SynFutures (F): Exploring the Decentralized Derivatives Platform

SynFutures is a decentralized marketplace that lets users list on-chain perpetual futures for any cryptocurrency and trade them on the platform. In addition to the wide range of supported assets (such as real-world assets, or RWAs, and NFTs), the project's Oyster automated market maker (AMM) solution enhances liquidity through the combination of an AMM model and an order book. Powered by the native F token, SynFutures is backed by prominent investors and features a cumulative trading volume of over $230 billion.

In this article, we’ll explore SynFutures, its key features and the mechanics behind the Oyster AMM, as well as the F token and its tokenomics.

Key Takeaways:

SynFutures is a decentralized derivatives platform that lets users trade on-chain perpetuals based on cryptocurrencies.

As part of a permissionless listing process, anyone can list any asset on the platform without centralized oversight or decentralized autonomous organization (DAO) proposals.

SynFutures is powered by the Oyster automated market maker (AMM) mechanism that combines AMM and order book functionality to enhance liquidity, user experience and capital efficiency.

What Is SynFutures?

SynFutures is a decentralized derivatives platform that enables users to trade on-chain crypto perpetual futures. Powered by a single-token liquidity model, SynFutures allows free listing of any digital asset on its protocol without any decentralized autonomous organization (DAO) proposals or centralized intervention. Doing so fosters on-chain trading of a diverse range of cryptocurrency perpetuals via the platform.

To maximize liquidity, SynFutures employs the Oyster automated market maker (AMM) that provides a customizable set of tools, such as concentrated liquidity and limit orders. In addition to crypto, the project also enables users to trade perpetual contracts based on non-fungible tokens (NFTs) in a user-friendly way via the NFTures platform. As the native coin of the SynFutures ecosystem, the F token is utilized primarily for community governance and airdrop boosts, as well as for fee discounts and rewards.

At the time of this writing (Dec 19, 2024), SynFutures boasts a cumulative trading volume of over $230 billion and 308,900 total users, of which 22,410 were active within the past seven days. In addition to featuring a total value locked (TVL) of over $50 million, the decentralized derivatives platform has processed 15.24 million transactions to date.

Who Founded SynFutures?

SynFutures was founded in 2020 by Rachel Lin and Matthew Liu.Before serving as the CEO and co-founder of the decentralized futures platform, Lin worked at Deutsche Bank, specializing in derivatives. She also co-founded Matrixport, one of Asia's largest digital asset neobanks.

Starting his career as a trader managing Deutsche Bank's Asia rates desk, Matthew Liu's MBA at Northwestern eventually led to him joining the blockchain space. While at Ant Group, he was instrumental in setting up the company's global treasury and later took charge of its financial blockchain business, with a focus on secondary market trading and credit tokenization.

SynFutures Investors

To date, SynFutures has raised $37.4 million in funding from investors in one seed and two early-stage financing rounds. Some of the most notable contributors include Bybit, Pantera Capital, Polychain Capital, Dragonfly Capital, HashKey Capital and Standard Crypto, among others.

Key Features of SynFutures

SynFutures' ecosystem consists of three flagship solutions:

SynFutures Perpetual Futures Trading Platform: The first and most important offering within SynFutures' ecosystem is its decentralized perpetual futures trading platform. This is where users can list and trade perpetuals based on any digital asset with enhanced liquidity.

NFTures: Also known as NFT Futures, NFTures enables users to go long or short on NFT perpetuals with two simple clicks and a Tinder-like design tailored specifically for mobile devices.

Perp Launchpad: SynFutures Perp Launchpad supports coin margin perpetual markets with one single token, and allows projects to enable leveraged trading and offer passive liquidity provider (LP) rewards for their token holders.

SynFutures' Oyster AMM: How Does it Work?

One of the most unique components of SynFutures' ecosystem is the Oyster AMM. It combines the functionality of order books and AMMs to offer users the following key features:

Single-Token Concentrated Liquidity: With a margin management and liquidation framework tailored for derivatives, the Oyster AMM incorporates leverage and facilitates liquidity concentration within specific price ranges to boost capital efficiency. Despite implementing the concept of two-sided liquidity, LPs only need to provide liquidity via a single token to SynFutures. This allows users to list "anything against anything," significantly increasing the diversity of assets.

Permissionless On-Chain Orderbook: The Oyster AMM combines the democratized market access and diverse asset support of the AMM model with the capital efficiency of order books. This ensures transparency, anti-censorship, trustlessness, efficiency, robustness and security without potential back doors or centralized administrators.

Single Model for Unified Liquidity: Integrating concentrated liquidity and an order book in a single model, the Oyster AMM offers a system of unified liquidity tailored to suit the needs of both passive liquidity providers and active traders. This guarantees users atomic transactions with predictability.

Stabilization Mechanism for User Protection: With advanced financial risk management mechanisms in place, the Oyster AMM also aims to improve price stability and user protection. This includes a dynamic penalty fee to discourage price manipulation, and a stabilized mark price mechanism to mitigate risks related to mass liquidations and sudden price fluctuations.

What Is the SynFutures (F) Token?

SynFutures' F token serves as the native coin within the project's ecosystem. The main utilities of the digital asset include the following:

Staking F to propose and vote on community governance-related matters.

Boosting incentives accrual rates for future airdrops by staking F.

Depending upon the amount and duration of staked tokens, F holders will be able to claim fee discounts and potential future rewards after SynFutures' fee discount program is rolled out.

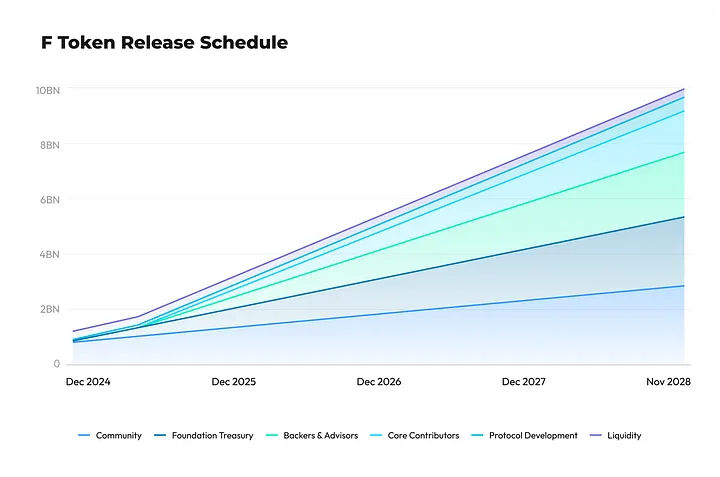

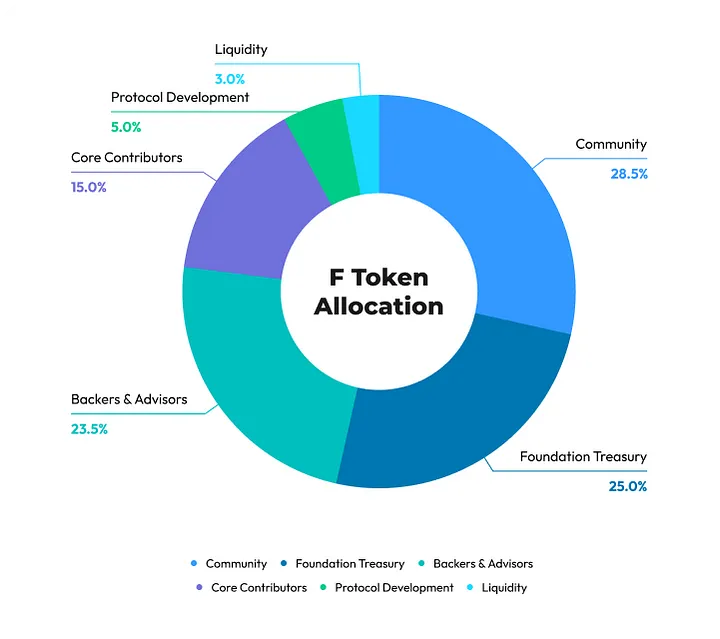

F's max supply is capped at 10 billion tokens. Currently, 1.2 billion F are circulating in the market. As of Dec 16, 2024, the native coin features a nearly $86.5 million market cap, a fully diluted valuation (FDV) of $720 million and a trading volume of $28.52 million over the past 24 hours. F’s allocation is per the graphic below:

Trade SynFutures (F) on Bybit Now

SynFutures’ decentralized derivatives platform enables users to list and trade any digital asset and combine it with other cryptocurrencies to create combinations of perpetual futures pairs. Powered by the F native token and the Oyster AMM, SynFutures fosters enhanced liquidity and user experience and a permissionless listing process for perpetuals.

Get access to SynFutures by trading F on Bybit's user-friendly and intuitive Spot trading platform. Create an account now to get started!

#LearnWithBybit