Thruster (THRUST): An Advanced AMM for the Blast Ecosystem

The world of Ethereum (ETH) Layer 2 chains has plenty of solutions offering minuscule fees, excellent scalability and nearly instant transactions. Seemingly countless sidechains, rollups and other types of Layer 2 networks servicing the Ethereum blockchain have been launched in recent years. However, many, if not most, of these chains struggle to offer anything beyond low fees and fast transaction processing capacity. While these benefits are nothing short of remarkable — especially considering Ethereum's never-ending network congestion issues — the innovation in this area needs to move beyond another platform offering the same cost and speed advantages.

The arrival of the Blast (BLAST) Layer 2 blockchain in early 2024 was a refreshing change — finally, an Ethereum Layer 2 solution that provides something more than just cost and speed efficiencies. Blast is known as a unique Layer 2 chain that offers native yields for ETH and stablecoins, a feature that has attracted significant capital and decentralized finance (DeFi) actors to the platform. Leveraging Blast's unique capabilities and popularity in DeFi, the Thruster Finance decentralized exchange (DEX) was launched on Blast’s blockchain in March 2024.

Thruster offers both the tried-and-tested automated market maker (AMM) model and a more advanced AMM model derived from the Uniswap (UNI) v3–inspired concentrated liquidity provision. Despite offering sophisticated options for token swaps and liquidity provision, Thruster aims to be as beginner-friendly as possible for traders, liquidity providers (LPs) and developers. It has also tightly integrated Blast's own loyalty programs — Blast Gold and Blast Points.

Key Takeaways:

Thruster Finance (THRUST) is a DEX on the Blast Layer 2 network that features standard (constant factor) and concentrated liquidity AMM swap pools.

Among the key advantages of Thruster are a beginner-friendly interface mode, flexible fee tiers for pools and a range of additional rewards — Blast Gold, Blast Points and Thruster Credits.

The app's native crypto token, THRUST, can be staked to obtain veTHRUST, which entitles holders to a share of revenues from protocol fees, additional bonuses for liquidity provision, voting rewards and participation in the platform's governance processes.

What Is Thruster Finance?

Thruster Finance (THRUST) is a DEX on the Blast Layer 2 chain that provides standard AMM and concentrated liquidity AMM services to power its token swap and liquidity provision operations.Thruster was launched in March 2024, soon after the introduction of Blast's mainnet, and builds upon the Layer 2 blockchain's popularity in the DeFi community, its capital efficiency and its cost and speed advantages.

Debuting in February 2024, Blast became a major Layer 2 market disruptor by introducing native yield benefits for holders of Ether and stablecoins. Simply by bridging your ETH or stablecoin funds to Blast, you can earn competitive yields from these assets as an added benefit to the cost and speed efficiencies that Blast boasts as an optimistic rollup solution. The native yield functionality quickly attracted DeFi users to the platform, a development that Thruster Finance has successfully capitalized on since the early days of its operation.

Thruster Finance consists of three key parts: the token swap section, the Uniswap v2–inspired constant factor AMM and the concentrated liquidity AMM, which adopts the basic characteristics of Uniswap v3.

Thruster quickly became the largest DEX on Blast by offering user-friendly and highly flexible token swap and liquidity provision options for its AMM and concentrated liquidity AMM components. At the height of its dominance on the chain, in June 2024, Thruster boasted a total value locked (TVL) of close to $600 million. Although the protocol is currently off these highs, it still ranks as the largest DEX on the Blast blockchain, with a current TVL of around $150 million (as of Dec 4, 2024).

The Thruster Finance project’s seed-stage startup is based in California. It was founded in 2023 by a pseudonymous team that has reportedly contributed to several top-50 protocols. In April 2024, Thruster attracted media attention when it raised $7.5 million from several well-known institutional and individual crypto investors, including Pantera Capital and OKX Ventures.

How Does Thruster Finance Work?

Thruster supports token swaps for ETH, Blast's native cryptocurrency; BLAST, the blockchain's own stablecoin; USDB; and a range of tokens within the Blast ecosystem. Like other AMM-based exchanges, users trade against liquidity pools funded by LPs earning fees from transactions in each respective pool.

The platform features an analytics section that provides up-to-date, transparent information on the current swap rates, fees involved, APRs, liquidity levels and pool performance.

There's also a portfolio section that helps traders track their investments and operations across pools and provides information on users' balances, earnings, staking and liquidity pool commitments.

For LPs, the platform offers two varieties of swap pools: the standard constant factor AMM and the concentrated liquidity AMM. We'll discuss these two kinds of pools in the section below.

Thruster also offers income opportunities via staking. Users who stake the platform's native crypto, THRUST, are issued veTHRUST tokens, which entitle them to earn revenues from the protocol's operations and other protocol benefits.

Although Thruster Finance offers fairly sophisticated products, it aims to appeal to all kinds of DeFi users, from rank beginners to seasoned pros. To meet this goal, the platform offers two user interface modes: lite and pro.

The lite mode is suitable for newbies and less experienced users. It features user-friendly token charts, critical token and pool information and social integrations. Meanwhile, pro mode is designed for experienced DeFi users and provides additional tools for order management, leverage use and asset discovery.

Thruster Finance Key Features

Constant Factor AMM

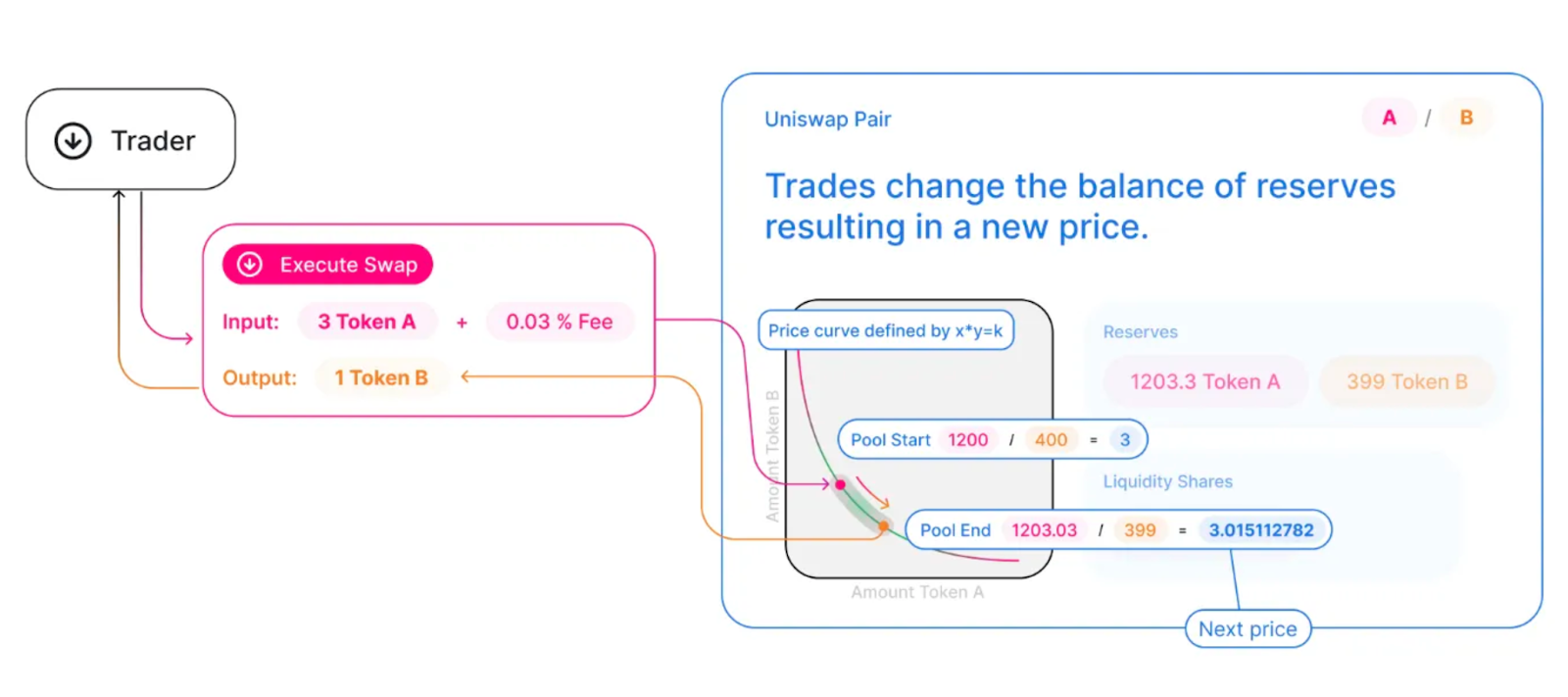

One variety of swap pools on Thruster is based on the constant factor AMM model. This is a standard AMM system, first introduced by Uniswap v1 and improved upon in Uniswap v2. In a constant factor AMM, a swap pool is based on a simple formula, X * Y = K, where X and Y represent the quantities of two tokens in the pool and K is a constant that remains the same regardless ofprice fluctuations. LPs provide liquidity at any price point for the swap pair, irrespective of how the swap rate moves.

The constant factor AMM model provides numerous advantages, including simplicity and relatively high predictability of yields for LPs.

Thruster, however, has made some modifications to the original constant factor AMM developed by Uniswap. First of all, the platform has implemented different fee tiers for swap pools. With Uniswap v2, all swaps are charged one fixed fee — 0.3% per transaction. However, using the same rate, without taking into account liquidity and activity levels for a particular pool, isn't the most flexible solution. This structure limits the flexibility of incentives for LPs — the primary recipients of revenues from swap fees. This is why Thruster has implemented a tiered fee system, as the differential fee model is designed to encourage more active and targeted liquidity provision and token trade.

Another unique feature of Thruster's constant factor AMM is the direct integration of Blast's reward systems, Blast Points and Blast Gold. In addition to transaction fee revenues, LPs may qualify for points under these loyalty programs.

Concentrated Liquidity AMM

Thruster also offers a more advanced variety of crypto trading and liquidity provision based on the concentrated liquidity AMM model. This is the AMM variation first introduced in Uniswap v3.

In a concentrated liquidity AMM, LPs can provide liquidity within specific price ranges within a pool. The advantages of concentrated liquidity over the standard constant factor model are numerous, such as greater capital efficiency, potentially higher yields and reduced slippage rates. This type of AMM provides greater flexibility to LPs in terms of their capital allocation.

LPs contributing funds to Thruster's concentrated liquidity AMM pools are also rewarded with Blast Points and Blast Gold in addition to revenues from swap fees.

Blastscan

Blastscan is a blockchain explorer tool for the Blast ecosystem. In terms of functionality and design, it’s quite similar to Ethereum's Etherscan. Blastscan lets you view detailed statistics on tokens and smart contract addresses hosted on Blast’s Layer 2 platform. While Blastscan covers the entire blockchain's ecosystem and isn't specifically a part of Thruster Finance, it can be used by LPs to withdraw liquidity from Thruster's swap pools.

LPs can add liquidity only via the Thruster user interface, but they can use either the interface or Blastscan when removing previously added liquidity. The latter method isn't as user-friendly as the former option, but it might suit more technically minded users accustomed to the active use of Blastscan.

Thruster Finance Incentives

One distinct feature of Thruster is the abundance of additional incentives for users on top of the standard income from transaction fees. Rewards offered on Thruster include Blast Gold, Blast Points and Thruster Credits. Notably, these rewards aren't restricted to LPs, as other platform participants, such as token traders and referrers, can also expect to receive some of these reward types.

Blast Points

Blast Points are rewards that qualify you for BLAST token airdrops. The Blast project distributes these points to eligible individual wallets and smart contract addresses that hold balances of either of three assets — ETH, Wrapped Ether (WETH) or Blast's USDB stablecoin. Thruster Finance has integrated the distribution of these points to specific liquidity pools. The points are allocated to eligible LPs contributing to these pools.

Blast Gold

Blast Gold represents rewards paid out by the Blast Layer 2 project to decentralized applications (DApps) that actively contribute to the development of the blockchain's ecosystem. Essentially, Blast Gold is a bonus reward (on top of Blast Points) that Blast distributes to select DApps on its network. Thruster Finance is one of the recipients of Blast Gold. A recipient DApp project can internalize its Blast Gold rewards, or share them with their own user community.

Thruster has decided to share its Blast Gold rewards with its two main user community groups: LPs and token swappers. For the latter group, swaps involving ETH or USDB are eligible for Blast Gold rewards.

Thruster Credits

On top of the rewards provided by Blast, Thruster has designed its own loyalty program, Thruster Credits. These credits are awarded to LPs, token swappers, active participants in social media campaigns run by Thruster and those referring new users to the platform. Thruster Credits qualify you for the ongoing THRUST token airdrop, designed to distribute 7% of the token's supply to various groups of eligible users.

What Is the THRUST Token?

THRUST is Thruster Finance’s native cryptocurrency. Launched on Oct 9, 2024, it's an ERC-20 asset issued on the Blast chain. When you stake THRUST on Thruster Finance, you’re issued Vote Escrowed Thrust (veTHRUST), an asset that qualifies you for a range of benefits, including a share of revenues from protocol fees, additional bonuses for liquidity provision, rewards from participation in on-chain voting and the ability to vote on key features and the future direction of the protocol.

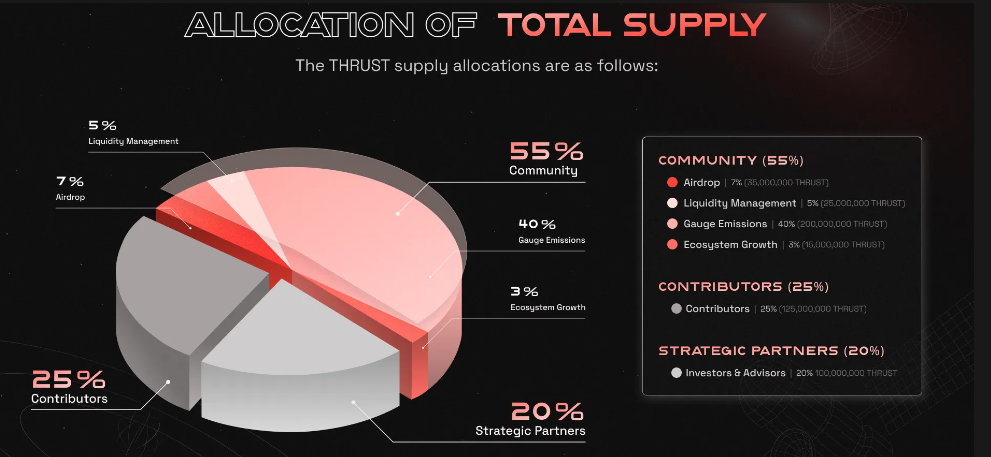

THRUST is a supply-capped asset, with a total and maximum supply of 500 million. As noted earlier, 7% (or 35 million) of the token's supply is slated for distribution via an airdrop to several eligible user groups. These include eligible LPs, token traders and recipients of Thruster's reward program points, including Thruster Credits. The airdrop started on the day of THRUST's token generation event (TGE) in early October 2024, and is scheduled to last 90 days, until Jan 9, 2025.

The THRUST token's overall supply allocation shares are per the chart below:

Where to Buy THRUST

You can buy the THRUST token on Bybit's Spot market as a swap pair with USDT. You can also take advantage of Bybit's THRUST Token Splash campaign to earn a share of the total 2 million THRUST prize pool. To qualify for a 200 THRUST reward, new users need to either deposit at least 500 THRUST, or deposit at least 100 USDT and trade 100 USDT worth of THRUST via their first Spot trade. Meanwhile, existing Bybit account holders can also earn a reward of up to 1,000 THRUST by trading at least 500 USDT worth of THRUST on the Spot market. The campaign runs through Dec 10, 2024, 8:59PM UTC.

Closing Thoughts

Automated market makers (AMMs) have experienced rapid growth ever since the introduction of the concept by Uniswap in 2018. The concentrated liquidity model, again championed by the Uniswap DEX, has added further options and versatility for LPs. However, inflexible fee structures and poor user interfaces have dogged the broader adoption of both liquidity provision and token swaps on AMMs for years.

Thruster Finance is a timely addition to the AMM DEX landscape, with advantages like a beginner-friendly interface, different fee tiers based on the specifics of each pool, and an array of additional rewards — Blast Gold and Blast Points, as well as app-specific credits.

Thruster offers a comprehensive suite of options for DeFi veterans, as well as for those new to AMM-based liquidity provision or token trade. All that Thruster needs now is wider recognition and adoption by the DeFi user community — never an easy job in a competitive field where the likes of Uniswap, Curve Finance (CRV), and PancakeSwap (CAKE) still dominate mightily.

#LearnWithBybit