Initia (INIT): The Interwoven Stack behind scalable rollups

Today's blockchain ecosystem forces developers to choose between security and customization, while fragmenting liquidity across isolated chains. Enter Initia (INIT), a groundbreaking protocol that reimagines blockchain architecture by seamlessly integrating Layer 1 and Layer 2 technologies.

This article examines Initia's Interwoven Stack architecture, its innovative economic features and the INIT token's utility and distribution, and considers whether this ambitious ecosystem redesign represents a promising investment opportunity following its recent mainnet launch.

Key Takeaways:

Initia is a blockchain ecosystem that unifies Layer 1 security with customizable Layer 2 rollups through its Interwoven Stack architecture.

Initia enables developers to build specialized application chains without sacrificing interoperability or liquidity or requiring deep infrastructure expertise.

Looking to trade Initia tokens? Bybit now offers the INITUSDT Perpetual contract for trading.

What is Initia?

Initia is a blockchain ecosystem that unifies Layer 1 security with customizable Layer 2 rollups through its Interwoven Stack architecture, enabling developers to build specialized application chains without sacrificing interoperability or liquidity or requiring deep infrastructure expertise.

History of Initia

Initia emerged in 2022 when Stanford Liu and Ezaan "Zon" Mangalji left Terraform Labs to tackle blockchain's fragmentation challenges. They later added ecosystem lead OmniscientAsian from Sino Global Capital to help create a more streamlined blockchain infrastructure.

The project quickly gained investor backing, starting with Binance Labs' pre-seed funding in October 2023. This was followed by a $7.5 million seed round led by Delphi Digital and Hack VC, then a $2.5 million community round and a $14 million Series A that valued Initia at $350 million by late 2024.

What does Initia aim to achieve?

Initia aims to eliminate the traditional security/customization trade-off in blockchain by creating a unified ecosystem that allows both to coexist. By establishing a central hub for all rollups, the project combines the advantages of monolithic security with the flexibility of modularity, thereby eliminating the fragmentation that currently plagues blockchain systems.

The platform's integrated stack simplifies blockchain development with pre-built solutions that work together seamlessly. Users benefit from Initia's Universal Accounts system, which provides a consistent experience across all connected chains, eliminating the need for multiple wallets or managing different tokens for gas fees.

By introducing economic alignment mechanisms such as the Vested Interest Program, Initia creates an environment in which developers can focus solely on innovation in their applications. This shift away from infrastructure concerns toward product development aims to enhance capital efficiency and drive broader adoption of blockchain.

How does Initia work?

Initia fuses Layer 1 (L1) and Layer 2 (L2) technologies into a unified architecture with three distinct components. The foundation is Initia L1, built on Cosmos SDK, which functions as the orchestration layer. This base provides security, governance and interoperability.

Above this foundation, Interwoven Rollups (Minitias) provide developers with customizable Layer 2 environments, allowing them to select their preferred virtual machine (EVM, Move or Wasm), define unique gas token systems and implement specialized transaction ordering mechanisms.

Binding everything together is the Interwoven Stack, a comprehensive framework that provides all necessary tools for building and deploying rollups without requiring developers to source and integrate disparate components.

The system leverages optimistic rollups through the OPinit Stack to achieve remarkable transaction speeds (up to 10,000 TPS) while maintaining security. Transactions processed via L2 rollups are submitted to Initia’s L1 for finalization, with data availability secured through Celestia (TIA) integration.

Features of Initia

Initia provides the following core features that work together to simplify development and unify the blockchain ecosystem.

Initia L1

Initia L1 serves as the foundational layer and central coordination hub for the entire ecosystem. Built on the Cosmos SDK with CometBFT and MoveVM, it provides essential services, including network security, governance mechanisms and liquidity solutions through InitiaDEX.

Interwoven Rollups

Interwoven Rollups (also known as Minitias) are flexible Layer 2 blockchains built on top of Initia L1. These rollups rely on the orchestration layer for security and data settlement, operating without native consensus mechanisms while enabling advanced rollup functionalities.

Developers can customize their rollups by selecting from multiple virtual machines and defining their own gas token and fee structure. This flexibility enables application-specific optimizations and economic models, at the same time maintaining seamless interoperability within the broader Initia ecosystem.

Interwoven Stack

The Interwoven Stack is Initia's comprehensive, all-in-one solution, designed to empower developers in building and deploying rollups with unmatched ease. Instead of requiring developers to research and piece together numerous components — such as wallets, explorers and bridges — the Stack provides everything needed right out of the box.

At the core of this framework is OPinit Stack, designed exclusively for optimistic rollups within the Cosmos ecosystem. It includes mechanisms for fraudproofs and rollback capabilities and supports multiple virtual machines, which allows developers to focus solely on building their applications, rather than configuring complex infrastructure.

Vested Interest Program

The Vested Interest Program (VIP) is Initia's novel incentive alignment mechanism that’s designed to address common issues in multi-rollup ecosystems. It addresses the misalignment of incentives for high-activity decentralized applications (DApps), the economic underutilization of the native token and the inefficient distribution of protocol-level incentives.

VIP programmatically rewards valuable economic activities by allocating INIT tokens to rollups that create innovative applications, and to users who perform beneficial actions. This approach ensures that rollup teams, users and token holders all share aligned interests in the ecosystem's long-term success.

InitiaDEX

InitiaDEX serves as a decentralized exchange (DEX) built on the Initia L1, functioning as the central liquidity hub for all Interwoven Rollups. It features Balancer-style weighted pools for diverse asset pairs, and StableSwap pools for assets with closely correlated prices, ensuring an optimal trading experience.

Enshrined Liquidity

Enshrined Liquidity is Initia's solution to the traditional dilemma in proof of stake (PoS) systems, whereby token holders must choose between either staking for security or providing liquidity. It allows governance-whitelisted InitiaDEX liquidity positions (INIT-TOKEN pairs) to function as staking assets alongside the native INIT token.

Users can earn both staking rewards and trading fees from a single position, dramatically improving capital efficiency. To qualify, LP tokens must include INIT as part of the pair (with at least 50% weight for Balancer pools) and receive governance approval, which also determines reward weight distribution among all whitelisted tokens.

Minitswap

Minitswap eliminates the days-long waiting periods typically required by optimistic bridges when moving assets from rollups to Layer 1s. Users can instantly swap their rollup tokens for L1 assets through liquid trading pairs, creating a frictionless experience for asset transfers throughout the Initia ecosystem.

Initia Wallet Widget

The Initia Wallet Widget offers a unified interface for managing assets across multiple rollups, thereby facilitating cross-chain transfers and accessing DApps. By abstracting multichain complexity into a single interface, users can navigate the entire Initia ecosystem without confronting technical barriers or fragmented experiences.

Bridge

Initia's bridge technology enables secure token transfers between Initia L1 and rollups using an optimistic bridge model. The OPinit Bridge leverages Cosmos SDK modules, and operates through two key components that work in tandem to ensure system integrity.

The Executor handles token movements, output submissions and data relay, while the Challenger monitors for invalid proposals and provides security oversight. This balanced architecture delivers verifiable cross-chain communication that maintains the integrity of both L1 and L2 chains while enabling reliable asset transfers throughout the Initia ecosystem.

Initia road map

Initia reached a major milestone with its successful mainnet launch on Apr 24, 2025. Before then, the project had completed several critical developments, including the MiniEVM and MiniMove frameworks, the deployment of InitiaDEX and the implementation of the innovative Vested Interest Program.

The immediate post-launch phase is focusing on expanding the ecosystem by onboarding strategic partner projects across DeFi, gaming and enterprise sectors. This expansion demonstrates Initia's versatility as it builds a network of interconnected Interwoven Rollups that leverage the platform's unified infrastructure.

INIT Airdrop

The INIT airdrop will distribute 50 million tokens, representing 5% of the total supply, to early supporters and community members. This allocation is strategically divided across three main categories: testnet participants (89.46%), social contributors (6.04%) and Interwoven Stack partners (4.50%).

The largest portion (44.7 million INIT) is being designated for the 194,294 users who participated in Initia's public testnet campaigns, particularly those who engaged with interactive Jennie NFT activities. Additional allocations target users from partner ecosystems, including LayerZero, IBC and milkTIA holders.

Following the mainnet launch on Apr 24, 2025, eligible participants will have a 30-day claim window to secure their tokens. This airdrop serves as both a community-building initiative and a strategic token distribution to those most likely to contribute to the ecosystem's growth.

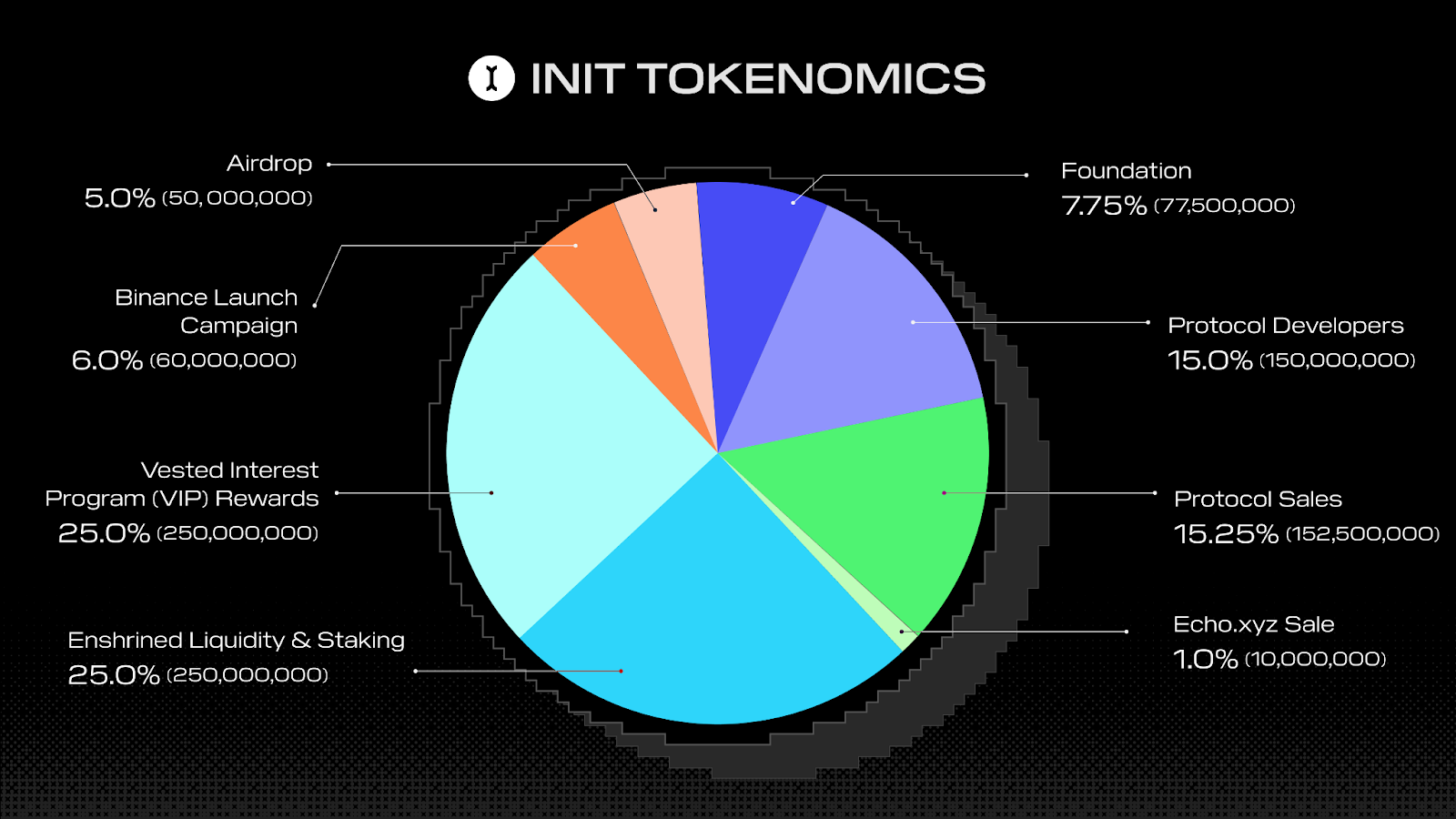

INIT tokenomics

INIT is the native token of the Initia ecosystem, with a fixed total supply of 1 billion. Initial circulating supply at launch was 148.75 million INIT, representing 14.88% of the total supply. The token’s distribution is strategically designed to ensure long-term sustainability and broad community engagement.

Foundation (7.75%, or 77.5 million): Reserved for initial liquidity bootstrapping, genesis validator delegations and ecosystem grants

Protocol developers (15%, or 150 million): Allocated to current and future team members with 4-year vesting (12-month lock, 36-month unlocking)

Protocol sales (15.25%, or 152.5 million): To be distributed across three investment rounds with similar 4-year vesting terms

Enshrined liquidity & staking (25%, or 250 million): Released at a rate of 5% (12.5 million) annually to power the unique, capital-efficient staking mechanism

Vested interest program (25%, or 250 million): Released at 7% (17.5 million) annually to align incentives across the ecosystem

Launch campaign (6%, or 60 million): Dedicated to initial CEX liquidity bootstrapping

Airdrop (5%, or 50 million): Distributed to early supporters, with a 30-day claim window

Echo.xyz community sale (1%, or 10 million): Allocated to participants in Echo's investment round, unlocking in four equal tranches over 24 months

INIT enables staking to secure the network, powers governance decisions for protocol changes, facilitates cross-rollup operations between different Minitias and provides liquidity through InitiaDEX. This utility-driven model ties INIT's value directly to ecosystem activity and adoption.

Where to buy INIT

Looking to trade Initia tokens? Bybit now offers the INITUSDT Perpetual contract following the recent mainnet launch. To get started, you'll need to create a Bybit account, fund it with cryptocurrency and navigate to the INITUSDT Perpetual contract page.

Is INIT a good investment?

While Initia represents a groundbreaking approach to blockchain scalability through its interwoven architecture and unified liquidity model, investors must carefully weigh its significant growth potential against relevant risk factors.

Growth potential

Interwoven Stack technology works to solve blockchain fragmentation and scalability challenges

Substantial funding of over $24 million from the likes of Delphi Digital and Hack VC

Vested Interest Program creates strong economic alignment between rollups, users and token holders

Enshrined Liquidity mechanism dramatically improves capital efficiency, as compared to traditional PoS systems

Support for multiple virtual machines (EVM, Move and Wasm) attracts a diverse range of developers and applications

Minitswap's instant withdrawal solution eliminates a major user experience barrier for optimistic rollups

Risk factors

Still in early stage of development, with some features being refined and tested in real-world conditions

Dependency upon developer adoption to build a robust ecosystem of Interwoven Rollups

Initia shows promising potential with its comprehensive ecosystem approach and significant financial backing. In addition, growing demand for scalable blockchain infrastructure that doesn't sacrifice security or customization provides a favorable market environment. However, potential investors should conduct thorough research and consider their individual risk tolerance.

Closing thoughts

Initia revolutionizes blockchain architecture by creating a multichain environment in which thousands of appchains can coexist harmoniously through modularity and orchestration. With established financial backing and over 16 appchains already onboarded at mainnet launch, Initia could transform the way blockchain applications are built, deployed and interconnected.

#LearnWithBybit