StakeStone (STO): Cross-chain liquid staking protocol

StakeStone (STO) is a next-gen omnichain liquidity infrastructure protocol designed to optimize yield and cross-chain liquidity. Its introduction of liquid yield-bearing versions of ETH and BTC — STONE and STONEBTC — enables users to earn sustainable yield while enhancing capital efficiency. This article explores StakeStone’s architecture, core assets, founding team, tokenomics and recent market performance.

Key Takeaways:

STONE and STONEBTC enable users to earn yield while retaining cross-chain liquidity.

Protocol governance and strategy allocation are community-driven through Optimizing Portfolio and Allocation Proposals (OPAPs).

Bybit users can trade STOUSDT Perpetual contracts on Bybit with up to 20x leverage.

What is StakeStone?

StakeStone is a decentralized liquidity infrastructure protocol that issues liquid, yield-bearing assets like STONE (Ethereum) and STONEBTC (Bitcoin). Designed for omnichain integration, it empowers users and protocols with composable staking solutions and efficient cross-chain liquidity.

Launched in 2024, StakeStone was built to address the fragmented and capital-inefficient nature of ETH and BTC staking by introducing secure, flexible and modular primitives. StakeStone’s mission is to maximize on-chain yield while ensuring deep liquidity across ecosystems.

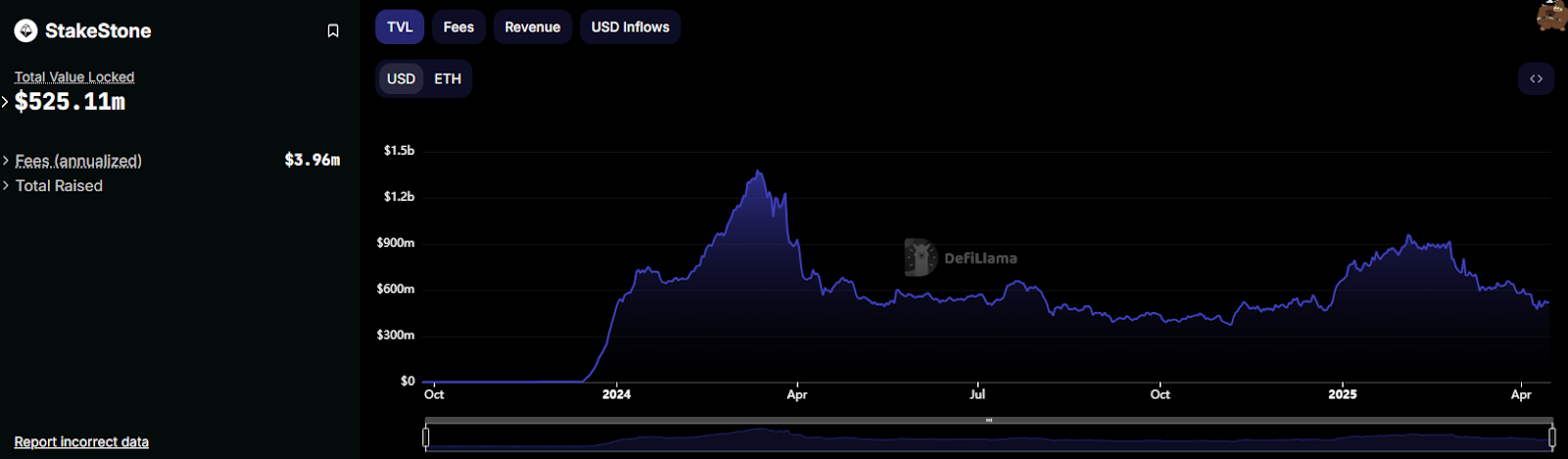

Key Stats (as of April 2025):

Total value locked (TVL): $525.1 million

Annualized protocol revenue: $3.96 million

Circulating STO supply: 225 million

Key partners: Cobo, Coincover, EigenLayer, Native

StakeStone founders and investors

StakeStone was founded in 2023 by a team of DeFi-native builders led by Charles K, a crypto veteran with over 10 years of experience in centralized exchanges (CEXs), hardware wallets and DeFi infrastructure The core team includes Rose Li, Chief Strategy Officer, and Ivan K, Chief Marketing Officer.

The project has secured funding from notable crypto funds, including Polychain Capital, Binance Labs, OKX Ventures, Amber Group, HashKey Capital and Bankless Ventures. These backers not only provide capital but also strategic ecosystem access — positioning StakeStone as a serious player in omnichain liquidity and yield infrastructure.

How does StakeStone work?

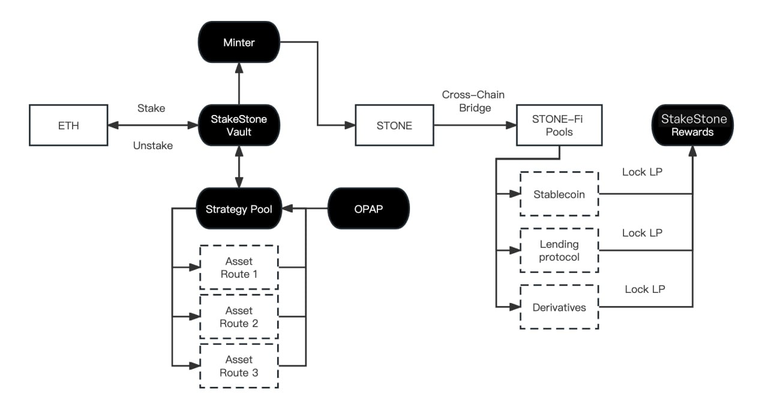

StakeStone converts ETH and BTC into liquid, yield-bearing assets — STONE (ETH) and STONEBTC (respectively) — through a modular and omnichain framework. When ETH is staked, it flows into the StakeStone Vault and is allocated to the Strategy Pool, and STONE is minted via the Minter.

Yield is generated through strategies such as:

stETH staking

EigenLayer restaking

BTC-based liquidity provisioning

Users can deploy STONE across chains via the cross-chain bridge into STONE-Fi Pools to earn liquidity pool (LP) rewards, with optional LP locking for enhanced returns. SBTC is the liquid BTC asset mirroring Bitcoin’s value, with STONEBTC adding a yield layer to BTC and unlocking passive income without sacrificing liquidity.

StakeStone implements key security measures, including the following:

Audited contracts and whitelisted strategies

Community-driven governance via OPAP

Multi-signature custody by Cobo and CoinCover

STONE (ETH): Omnichain yield-bearing asset

STONE (ETH) is StakeStone’s flagship liquid staking derivative. It’s minted when users stake ETH, and is backed by underlying yield from stETH, EigenLayer restaking and additional DeFi strategies.

STONE supports seamless cross-chain bridging, enabling deployment across supported networks and STONE-Fi Pools for additional rewards. Users benefit from passive yield, cross-chain utility, governance participation and on-demand liquidity.

SBTC and STONEBTC

SBTC is a liquid Bitcoin asset that mirrors BTC’s value and enables seamless use within EVM-compatible chains. STONEBTC, on the other hand, enhances SBTC by adding a yield layer, empowering users to earn yield from BTC-based strategies while preserving liquidity.

These tokens address BTC's limited DeFi utility by unlocking native BTC liquidity and enabling new use cases, such as cross-chain lending and borrowing, LP participation in BTC-based DeFi pools and composable integration across multichain DeFi protocols.

Together, SBTC and STONEBTC aim to position Bitcoin as an active capital layer across Ethereum and beyond.

STO tokenomics and utility

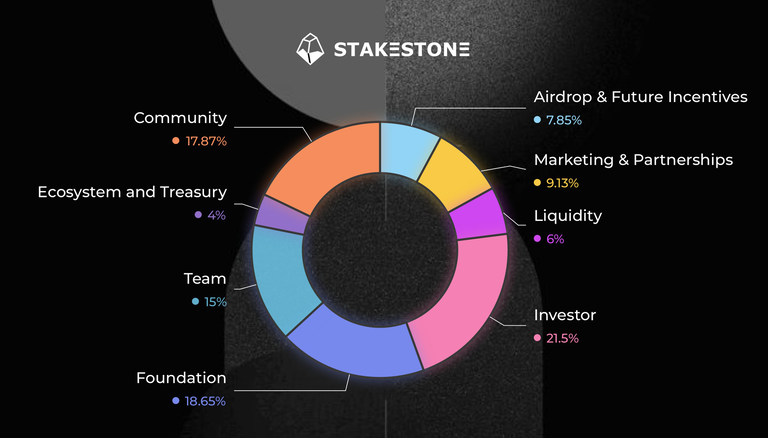

STO is the native governance and utility token of StakeStone, with a total supply of 1 billion. It underpins protocol governance via OPAP proposals, voting-escrowed STO (veSTO) staking and bribe markets.

By locking STO into veSTO, users can:

Vote on governance proposals

Boost staking yields

Access bribe incentives

STO token’s allocation is as follows:

Investors | 21.5% |

Foundation | 18.65% |

Community | 17.87% |

Team | 15% |

Marketing & partnerships | 9.13% |

Airdrops & future incentives | 7.85% |

Liquidity, ecosystem and treasury | 10% |

Emissions are set to taper gradually until 2031, aligning incentives with long-term ecosystem growth.

Where to buy StakeStone (STO)

According to CoinGecko, as of Apr 24, 2025, STO was trading at $0.1122 with a market cap of over $25 million. The token has recently shown strong momentum, rallying 85.4% over the past two weeks. Furthermore, StakeStone’s value could benefit from various catalysts, such as the rise in demand for Bitcoin liquid staking and the emergence of Ethereum restaking.

Bybit recently listed the STOUSDT Perpetual futures contract in the Innovation Zone, with up to 20x leverage.

How to trade StakeStone (STO) on Bybit

Sign in or create a Bybit account, complete identity verification and fund your unified trading account using crypto deposits or fiat currencies.

Head to the STOUSDT futures page to start trading StakeStone on Bybit!

#LearnWithBybit