deBridge (DBR): Powering Seamless Cross-Chain Liquidity in DeFi

Liquidity is the heartbeat of the cryptocurrency market. Without it, transactions wouldn't go through, or would be extremely sluggish. For a long time, illiquidity has plagued many decentralized finance (DeFi) platforms, making it cumbersome to move assets around the crypto space.

The ability to quickly trade assets helps investors take advantage of opportunities in the market, which leads to overall growth and eventually making crypto trading mainstream.

The idea of bridging assets across platforms was a game changer in DeFi. However, most of the current bridges suffer from low liquidity, which has led many crypto users to shy away from tapping into the vast array of opportunities offered by DeFi.

To solve this challenge, deBridge has created a liquidity network to facilitate bridging in real time across multiple blockchains without the need to wait.

Let's explore deBridge further.

Key Takeaways:

deBridge is a cross-chain interoperability protocol designed to provide fast and seamless value transfer of messages and assets across different blockchains.

With features such as deBridge IaaS for interoperability, the DLN liquidity solution and deBridge P2P for OTC trading, deBridge offers an innovative approach to bridging in the DeFi space.

The native token for deBridge, DBR, serves as a governance token. It can be traded on Bybit as a Spot pair or a USDT Perpetual contract.

What Is deBridge?

deBridge is a DeFi liquidity network protocol that facilitates fast and seamless bridging of assets and messages across blockchains. Its cross-chain messaging protocol is designed to allow simultaneous exchanging of messages and data across chains.

deBridge’s user interface consists of two components: dePort and deSwap. dePort is a native bridge on deBridge that’s designed to facilitate the trustless and flexible bridging of tokens, and to create utility for a user’s synthetic tokens in other chains. Meanwhile, deSwap is a framework that’s designed to facilitate capital-efficient, cross-chain swaps between arbitrary assets.

The deBridge protocol has also introduced the DLN API, a feature that makes it easy for decentralized applications (DApps) to quickly and efficiently transfer liquidity on demand across chains. This feature ensures that transactions on DApps go through quickly, with no risk of reverting.

Developers can also tap into deSDK, a production-ready software development kit for creating innovative cross-chain applications. Furthermore, developers can integrate the deBridge Widget to create customizable widgets without much code, simplifying interactions with their applications through a user-friendly interface.

The deBridge ecosystem is powered by the DBR token, which helps ensure that the platform remains decentralized.

How Does deBridge Work?

deBridge's architecture consists of two layers — the protocol layer and the infrastructure layer — to facilitate highly efficient cross-chain transactions. The protocol layer consists of on-chain smart contracts for facilitating cross-chain trades, while the infrastructure layer consists of “solvers” who are charged with off-chain validation of orders and on-chain settlement of trades.

For seamless cross-chain bridging, the following components of deBridge are critical.

deBridge Hooks

deBridge has created deBridge Hooks, a feature that allows protocol users to attach on-chain actions to their transactions (which will automatically execute once the order has been fulfilled on the destination chain). When transacting, you attach a “hook,” which represents destination-specific data that executes instantly upon order fulfillment. The execution instructions can occur on Solana or the Ethereum virtual machine (EVM)–based chain, offering a seamless cross-chain experience.

Hooks enhances crypto bridging and unlocks a host of cross-chain possibilities, since the feature allows real-time transfer of value across the DeFi space. Case in point: an application operating on Kamino (on Solana) can receive funds from a platform on Ethereum in a single step, eliminating the need for multiple transactions typically required in a traditional bridge.

deBridge Points

deBridge has created a rewards system, deBridge Points, that rewards its supporters, contributors and users who pay fees on the protocol. You can acquire deBridge Points in the following ways:

Integrate deBridge into your DApp via the DLN API or deBridge Widget. After the integration, users will earn 100 points for every $1 in fees paid to the protocol, with 25% of the Points allocated to the integrator.

Refer new users. For every new user brought to deBridge via your referral code, you’ll earn 25% of the Points they generate.

Bridge assets with its partner applications. When bridging, for every $1 you spend on fees on deBridge or partner applications, you’re rewarded with 100 deBridge Points.

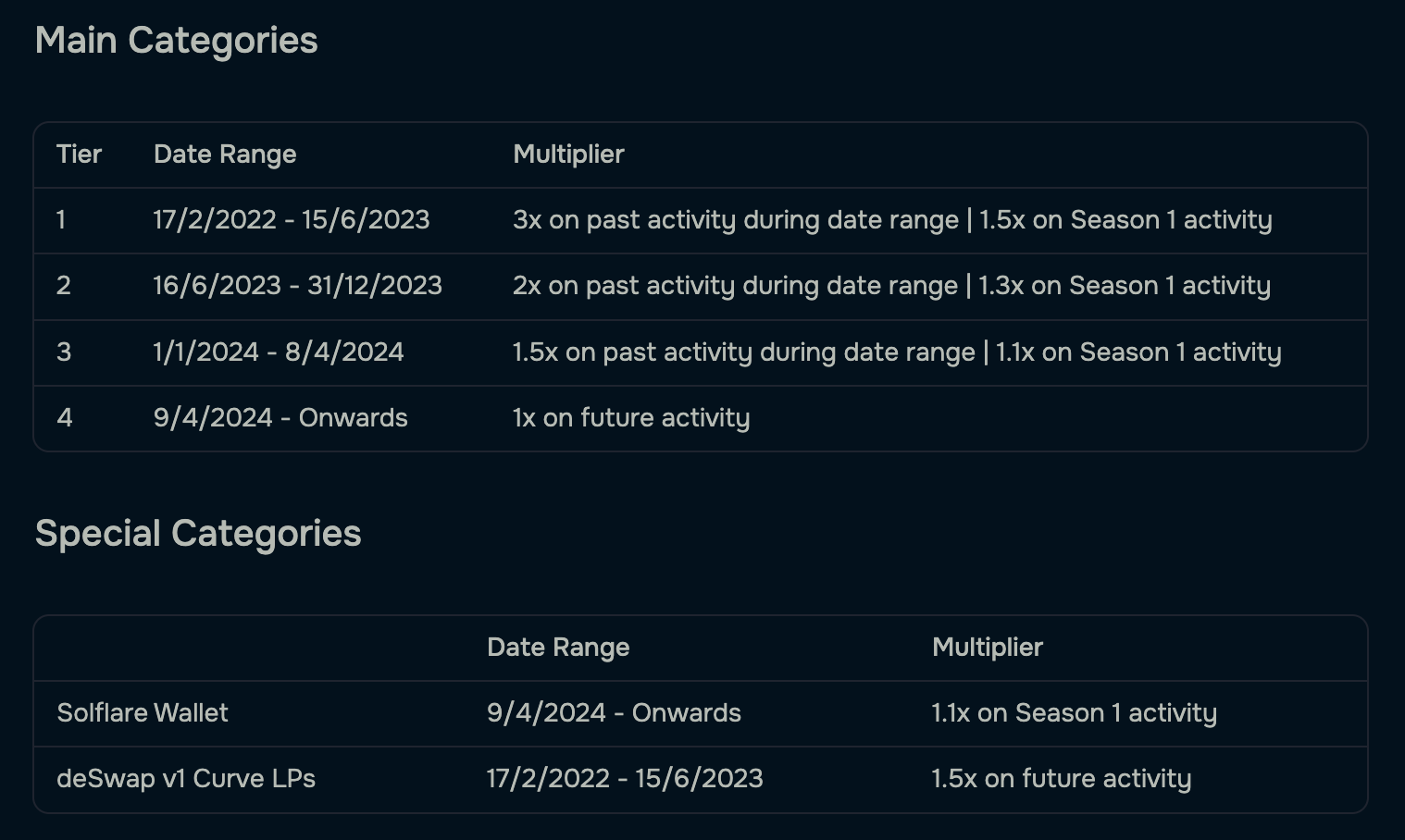

Early supporters and active users also benefit from a tiered-multiplier system for their loyalty, based on the following structure:

Upon launch, deBridge airdropped its native token, DBR, to over 490,000 wallets, based on the deBridge Points accumulated over time. Earning deBridge Points is an ongoing activity on deBridge’s protocol.

deBridge Key Features

deBridge supports cross-chain bridging and messaging via the following key features.

deBridge IaaS

deBridge Iaas (Interoperability as a Service) is a feature provided by deBridge for EVM and Solana Virtual Machine (SVM) blockchains to facilitate the high-performance value exchange of assets and messages in an interoperable manner.

Some of the opportunities that ecosystems on these blockchains can benefit from include:

deBridge messaging: Cross-chain sharing of authenticated messages

Cross-chain exchange of assets on deSwap Liquidity Network (DLN): A secure cross-chain trading infrastructure with zero slippage and deep liquidity)

Seamless dePort asset custody: seamless tapping into the custody of assets in other networks with one click)

In short, with deBridge IaaS, blockchain networks can become accessible from the EVM or SVM chain, which leads to better scalability and secure cross-chain interactions.

deBridge is a subscription-based model where you pay monthly or quarterly. Neon EVM, an EVM built on the Solana blockchain, is the first chain to utilize deBridge IaaS to power the seamless liquidity transfer between Neon EVM and all other supported platforms on deBridge.

deSwap Liquidity Network (DLN)

deSwap Liquidity Network (DLN) is a feature designed to power limitless and zero-slippage value transfers across chains, without any locked liquidity. DLN's improved design solves the challenges of security and capital efficiency faced by traditional bridges, which often can't present instant liquidity on demand.

DLN is a successor to deSwap V1, only faster and more efficient. With deSwap, there's no need to lock liquidity or wrap assets when transacting. DLN's “liquidity on demand” approach eliminates the need for liquidity mining, which can be a challenge for traditional bridging ecosystems.

deBridge P2P

deBridge P2P is an over-the-counter (OTC) desk targeting global DeFi users. Through the deBridge P2P tab, you can perform noncustodial cross-chain trades of any arbitrary token at your desired price with zero slippage.

The hallmark of deBridge's P2P is that DeFi users have complete control over trades. Some of the benefits of the deBridge P2P are that institutions can make optionally compliant trades, eliminate counterparty risks when trading and trade a token even before it’s listed.

What Is the deBridge Token (DBR)?

DBR is the governance token for deBridge. Its main purpose is to power deBridge’s DAO governance, whereby holders can participate in decision-making through voting. By staking their DBR tokens, holders earn the right to vote on protocol parameter decisions, such as electing active validators and voting for new chains to integrate.

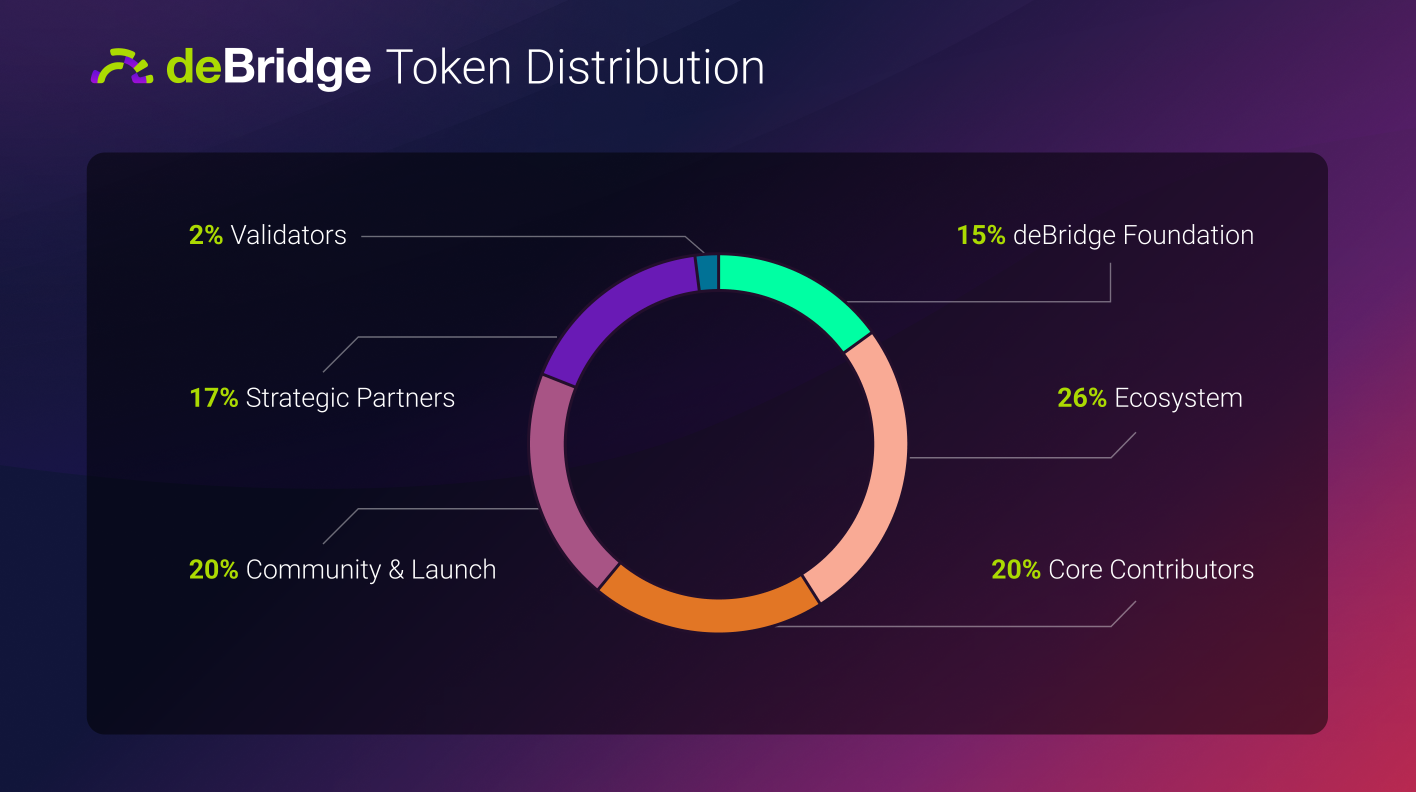

The deBridge token has a maximum supply of 10 billion, of which 1.8 billion were available as circulating supply upon launch. DBR’s token distribution is as follows:

Validators — 2%

Strategic Partners —17%

Community and Airdrop — 20%

deBridge Foundation — 15%

Ecosystem — 26%

Core Contributors — 20%

Where to Buy the deBridge Token (DBR)

You can buy DBR on Bybit as a Spot pair (DBR/USDT) or as a USDT Perpetual contract (DBRUSDT). From Oct 17, 2024, 8AM UTC to Oct 24, 2024, 8AM UTC, Bybit is also holding a DBR Launchpool event where you can stake DBR, USDT or MNT to earn a share of the 50 million DBR tokens up for grabs. After you’ve staked either of these three tokens, you’ll earn a daily yield that will be calculated the next day.

Closing Thoughts

Liquidity is essential when carrying out transactions such as bridging. Traditional bridging protocols often experience challenges due to illiquidity. That’s why deBridge has provided an innovative solution with multiple interoperable features, from instant asset bridging via the liquidity-on-demand approach to sharing messages and transferring value across chains. As the web3 space continues to unfold, projects such as deBridge are worth watching for the innovative value propositions they provide in the crypto market.

#LearnWithBybit