Corn (CORN): The Next-Gen BTCFi Solution

For years, the Bitcoin (BTC) blockchain trailed behind its key rival, Ethereum (ETH), in decentralized finance (DeFi) adoption for one simple reason — the world’s oldest chain lacks any sort of native smart contract functionality. However, the last few years have seen healthy growth in Bitcoin DeFi solutions, thanks to the numerous Layer 2 rollups, sidechains and other protocols that have introduced Bitcoin-linked smart contract capabilities.

The Bitcoin blockchain’s finance ecosystem — referred to as BTCFi, a portmanteau of the words “Bitcoin” and “Finance” — is now expanding rapidly, with numerous protocols that provide yield-generating opportunities, enable token swaps, consolidate DeFi lending rates and provide other crypto finance services.

One of the most interesting upcoming BTCFi projects is Corn (CORN), an Ethereum virtual machine (EVM)–compatible platform that allows you to use your BTC in various protocols across both the EVM and Cosmos ecosystems.

As a cross-chain project, Corn is expected to contribute significantly to expanding BTCFi opportunities. The platform is envisioned to operate in a dual-token mode, with the BTCN and CORN tokens enabling a variety of crypto finance use cases. BTCN is of particular interest, with its unique 1:1 Bitcoin-backed mechanism and Bitcoin Clearing House mint system.

Key Takeaways:

Corn (CORN) is a BTCFi project designed to support the use of Bitcoin funds on finance protocols of two large blockchain ecosystems: EVM and Cosmos chains.

The platform features two native tokens, BTCN and CORN. BTCN is used for gas and on external DeFi protocols, while CORN will support the reward, staking and governance functions.

While CORN is yet to be released, it is already available on Bybit Spot Pre-Market Trading.

What Is Corn?

Corn (CORN) is a decentralized BTCFi platform that allows users to leverage their BTC funds in crypto finance protocols across the EVM and Cosmos blockchain ecosystems.

Built using the Arbitrum Orbit stack, Arbitrum’s (ARB) framework for rollup development, Corn features great scalability and low costs. As an Arbitrum-based network, Corn is also fully EVM-compatible and enjoys the security of the underlying Ethereum Layer 1 chain.

To further enhance its cross-chain properties, Corn has integrated the LayerZero interoperability protocol. Additionally, to support native BTC bridging, Corn has implemented ThorCorn bridging, a solution based on the THORChain liquidity protocol.

As of late February 2025, Corn is planning to launch its mainnet operations and its second native token, CORN. Its first token, BTCN, is already available.

By utilizing a BTC-backed asset with cross-chain properties, Corn will allow its vast army of BTC holders to use their funds on Ethereum- and Cosmos-based networks, with both of the ecosystems featuring a rich set of DeFi products and solutions.

What Is Bitcorn (BTCN)?

Bitcorn (BTCN) is an ERC-20 token described as a hybrid tokenized Bitcoin, backed 1:1 by BTC through a specialized minting mechanism known as the Bitcoin Clearing House. Users can mint BTCN by depositing two popular Bitcoin derivatives — Coinbase’s cbBTC and Wrapped Bitcoin (WBTC) — into Corn’s Bitcoin Clearing House. In order to do so, cbBTC and wBTC first have to be bridged via supported blockchains on LayerZero.

Corn’s BTCN crypto is a Bitcoin-backed asset that can be used within DeFi protocols on various EVM chains. The cbBTC cryptocurrency is backed by Bitcoin reserves held by Coinbase, one of the leading cryptocurrency exchanges in the world. Additionally, wBTC is a community-driven project, and the token is backed by a wide network of carefully monitored liquidity providers, merchants, exchanges and other partners.

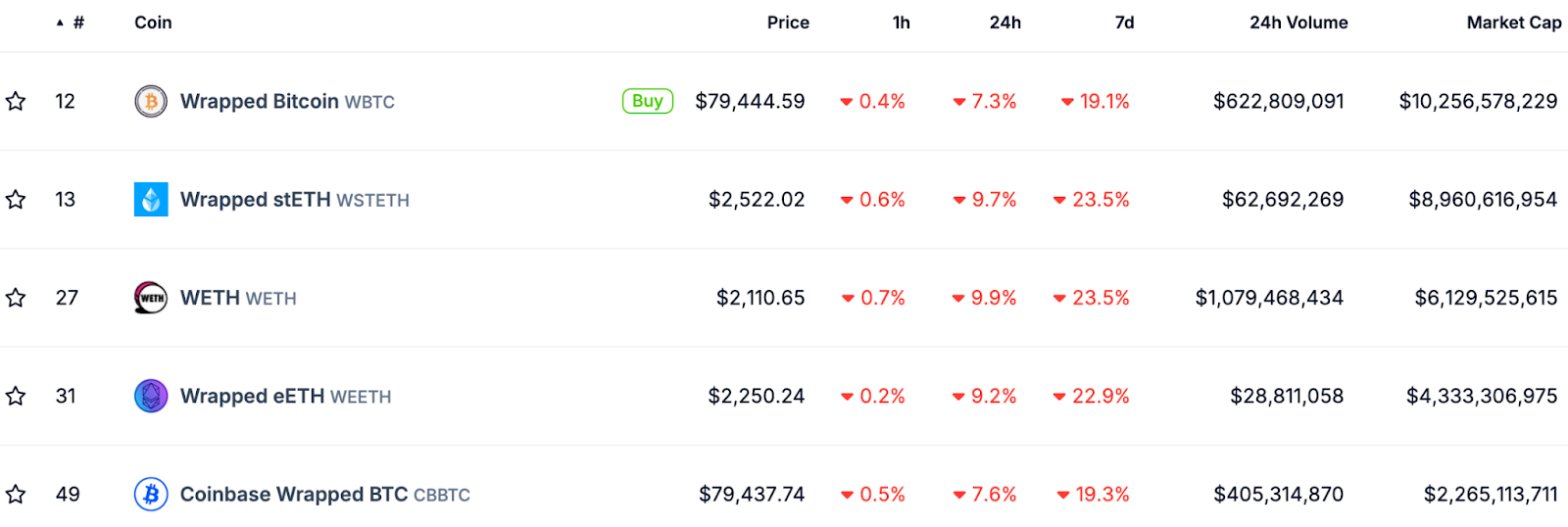

Both wBTC and cbBTC maintain a tight peg to Bitcoin, and rank among the most popular wrapped assets in the industry. As of Feb 28, 2025, wBTC holds the highest market cap among wrapped tokens, while cbBTC ranks fifth.

You can also bridge your BTC directly to the Corn network and convert your funds to BTCN through the ThorCorn protocol. Additionally, you may also deposit BTC from the Coinbase exchange via BlueCorn, a dedicated hub formed through a partnership between Coinbase and the Corn project.

Once BTC funds are bridged to the Corn chain and converted to BTCN, they can be utilized within the EVM-based DeFi ecosystem, thanks to Corn’s Arbitrum-based technical backbone.

Corn has also partnered with the Babylon staking protocol to enable the securing of its network through Bitcoin staking, and to facilitate the use of BTCN across various blockchains within the Cosmos ecosystem.

In addition to being used as a BTCFi asset, BTCN will also serve as the Corn chain's gas token to pay for network transactions.

What Is CORN?

CORN is the other native asset of the platform, set to launch in the near future. The token will function as a staking, reward and governance asset. Users can stake the CORN token to receive popCORN, a yield-bearing asset granting participation rights in the platform's governance processes.

Another function of CORN, also via popCORN ownership, will revolve around the platform’s so-called “bribe market.” Rather sinisterly named, bribe markets in DeFi typically refer to systems in which projects or applications offer incentives (bribes) to stakers in exchange for their governance votes to direct yield. In this case, popCORN will be used as the bribe currency on the project’s Farmer’s Market upon its launch.

Ahead of its full release, the Corn project is distributing Kernels (off-chain reward points) to incentivize active user participation. Kernel ownership will entitle holders to a share of CORN's supply upon its token generation event (TGE), which is expected at some point in Q1 2025 per the project's public communications.

Where to Buy CORN

Prior to its public release, the CORN token is already available on the Bybit exchange via its Spot Pre-Market Trading, an over-the-counter (OTC) platform that lets you trade promising new cryptocurrencies before they’re officially launched. By trading crypto assets on Bybit’s Pre-Market platform, you can access potentially high-growth assets at great rates before the broader market drives their prices higher.

Naturally, the future growth of coins offered via the Pre-Market Trading platform isn’t a guarantee, so be sure to always do your own comprehensive research before investing in any crypto asset.

Closing Thoughts

Powered by Arbitrum technology and partnering with providers like LayerZero and Babylon, the Corn (CORN) platform is an innovative solution for secure, cross-chain BTCFi use cases. For years, Bitcoin holders have had concerns regarding the security of token transfers to chains outside the Bitcoin network's ecosystem. Corn solves many cross-chain interoperability issues, allowing for seamless use of BTC on EVM and Cosmos chains. And it's not just about cross-chain token transfers — since the platform will serve as a comprehensive solution for yield-generating applications of BTC.

Of special interest is Corn's BTCN token. The platform features a novel BTCN minting and backing mechanism, utilizing two popular wrapped assets — cbBTC and wBTC. This sounds reassuring. But will this system be enough to convince the often skeptical community of BTC holders? We'll find out later this year when Corn goes fully public!

#LearnWithBybit