Ethervista (VISTA): A Game Changer for DEX Sustainability

The automated market maker (AMM) model championed by the Uniswap (UNI) decentralized exchange (DEX) back in 2018 changed the entire landscape of the decentralized finance (DeFi) industry. Thanks to the AMM-based setup, liquidity levels on DEXs have risen sharply, and the efficiency of coin swaps has skyrocketed. Nevertheless, crypto trading using AMM pools has its drawbacks, along with the numerous benefits this model has ushered in.

Among the main cons of AMM DEXs is the short-term approach adopted by many liquidity providers (LPs) and token issuers. Since AMM DEXs pay out LP rewards denominated in the tokens of the pool, many LPs are eager to quickly withdraw their liquidity and sell the tokens at the first sign of volatility. This is understandable, as many of these tokens are highly volatile and may crash and burn quickly, falling victim to the powerful forces driving the crypto market. The same risk of pool assets becoming worthless often drives token issuers to withdraw liquidity and support for their tokens as well. In addition, another drawback of AMMs is the lack of meaningful long-term incentives provided to LPs and token creators.

Ethervista (VISTA) is a new DEX platform that aims to resolve the inherent deficiencies of the AMM trading model. The platform pays out LP rewards in ETH, and distributes the rewards after accumulating them in a dedicated pool so that LPs and token issuers are incentivized by genuine, long-term trading activity in swap pools, rather than by the short-term price movements of tokens in these pools.

Key Takeaways:

Ethervista (VISTA) is an innovative DEX platform that rewards LPs and token creators in ETH, rather than in volatile ERC-20 tokens, and provides a high level of customizability for its liquidity pools.

The platform uses a mathematical model, the Euler sequence model, to calculate and distribute rewards to LPs and token creators fairly, commensurate with their long-term contribution.

Ethervista's native crypto, VISTA, is a deflationary asset with a built-in burn mechanism designed to boost the token's value over time.

What Is Ethervista?

Ethervista (VISTA) is a new-generation DEX platform on the Ethereum (ETH) blockchain that uses a unique LP rewards distribution model in which LPs and token creators are paid in ETH, based on a mathematical model that ensures fair value for their contributions. Ethervista aims to address the key inefficiencies of the standard AMM trading model, particularly the issue of rewards paid out in volatile or low-worth tokens.

In a standard AMM like Uniswap, LPs earn fees denominated in the pool's token. These fees are generated from trading activity in the pool to which the LP contributes its funds. The key problem with this model is that the asset used for the fee payments — typically an ERC-20 token — is often a highly volatile or obscure cryptocurrency whose origins or future value may be questionable. This drives many LPs away from contributing to pools made up of low-cap, volatile tokens.

Ethervista collects and distributes LP rewards exclusively in ETH, the native cryptocurrency of the Ethereum blockchain. The market's second-highest-capped crypto, ETH is a widely trusted asset that provides greater stability and security than the many tokens used for LP rewards on AMM DEXs.

Ethervista also offers staking rewards denominated in ETH via its Hardstake and Hardlock services to users locking ERC-20 and LP tokens. Its platform’s operations launched on Ethereum in September 2024.

How Does Ethervista Work?

Ethervista allows any user to configure and launch a liquidity pool, specifying a custom fee structure for token buy-and-sell operations. Users can also launch tokens using the app's interface. Partial revenues collected from a pool go to LPs contributing liquidity, while the protocol also collects an additional fee for its treasury and reward distribution model.

The custom nature of each pool is a drastically different concept from the one used on popular AMM DEXs. In a typical AMM, a fixed fee rate for LP rewards is preset by the platform. At best, you can choose from a few fee tiers, but there isn’t complete flexibility in this regard. On Ethervista, pool creators have much more freedom in terms of setting their preferred fee levels.

Ethervista accumulates revenue collected from the trading activity in a pool and distributes it in ETH to LPs and token creators, based on a mathematical formula — the Euler sequence model.

Reward Distribution

The Euler model employed by Ethervista recalculates the pooled ETH funds for a swap pair following each transaction. It's designed to reward each beneficiary fairly, based on their contributions to the pool over time. Beneficiaries include LPs, token creators and stakers of ERC-20 tokens and LP tokens.

The Euler model is designed to incentivize long-term, fair contributions to a pool, reducing the likelihood of short-term focused behavior that many LPs exhibit in traditional AMMs. Another goal of the Euler model is to minimize gas fees for each swap operation.

Fees

Pool creators need to specify four custom fees when launching a new pool:

LP fees for buy transactions

LP fees for sell transactions

Protocol fees for buy transactions

Protocol fees for sell transactions.

The fees are specified in USD and are recalculated by the protocol in ETH using an on-chain oracle.

There's also an additional fee of $1 per swap transaction that goes to the project's treasury to fund ecosystem development.

What Is Etherfun?

Etherfun is a component of Ethervista that’s dedicated to meme coins. It allows users to launch and trade meme coins, similar to the manner in which platforms like Pump.fun and SunPump operate. Etherfun offers a highly affordable way of creating meme coin assets, as token launches cost only about $1–$2.

If the token creator prefers not to cover the initial deployment costs, the first buyer for the asset can step in and cover the costs. As a reward for covering deployment costs, the first buyer is then entitled to 2% of the meme coin's pool fees.

Etherfun uses a bonding curve model — somewhat similar to the one employed by Pump.fun — whereby the price of an asset follows a specific trajectory, based on the token's buy and sell activity. Etherfun's bonding curve target for a token is set at $4,000, or just one-third of Pump.fun's $12,000. This helps accelerate development for new token projects, providing more realistic success targets for meme coin creators.

What Is the Ethervista Token (VISTA)?

VISTA, Ethervista’s native cryptocurrency, is an ERC-20 token launched on Ethereum in early September 2024. Unlike ETH, VISTA isn't used for LP provider rewards or other protocol and liquidity providers' incentives derived directly from Ethervista's trading operations.

VISTA is designed to serve as a deflationary token, with the protocol buying and burning some VISTA after each transaction using the ETH funds generated from trading activity. The continual decrease in VISTA's supply should lead to its price appreciation, making it a value-compounding deflationary currency.

Upon its launch, VISTA had a total supply of 1 million. The burn mechanism has gradually reduced its supply to 962,287 as of Nov 10, 2024. The supply is expected to slowly trend lower over time, as the Ethervista platform buys and burns the token in line with transaction activity.

How to Buy Ethervista (VISTA)

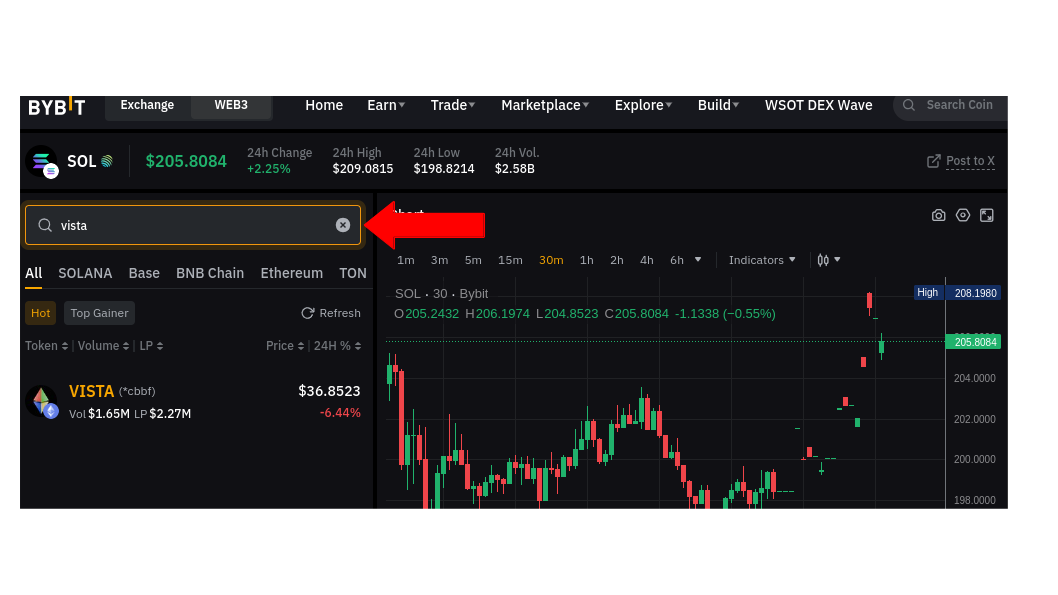

You can buy VISTA on Bybit Web3 DEX Pro — a decentralized trading platform that supports nine popular blockchains, including Ethereum, Solana (SOL), Arbitrum (ARB) and Avalanche (AVAX). To buy the token, first navigate to the Trade tab on the Bybit Web3 homepage and choose the DEX Pro option from the drop-down menu. (Note: Please ensure that you have a wallet connected to the platform.) Bybit Web3 DEX Pro supports several wallet apps, including Bybit’s Cloud Wallet and Keyless Wallet, in addition to third-party wallets.

In the left pane of the DEX Pro interface, type the name of the token into the search box and select it in the search results just underneath it.

When you land on VISTA's page, simply click on the green Buy button in the top right corner. You'll then be able to select a cryptocurrency that you would like to use to buy VISTA.

Ethervista (VISTA) Price Prediction

As of Nov 14, 2024, the VISTA token is trading at $24.05, which is 67.9% lower than its ATH of $74.91 on Nov 1, 2024 and 457.2% higher than its ATL of $4.32 on Oct 9, 2024.

Long-term price forecasts for VISTA are generally bullish.DigitalCoinPrice predicts a maximum rate of $58.37 in 2025 and $173.19 in 2030, whileCoinCodex expects the token to hit $113.38 in 2025 and $110.43 in 2030.

Closing Thoughts

Ethervista is an innovative departure from the standard AMM concept, offering LP providers rewards boosted through long-term genuine participation, rather than short-term maneuvering. The distribution of rewards in ETH — rather than volatile ERC-20 tokens — is a rare feature that will certainly be appreciated by DeFi traders, and may also attract significant numbers of new liquidity providers to the platform.

While Uniswap started the AMM revolution back in 2018, Ethervista may have just initiated a completely new chapter in AMM history by offering LPs and token issuers greater stability and long-term value than ever before.

#LearnWithBybit