Sanctum (CLOUD): Unlocking the Future of Liquid Staking on Solana

The introduction of the proof of stake (PoS) block validation method on Ethereum (ETH) back in 2021 led to an explosion in the number of liquid staking protocols on its blockchain. Due to the inflexibility and high capital requirements of direct Ethereum staking, the liquid staking sector flourished, quickly becoming one of the leading niches within the decentralized finance (DeFi) industry. Popular thanks to their affordability and flexibility, these protocols offer liquid staking tokens (LSTs), also known as liquid staking derivatives (LSDs), as a confirmation of your staked funds, and LSTs can be freely reinvested within the DeFi pools and solutions of the Ethereum ecosystem and beyond.

Sanctum (CLOUD) is a liquid staking protocol that’s taken the concept of LSTs to the Solana (SOL) ecosystem. Although Sanctum isn't the first liquid staking protocol on Solana, it has introduced several innovative solutions in this area, the most notable of which is a multi-asset liquidity pool that aims to provide virtually limitless liquidity for Solana LSTs. By offering a highly flexible, multi-LST liquid staking environment, Sanctum opens up unique opportunities for the Solana DeFi user community.

Key Takeaways:

Sanctum is a Solana-based liquid staking protocol featuring a multi-LST liquidity pool and token swaps.

Sanctum aims to offer an environment in which protocols and even individual validator nodes can create their own custom LST tokens and leverage infinite liquidity via the platform's multi-asset pool.

CLOUD, Sanctum’s native governance token, can be bought on Bybit as a Spot pair (CLOUD/USDT).

What Is Sanctum?

Sanctum (CLOUD) is a liquid staking protocol on the Solana blockchain that introduces the concept of a shared multi-LST pool to provide limitless liquidity levels for Solana LSTs. Sanctum allows users to contribute SOL coins and whitelisted Solana LST assets to the platform's liquidity pool, in order to earn yields and provide liquidity to Solana-based DeFi protocols. If you’ve staked your SOL with a Solana validator, Sanctum also allows you to convert your staked funds into supported LSTs or instantly unstake them.

The origins of Sanctum go back to 2021, when the Unstake.it liquidity protocol was launched. Supported by Solana Labs, Unstake.it (now known as Sanctum v0) was a solution based on a single-asset (SOL) liquidity pool. In March 2024, the project’s team announced a rebranding of Unstake.it to Sanctum, with overhauled functionality that supports multi-LST liquidity provision and trading. The new project launched its native governance token, CLOUD, on Jul 18, 2024.

Sanctum is a novel project within the Solana DeFi space. Although it isn’t the first liquid staking protocol on the blockchain, it offers a unique set of functions that lets users contribute liquidity in multiple LSTs and trade these tokens.

Controlling issued and traded LSTs on the platform is highly secure, with a 10-member Multisig group jointly making decisions on the liquid tokens' introduction, structure, changes and upgrades. Key decisions must be approved by at least six out of 10 group members. The members of the Multisig group are reputed institutional entities affiliated with the Solana ecosystem, including providers such as the Jupiter swap aggregator, the SolBlaze liquid staking platform and the Jito DeFi platform.

Liquid Staking on Solana

Following the popularity of Ethereum-based liquid staking, new projects applying the same concept on the Solana blockchain have emerged. However, most of these projects provide only the most standard liquid staking functionality, issuing LSTs in exchange for SOL liquidity and allowing their liquid tokens to be used on various Solana DeFi protocols. While providing a much-needed contribution to the staking process on the network, these projects, unlike Sanctum, aren't designed to provide deep liquidity across the entire Solana ecosystem.

Although Solana boasts stellar technical capabilities, including rapid 400 millisecond block times, the chain has faced challenges due to the influx of meme coins and DeFi protocols seeking to take advantage of its low fees. The rush of these projects has caused network congestion and outages, with validator nodes struggling to cope with the loads.

Sanctum's multi-LST liquidity pool is designed to open up virtually limitless — or at least considerable — liquidity levels directly involved in supporting the staking process. This should help ease the load and increase the provision of validator services on the network.

Another critical issue with the process of staking on Solana is the slow release of unstaked funds. It may take up to three days to unlock staked SOL and have the funds returned to the user. While a period of a few days may not sound too long, it's often critical for many stakers, who tend to be active DeFi users, to have their funds available as quickly as possible. Every minute their funds are staked on Solana means loss of opportunity to these crypto users. Sanctum directly addresses this issue by supporting an instant unstake function.

How Does Sanctum Work?

The Infinity Pool, Sanctum's multi-LST liquidity pool, is the primary mechanism supporting liquidity provision on the platform. Users can deposit certain whitelisted LST assets (more on these later) or SOL tokens to earn staking rewards and support the liquidity requirements of the Solana ecosystem.

Sanctum also supports swap operations for these LSTs and SOL tokens. When you buy an LST asset using SOL, you effectively start liquid staking using the LST. Similarly, selling an LST for SOL means withdrawing from a staking position for that liquid asset/protocol. Swap operations are enabled either through Sanctum Router or through the Jupiter exchange. When Sanctum handles an LST-to-SOL operation through its own router, a fee of 0.01% of the transaction amount is charged.

Users who have staked SOL on a Solana validator in the past usually have what’s known as a staking account. This type of account exists outside of the Sanctum platform. The Sanctum protocol allows you to convert your Solana staking account into a Sanctum-based liquidity staking account. This has a couple of benefits. First, you can unstake your funds using Sanctum's Instant Unstake functionality. Secondly, you can easily convert your SOL stake into a supported liquid staking token.

Sanctum Key Features

Infinity

Sanctum’s Infinity Pool — thanks to its multi-asset composition — enables liquidity provision and token swaps across the LST assets supported by its platform, as well as Solana's native SOL tokens. Depositing an LST or SOL into the pool is completely free. When you add liquidity to the pool, you’re issued INF tokens (see below) to confirm your deposit.

INF Token

The INF token, which acts as a form of your certificate of deposit, is an asset that accrues yields from your staked position in the Infinity Pool. INF can be used for Solana-based DeFi activities while you earn your yields. When you decide to withdraw your funds, you simply sell your INF and receive your investment back, naturally with all the accrued interest. Besides obtaining INF tokens by adding liquidity to the Infinity Pool, you can also purchase INF via Sanctum's token swap section using SOL or a supported LST asset.

Validator LST

Sanctum Validator LSTs are custom liquid tokens issued by network validators. Validators can use these assets to incentivize stakers and run their own loyalty programs and campaigns. These LSTs combine the benefits of direct staking — no fees and the ability to choose your own validator — along with the benefits of liquid staking, namely flexibility, instant unstake and opportunities to reinvest in Solana DeFi protocols. Validator LSTs are part of the infinite LST future concept, whereby everyone can issue their own LST, promoted by Sanctum.

Sanctum Reserve Pool

Sanctum Reserve Pool is a SOL liquidity pool that can facilitate instant LST unstaking for any liquid asset supported by the Sanctum protocol. With a growing number of LST tokens, one potential issue that may arise is the ability to unstake these tokens into SOL, particularly at times of high demand for the unstake service. Also known as the Reserve, it’s designed to protect from any such liquidity crunch by retaining enough SOL to meet the needs of unstakers.

The Router

As mentioned above, Sanctum swap operations are channeled either through the Jupiter decentralized exchange (DEX) or through Sanctum's own Sanctum Router, which balances liquidity for different LSTs to meet users' demands when converting their liquid tokens into SOL. The Router reallocates liquidity so that LSTs with low liquidity levels aren't adversely affected when users need to swap them for SOL. In order to provide optimally enhanced liquidity levels, the Router has access to certain Solana-based DEX platforms, specifically Orca (ORCA) and Raydium (RAY).

What Is the Sanctum Governance Token (CLOUD)?

Sanctum's native token, CLOUD, was launched on Jul 18, 2024. CLOUD is officially designated as a governance token. Following the platform's rebranding from Unstake.it to Sanctum, the project’s team announced plans to establish a decentralized autonomous organization (DAO) that will handle the platform's governance processes. As of mid July 2024, precise details of the DAO have yet to be released. It's widely expected that holding or staking CLOUD will entitle users to participation in the DAO.

Prospective participants in Sanctum's Verified Partner program will need to stake CLOUD in order to be considered. The program allows verified LST issuers to have their assets included in the list of tokens eligible for the Infinity Pool. CLOUD holders will vote on which partners to accept into the program.

CLOUD Tokenomics

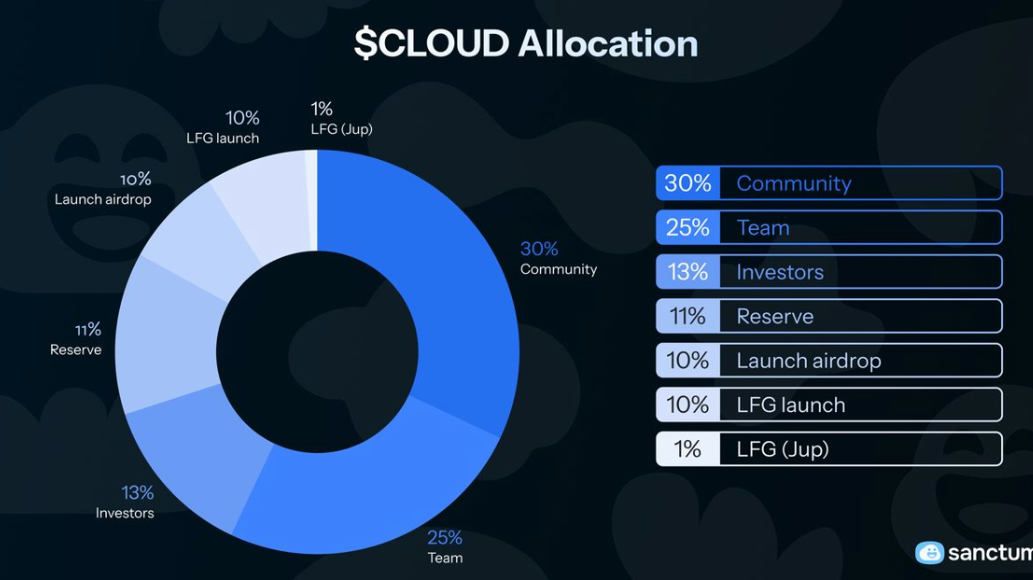

CLOUD is a supply-capped token with a total and maximum supply of 1 billion. Of this supply, 10% (100 million CLOUD) is allocated to a launchairdrop that went live on Jul 18, 2024, the day of the token generation event (TGE).

Overall allocation of the CLOUD supply is shown in the chart below.

Where to Buy CLOUD

The CLOUD token is available on Bybit's Spot Market as a swap pair with USDT. In addition to standard swaps, the token can be used with Bybit's Spot Grid Bots to help you optimize your trades and take advantage of our automated grid trading opportunities.

Main Types of Sanctum LSTs

Several LSTs have proved popular on Sanctum and within the wider Solana community. Below are the five assets that form the backbone of the LST ecosystem on the Sanctum platform.

JupSOL

JupSOL is an LST representing SOL funds staked on Jupiter exchange's validator. Jupiter is among the leading DEX platforms on Solana. It aggregates liquidity to provide the best swap rates available on Solana. Besides acting as a DEX, Jupiter also runs its validator node on the Solana network, helping secure the blockchain and enable its operations. It's not unusual for large DEX platforms to run their own validators on a network. Large reputed validators such as the Jupiter Validator tend to attract significant staking funds, and running a validator also provides reputational benefits to DEXs and other DeFi protocols.

bonkSOL

bonkSOL is an LST representing SOL staked on the BONK validator node. Operated by Jito Labs, the BONK validator supports the ecosystem revolving around the popular BONK meme coin. Launched in late 2022, BONK is among the earliest Solana meme coins. It's one of the cryptos that eventually led to Solana becoming a leading host platform for meme coins.

Despite the recent influx of highly popular and widely hyped new Solana meme coins, BONK retains a leading position in the niche and is currently ranked as the second-highest-cap Solana meme coin asset.

dSOL

dSOL is an LST of the Drift Validator, a Solana validator node that belongs to the Drift protocol. The protocol is among the most popular Perpetual trading platforms on Solana. As of Jul 24, 2024, it's ranked first among Solana-based derivatives protocols by weekly trade volumes. Staking SOL on the Drift Validator and receiving dSOL will soon have one unique benefit: the ability to use dSOL as collateral on the Drift protocol.

jucySOL

jucySOL is an LST of the Juicy Stake validator node. Run by Knox Trades, the validator is linked to the Juicy Stake protocol, a multichain platform that provides validator and staking services on a variety of PoS blockchains. Besides Solana, Juicy Stake also services Ethereum, Sui (SUI) and Aptos (APT).

cgntSOL

cgntSOL is an LST representing SOL staked on Cogent Crypto, one of the earliest and most reputable validator nodes on the Solana blockchain. As a trusted member of the Solana validator club, Cogent Crypto has featured superior staking returns and stellar security measures. When staking your SOL on this validator, you can be certain that your funds are protected using the most advanced security measures available to Solana validators.

Over the years, Cogent Crypto has also contributed to the body of knowledge within the Solana community by developing a variety of calculator apps, such as a validator profit calculator, a lending APY calculator and an impermanent loss calculator.

Closing Thoughts

Liquid staking, first popularized on Ethereum, is now an area of active growth on Solana. Sanctum occupies a unique position in this niche, being a protocol that offers something more than the standard staking service - the ability to issue custom LSTs, such as validator-bound LST assets, and importantly, the idea of creating limitless liquidity for LST tokens across the entire Solana ecosystem. The platform's multi-LST Infinity Pool and liquidity-balancing router are among the most innovative mechanisms offered on Solana.

Sanctum’s Solana-based liquid staking protocol has just launched its native governance token, CLOUD, and a lot of its platform’s potential will be realized over the coming months and years. As Solana grows and its network demands more reliable validator services, the Sanctum protocol will undoubtedly support this growth with its unique offerings and flexible products.

#LearnWithBybit