

Let’s take a deeper look at the Spark protocol and learn why it’s the connective tissue that has been missing in DeFi.

Key Takeaways:

Spark, the first Star from Sky (formerly MakerDAO), offers various products, such as Savings and SparkLend, that are designed to maximize yield-generating activities across different networks on DeFi.

Its native token is SPK, which is used for staking, governance and rewarding participants through airdrops and other activities.

You can buy SPK on Bybit's Spot trading platform and as a Perpetual contract.

What is Spark?

Spark is a DeFi protocol designed to provide crypto enthusiasts with innovative ways to earn yield from their savings, provide liquidity and utilize any idle stablecoin capital they may have. It’s the first Star in the Sky ecosystem. Stars were formerly known as SubDAOs on MakerDAO, and represented smaller, specialized ecosystems within the larger protocol.

With its rebranding from MakerDAO, Sky now provides an upgraded stablecoin system, native token rewards and a more accessible governance structure. Spark has leveraged these upgraded features on Sky to provide a liquidity and yield infrastructure for DeFi users.

Spark stands out because of its cross-chain infrastructure, which enables users to access borrowing and lending functionality across multiple blockchains without sacrificing speed, security or composability. Whether you're looking to supply stablecoins and earn yield or borrow assets with confidence, Spark offers a streamlined experience backed by the power of Sky's modular and scalable architecture.

Spark's ecosystem is powered by its native token, SPK, which acts as the platform's governance and utility token.

What is Spark Liquidity Layer?

Spark Liquidity Layer (SLL) is a product that leverages Sky's allocation system to automate the provision of liquidity using USDS, sUSDS and USDC across different blockchains and protocols in the DeFi sphere. As such, DeFi users get to easily earn via Sky Savings Rate (passive income from holding USDS stablecoins) and also optimize yields from various protocols.

One key benefit of SLL is easy and automated yield farming using sUSDS, formerly only available via the Ethereum network, which creates low liquidity challenges for users.

Another benefit is that the Spark platform can provide risk-managed liquidity to other networks via SLL, supplying liquidity through stablecoins into yield strategies (e.g., lending markets like Aave and Morpho), with the yield earned used to fund the Sky Savings Rate.

SLL uses an off-chain automated liquidity management system to determine where to provide stablecoin liquidity. This layer consistently monitors sUSDS and USDS liquidity levels in other networks, and adjusts accordingly to meet the demand.

SLL is governed by Sky Governance, and can only deploy funds approved by it. Furthermore, SLL uses various bridges, depending upon the token involved. It uses Sky's SkyLink for USDS and sUSDS, and the CCTP bridge by Circle for USDC stablecoin bridging.

Some of SLL's key integrations are the Aave Lido market, which supplies USDS liquidity that’s used for lending. Borrowed USDS generates yield for Spark. In addition, SLL supplies Dai liquidity through the Morpho lending platform, on which USDe and sUSDe stablecoins are used as collateral.

Spark’s key products

At the heart of Spark's mission is a suite of powerful, user-focused products designed to solve DeFi's most pressing problems: fragmented liquidity, unstable yields and inefficient capital deployment. Each product within Spark's ecosystem is built to enhance capital efficiency, deliver predictable returns and make DeFi more accessible across chains.

From native lending markets to innovative yield strategies and liquidity solutions, Spark's key offerings work in harmony to create a seamless, scalable and secure financial layer — not just for the Sky ecosystem, but also for other DeFi protocols.

Let's examine Spark's core products to learn how they're reshaping users' interactions with decentralized finance.

Spark Savings

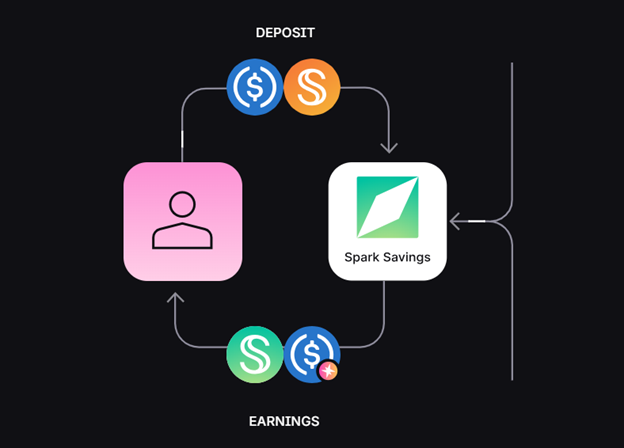

Spark Savings is a product that lets you earn from your stablecoin savings at transparent rates (currently at 4.5%, with around $3.25 billion in total volume locked). With Spark Savings, you deposit stablecoins into a Savings Vault, from which equivalent Savings Tokens are generated to represent your share in the vault. These Savings Tokens accrue value with time.

At the moment, Spark has three savings vaults available: Savings USDS (for USDS), Savings USDC (for USDC) and Savings DAI (for Dai). Curve, the decentralized exchange (DEX), transfers USDS into and from its Savings Vault, which creates a small slippage for users. There are no slippage fees for transfers in Savings USDC and Savings DAI.

Spark doesn't have custody of funds in these vaults. The product is powered by permissionless, noncustodial smart contracts under the Sky protocol.

SparkLend

SparkLend is an open-source decentralized lending and borrowing protocol powered by Sky through Spark. As a lender, you can provide liquidity and earn yields, while as a borrower, you can borrow (DAI or USDS) through overcollateralization.

There are different modes for borrowing on SparkLend:

High Efficiency Mode (E-mode) — Borrowers get to derive the highest borrowing power on their collateral.

Isolation Mode — Borrowers can only use the isolated asset as collateral, and the debt ceiling is capped.

Siloed Borrowing — Users can only borrow the siloed asset, which is listed as a single borrowing asset.

Spark Farms

Spark Farms allows users to deposit USDS into noncustodial yield farms to earn Sky Token Rewards (SKY) in real time. Offering a selection of farms tied to different Sky Stars, it displays live APY and historical metrics for informed deposits.

Users can claim accrued SKY tokens anytime, and their funds remain fully withdrawable without fees (beyond gas). Conversions from USDC and other stablecoins are seamless and without slippage via Sky’s noncustodial contracts.

Overall, Spark Farms delivers flexible and transparent rewards on idle stablecoin capital.

What is the Spark crypto token (SPK)?

Spark’s native crypto token (SPK) powers governance and staking on the platform. For governance, SPK will initially be used to signal and check sentiments on the platform through Snapshot voting. SPK can also be staked through the Symbiosis Finance protocol to secure the Spark ecosystem, as staked SPK earns SPK points as rewards.

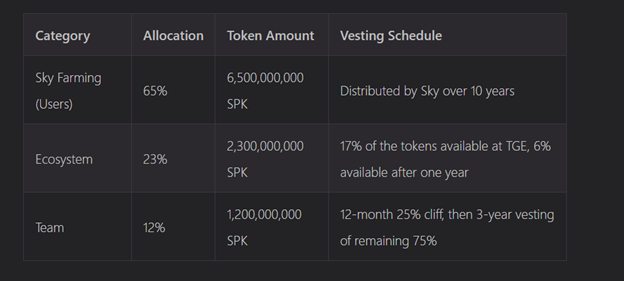

At Spark’s genesis, a total supply of 10 billion SPK tokens were minted and allocated as follows:

Spark crypto (SPK) airdrop

Spark is offering an airdrop for the following categories of users, which can be claimed at its official airdrop page:

Those who participated in pre-farming activities through lending and borrowing on SparkLend and Aave

Participants in the Spark Ignition airdrop campaign (which involved DeFi activities at specific periods)

Participants in the Overdrive airdrop (the second phase of the Ignition airdrop, which will last six weeks after the initial airdrop date)

Those who participated in Spark quests on the Layer3 platform

Where to buy the Spark crypto token (SPK)

You can buy SPK on Bybit’s Spot trading platform, and as a Perpetual contract. To celebrate this listing, Bybit is holding a Token Splash event where 4 million SPK tokens are up for grabs. The event runs through Jul 1, 2025, 10AM UTC.

The are two events:

Event 1 — Exclusive to new users — To earn from a 2.5 million SPK prize pool, new users need to sign up on Bybit, and then either complete Identity Verification and accumulate a deposit volume of 10,000 SPK, or deposit and trade 100 USDT worth of SPK as their first trade on Bybit’s Spot trading platform.

Event 2 — Trade to earn — Trade at least 500 USDT worth of SPK on the Bybit Spot market to earn a share of a 1.5 million SPK prize pool, with rewards capped at 40,000 SPK per user.

Spark crypto (SPK) price prediction

As of Jun 26, 2025, SPK is trading at $0.0386, a 49% drop from its all-time high of $0.075 on Jun 17, 2025, and a 5.8% increase from its all-time low of $0.03648 on Jun 25, 2025.

Price prediction experts are bullish on the future price of the Spark token. According to price forecasting experts at CoinDCX, SPK may hit a maximum price of $0.138 in 2027 and increase to $0.19 in 2030. Another price prediction platform, DigitalCoinPrice, forecasts that SPK’s price could surge to $0.14 in 2027 and increase to $0.21 by 2030.

While these prices are bullish, they aren't investment advice, and they don't guarantee the future price of SPK. We highly recommend you do your own research before investing in Spark or any other projects in the crypto market.

Closing thoughts

Spark represents a bold step forward for the DeFi ecosystem, offering sustainable yield, cross-chain liquidity and efficient capital deployment through an integrated suite of products.

As the first Star in the Sky ecosystem, Spark combines upgraded infrastructure, noncustodial smart contracts and decentralized governance to unlock new value for stablecoin holders and yield seekers.

With solutions like SparkLend, Spark Savings and the Spark Liquidity Layer, the Spark protocol directly addresses many of DeFi's long-standing inefficiencies. Whether you're an investor, builder or user, Spark offers seamless access to DeFi in a more scalable, transparent and rewarding way.

#LearnWithBybit