Syrup: Institutional DeFi Yields

Syrup is a decentralized finance (DeFi) platform designed to bring institutional-grade lending yields to a broad audience. Built on Maple’s proven lending infrastructure, Syrup allows users to earn consistent yields by participating in overcollateralized lending pools. Syrup stands out for its integration with major DeFi protocols.

This article explores Syrup’s features, tokenomics and staking opportunities, showcasing its ability to bridge institutional-grade lending with DeFi accessibility.

Key Takeaways:

Institutional-Grade Yields: Syrup generates consistent returns, powered by Maple's $5.1 billion in loan originations.

Seamless Access: Users can deposit USDC or USDT and immediately earn yield with LP tokens, such as syrupUSDC or syrupUSDT.

Robust Ecosystem: Integration with leading DeFi protocols like Pendle and ether.fi expands Syrup’s utility and interoperability.

This article also highlights the innovative SYRUP token, staking mechanisms and security measures on Syrup that ensure both scalability and reliability in the DeFi space.

What Is Syrup?

Syrup is a DeFi platform that offers institutional-grade lending yields to retail and DeFi users. Powered by Maple, Syrup facilitates overcollateralized, fixed-rate loans to institutional borrowers, ensuring consistent returns for users.

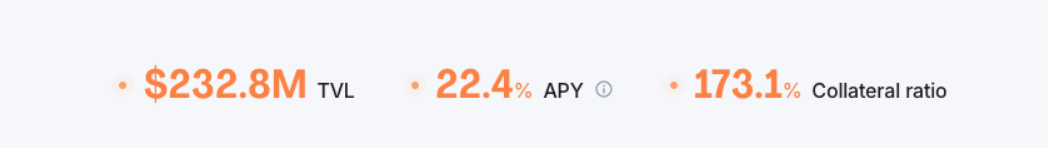

With a TVL of $232.8 million, an average APY of 22.4% and a collateral ratio of 173.1%, Syrup has quickly become a trusted name in the DeFi space.

By allowing users to deposit USDC or USDT and earn yield through LP tokens like syrupUSDC, Syrup combines Maple’s lending infrastructure with DeFi’s permissionless access to create a seamless earning experience.

What Is Maple?

Maple is a leading institutional lending protocol in the DeFi space, designed to deliver fixed-rate, overcollateralized loans to institutional borrowers. Established in 2019, it plays a pivotal role in Syrup’s ecosystem by providing its robust lending infrastructure.

Loan Volume: Over $5.1 billion in loans originated, showcasing Maple’s scale and trustworthiness.

Focus on Compliance: Implements KYC checks, credit underwriting and risk management to ensure high borrower quality.

Core Offering: Provides fixed-rate, institutional-grade loans using collateralized digital assets like BTC, ETH and SOL.

Integration with Syrup: Maple powers Syrup’s high-yield lending pools, enabling permissionless access for DeFi users.

By merging the strengths of traditional finance (TradFi) with blockchain efficiency, Maple sets the foundation for Syrup to offer institutional-grade yields to DeFi participants.

Yield Opportunities and Institutional Lending From Maple

Syrup is powered by Maple’s lending infrastructure, leveraging its expertise in fixed-rate lending and compliance to deliver consistently high yields. By tapping into Maple’s ecosystem, Syrup enables permissionless access to institutional-grade lending for DeFi participants.

How Syrup Utilizes Maple

Integrated Lending Pools: Syrup inherits Maple’s established lending pools, including Blue Chip Secured and High Yield Secured pools.

Yield Consistency: Maple’s institutional lending engine ensures steady returns, with Syrup achieving 22.4% APY on deposits.

Permissionless Access: While Maple targets accredited investors, Syrup democratizes access, allowing DeFi users to deposit USDC or USDT and earn yield.

By combining Maple’s structured credit framework with Syrup’s permissionless accessibility, the two platforms create a seamless bridge between TradFi and DeFi for institutional-grade lending opportunities.

Key Features of Syrup

Syrup offers a suite of features designed to simplify earning yields and managing assets in the DeFi space.

Lending: Users can deposit USDC or USDT into Syrup’s lending pools to earn yield. These funds are allocated to Maple’s institutional lending engine, providing fixed-rate, overcollateralized loans. Current returns include an impressive 22.4% APY, ensuring steady income for participants.

Staking SYRUP: Syrup token holders can stake their tokens to earn additional rewards. Doing so aligns participants with the platform’s growth while allowing them to earn a share of protocol revenue. Staked SYRUP tokens also grant governance rights, enabling holders to influence key decisions.

Convert: Maple’s MPL token holders can seamlessly convert their tokens into Syrup tokens (SYRUP) at a rate of 1 MPL = 100 SYRUP. This feature integrates Maple and Syrup’s ecosystems, making it easy for MPL holders to transition and participate in Syrup’s DeFi offerings.

Drips Rewards: Syrup rewards participants with “drips,” which are regular payouts generated from lending activities. These rewards encourage long-term engagement and provide consistent returns for active users.

By combining lending, staking and reward mechanisms, Syrup offers a streamlined approach for users to generate high yields while actively participating in the platform’s ecosystem.

How Does Syrup Work?

Syrup operates as a layer on top of Maple, simplifying access to institutional-grade DeFi yields. It abstracts the complexities of Maple's permissioned system to allow seamless user interaction while leveraging Maple's robust lending infrastructure.

Built on Maple Protocol: Syrup connects to Maple’s decentralized corporate credit market, in which capital is provided to institutional borrowers.

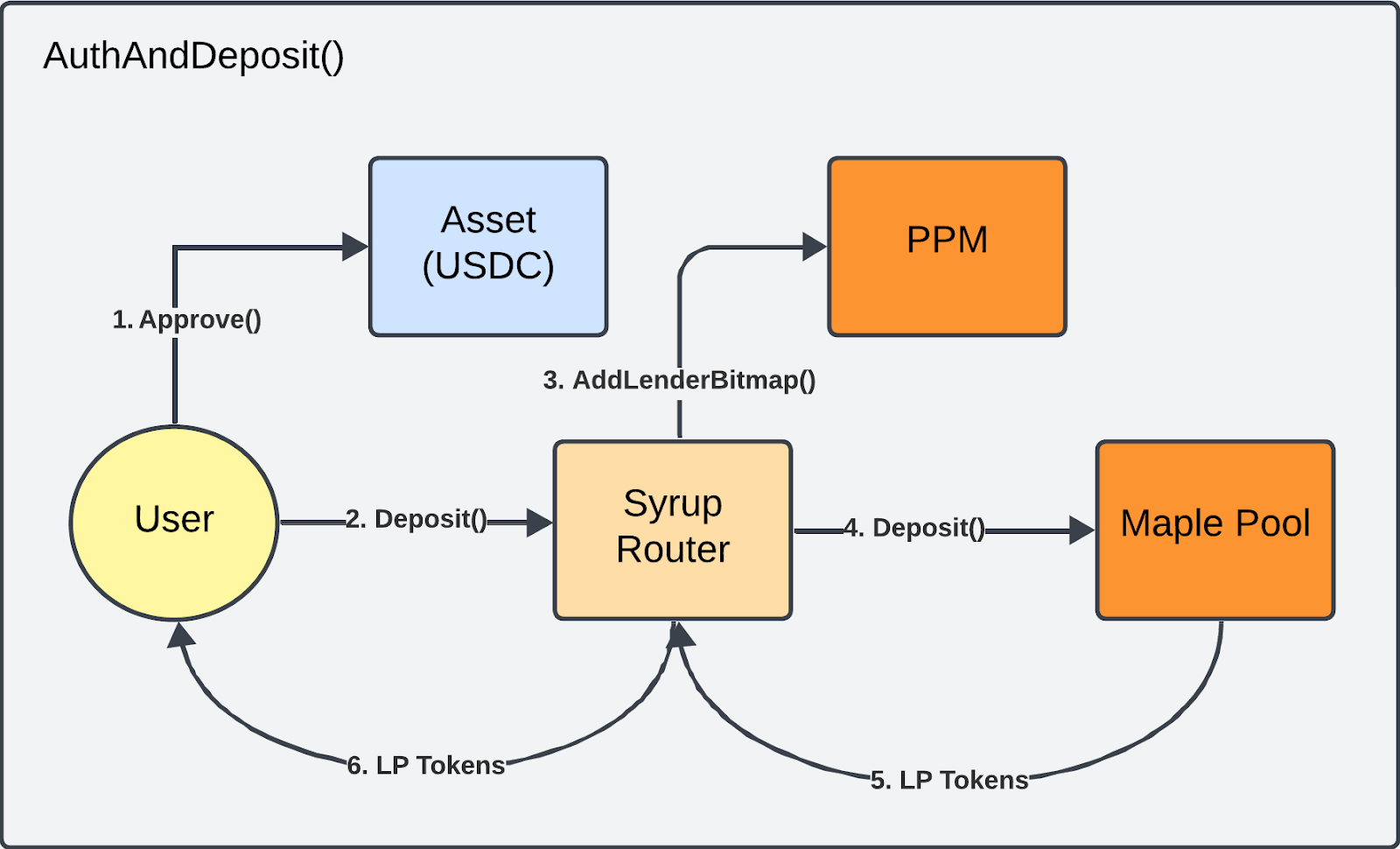

Simplified Access: Syrup's primary contract, the SyrupRouter, integrates with Maple’s Pool Permission Manager, enabling users to securely access yields without navigating complex authorization systems.

Permission Management: Syrup ensures only eligible users interact with the pools. Eligible users can self-authorize and deposit in a single transaction.

User Flow

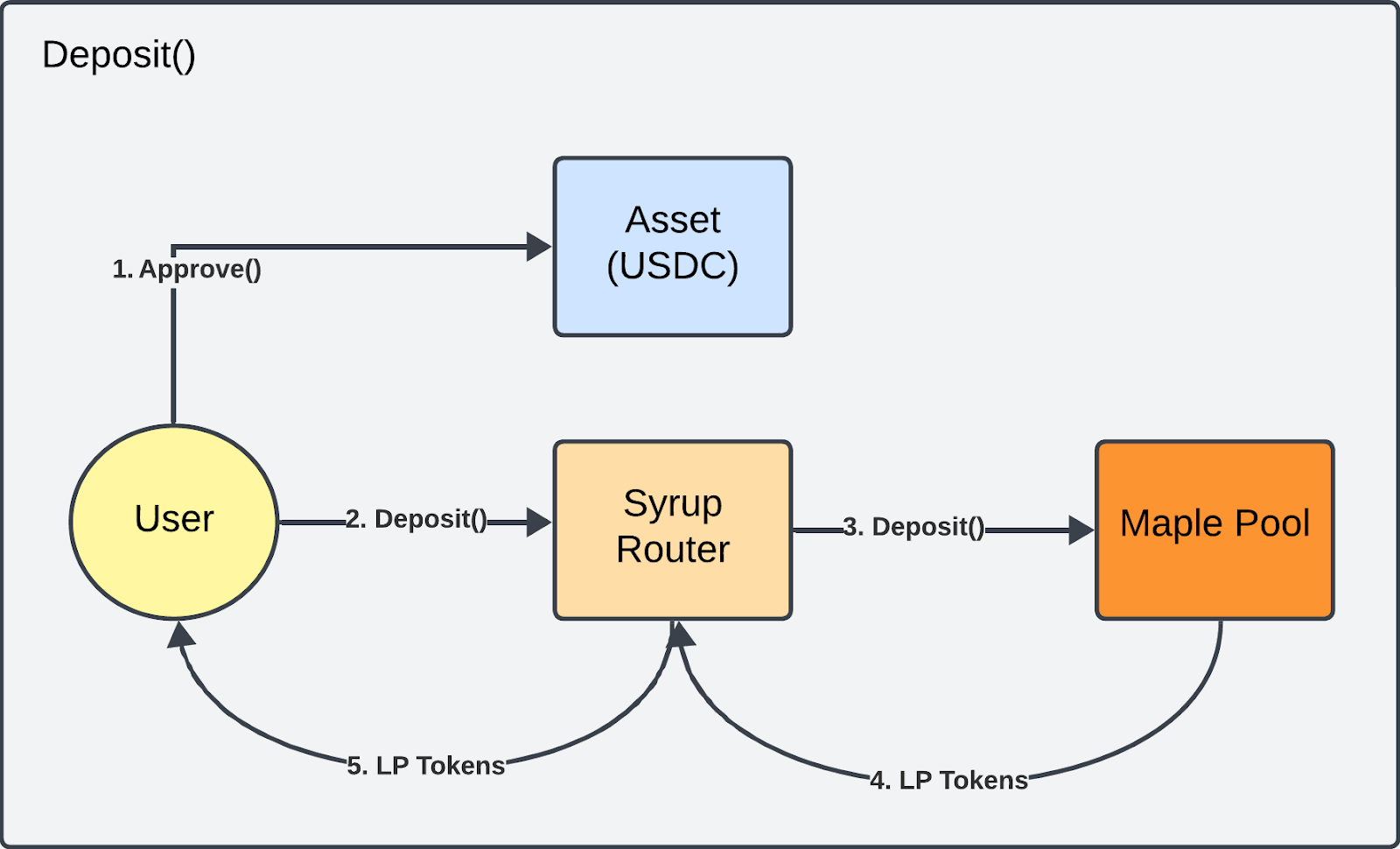

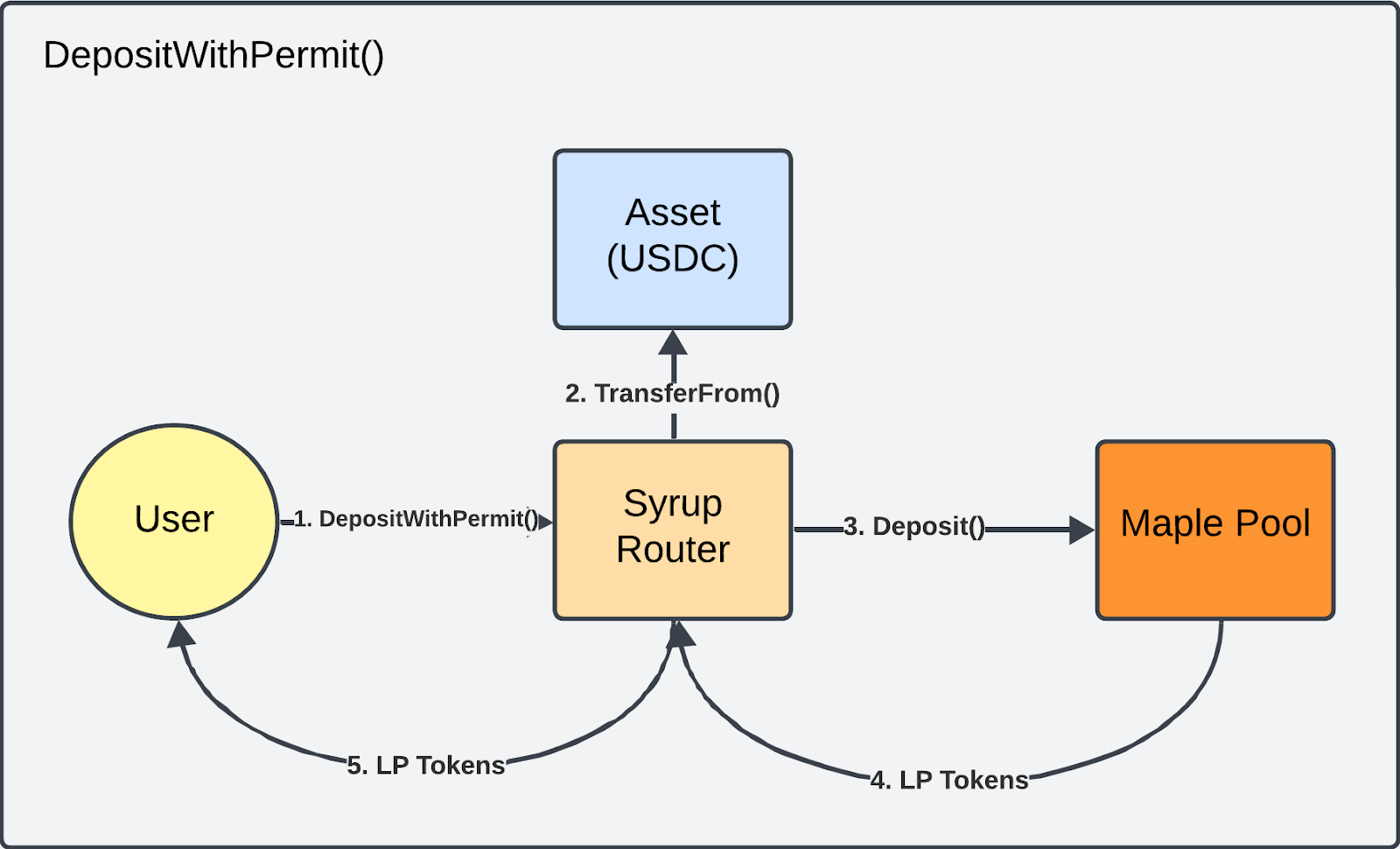

Authorized Users: Users who meet Maple's eligibility can deposit directly using functions like deposit() or depositWithPermit().

Deposit() functions

DepositWithPermit() functions

Non-Authorized Users: Those without prior permissions can use integrated functions like AuthAndDeposit() to both authorize and deposit in one step.

AuthAndDeposit() functions

By streamlining access to institutional lending, Syrup empowers users to benefit from Maple's high yields with reduced operational complexity. This user-centric design makes DeFi yields more accessible while maintaining robust security.

SYRUP Tokenomics and Market Performance

The Syrup token (SYRUP) operates as the core utility token of the Syrup platform, bridging its DeFi ecosystem with institutional-grade lending from Maple.

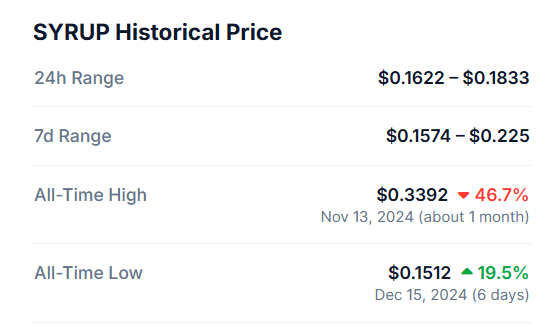

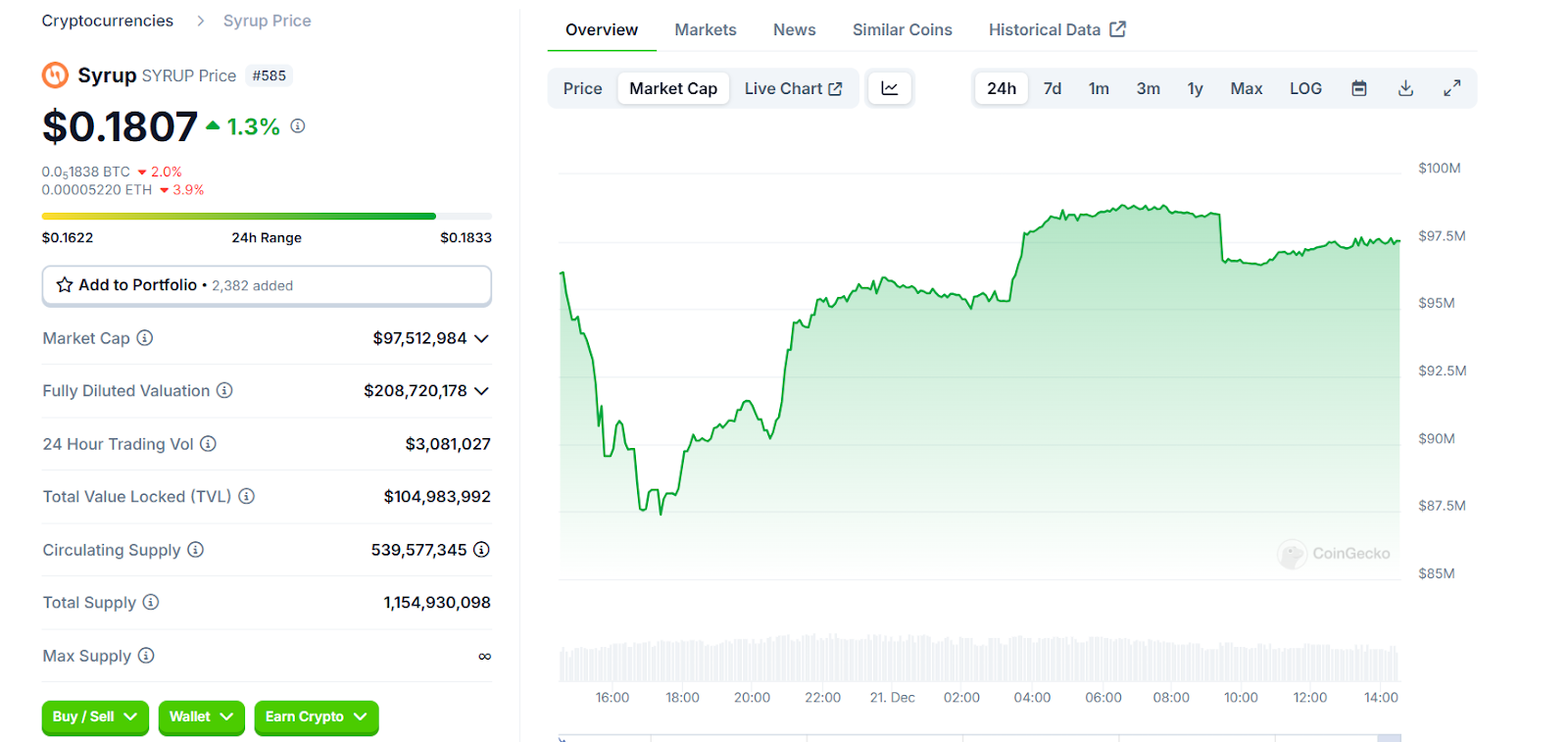

Market Cap: SYRUP’s highest market cap was $132.6 million on Dec 5, 2024, showcasing robust growth and adoption.

All-Time High: SYRUP reached its peak price of $0.3392 on Nov 13, 2024.

All-Time Low: The lowest price recorded was $0.1512 on Dec 15, 2024, with a 19.5% rebound since then.

Circulating Supply: Approximately 540 million tokens contribute to active trading and liquidity.

Migration Mechanism: Maple’s MPL token holders can swap for SYRUP at a 1:100 ratio, integrating both ecosystems seamlessly.

SYRUP provides staking incentives, governance rights and utility across both Syrup and Maple’s ecosystems, ensuring active engagement and long-term value for holders.

SYRUP Token Staking

Staking SYRUP tokens allows holders to earn rewards while contributing to the ecosystem's growth. Here’s how the staking mechanism works:

One-Click Staking: Users can convert MPL to SYRUP and stake it to receive stSYRUP, which represents their staked position and earns rewards.

Rewards Distribution: Stakers earn from two sources:

Protocol Revenue: Fees from institutional loans, including management and service fees, are used for SYRUP token buybacks.

Token Inflation: 5% annualized increase in SYRUP supply.

Initial Incentives: In the first 90 days, 5 million SYRUP will be distributed to stakers. With a 25% staking rate, this equals an estimated APY of 9%.

Decentralized and Noncustodial: Staked tokens remain under user control, with no lockup period. Rewards accumulate directly in the staking dashboard.

Staking rewards, governance participation, and instant unstaking options make SYRUP staking attractive for its ecosystem’s participants.

Outlook for Syrup

Syrup effectively bridges institutional-grade lending with DeFi accessibility, offering consistent yields, seamless staking and robust integrations with the Maple ecosystem. With strong tokenomics, comprehensive security audits and a clear road map for growth, Syrup has positioned itself as a leader in sustainable DeFi solutions

#LearnWithBybit