Banana Gun (BANANA): The Telegram Bot for Effortless Trading on Multiple Chains

Although blockchain technology is famed for its security features based on cryptographic hashing, immutability and decentralization, there are ways to exploit unique vulnerabilities inherent in trading on decentralized finance (DeFi) platforms. For instance, the crypto world's leading decentralized exchange (DEX), Uniswap (UNI), while providing great trading opportunities, also suffers from the presence of various malicious bots, such as MEV bots, which frequently manipulate the ordering of transactions on a blockchain to profit at the expense of other users.

Banana Gun (BANANA) is a Telegram-based multichain trading bot that aims to protect users from maximal extractable value (MEV) bots and certain types of scams and vulnerabilities, such as rug pulls and sandwich attacks. In addition to providing protection from malicious bots and scams, the Banana Gun bot facilitates flexible trading opportunities through auto-sniping, automated limit orders and manual swaps.

Key Takeaways:

Banana Gun is a Telegram trading bot with robust built-in security measures, such as protections against MEV bots, honeypots and rug pulls.

The bot offers a variety of functions to automate operations like token sniping and limit order trading.

Banana Gun's native ERC-20 token, BANANA, is designed to encourage active community engagement through rewards and governance. BANANA can be bought on Bybit as a USDT Perpetual contract.

What Is Banana Gun?

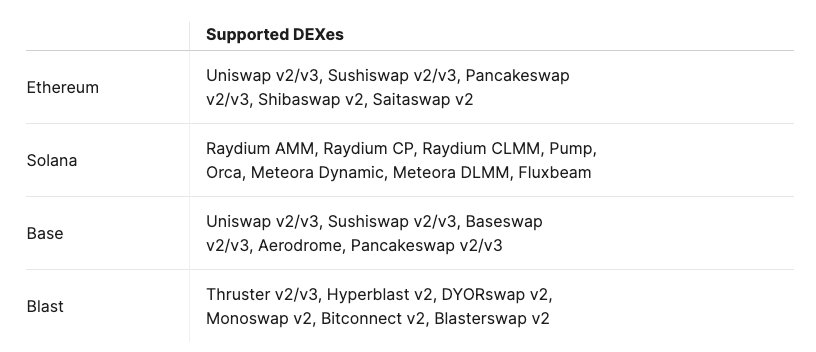

Banana Gun is a Telegram trading bot that provides enhanced security measures and flexible trading opportunities across four blockchain networks — Ethereum (ETH), Solana (SOL), Base and Blast, the latter two being Layer 2 platforms servicing Ethereum. The table below shows the DEX platforms supported by the Banana Gun bot as of July 2024.

Among the security features offered by the Banana Gun bot are protections against malicious MEV bots, rug pulls and honeypot scams.

For years, malicious MEV bots have been a particularly problematic issue on many DEX platforms. In general, MEV bots are used on DEXs to automatically identify and take advantage of arbitrage opportunities. There's nothing wrong with many of these bots; however, certain MEV bots are known to employ fraudulent methods to drain other users' funds.

The classic scam used by these bots involves sandwich attacks. In a sandwich attack, the MEV bot identifies a pending transaction on a DEX and places an order just before it (front-running) and after (back-running), quickly manipulating the asset's price. This transaction "sandwiching" typically inflates the price at which the victim buys the crypto asset, with the price dropping significantly post-purchase.

With Ethereum DEXs being inundated by these bots, the Banana Gun project has implemented strong anti-MEV bot measures to protect users from sandwich attacks and other types of scams employed by these malicious actors.

How Does the Banana Gun Crypto Bot Work?

Banana Gun implements several types of protection measures. One of these is MEV-resistant swaps, which protect traders from sandwich attacks and other scams attempted by malicious MEV bots. Another is an anti-rug system, which scans trading platforms covered by the Banana Gun bot to identify rug pulls — scams that typically occur when a crypto token’s developer tries to pull out all the liquidity for the asset quickly. When a liquidity pull attempt is spotted, the Banana Gun sell bot quickly sells the asset before the malicious pull takes place.

The third security measure employed by the platform's bot is honeypot protection. Honeypot scams involve various tactics to deceive users: Fraudulent wallets with seemingly filled funds, smart contracts with a design flaw that appears to offer users access to the contract's tokens, or smart contracts in which users can buy tokens but cannot sell them. Honeypot scams are targeted at deceiving users to think that they can gain access to or benefit from these assets. The users deposit their tokens only to discover that their funds are locked, and are eventually collected by the attacker.

To combat against the specific scam of buy-only restricted smart contracts placed on tokens, the Banana Gun bot tries to simulate a successful sell operation with the target token before approving a buy order. If the simulation fails, the user is prevented from buying the token, protecting them from a honeypot scam involving the target asset.

Banana Gun Key Features

In addition to protection measures, Banana Gun offers a number of flexible services to help traders execute their orders profitably and securely. Some of the core services include auto sniping, manual trading and limit orders.

Auto Sniping (Automated Trading)

Traders can set up auto sniping — targeting and trading newly launched cryptocurrencies with significant profit opportunities — through Banana Gun. All you need to do is provide initial settings for the token you’re interested in, and the bot will take care of the entire token sniping process, including handling issues like tax calculations and targeting the first safe block. While customarily successful token sniping requires programming skills, Banana Gun helps you handle the entire process using a point-and-click interface.

Manual Trading

Using Banana Gun's manual trading function, you can manually snipe cryptos based on your preferred settings. Adjustable settings include acceptable slippage levels, toggling the Degen mode (which allows you to trade without the majority of security measures activated) on and off, the number of wallets used for sniping, tax limits, liquidity limits and more. In essence, manual trading gives you more flexibility than the auto sniping function when executing your trades.

Limit Orders

You can also specify preferred settings for buy and sell limit orders to allow the bot to take advantage of these order types. Limit orders are useful for protecting yourself from sudden changes and volatility in the crypto market. You can even set an Unlaunched Sell Limit Order for the tokens in your auto-sniping bot so that you can earn automated profit from pre-launched tokens. In addition, Banana Gun supports the following order types: take profit, stop loss and trailing stop loss.

What Is the Banana Gun Crypto Token (BANANA)?

The Banana Gun platform's native cryptocurrency is BANANA, an ERC-20 token on the Ethereum blockchain. Launched in 2023, its ecosystem token is designed to encourage active community engagement. BANANA's key functions include governance, rewards to token holders through revenue-sharing schemes and access to community participation features like the holders' chat. There's also a Banana Burn functionality — BANANA tokens can be burned to access extra features on the platform.

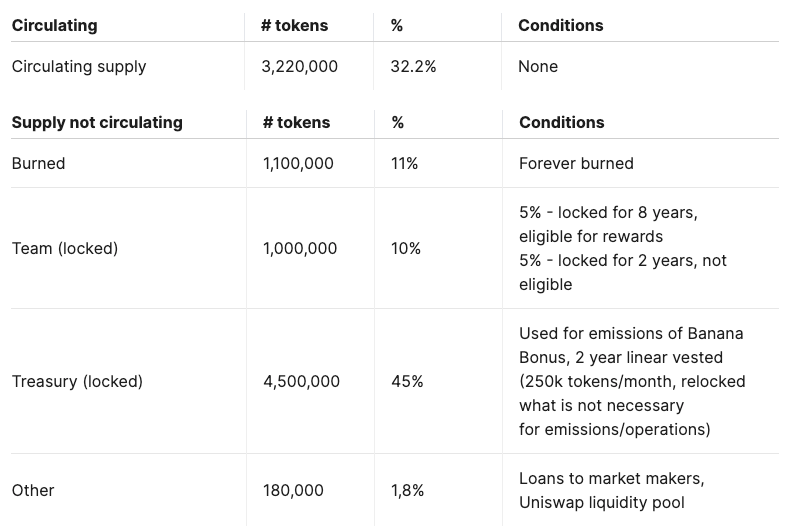

BANANA is a deflationary token, with a maximum supply specified at just 10 million units, a much lower supply specification than customarily used in the industry. The token's total supply stands at 8.9 million. These limited supply amounts should ensure asset scarcity, which could, in turn, provide a certain level of support for the token's price.

The token's supply allocation shares are shown in the table below.

Where to Buy the Banana Gun Crypto Token (BANANA)

The BANANA token is available on Bybit's Derivatives market as a Perpetual contract (BANANAUSDT) that allows you to trade the token with up to 25x leverage. The contract can also be used within Bybit Futures Bot products, such as Futures Grid, Futures Martingale and Futures Combo.

Banana Gun Crypto Price Prediction

As of Jul 30, 2024, the BANANA token is trading at $56.32, which is 28.8% lower than its ATH of $78.62, achieved just 10 days prior on Jul 20, 2024, and almost 1,000% higher than its ATL of $5.13, recorded on Oct 12, 2023.

Long-term price forecasts for BANANA are generally bullish. PricePrediction expects the token to shoot to $120.72 in 2025 and achieve a price of $709.85 in 2030, while DigitalCoinPrice predicts a maximum rate of $150.27 in 2025 and $430.39 in 2030.

As of late July 2024, BANANA is in the territory of its historical highs in terms of price and market cap. Since early 2024, BANANA has been on a consistent uptrend, with expected local ups and downs along the way.

For comparison, the market's primary performance gauge, Bitcoin (BTC), has been on a largely sideways pattern since mid-March 2024. Thus, we can conclude that BANANA is one of the crypto assets that have outperformed the overall market in recent months. Enthusiastic bullish forecasts by the major prediction portals also point to BANANA being an asset deserving interest from investors.

Moreover, current highs may still not reflect the token's full potential. Banana Gun’s project team plans future enhancements, such as a much-anticipated copy trading functionality. When the planned new features are implemented, the BANANA token might receive a further boost.

Of course, while many factors point to the token's great potential, it's important to do thorough research on all aspects of the project before making any final investment decision.

Closing Thoughts

Malicious MEV bots, honeypot scams and rug pulls have been a blight on DEX platforms for years. Banana Gun is among the first platforms that have decided to tackle these threats head-on. Thanks to Banana Gun's security protection measures, users can now have a trading experience that minimizes these threats. Banana Gun's Telegram bot, designed to automate activities such as sniping and limit order trading, also helps users trade without requiring time-consuming and error-prone manual adjustments.

With the BANANA token hovering at its historical peaks, enthusiasm and appreciation for the token are as high as ever. While malicious bots are doing their sinister job every day on DEX platforms, the Banana Gun Telegram bot is working tirelessly to protect its users from these unfortunate aspects of the web3 world.

#LearnWithBybit