Morpho (MORPHO): Leading Efficient, Permissionless Crypto Lending

Liquidity pools have revolutionized decentralized lending and borrowing by offering a wide choice of product options and significant liquidity levels. For several years, protocols like Aave (AAVE) and Compound (COMP) have been lauded as true innovators that introduced a real game-changer: pool-based lending and borrowing. However, a closer look reveals that things aren’t as efficient and smooth as they may seem within the world of crypto lending. The problem is that lending pools on decentralized protocols often have mismatches between lenders and borrowers, with the former substantially outnumbering the latter. As a result, lenders earn only meager APYs, while borrowers pay exorbitant fees to access funds via these pools. Another critical problem is the lack of customizability in lending and borrowing products, with many protocols adopting a one-size-fits-all approach.

Morpho (MORPHO) is a decentralized protocol on Ethereum (ETH) that aims to improve the efficiency and flexibility of crypto lending and borrowing by offering a unique model that combines the elements of peer-to-peer (P2P) and pool-based matching of lenders and borrowers. To be precise, one of Morpho's essential products, Morpho Optimizers, specifically focuses on P2P matching, with pool-based lending and borrowing used as a fallback option. Morpho also offers users an excellent level of customization for creating new lending markets through its core protocol.

With its innovative lender-borrower matching mechanism and highly customizable and flexible markets, Morpho greatly improves capital allocation and transaction efficiency in the decentralized finance (DeFi) industry's lending sphere.

Key Takeaways:

Morpho (MORPHO) is an Ethereum-based decentralized platform that features a protocol to create customized permissionless lending markets and curated lending vaults, as well as an add-on P2P lending and borrowing solution.

The platform's new native cryptocurrency, MORPHO, is envisioned to act as a governance token. As of mid-November 2024, the token has yet to be publicly launched, but is already available via Bybit Pre-Market Trading.

What Is the Morpho Protocol?

Morpho (MORPHO) is an Ethereum-based decentralized lending protocol that offers a unique P2P order matching mechanism to improve the efficiency and affordability of crypto lending and borrowing. The platform also enables users to create efficient lending markets with highly customizable lending and borrowing parameters. Additionally, it offers a product, Morpho Vaults, for curated lending at varying risk levels.

The Morpho protocol was developed by Morpho Labs, a France-based software development company founded in 2021 by Merlin Egalité and Paul Frambot. It's also supported by the nonprofit Morpho Association.

As its first major product, the project launched Morpho Optimizers on the Ethereum blockchain in 2022. Morpho Optimizers is designed as an add-on solution for lending pools on Aave and Compound to help match individual lenders and borrowers. The transacting parties can benefit from a more efficient lending process than with the default pool-based mode.

In January 2024, the project launched Morpho Blue, later rebranded to Morpho, a solution to help users create highly flexible lending markets with custom parameters and options. Morpho acts as the backbone of the Morpho ecosystem, and the project team has turned its focus to promoting and further developing this product. At the same time, Morpho Optimizers remains an integral part of the platform's core offering, albeit in a less prioritized state than Morpho.

What Is Morpho?

The Morpho protocol consists of three main products — Morpho, Morpho Vaults (based on the underlying protocol) and the legacy Morpho Optimizers. Morpho allows users to create individual lending markets by specifying their preferred options for the following key attributes:

A preferred collateral asset.

An asset used for lending.

An oracle used for sourcing the rates utilized by the market. Morpho is an oracle-agnostic solution, a significant difference from many other lending solutions that use their preset oracles (or no oracles at all).

A preferred interest rate model (IRM). Users can choose from a list of whitelisted IRMs, which define how the interest rate on loans taken out through the market is calculated.

A custom Liquidation Loan-to-Value (LLTV).

All these parameters are highly customizable, with minimal interference from the Morpho governance mechanism. Some parameters do have to conform to certain requirements; e.g., the IRM and LLTV must be from the list approved by the protocol's governance.

Morpho's high level of customizability is a significant departure from the typical model used on decentralized lending and borrowing platforms. On most other protocols, there are fixed parameters governing the lending and borrowing process; e.g., only certain collateral assets, lending assets or LLTV rates are allowed. In contrast, Morpho lets you customize all of these options, giving lending market creators an unmatched degree of freedom. The protocol offers the following key benefits to users, developers and market operators:

Highly efficient collateral rates. Since each Morpho market is isolated, creators don't need to set a blanket collateral ratio that has to cover the most risky assets.

Lower gas fees. The protocol uses a single smart contract to handle all of its market primitives, leading to the optimization of gas consumption.

Better interest rates, thanks to more efficient, isolated and highly customizable markets.

A greater degree of flexibility for market creators as compared to other lending protocols.

Minimal interference from Morpho governance.

Minimal coding required for developers.

While Morpho is currently the platform's flagship product, the legacy Morpho Optimizers continues as a key offering in the platform's product line. Morpho Optimizers are add-on layers to the Aave and Compound lending pools. They can be used to facilitate a peer-to-peer match between lenders and borrowers. Since typical lending pools — including on platforms like Aave and Compound — are often heavily skewed with more lenders than borrowers, both parties end up paying excessive fees. Borrowers have to confront high costs due to the need to service the many lenders in the pool. In turn, lenders fight for the meager scraps left over from insufficient numbers of borrowers.

By using a P2P matching mechanism, Morpho Optimizers effectively takes the lender and borrower away from pool-based interaction and establishes a direct relationship between them. This allows users to borrow assets at cheaper rates, while also delivering better APYs for lenders. If either party withdraws from the direct lending relationship, both parties have the option to use the standard lending pools on Aave and Compound as a fallback.

The platform's third core product, Morpho Vaults (covered in more detail below) utilizes the underlying protocol and provides a way to lend through carefully curated market options at different risk profiles. This can suit lenders who are less proficient in using fully customized markets, but still prefer to take advantage of the lending opportunities offered by Morpho.

How Does Morpho Work?

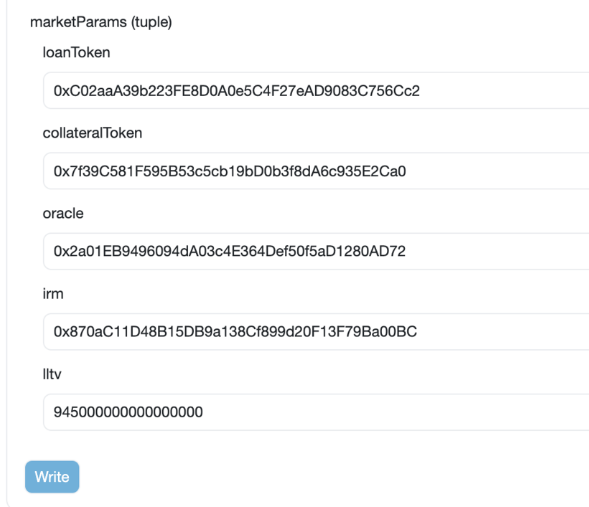

In order to create a custom lending market on Morpho, you need to have some technical proficiency and, preferably, knowledge of Solidity, the programming language that the protocol uses for its smart contracts. As noted earlier, developers can create a custom market by supplying five base parameters — a collateral asset, an asset offered for lending, an oracle, a preferred IRM and an LLTV. The first four of these normally require an Ethereum smart contract address to be specified. For the collateral and lending assets, these are the addresses for the tokens' contracts. The selected oracle is also usually established via a pointer to its smart contract address, although oracle-less hard-coded prices for the collateral and lent assets are acceptable. Morpho also maintains Ethereum addresses for each IRM whitelisted by the protocol's governance; developers can use these when choosing a preferred IRM.

The last value, LLTV, is a hard-coded figure that defines the threshold beyond which a loan becomes unhealthy due to its poor loan-to-value (LTV) ratio and is, therefore, due for liquidation. Liquidators on Morpho are protocol actors who are incentivized to cover bad debts in return for collateral, similar to the method used on many other lending platforms. They’re allowed to liquidate up to 100% of the debt. In return, liquidators receive the debt's collateral, as well as an additional incentive for their work.

Since Morpho is an oracle-agnostic protocol without a built-in oracle, each market can have its own oracle that sources prices for the collateral and lending assets from external sources. Developers are completely free in that regard, and can even hard-code asset prices for the market if they don't wish to use a price oracle at all. Naturally, an oracle is preferred for maintaining the most up-to-date and dynamic pricing information.

The IRM used is the only base parameter with which developers are somewhat restricted in their choice, as only whitelisted IRMs are allowed for a market. As of mid-November 2024, there’s just one whitelisted IRM that market creators can specify — the AdaptiveCurveIRM. This model dynamically adjusts interest rates to maintain the proportion of borrowed funds to supplied funds at close to 90%.

What Are Morpho Vaults?

Morpho Vaults are a tokenized vault product that offers curated lending opportunities with varying pre-programmed risk parameters. Each vault is associated with a single loan asset, and can allocate deposits across multiple Morpho markets, thereby leveraging the overall liquidity available on the Morpho protocol. Morpho Vaults suit lenders who prefer predictable risk management over the uncertainty of completely custom markets. Each lender can earn APY rates commensurate with their chosen risk profile.

There is no limit on the number of vaults you can open on Morpho. Thus, you might even allocate funds to different vaults with significantly different risk levels to diversify your exposure.

Morpho Vaults' curated nature eliminates the need for users to spend time researching and evaluating individual markets' risk levels and return opportunities, as risk exposure is actively managed by the vault.

Since the vaults are connected to the underlying protocol, and source liquidity from it, they’re dynamically rebalanced, which helps optimize yields. Thanks to their permissionless and immutable nature, the vaults are also completely transparent. Moreover, they’re noncustodial, granting users full control over their deposited assets, which can be withdrawn at any time.

How Do Morpho Vaults Work?

A lender deposits an asset into a Morpho Vault and receives shares of the vault as confirmation of their investment. The vaults themselves are tokenized products utilizing Ethereum's ERC-4626 standard, designed to represent tokenized vaults for yield-bearing assets. Each vault may be owned by a decentralized autonomous organization (DAO), an individual DeFi expert or some algorithm maintained by a DeFi platform. A vault can be owned by only one entity. The owner may specify additional roles/entities for managing the vault. These roles can include one curator, one guardian and multiple allocators.

Morpho Vault Roles

The curator is a party who sets certain limits, rules and boundaries for the vault, such as specifying asset supply limitations and enabling/disabling specific markets. Curators are instrumental in maintaining appropriate risk levels for their vaults. Assets that lenders lock in a vault are supplied to the protocol's underlying markets, based on curators' whitelists. There can only be one curator for each vault.

The role of guardian is a key vault position. A guardian protects the integrity and security of the vault. Guardians can revoke any action by the vault owner (or other entities) if they consider it to be against the interests of vault lenders. Each vault can only have one guardian, typically a DAO consisting of vault depositors.

Allocators are protocol actors whose job is to rebalance the liquidity utilized by Morpho Vaults to optimize interest rates and accessible liquidity. An allocator’s job is to rebalance and optimize the total liquidity, either manually or using bots, to best meet the needs of Morpho borrowers.

Morpho Vaults' operations aren't regulated by the protocol's governance mechanism. Each vault owner is responsible for their vault's governance model. Specific roles, such as the curator and the guardian, are designed to help in establishing transparent and secure governance procedures for a vault.

What Is the Morpho Crypto Token (MORPHO)?

The platform's native cryptocurrency, MORPHO, is envisioned as a governance token. Holders of MORPHO have the right to participate in decision-making on the platform's future direction, general rules, deployment of smart contracts and allocation of funds from the treasury. Although Morpho promotes lending and borrowing markets that operate with minimal interference from the protocol's governance community, there are some general guidelines and rules through which the community needs to establish certain standards, minimum requirements or whitelists. MORPHO token holders are instrumental in this process.

The original MORHPO token was launched on Ethereum in June 2022 with a supply cap of 1 billion. However, there were limitations to the original token contract that negatively affected its functionality. Specifically, the token wasn't designed to facilitate efficient on-chain voting. As a result of these limitations, the project decided to relaunch the token, now on an upgraded contract. The new reincarnation of MORPHO will offer better functional capabilities, including more efficient on-chain governance processes.

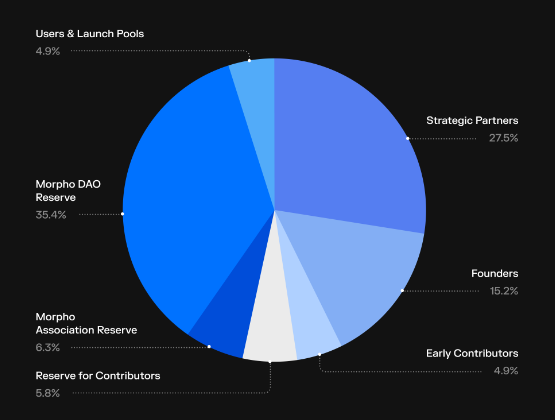

As of the time of writing on Nov 17, 2024, the project team has yet to deploy the new token. The new MORPHO will also be a supply-capped crypto, with a maximum and total supply of 1 billion. The token's supply distribution shares are shown in the chart below.

Where to Buy MORPHO

Bybit's Pre-Market Trading platform offers you the opportunity to buy the new MORPHO token before its market launch. Bybit Pre-Market Trading is an over-the-counter (OTC) trading platform that provides access to promising new cryptocurrencies before their listings on the Spot market. The key advantage of the platform is the ability to access cryptocurrencies at desirable rates before the broader crypto market affects their prices.

Bybit's carefully designed curation process ensures that only crypto assets with solid potential and fundamentals are whitelisted for Pre-Market Trading. This saves you the time required to investigate each cryptocurrency, and reduces the risk of investing in scam projects. Naturally, you’re also encouraged to do your own in-depth research on crypto assets you might consider purchasing through Bybit Pre-Market Trading.

Closing Thoughts

Morpho represents a unique and potentially highly effective approach to DeFi lending and borrowing. The platform's facilitation of isolated and highly customizable lending markets gives DeFi users unmatched freedom in terms of choice and variety. In addition, users who prefer the stability of curated and well-defined risk profiles can take advantage of Morpho Vaults for more predictable yields. The use of the overall underlying protocol liquidity along with entities such as allocators makes Morpho Vaults particularly effective at optimizing lending and borrowing costs.

While custom lending markets launched via the protocol are now Morpho's key focus, the legacy Morpho Optimizers also continue to offer value. P2P matching of lenders and borrowers as an add-on to the standard pool-based mechanism is a functionality many DeFi users will find helpful. Morpho Optimizers can offer lenders and borrowers active on Aave and Compound an alternative and highly effective way of conducting their operations.

With this arsenal of innovative and unique products, the Morpho protocol is quickly shaping up as a leading platform in the lending niche of the DeFi industry.

#LearnWithBybit