Fragmetric (FRAG): Redefining asset management on Solana

Liquid restaking first emerged on Ethereum (ETH) as a way to increase capital efficiency for stakers by issuing liquid tokens representing their staked assets. The concept has subsequently made its way to Solana (SOL) through the Fragmetric (FRAG) protocol — the blockchain's first native liquid restaking platform.

Fragmetric initially focused on liquid restaking for Solana's native token, SOL, and various liquid staking tokens (LSTs), such as JitoSOL and mSOL. Over time, Fragmetric has expanded its operational scope by introducing the FRAG-22 asset management standard. This framework supports multi-asset deposits and real-time tracking of multiple reward streams.

Today, Fragmetric offers three liquid restaking tokens (LRTs) — fragSOL for SOL, fragJTO for the Jito protocol (JTO) governance token and fragBTC, a yield-bearing Bitcoin-pegged asset on Solana. Each token aggregates rewards from staking, MEV and other yield sources, often with auto-compounding features. This positions Fragmetric as a comprehensive solution for efficient asset management within Solana's growing decentralized finance (DeFi) ecosystem.

Key Takeaways:

Fragmetric (FRAG) is a liquid restaking protocol on Solana that allows you to deposit SOL and various LSTs to earn yields while helping secure Solana-based blockchain services and protocols.

Fragmetric's native token, FRAG, is used for protocol governance, staking and determining the mechanics of reward distribution on the platform.

FRAG can be bought on Bybit as a USDT Spot pair and as a Perpetual contract.

What is Fragmetric?

Fragmetric (FRAG) is a decentralized protocol that’s designed to optimize asset management and staking efficiency on the Solana blockchain. It addresses the challenge of unlocking liquidity for staked assets, allowing users to deposit staked SOL and other supported tokens into the protocol and receive tradable fragAssets in return. These tokens represent the underlying staked assets plus accumulated rewards, enabling continuous staking yield while maintaining liquidity.

At the core of Fragmetric is the FRAG-22 asset tokenization standard, built on Solana’s Token-22 transfer hook feature. FRAG-22 supports multi-asset deposits under a single token and enables real-time distribution of multiple reward streams. This modular framework allows Fragmetric to integrate various yield strategies beyond staking, such as liquidity pools, lending platforms and structured DeFi products, making it a versatile asset management solution.

Fragmetric distributes rewards from staking and restaking activities performed through Node Consensus Networks (NCNs) — decentralized networks of independent nodes that collectively validate data and maintain network security across Solana’s ecosystem, including for Actively Validated Service (AVS) protocols like cross-chain bridges and oracles. By restaking assets through Fragmetric, users support these NCNs and contribute to the security and decentralization of Solana’s infrastructure.

Users benefit from a dual reward system: auto-compounded rewards that automatically increase fragAsset holdings, and manual claims for other reward tokens.

The protocol relies on the SolanA Network Guard (SANG), a community of users who restake their tokens through Fragmetric. SANG members actively safeguard the Solana ecosystem by enhancing security and reliability across on-chain and off-chain services.

Founded in 2024 by blockchain entrepreneurs (known by their X handles as SolZac and sang.sol), Fragmetric held its token generation event (TGE) on Jul 1, 2025, marking a key milestone in its history within the Solana DeFi ecosystem.

How does Fragmetric work?

Fragmetric enables users to maximize staking efficiency on Solana by depositing SOL or supported LSTs into the protocol in exchange for fragAssets. These fragAssets represent restaked holdings, plus accumulated rewards, and they remain liquid and tradable. The protocol supports multiple LSTs, including JitoSOL, mSOL and BNSOL.

When users deposit their assets, Fragmetric's smart contracts lock them into restaking mechanisms that support Solana's NCNs. These decentralized networks consist of independent nodes that collectively validate and secure Solana's infrastructure, including bridges, oracles and other blockchain-based services relying on decentralized consensus.

Upon deposit, the protocol issues corresponding fragAssets, such as fragSOL or fragJTO, which aggregate multiple underlying assets and multiple reward streams. Fragmetric tracks and distributes rewards generated from staking, restaking and network services in real time. Rewards in supported assets are automatically compounded — meaning that the protocol reinvests them back into users' fragAsset balances to increase yield. For rewards issued in tokens that cannot be auto-compounded, users can claim them manually through Fragmetric's decentralized application interface.

Users interact with Fragmetric through supported wallets, such as Phantom or Backpack, into which they can deposit tokens, monitor accrued rewards and manage claims or withdrawals. The protocol requires users to maintain a small SOL balance to cover gas fees. Fragmetric's use of on-chain logic and Solana's Token-2022 standard ensures transparency and verifiability for all token transactions, reward calculations and balance updates.

FRAG-22

FRAG-22 is Fragmetric’s proprietary asset tokenization standard. It leverages Solana’s Token-2022 extension, enabling a single token to represent deposits of multiple different underlying assets and streamlining complex multi-asset management under one unified token. This standard supports real-time tracking and precise allocation of multiple reward streams from various sources, such as staking yields, restaking rewards, NCN reward distributions and yields from other DeFi protocols.

A key innovation of FRAG-22 is its on-chain recalculation mechanism, triggered by every token transfer. This ensures that rewards are updated nearly instantly, maintaining accurate balances even during high-frequency transactions. FRAG-22’s modular design allows the integration of diverse yield strategies beyond simple staking — including liquidity pool rewards, lending platform returns and structured DeFi products — without requiring changes to the core token logic.

By standardizing multi-asset deposits and multi-reward distributions, FRAG-22 reduces transaction overhead, improves liquidity efficiency and enhances composability. It lays the foundation for Fragmetric’s efficient asset management ecosystem on Solana, enabling users to access sophisticated yield strategies while retaining a single, tradeable token that continuously accrues rewards from multiple sources.

Fragmetric key products

Fragmetric’s core products — yield-bearing restaking tokens known as fragAssets — are tokenized representations of users’ deposits into the protocol. These fragAssets are issued to users who restake supported tokens via Fragmetric. They not only reflect the underlying value of the deposited token, but also automatically track and accrue various forms of yield distributed by the protocol.

As of early July 2025, three fragAssets — fragSOL, fragJTO and fragBTC — are in circulation, each representing a different stackable underlying asset. These tokens can be freely transferred, traded or used across supported DeFi platforms. Moreover, fragAssets are available in wrapped formats that provide additional compatibility with external protocols without compromising the reward accrual mechanics.

fragSOL

fragSOL is the liquid restaking representation of SOL within the Fragmetric protocol. Users deposit SOL directly via the Fragmetric interface and receive fragSOL. This asset entitles holders to a stream of rewards sourced from validator staking and Fragmetric’s integrations with restaking protocols. fragSOL is compatible with additional restaking layers and NCNs such as TipRouter, so that it contributes to Solana’s decentralized infrastructure.

The Fragmetric protocol handles validator selection, delegation and rebalancing behind the scenes, while users maintain a liquid, composable token. fragSOL can also be wrapped as wfragSOL to improve compatibility with external DeFi protocols. All reward calculations are handled on-chain using the FRAG-22 standard, ensuring precise yield accounting across sources.

fragJTO

fragJTO is issued when users restake JTO, Jito’s governance token, through Fragmetric. The deposited assets are restaked to support Jito’s infrastructure, particularly its integration with Solana’s MEV layer; the resulting fragJTO represents the Jito restaking position, and accrues rewards tied to Jito’s validator activity, as well as any additional restaking integrations.

This process follows the same mint-on-deposit model used for other fragAssets. However, fragJTO’s reward stream is uniquely tied to the Jito ecosystem. As with fragSOL, a wrapped version, called Wrapped fragJTO (wfragJTO), is available for purposes of interoperability.

fragBTC

fragBTC is a yield-generating representation of BTC-pegged assets on Solana. It’s currently backed by SolvBTC, a product from Solv Protocol, and earns yield through SolvBTC.JUP, a strategy that provides liquidity to Jupiter Exchange’s JLP pool. This delta-neutral strategy aims to generate BTC-denominated returns by employing risk-hedging techniques.

Users deposit supported BTC-pegged tokens into Fragmetric and receive fragBTC in return. These deposits are routed into SolvBTC’s contracts, with the yield generated passed through to fragBTC holders. The fragBTC token can also be wrapped (as wfragBTC) for DeFi compatibility, with all rewards and balances managed under the FRAG-22 architecture.

What is the Fragmetric crypto token (FRAG)?

FRAG is the native governance and utility token of the Fragmetric protocol. The token is based on Solana's SPL format, the default standard for fungible tokens on the blockchain. Key functions of the token include governance and staking; stakers can also vote on the reward distribution mechanics on the protocol.

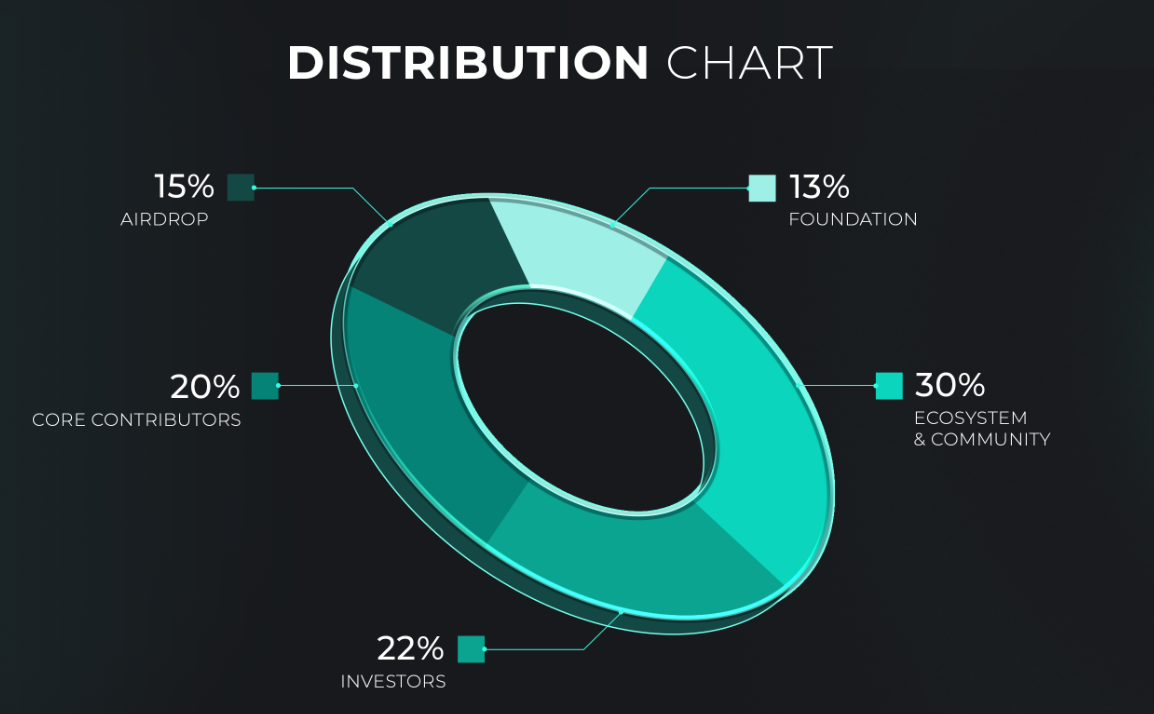

FRAG has a fixed total and maximum supply of 1 billion tokens. Supply distribution shares are per the image below:

Fragmetric crypto (FRAG) airdrop

Season 1 of the FRAG airdrop distributes 10% of the total supply to users and community members, with the remaining 5% reserved for future seasons. Eligibility is based on reward points earned by holding or depositing fragAssets, as well as via participation in community activities on social platforms like Drip and Discord. One percent of the supply is allocated to NFT holders from the collections of Mad Lads, TOPU, Inc. and WAO X STEM. All tokens were fully unlocked at launch. The claim window began on Jul 1, 2025 and runs for 30 days.

Where to buy the Fragmetric crypto token (FRAG)

The FRAG token is available on Bybit as a Spot pair with USDT and as a USDT-based perp contract. You can also take advantage of Bybit's event dedicated to the token to grab a share of the 1.8 million FRAG prize pool. New users can earn FRAG tokens by accumulating a deposit volume of at least 2,000 FRAG, or by depositing 100 USDT and trading 100 USDT worth of FRAG via their first trade using their Bybit account. Additionally, existing users can earn rewards by trading at least 500 USDT worth of FRAG on Bybit’s Spot market. This event is valid through Jul 15, 2025, 11AM UTC.

Closing thoughts

Fragmetric, Solana's first native liquid restaking protocol, is now championing complex, multi-source yields and helping users access additional rewards of varied nature, including staking, liquidity, yield farming and AVS rewards.

Additionally, by introducing the FRAG-22 standard, Fragmetric has established itself as a vital innovator within the Solana restaking ecosystem. By championing FRAG-22, Fragmetric empowers users to earn complex yields in a way that's far from complex, as fragAssets are designed to make yield collection as easy and efficient as possible. In turn, this improves the accessibility and economic potential of the entire Solana DeFi ecosystem.

#LearnWithBybit