Tranchess (CHESS): One-Stop DeFi Solution for Every Risk Profile

The decentralized finance (DeFi) sector knows no shortage of protocols and solutions for yield generation and enhancement. Many asset optimization platforms, liquid staking solutions and a variety of other protocol types all promise to deliver the best yields possible in the industry. However, most of these protocols don't provide enough flexibility for traders to pick and choose preferred risk profiles. Although traders can invest in different crypto assets, each with their own risk level, the ability to select different risk profiles based on the same underlying investment asset isn't the most commonly encountered option in DeFi.

Tranchess is a protocol that offers exactly this opportunity. By utilizing the concept of tranches, structured products with differing risk profiles but based on the same underlying asset, the chess-themed Tranchess aims to provide DeFi traders with yield opportunities based on their preferred risk tolerances and investment styles.

The protocol started in 2021 as an asset tracker for yield optimization and developed over time into a platform offering a range of DeFi services — tranche-based crypto fund investment, liquid staking and liquid token swaps. Tranche-based crypto investment in funds based on high-cap assets like BNB and ETH is the protocol's core service.

Key Takeaways:

Tranchess is a DeFi protocol that provides two primary services: liquid staking and tranche-based crypto investment, a form of structured investment where traders can choose different risk/reward profiles in a fund based on the same underlying asset.

The protocol offers its services on two blockchain platforms — BNB Chain (BNB) and Ethereum (ETH).

Tranchess uses a multi-token system, with the main token, CHESS, used for governance, revenue-sharing and staking reward accruals. CHESS can be bought on Bybit as a USDT Perpetual contract.

What Is Tranchess?

Tranchess is a decentralized protocol on BNB Chain that offers users crypto fund investment opportunities with varying risk profiles as well as liquid staking services. The protocol's core service is tranche-based crypto fund investment. Tranche investment offers traders opportunities to choose different risk levels based on tranches, or portions, of investment in the same underlying asset. It's been a popular way to structure products for various investor segments based on the same overall fund in traditional finance (TradFi). Tranchess is one of the first protocols to bring this concept to the world of DeFi.

Founded by Danny Chong and his associates in 2020, Tranchess started its operations in June 2021 as an asset-tracking solution that offered yield opportunities in a fund based on Bitcoin (BTC). In November of the same year, the protocol added support for an Ethereum (ETH) fund as well. In January 2022, Tranchess introduced its third major fund, based on the BNB coin, and also became a validator for the BNB Chain.

The original version of the protocol was based on an order book system. Traders who executed their preferred strategies were supported in the background by a swap solution based on order matching. In August 2022, Tranchess introduced V2, a major revamp of the platform that largely replaced the order matching system with automated market maker (AMM) pools in Ethereum and BNB Chain.

In February 2024, the project team upgraded the platform to V3, introducing a range of Ethereum liquid staking products for enhanced yield opportunities.

How Does Tranchess Work?

The protocol uses three chess-themed crypto tokens — QUEEN, BISHOP and ROOK — to allow investors to select their preferred strategy and investment approach.

The QUEEN token is used for yield farming and is issued on the platform when you deposit ETH, BNB or BTCB (a BTC-pegged stablecoin issued and used on the BNB Chain) as collateral. This token tracks its specific underlying asset, and is designed for investors who prefer a more stable, long-term investment approach.

QUEEN also possesses a pretty curious feature: it can be split into two tokens, BISHOP and ROOK, that open opportunities for additional investment strategies. BISHOP allows investors to earn additional yields on their stablecoin investments. Yields on BISHOP are typically somewhat higher than QUEEN yields, reflecting a slightly riskier profile for this token. However, BISHOP is still an asset for relatively less risky strategies, at least when compared to ROOK.

The ROOK token opens up opportunities for particularly high yields in a high-risk investment environment. ROOK is used to open leveraged positions that are protected from forced liquidation. The three tokens — QUEEN, BISHOP and ROOK — essentially act as tokenized fund-tracking investments, each with its own risk-and-reward profile.

The sustainability and stability of the Tranchess platform are directly tied to a fine balancing act between BISHOP's stable returns and ROOK's volatility. For instance, during adverse market events, the value of ROOK might drop so low (due to its leveraged nature) that it might affect the viability of stable returns from BISHOP. In order to protect the platform against such scenarios, Tranchess uses a Rebalance feature that resets the net asset values (NAVs) of the protocol's three tokens back to 1 to trigger a reduction in ROOK's leverage. Rebalancing might also be applied when the market moves sharply in the opposite direction.

Tranchess Tranche Tokens

Tranche QUEEN

The QUEEN token is the gateway to investing via the protocol. You’ll first need to provide collateral and be issued QUEEN in order to further split your strategies into the lower-risk BISHOP and the higher-risk ROOK variations. This division must be even, i.e., each QUEEN can only be split into 0.5 BISHOP and 0.5 ROOK, and not in any other proportion.

Having said that, you don't have to split QUEEN any further, and you can enjoy the basic yield opportunities provided by this token based on the three main underlying assets — BTCB, ETH and BNB.

If you decide to exit your positions represented by BISHOP and ROOK, you can merge them back into QUEEN using the Split & Merge utility provided by the protocol.

Tranche BISHOP and ROOK

BISHOP and ROOK are the main assets that demonstrate the power of tranche investment via the Tranchess protocol. While the underlying investment may remain the same, ROOK's leveraged nature substantially changes the overall risk profile compared to BISHOP-based investments. As such, Tranchess uses leveraged crypto asset trading to vary the risk levels that are based on a specific token.

Tranchess Key Features

Tranchess Liquid Staking

Besides tranche-based investment, the Tranchess protocol offers liquid staking opportunities for the Ethereum and BNB Chain networks. These allow traders to reuse their invested funds via liquid staking tokens (LSTs) throughout the DeFi ecosystem.

When you stake ETH via Tranchess, you are issued the QUEEN ETH (qETH) token, which can be further reinvested for additional yield. While your ETH remains staked, qETH continues to accrue rewards.

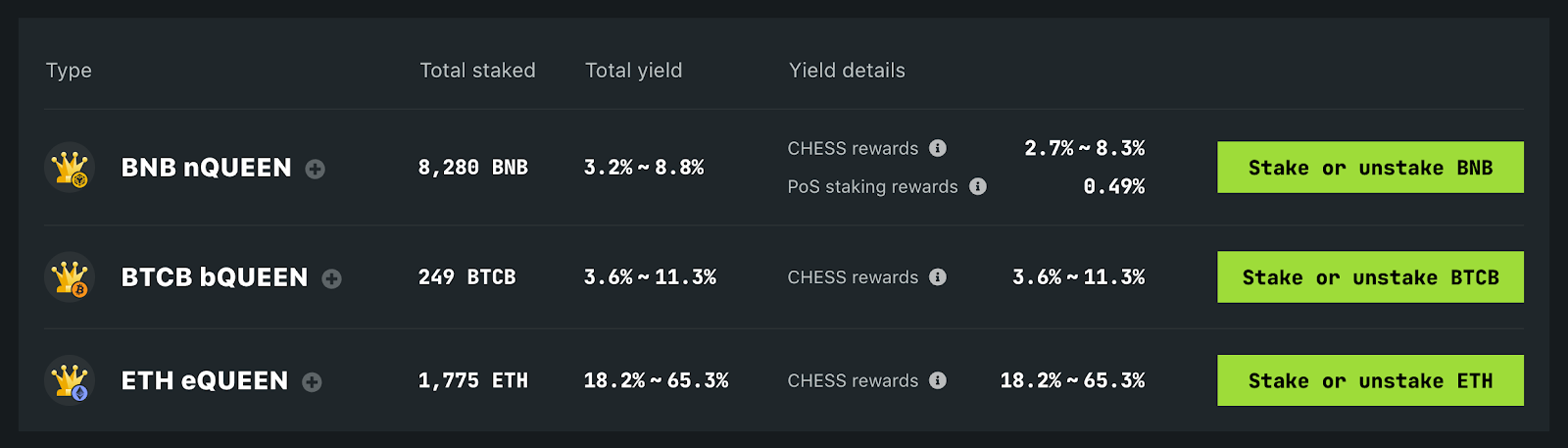

On BNB Chain, the liquid staking opportunities offered by the protocol are even more varied. As noted earlier, Tranchess acts as a validator for BNB Chain, which allows the platform to provide flexible options for liquid staking on the blockchain. You can use any of the three primary underlying assets the protocol uses — BNB, BTCB or ETH — to earn yield from liquid staking. When you stake these assets, you’re issued an LST in the form of nQUEEN (for BNB), bQUEEN (for BTCB) or eQUEEN (for ETH), each with somewhat varying APY rates. The rewards accumulate in CHESS tokens, the platform's primary governance asset, which we'll cover shortly.

Tranchess Primary Market

Tranchess operates a convenient primary market redemption and issuance platform that can be used to easily create QUEEN tokens from customized tokenized assets or representations of underlying assets. The Tranchess primary market currently supports five such assets: SolvBTC and SlisBNB for the BNB Chain, staked ETH on Ethereum, and weETH and STONE on Scroll.

Tranchess Swap

Tranchess also offers convenient secondary market trading for staked tokens through its Swap market, which allows you to easily move assets between the original staked tokens and their Turbo or Stable versions. Tranchess Swap features three AMM pools on Ethereum and four AMM pools on BNB Chain that support not only instant swaps for BISHOP and ROOK, but also immediate creation and redemption for all QUEENs and their corresponding underlying assets.

We noted earlier how the primary market currently supports five customized underlying QUEEN assets — SolvBTC, SlisBNB, staked ETH, weETH and STONE. Investments in these assets can further be enhanced by splitting them into Turbo and Stable strategies. The former provide higher risk/reward leveraged opportunities, while the latter are designed for more stable yields to protect your gains. To apply these strategies, you’ll need to swap your original underlying QUEEN assets into their respective Turbo or Stable tokens, e.g., turPSBTC for a Turbo strategy, based on the original SolvBTC fund.

What Is the Tranchess Crypto Token (CHESS)?

CHESS is the protocol's governance token. While QUEEN, BISHOP and ROOK are designed to tokenize and represent crypto investments, CHESS is primarily used to facilitate on-platform governance. The token is based on BNB Chain's primary BEP-20 fungible standard.

Users who lock CHESS tokens on the platform are issued veCHESS, a token designed for actual operational use on the protocol. All primary functions of CHESS involve the use of veCHESS, while the actual CHESS tokens remain locked and are, therefore, utilized indirectly. These primary functions include:

On-platform governance. Token holders get to vote on important protocol parameters and rates.

Revenue accrual. Holders of CHESS are entitled to 50% of protocol revenues, paid out weekly in fee rebates in the form of the underlying crypto asset (i.e., BTCB or ETH).

Staking rewards accrual. Staking QUEEN, BISHOP or ROOK is a key way to earn CHESS rewards at a faster rate on the protocol.

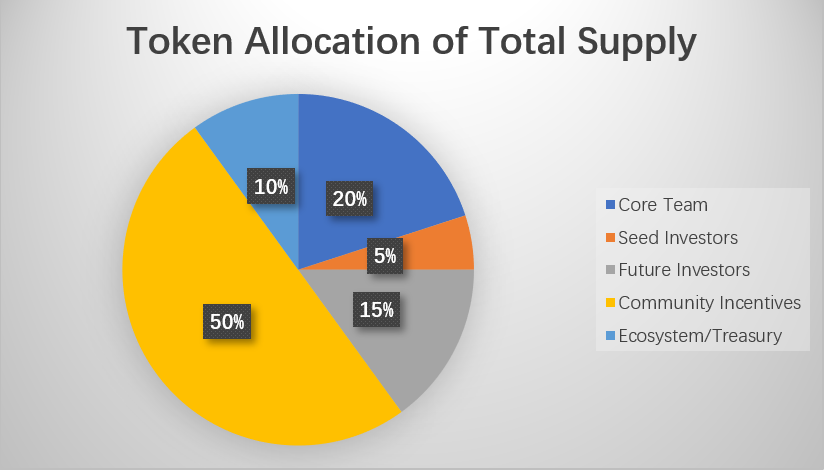

Launched in mid-2021, CHESS is a supply-capped token, with a maximum and total supply of 300 million. The token's original distribution shares are shown in the chart below.

Where to Buy Tranchess (CHESS)

The CHESS token is available on Bybit's Derivatives market as a Perpetual contract with USDT (CHESSUSDT). You can trade CHESS under the contract with up to 12.5x leverage. Bybit's Derivatives market allows you to trade hundreds of crypto assets with low fees at up to 100x leverage, depending upon the chosen asset. There are markets for perpetuals, standard futures and options, with contracts based on popular stablecoins — USDT and USDC — as well as a range of other popular high-cap cryptocurrencies.

Tranchess (CHESS) Crypto Price Prediction

As of Sep 9, 2024, the CHESS token is trading at $0.152, which is 98.1% lower than its ATH of $7.91 on Oct 22, 2021, and 69.8% higher than its ATL of $0.0896 on Aug 5, 2024.

Long-term price forecasts for CHESS are generally bullish. PricePrediction expects the token to trade at maximum prices of $0.2875 in 2025 and $1.95 in 2030, while DigitalCoinPrice predicts a maximum price of $0.40 in 2025 and $1.13 in 2030.

Is Tranchess (CHESS) a Good Investment?

You might consider investing in the CHESS token based on the following factors:

Tranchess is a rare platform in the world of DeFi that provides tranche-based investment opportunities. In TradFi, the current asset management sector is increasingly adopting this advanced and innovative mode of investing. Investment banks and other traditional finance players have recognized the advantages of offering tranches with varying risk levels to attract different segments of traders. The adoption of tranche funds, however, has been less prevalent in DeFi, which can benefit the Tranchess protocol since this niche remains relatively uncongested.

The protocol still has significant unrealized potential that can support its growth and the price of CHESS over the medium and long terms, due to expansion into additional blockchain platforms. While Tranchess currently focuses on Ethereum and BNB Chain, it could extend its product to other chains and add omni-asset management capabilities in the form of liquid assets that are freely transferable between networks. Such expansion could further boost the protocol's potential.

Closing Thoughts

As a pioneer of crypto tranche fund investment, Tranchess aims to establish itself as the web3 leader in this highly specialized niche. Given how underexplored this area is, this could be a smart move indeed. However, this novel specialty area also presents particular challenges for the protocol. For instance, less experienced traders may not be familiar with this investing format, and their lack of familiarity could act as a significant barrier to the protocol's adoption.

This is where the Tranchess team needs to work hard to educate the wider DeFi community on the merits and process of tranche-based investment. When crypto traders begin to appreciate the advantages of tranche investment, Tranchess will get its chance to emerge from the shadows of the DeFi sector and become a major industry player.

#LearnWithBybit