Explained: What Are Crypto Lending and Loans in DeFi?

Cryptocurrency lending is a feature of Decentralized Finance (DeFi), in which investors lend cryptocurrencies to borrowers in return for interest payments. If you’re holding on to cryptocurrency with the expectation of future price appreciation, you might also receive steady passive income from your assets through lending. You could receive weekly or monthly interest when you deposit cryptocurrency in the wallet of a crypto lending platform.

On the borrowing side, crypto lending or crypto loan allows you to borrow fiat money (using your crypto as collateral) so that you won’t have to sell your cryptocurrency assets in an emergency.

What Exactly Is DeFi?

Decentralized Finance refers to blockchain-powered financial applications, protocols, and platforms that can be used to manage money. These tools provide many of the same opportunities that traditional financial institutions do for fiat money.

Unlike the conventional financial system, DeFi applications run without any centralized authority and are independent of banks, government-issued currencies, remittance platforms, and other traditional finance infrastructure.

DeFi offers an alternative to the existing traditional financial system and creates new solutions. It connects users in peer-to-peer (P2P) networks. This allows them to interact without knowing the other users because of underlying smart contracts, which safeguard each counterparty.

The smart contract that serves as the foundation for decentralized finance is transparent, open and self-executing, and doesn’t require supervision. Smart contracts can execute predetermined tasks, and users can access them using simple interfaces, as with regular applications. Because Etheruem was the first platform to introduce the concept of DeFi, most applications are built on the Ethereum blockchain.

Understanding Crypto Lending

Traditional lending and cryptocurrency lending both provide loans, but in different ways.

A key feature of crypto lending is over-collateralization. Collateral is the security deposit pledged for a loan, and it can be liquidated in case of default. Over-collateralization means borrowers must provide up to twice the value of the loan amount they seek as a security deposit. Over-collateralization gives the lender comfort if the price of a highly volatile cryptocurrency crashes.

Generally, over-collateralization ensures lenders have a margin of safety. More importantly, borrowers don’t need a credit score to access crypto loans, unlike traditional bank lending. This means that cryptocurrency lending is more accessible to the under-banked, those with poor credit scores or without a credit history, and self-employed people who find it challenging to meet stricter traditional lending requirements.

While it takes several days of processing time for a traditional loan to clear, cryptocurrency loans are instant.

How Crypto Lending Works

What if you need money urgently but have most of it invested in assets? Selling those assets might incur capital gains taxes, and you would also miss any investment performance by dipping into investment capital. This is where crypto lending shines.

Decentralized lending platforms provide the opportunities to loan crypto without intermediaries. DeFi lending protocols enable lenders to earn interest on supplied digital assets while borrowers pay interest when taking the loan.

Let’s say you have 10 ETH, and an emergency that requires cash comes out of the blue. But you don’t want to sell any of your ETH because you’re convinced that prices are on the verge of soaring. You may also be afraid that if you liquidate any Ether now, you won’t be able to repurchase as much in ETH later.

Here comes cryptocurrency lending to the rescue. Crypto lending platforms allow you to use your Ether as collateral and take out loans in USDT or any other stablecoin. However, due to cryptocurrency’s volatility, you’ll have to over-collateralize the loan. That means you have to lock up significantly more ETH than the value you receive as a loan.

The lending platform will release your cryptocurrency once you’ve repaid the loan with the agreed-upon interest. And if the price of ETH has indeed appreciated, as you predicted, you will still have profited from it.

You’ll only risk losing your cryptocurrency if you fail to repay your loan or if the value of your collateral (contrary to your optimistic outlook) falls below the value at which you borrowed.

Parties Involved in a Typical Crypto Lending Transaction

Cryptocurrency lending involves a borrower who needs liquidity but prefers to keep assets invested, a lender who wants passive income, and a lending platform.

A borrower approaches a lending platform, such as Compound or Aave, for a fiat loan from a lender, using cryptocurrency assets like Bitcoin (BTC), Ether (ETH), or Litecoin (LTC) as collateral.

Once the lender and borrower have agreed to terms and conditions, including a specific interest rate, the borrower receives the cryptocurrency loan. Just as in a traditional bank loan, the lending platform releases the collateral to the borrower once the lender has been paid in full.

Cryptocurrency lending on DeFi crypto lending platforms lets borrowers and lenders interact directly without intermediaries. However, cryptocurrency lending is also available on Centralized Finance (CeFi) platforms such as Nexo and BlockFi.

In contrast to a DeFi platform, a CeFi crypto lending platform has a centralized organization with a legal entity backing it and managing the loan platform.

Crypto Lending vs. Staking

Cryptocurrency staking and lending offer opportunities to make money from your idle assets but in different ways.

Cryptocurrency staking is the process of “locking up” a cryptocurrency asset to serve as a validator in a decentralized network. Validators maintain the security, integrity, and continuity of the network. The network encourages stakers (or validators) by rewarding them with new coins.

On the other hand, cryptocurrency lending pays interest as a reward for allowing the provider (or other users on the platform) to use your crypto assets.

While staking, on average, pays a lower return, it offers more security. Crypto lending typically pays higher returns, but the market is volatile, and rates change quickly.

How Is DeFi Lending Different?

Unlike traditional bank lending and CeFi crypto lending, Defi lending doesn’t rely on a central authority to oversee and enforce the loan’s terms and conditions. Instead, it relies on smart contracts. Users can stake their crypto assets on the platform for lending. A borrower can directly borrow from the DeFi platform through P2P (peer-to-peer) lending, without credit checks.

Basic Requirements for DeFi Lending

Getting a DeFi crypto loan is hassle-free. All you have to do is log on to your decentralized crypto lending platform, apply for the loan, and send your crypto collateral to a specified wallet. You don’t have to provide your personal information. You don’t need to worry about your credit score or any other documentation requirement. The most critical factor is the value of the crypto you’re offering as collateral and how large a loan it can get you.

That brings us to the loan-to-value (LTV) ratio.

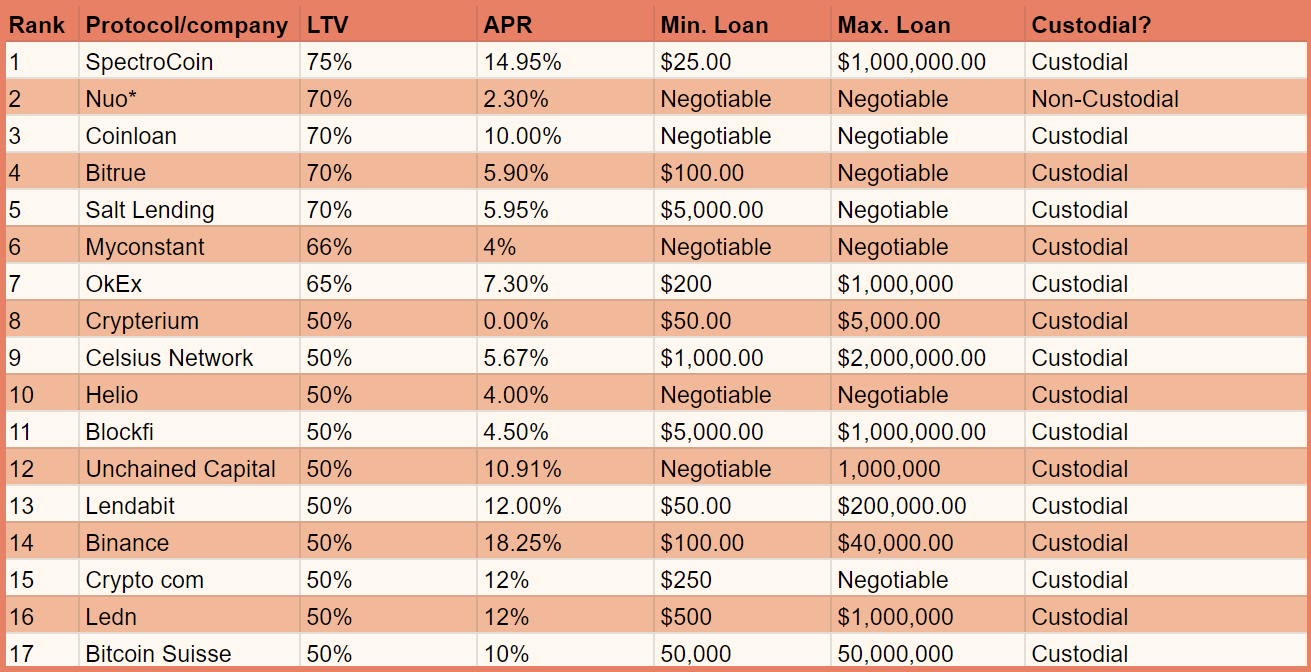

The loan-to-value ratio is precisely that: the ratio between the loan value and the collateral value. Let’s say you’re taking a $400 loan, and the LTV is 40%. In this case, you would need to put up $1,000 worth of crypto as collateral for a $400 loan, since $400 is 40% of $1,000. As compared to traditional finance, the LTVs for crypto lending or crypto loans, in general, is low due to the volatile nature of cryptocurrencies. For example, BlockFi’s LTV value goes to a maximum of 50% only. This may be a pass for investors, users who prefer to get bigger loans can benefit from the low LTV. As it helps minimize the risks of triggering a margin call.

Image source: BTCpressDeFi lending comes with a lending rate, which is the cost of borrowing. DeFi lending interest rates vary depending on the lending platforms, amounts, and the terms and conditions of the loan. DeFi lending platforms offer either fixed or floating interest rates.

A fixed interest rate means that you’ll pay a fixed (constant) interest rate throughout the loan tenor. In contrast, a floating interest rate varies according to the market — which means the rate can rise or fall at any time. When borrowing, fixed rates are typically higher than floating rates. Although floating rates can be lower, they may also shoot up at any time. This means that you have no way to know when, or how high, they’ll increase.

Where Does Crypto Lending Come From?

Motivated by the dramatic increase in Bitcoin’s (and other cryptocurrencies’) prices, many investors aim to hold their positions and profit from an expected long-term market price increase. However, this buy-and-hold strategy, known as HODLing, throws up a challenge. What do you do when most of your assets are tied up in cryptocurrency — but you need physical cash?

Luckily, cryptocurrency lending solves this problem because you can hold your crypto assets and still spend fiat currencies. Cryptocurrency investors can borrow money against their holdings or lend their crypto in return for interest. Investors can also let their assets work for them to generate passive income.

What’s in It for Me to Lend My Crypto?

As a lender, your cryptocurrency assets don’t just lie around in a wallet; they work and earn passive income for you. Here is why you should lend your crypto.

Interest Rate

Cryptocurrency lending can provide returns without you having to sell any of your assets. Some exchanges currently offer annual percentage yields (APYs) as high as 25% to borrow your cryptocurrency.

Sounds fantastic, right? Compare this with the best-yielding savings accounts in the U.S., which pay a paltry 0.55% average.

Stability

While you may lend any cryptocurrency you want, lending stablecoins allows you to grow your assets without the various risk associated with crypto. Stablecoins are cryptocurrencies that are designed to match the value of a real-world currency. For example, USDT is pegged to the US dollar.

The stability afforded by stablecoins also means you know how much you’ll earn from lending your crypto.

The Risks That Come with Crypto Lending

While crypto lending offers significant upside and lets your assets work for you, it’s not entirely without risks.

Volatility Risk

Cryptocurrencies typically experience wide price swings. As a borrower, your collateral is subject to volatility risk because the platform can liquidate some of your collateral due to drops in market value. If you don’t respond to a margin call by adding more collateral, the platform will liquidate your crypto instantly to restore the LTV ratio of the loan to the agreed-upon level.

Technology Risk

DeFi crypto lending platforms use smart contracts to manage your cryptocurrency lending transactions. Unlike CeFi platforms, no humans are involved in the operations. This means you don’t have anyone to rely on if the smart contract fails and you lose your cryptocurrency. Smart contracts and the functions they control can also be hacked or suffer security bugs.

Regulatory Risk

Cryptocurrencies are a new asset class, and the regulations guiding them are still unclear. Lawmakers can decide to introduce new laws regarding legality or taxation, which may or may not be to your advantage.

You can speak to tax consultants in your jurisdiction for guidance to minimize this risk.

Again, DeFi providers don’t have any legal entity behind their platforms, and they operate without a license. This provides a unique problem from a legal perspective, as you don’t have anyone to sue when things go wrong. It also means investors don’t know how regulations might affect them in the future.

Counterparty Risk

CeFi crypto lending platforms use the cryptocurrencies they receive from savers and borrowers to make money. They lend the crypto to counterparties — hedge funds, cryptocurrency exchanges, and other institutional investors. This creates counterparty risk because the counterparties to these transactions could fail to return the asset, making your provider insolvent.

Investors on these platforms don’t know the risks their providers take with these transactions. In addition, unlike with traditional bank savings products, regulators such as the Federal Deposit Insurance Corporation (FDIC) in the U.S. don’t protect your cryptocurrency investments.

DeFi platforms only lend directly to borrowers on their platforms. They do not lend to third parties. This eliminates counterparty risk because collateralization is built into the smart contract.

Should I Lend My Crypto?

Lending cryptocurrency gives you the benefit of holding on to long-term investment performance while earning additional money passively. Loans are over-collateralized, and even if a borrower defaults, you’ll still have access to their cryptocurrency as compensation.

Cryptocurrency lending platforms offer high-interest rates, paid out weekly in some cases. Fiat and stablecoins earn the highest rates — up to 12.7% APY. Other major cryptocurrencies, like BTC and ETH, typically command rates as high as 6%. This is far higher than traditional banking interest rates.

Top DeFi Lending Platforms

Among the decentralized lending platforms, Aave, Compound, and MakerDao remain top with one of the highest TVL within the platform.

Image Source: DeFi Pulse — July 9, 2021.

Image Source: DeFi Pulse — July 9, 2021.AAVE

Total TVL: $10.45B (July 9, 2021)

Opportunities: Wide range of loan options and flash loans.

Aave allows borrowers to put up collateral to support the protocol. At the same time, their contribution is represented in aTokens. On the flip side, flash loans offer fixed interest loan rates.

Compound Finance

Total TVL: $6.97B (July 9, 2021)

Opportunities: Higher LTV rates and lower liquidation threshold

Compound allows lenders to earn interest by supporting the protocol. The amount of digital assets a user supplies is represented by cTokens. The tokens can typically be used to keep track of the fund’s loan as collateral and the interest earned. Interestingly, Compound only liquidates 50% of the under-collateralized loan, and the penalties come at a fixed rate.

MakerDao

Total TVL: $6.76B (July 9, 2021)

Opportunities: Supports DAI stablecoin

Maker loans allow lending crypto to yourself. The Maker Vault is open for anyone to mint DAI by locking up your digital assets as collateral and paying back the loan based on the predetermined contract. Maker offers one of the highest 75% LTV rates for crypto loans.

The Bottom Line

Decentralized finance or DeFi is one of the most disruptive uses of nascent blockchain technology. By using self-executing smart contracts, DeFi replaces traditional institutions with platforms where users can borrow and lend money directly to each other, earning fees and interest in the process. While DeFi offers new opportunities to make money, it also improves the existing financial system by providing more trust, transparency, and efficiency. Still, always do your own research before lending crypto.