Odos (ODOS): Simple and Secure Multichain Swaps

The colorful variety of decentralized exchanges (DEXs) within the decentralized finance (DeFi) sector has long been a key driver of growth for another type of protocol in this area — DEX aggregator platforms. These aggregators scout the DEX ecosystem accessible to them to find and execute token swaps at optimal rates for their users. As the DEX landscape has grown increasingly complex and varied, aggregator platforms have become more relevant to the needs of DeFi users.

In the niche of DEX aggregators, Odos provides a solution that stands out, thanks to its intent optimization algorithm, an extensive network of used blockchains and protocols, an efficient order routing mechanism and a sophisticated multi-token swap functionality. Although Odos isn't among the heavyweights of the DEX aggregator category just yet, it features the ability to access liquidity on 14 chains, boasting some of the broadest coverage of sources in this sphere.

Key Takeaways:

Odos is a DEX aggregator that employs a proprietary order routing system to source the best swap rates from multiple blockchain protocols.

Odos offers users multi-token atomic swaps, limit orders, and simple swaps with guaranteed rates that include gas fees and other charges.

The platform's native crypto, ODOS, is used for governance, transaction rebate payouts and the qualification for different membership tiers within the Odos loyalty program. ODOS can be bought on Bybit as a Spot pair (ODOS/USDT).

What Is Odos?

Odos (ODOS) is a cross-chain DEX aggregator that offers users the best possible swap rates, thanks to its intent optimization order routing and its extensive network of accessible chains and protocols. As of late December 2024, Odos boasts the ability to access liquidity on over 900 protocols across 14 blockchain networks. The platform's coverage of liquidity sources is among the highest among DEX aggregators. Some of the leading chains accessible to Odos are Ethereum (ETH), Polygon (POL), Optimism (OP) and Avalanche (AVAX), to name a few. The platform can also access DEX liquidity on smaller networks, such as zkSync Era, Scroll (SCR) and Linea.

Odos employs Smart Order Routing (SOR), its proprietary algorithm, to search for the optimal swap deals for user intents across a vast network of liquidity sources. The platform's intent optimization algorithm scans available on-chain and off-chain sources via complex, nonlinear paths in order to identify and deliver the best rates.

The Odos aggregator supports different kinds of orders, including simple swaps, multi-token swaps and limit orders. Its simple swaps offer users guaranteed rates, without sneaking in any hidden charges, such as gas fees or slippage rate losses. When a user requests a swap quote, the protocol finds the best possible deal, inclusive of gas fees and other charges. The effect of slippage is also taken into account so as to avoid surprises for the user. In short, the rate you see is what you pay, with no additional fees involved.

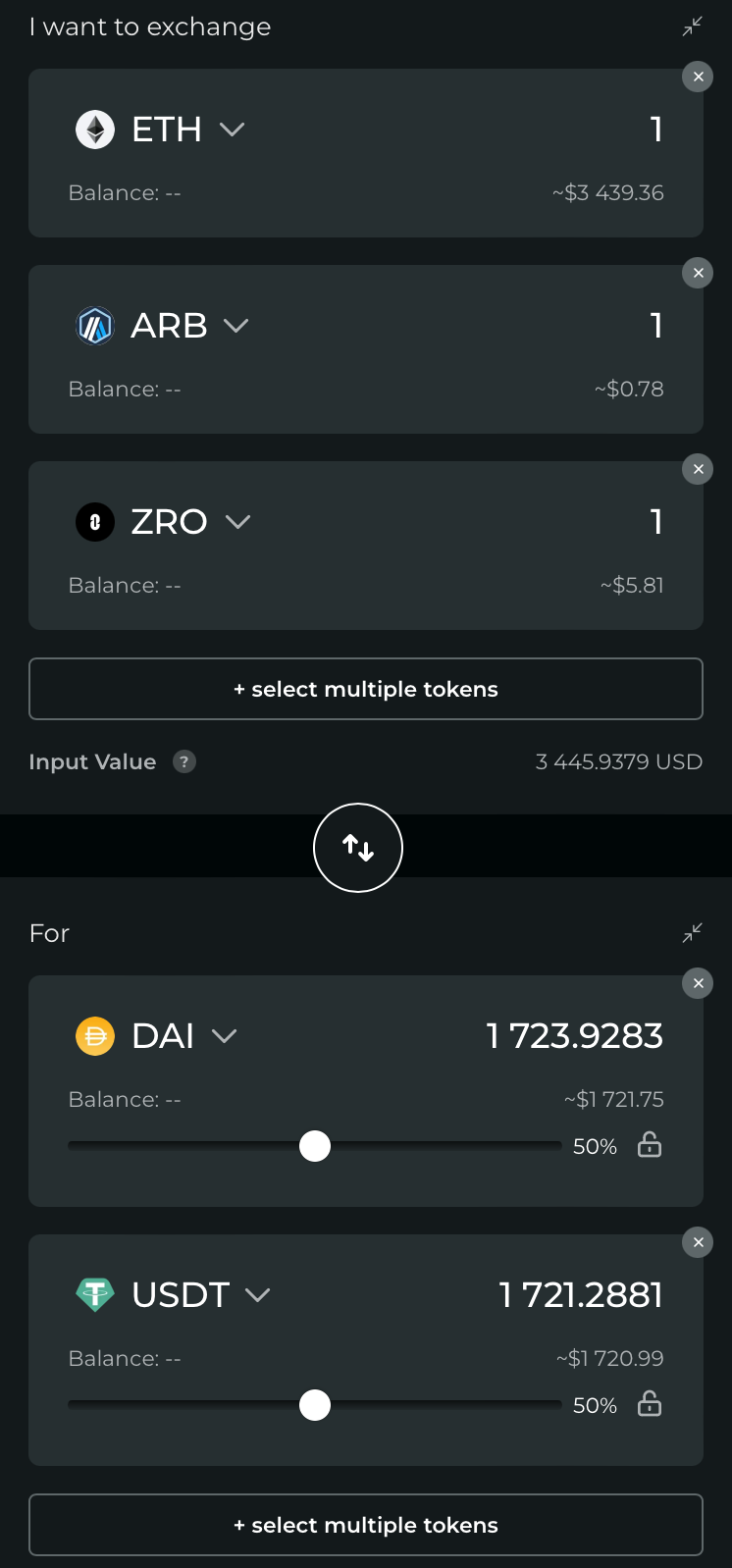

Odos also offers multi-token atomic swaps, sophisticated order types involving token swap combinations within one transaction. You can request swaps with multiple sell tokens at specified amounts and one or more buy tokens at preferred proportions. For instance, the image below is a screenshot from the Odos app showing a request to sell one Ether (ETH) token, one Arbitrum (ARB) token and one LayerZero (ZRO) token, via a single atomic transaction, to buy MakerDAO's Dai stablecoin and the Tether (USDT) stablecoin at a 50/50 proportion.

Odos also supports limit orders, so you can specify a target price for a token pair and have your order executed only if the desired rate is reached.

How Does Odos Work?

At the heart of the Odos platform is its intent optimization system, which scouts the network of liquidity pools across the entire ecosystem accessible to the protocol to find the best ultimate path for your swaps. In total, Odos has access to over 55,000 DeFi assets. Nonlinear, complex search routes are employed to source the best swap deals.

The rates Odos finds usually include gas fees to avoid uncertainty for users, and the protocol optimizes gas costs through the integration of Blocknative's Gas API, a leading gas estimation solution. In some cases, Odos might suggest routes involving higher gas fees, but only if the gains from the lower rates that it finds outweigh the expenditure on gas. In short, the routes and rates Odos finds take into account all the fees involved.

Odos is a permissionless system, and doesn't hold user funds in its own custody. It simply finds optimal routes for swaps by leveraging its smart contracts, which are regularly audited by third parties to ensure the security of the entire platform. As of December 2024, Odos has undergone three audits conducted by two reputable blockchain security companies — Zellic and Halborn.

Some order types on Odos (e.g., simple swaps) protect users from slippage rates by providing guaranteed quotes inclusive of all fees. For other swap operations, users can specify slippage rate limits, and their intended transactions will only be executed if the final rate stays within the acceptable slippage limit.

While not all components of the Odos platform are open-source, the critical order router system is, further ensuring the transparency of the protocol.

The project also offers an API for developers to easily integrate Odos's smart order routing into their own platforms. There’s a free API access mode, with a limit of 600 requests per five minutes. For any higher volume requirements or unlimited access, developers can get in touch with the Odos project for paid API plans.

Odos Key Features

Odos Zaps

Odos Zaps allow you to transform any crypto assets you own into liquidity provision (LP) tokens in one seamless transaction. Zaps offer Uniswap v2–style pools in which the ratio of provided tokens is fixed at 50:50. However, unlike standard Uniswap v2 pools, Zaps liquidity provision doesn't result in losses due to any imbalance in the ratio of contributed assets.

To correct any deviations from the 50:50 ratio at the liquidity provision stage, Odos Zaps recalculates and rebalances your asset contributions to deliver you the maximum number of LP tokens. Such rebalancing is used for standard Uniswap v2–style pools.

Additionally, Odos Zaps can be used for non-standard pools that don't conform to the Uniswap v2 format, and any imbalances in your asset contributions are returned to your wallet — instead of being rebalanced — so you pay only the minimum required amount for your LP tokens.

Loyalty Program

The Odos Loyalty Program rewards users based on the amount of transaction revenue generated from their on-platform trading activities. Rewards are calculated for each epoch (which currently lasts 30 days). The primary rewards within the program are transaction fee rebates, which are paid out to users (after each epoch) in ODOS tokens.

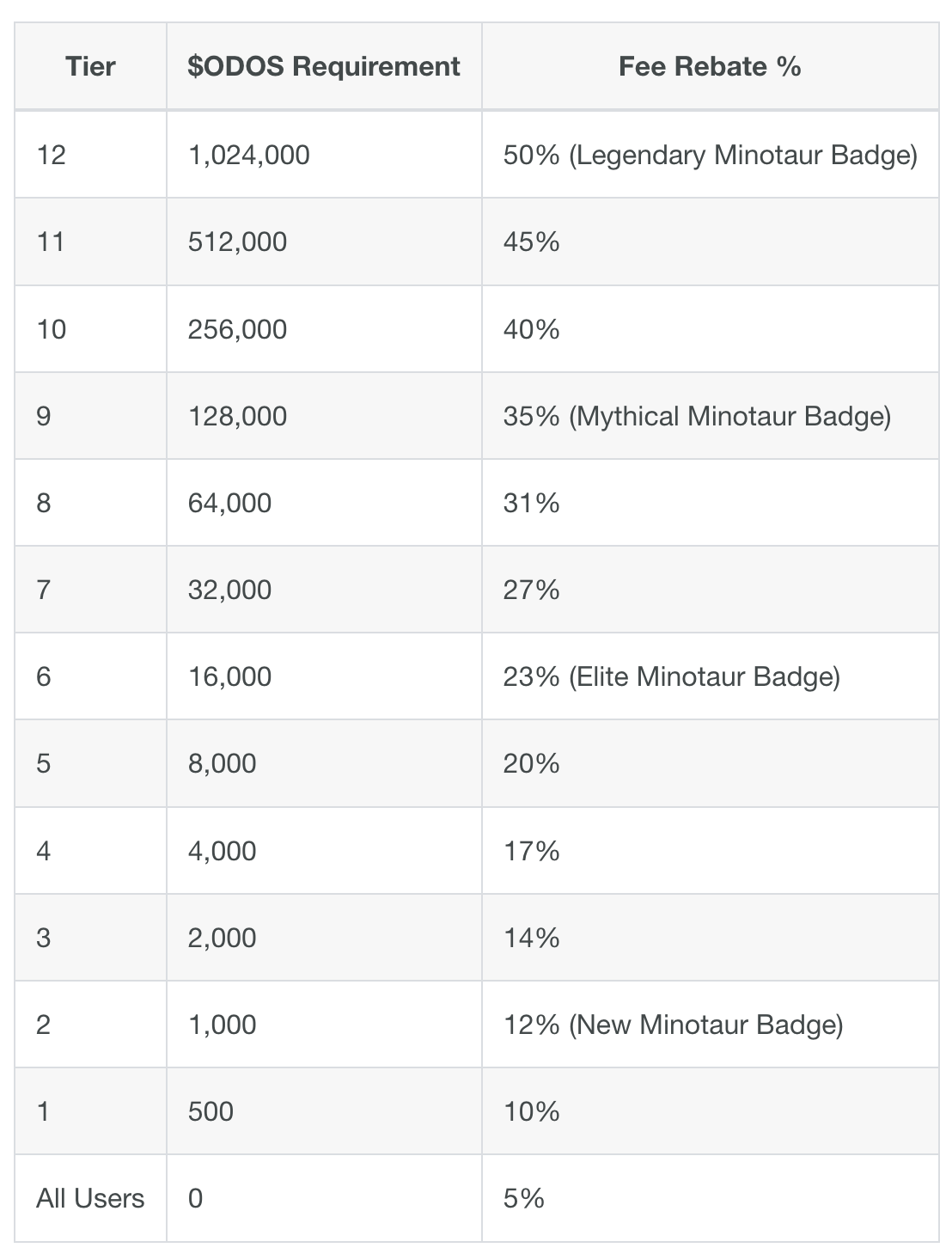

Rebate rates vary by tier, with each membership tier based on a specific number of ODOS tokens locked on the platform. The more ODOS you lock, the higher the rebate percentage. Loyalty badges are given to users who attain certain membership tiers. The table below shows the rebate rates and ODOS requirements for each tier of the program.

Odos DAO

The Odos DAO is the platform's decentralized, community-driven governance structure. It's designed to support all matters related to Odos's governance and decentralized development, including facilitating on-chain voting by ODOS token holders. Both the DAO and the platform's governance token, ODOS, were launched in December 2024, more than two and a half years after the platform's April 2022 public launch.

What Is the ODOS token?

The platform's native cryptocurrency, ODOS, is an ERC-20 token issued on the Base Layer 2 chain. As noted above, ODOS is used for governance purposes. Token holders can vote on proposals concerning the protocol's future direction, development and rules. Each ODOS token entitles the holder to one vote.

Besides governance, ODOS is also used within the platform's Loyalty Program for transaction rebate payouts and to qualify for different membership tiers.

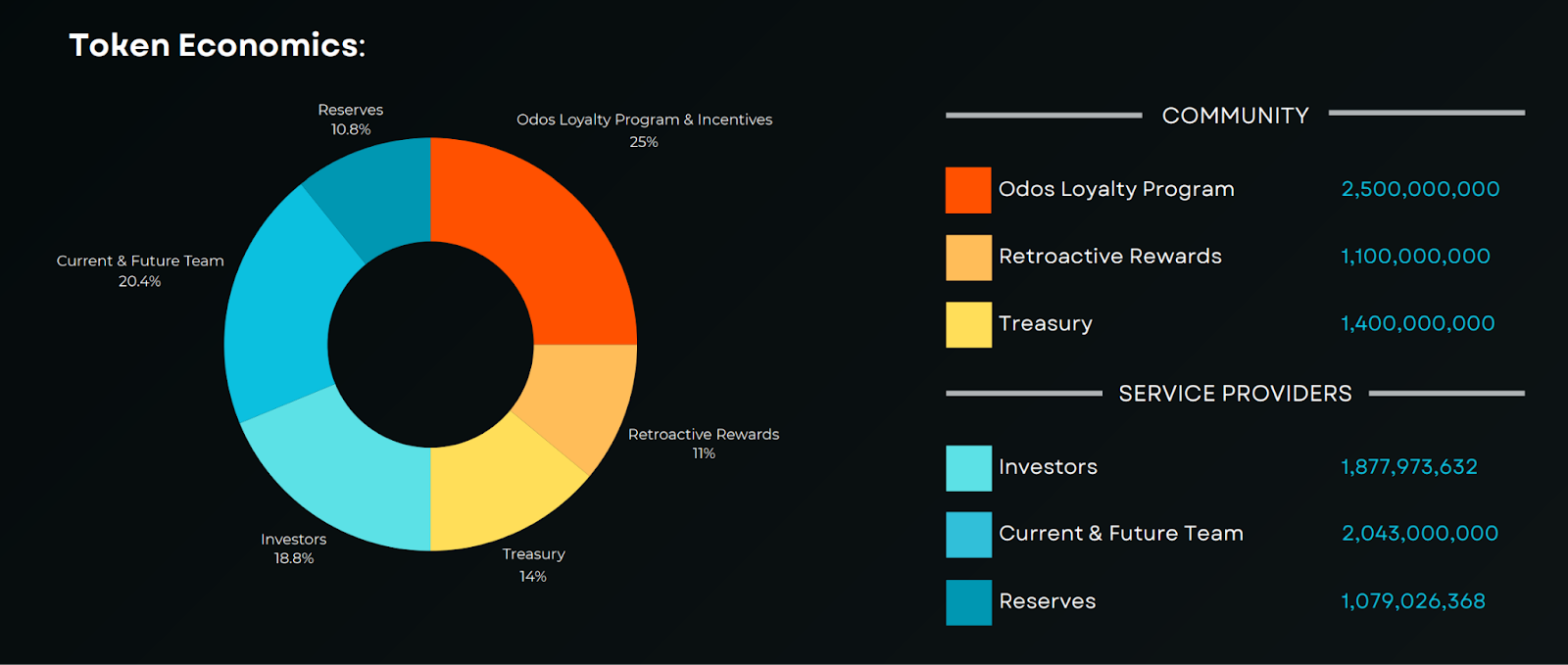

ODOS is a supply-capped token, with a total and maximum supply specified at 10 billion. The token's supply allocation shares are per the figure below.

Where to Buy ODOS

The ODOS token is available on Bybit's Spot market as a swap pair with USDT. You can also take advantage of Bybit's Token Splash campaign for ODOS (running through Jan 2, 2025, 9AM UTC) for the chance to grab a share of the 9.5 million ODOS prize pool. The first 6,000 new users who complete basic identity verification can earn 1,000 ODOS if they accumulate a deposit volume of at least 3,000 ODOS, or deposit at least 100 USDT and trade 100 USDT worth of ODOS for their first trade with Bybit.Meanwhile, existing users can qualify for up to 3,500 ODOS per user by trading at least 500 USDT worth of ODOS on the Spot market.

Closing Thoughts

Odos's optimal order routing solution offers DeFi users a unique way to conduct both simple and multi-token swaps and take advantage of the best rates available across no fewer than 14 blockchain platforms. As Odos increases its number of integrations and partners, it will be able to further optimize transaction costs and ensure that users can benefit from some of the most competitive swap rates available in the world of DeFi. Whether you’re after a complex multi-token swap functionality, or would like the certainty of guaranteed simple swaps with no hidden fees, the Odos DEX aggregator has something in store for you.

#LearnWithBybit