Gearbox: Powering On-Chain Credit for DeFi

Gearbox Protocol is leading a new wave of innovation in decentralized finance (DeFi) with its composable leverage system. It enables investors to use leverage on assets across multiple protocols, transforming how DeFi participants can trade with margin, yield farm, stake and execute complex strategies — all without leaving their ecosystem.

Gearbox Protocol is making leverage accessible and secure. Whether you’re a lender seeking passive yield or a leverage user exploring advanced strategies, Gearbox’s unique architecture opens up new possibilities. Let’s explore how this on-chain credit layer is improving DeFi.

Key Takeaways:

Gearbox Protocol provides a platform for composable leverage that integrates with major DeFi protocols, allowing users to amplify their capital efficiency without isolation.

Users retain full control over their funds while leveraging Gearbox’ Protocol’s permissionless and modular smart contract architecture.

At its core, Gearbox Protocol is decentralized and DAO-driven, prioritizing community governance and transparency from day one.

DeFi Sector Overview

Since the emergence of DeFi in 2020, it hasstrived to reimagine financial services by removing intermediaries, such as banks and brokers. Through peer-to-peer systems, DeFi offers transparent and direct access to lending, trading and investments. Despite market fluctuations, the DeFi sector remains resilient, with a current total value locked (TVL) of $123 billion — a 128% increase since the start of 2024.

The DeFi sector is poised for resurgence as secure and scalable innovations fuel its growth. With proven use cases and real-world adoption, DeFi continues to solidify its role as one of crypto’s most valuable use cases.

A recent entrant, World Liberty Financial (WLFI), backed by the Trump family, underscores a shifting acceptance of DeFi in the United States. The project’s multisig wallet has publicly acquired various DeFi tokens, such as AAVE, LINK, ENA and more. WLFI aims to make DeFi accessible to everyday users, but it remains to be seen if the project will achieve its goals.

What Is Gearbox?

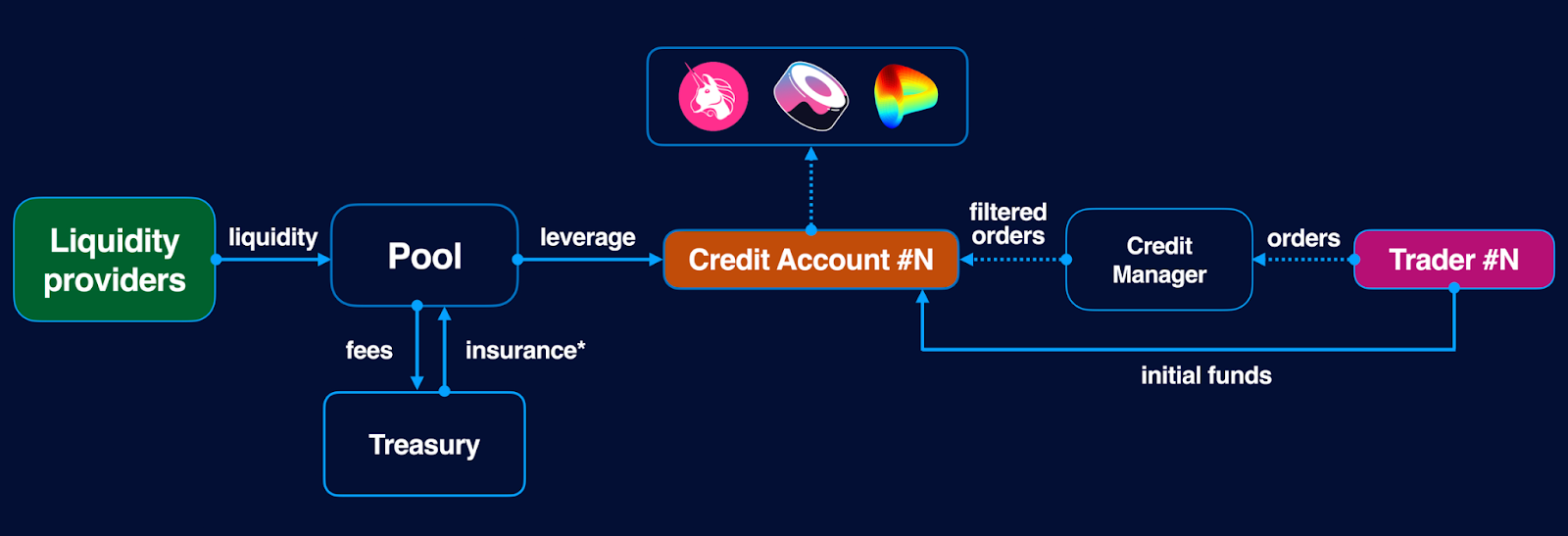

Gearbox Protocol is a composable leveraged lending protocol designed to enhance capital efficiency within DeFi. By offering a flexible credit layer, Gearbox empowers users to leverage their positions across multiple DeFi platforms, seamlessly integrating with protocols they already trust.

Gearbox’s fundamental design minimizes costs while maintaining flexibility. Its modular architecture reduces gas costs and improves scalability..

Unlike traditional leveraged lending protocols that silo funds within their ecosystems, Gearbox allows users to execute trades and strategies across integrated platforms, such as Uniswap, Curve Finance and Yearn. Whether it’s margin trading, delta-neutral farming or arbitraging correlated assets, Gearbox offers a new way to utilize leverage without restrictions.

With Gearbox Protocol, leverage becomes a DeFi primitive — an infrastructure layer that lets users go beyond basic long and short positions.

Key Features of Gearbox Protocol

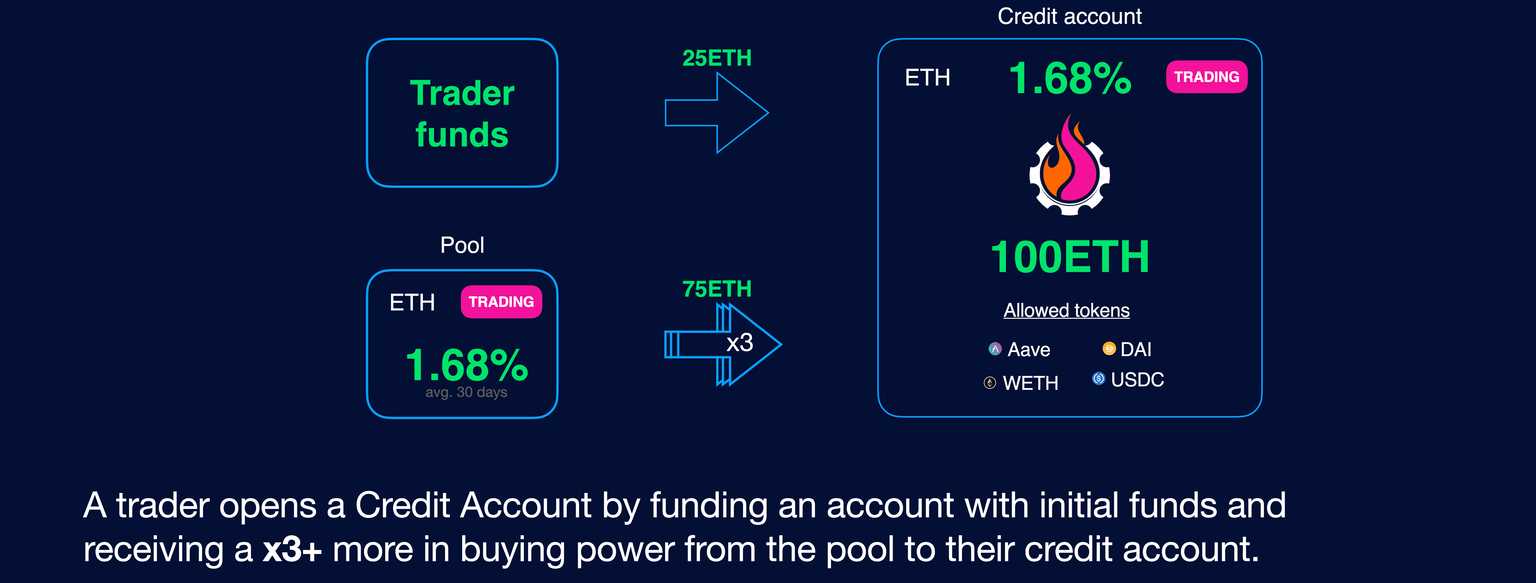

Credit Accounts: These are isolated smart contracts containing both user funds and borrowed margin funds. They serve as automated leveraged DeFi wallets, allowing users to manage positions and execute strategies independently.

Composable Leverage: Gearbox enables users to integrate leverage with DeFi protocols like Uniswap for margin trading, Curve for leverage farming, and more. This flexibility empowers diverse strategies across different platforms.

Credit Account Abstraction: Gearbox combines lending and prime brokerage functionalities within the same protocol, simplifying the user experience and expanding possibilities for leveraged trading and farming.

Capital Efficiency: By utilizing modular Credit Accounts, Gearbox maximizes capital efficiency. It minimizes gas costs and ensures that funds remain noncustodial, unlocking the full potential of leverage without compromising user security.

Decentralized and Community-Driven: With no central authority, Gearbox is governed by its DAO, ensuring that all integrations, policies and upgrades are managed transparently and collectively by the community and stakeholders.

How Does Gearbox Work?

Gearbox Protocol operates through two main user types:

Passive Lenders: These users provide liquidity to the protocol, earning passive yield with relatively lower risk. Similarly to platforms such as Compound Finance, lenders supply assets, which are then utilized by others in exchange for earning yield.

Borrowers: Active users — such as traders, farmers and protocols — borrow liquidity at multiples of their collateral up to 10x. This composable leverage empowers them to engage in advanced strategies across DeFi platforms like Uniswap, Curve and Yearn.

The Credit Accounts enable operations while maintaining safety through Allowed Token and Protocol lists, reducing risks of malicious activity.

Gearbox’s modular architecture supports seamless integrations with third-party protocols, ensuring assets remain decentralized and noncustodial. Liquidations are determined by health factors (based on calculated risks), and protect lenders while offering dynamic leverage possibilities.

GEAR Tokenomics and Market Performance

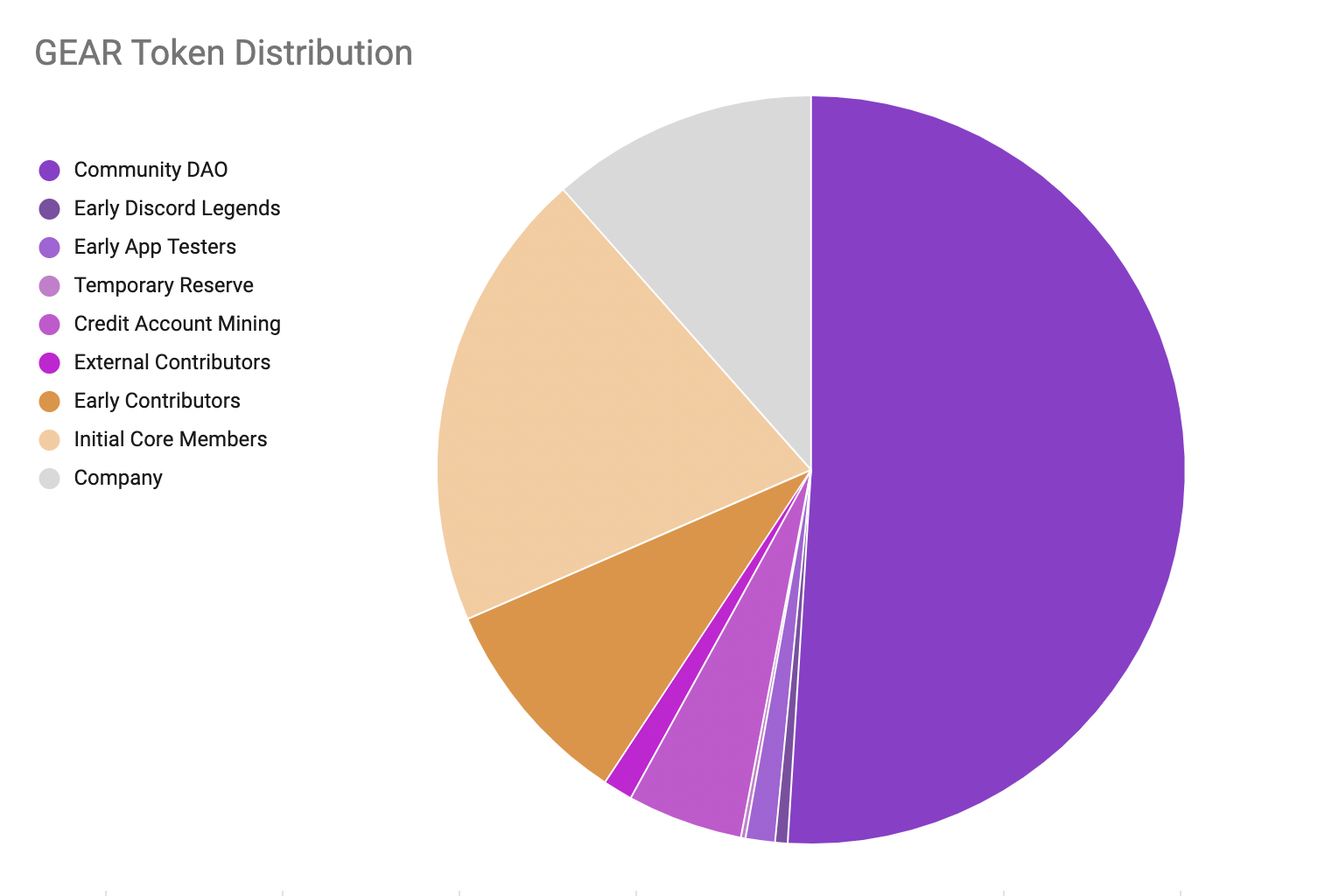

GEAR, an ERC-20 utility token with a capped supply of 10 billion, is the governance token of Gearbox Protocol. It empowers DAO governance and supports initiatives, such as liquidity mining and staking rewards, with an annual emission of just 3% from the DAO's holdings.

Token distribution percentages are as follows:

Community DAO portion: Around 58%, no vesting

Initial external contributors: 1.28%, locked > 1 year + vesting

Early backers: 9.2%, locked > 1 year + vesting

Initial core contributors: 20%, locked > 1 year + vesting

Initial company wallet: 11.52%, locked > 1 year + vesting

Nearly full circulation has been achieved, minimizing supply overhang as a majority of token vesting concluded in 2023. The DAO treasury retains around 40% of the supply, ensuring the community’s strong influence on protocol development.

Marketwise, GEAR has recently experienced notable price movements. Over the past seven days, the token has surged by 11.9%, and its 30-day performance skyrocketed by 166.3%. Year-to-date, GEAR's price has risen approximately 57.7%, reflecting increased investor confidence. Daily trading volume hit $11.8 million over the past 24 hours, marking a 600.3% spike that indicates growing market interest.

Gearbox Road Map and Future Outlook

Gearbox Protocol's innovative approach to DeFi simplifies user experience through its wallet-centric design and the integration of the Credit Account model. With a capped supply of 10 billion GEAR tokens, robust DAO governance and nearly full circulation, Gearbox prioritizes community-driven growth.

Recent market performance reflects growing investor confidence, with significant price increases and a surge in trading activity.

Looking ahead, Gearbox Protocol’s road map focuses on enhancing usability and interoperability within the Ethereum ecosystem. The integration of Credit Accounts into account abstraction (AA) wallets such as EIP-4337 revolutionizes the way users can access and manage funds, eliminating the need for complex lending interfaces.

Future developments may include pool-based models and optimizers to tackle liquidity fragmentation, further strengthening Layer 2 Ethereum solutions. As Gearbox Protocol evolves, its focus remains on delivering efficient, user-friendly financial tools that empower users and redefine DeFi as we know it.

#LearnWithBybit