Avalon Labs (AVL): Driving Bitcoin’s Financial Evolution

Bitcoin (BTC)’s financial ecosystem, known as BTCFi, has experienced significant growth over the past few years, with a number of sidechains, rollup platforms and cross-chain applications helping users leverage their BTC funds for decentralized finance (DeFi) operations. One of the newer BTCFi solutions on the market is Avalon Labs, a multi-chain platform focused on Bitcoin-backed stablecoin lending.

Avalon lets users borrow stablecoins by providing collateral in BTC or BTC-related assets, such as Bitcoin-pegged tokens and liquid staking derivatives of Bitcoin. Users can access funds at fixed repayment rates, ensuring stability in the otherwise volatile crypto finance world. This stability, in turn, drives the more active use of Bitcoin-backed assets in the web3 industry.

Importantly, Avalon Labs has secured access to billions of dollars in accessible stablecoin funds from centralized finance (CeFi) institutions, helping it act as a key bridge between the worlds of traditional and crypto finance.

Key Takeaways:

Avalon Labs (AVL) is a blockchain-based lending platform that offers a Bitcoin-backed stablecoin, USDa, as well as a range of centralized–decentralized finance (CeDeFi) and DeFi lending and borrowing products.

The platform’s upcoming native token, AVL, is envisioned to be used for staking, governance and access to various fee rebates and perks. AVL is already available on Bybit Pre-Market Spot trading platform.

What Is Avalon Labs?

Avalon Labs (AVL) is a decentralized BTCFi lending platform that lets users borrow stablecoins by supplying collateral in the Bitcoin cryptocurrency or in BTC-related crypto assets. The platform also provides opportunities to earn yield by supplying crypto funds to several liquidity pools. The platform's flagship asset is the USDa stablecoin, backed by Bitcoin.

Avalon also offers other lending opportunities via two primary modes: CeDeFi and DeFi. The CeDeFi offering allows users to access funds in the Tether (USDT) stablecoin, while the DeFi component is made up of three lending and borrowing pools — based on BTC and BTC's liquid staking derivatives, real-world assets (RWAs) and general crypto assets.

Avalon Labs has implemented a series of risk mitigation measures in order to protect its users and ecosystem. Measures focusing on the lending mechanism include the requirement for overcollateralization of all loans, and a rigorous liquidation procedure activated when the loan-to-value (LTV) ratio drops below sustainable levels. Platform-wide risk mitigation measures include regular internal and external security audits, and AI-driven on-chain security monitoring.

Avalon Labs operates on multiple blockchain platforms, including Merlin Chain (MERL), Ethereum (ETH), Arbitrum (ARB) and Bitlayer, with plans to expand to more decentralized networks in the future.

The project conducted its seed round fundraising in March 2024, and actively entered the BTCFi niche in November 2024 with the launch of its USDa stablecoin. As of the time of writing in early February 2025, the platform is preparing for the launch of its native token, AVL.

Avalon Crypto Products

USDa

USDa is Avalon’s Bitcoin-backed stablecoin, designed to help BTC holders put their funds to active use in the DeFi ecosystem. By providing Bitcoin-based collateral, borrowers can mint USDa, which is freely exchangeable with the USDT stablecoin at a 1:1 ratio. As such, USDa is indirectly pegged to the U.S. dollar via a fixed-rate USDT conversion mechanism.

By locking their collateral and requesting USDa, users create so-called collateralized debt positions (CDPs) — an overcollateralized crypto debt instrument first popularized in the DeFi industry by MakerDAO (MKR).

Besides the stable, USD-pegged rate, USDa boasts several other benefits. First, borrowers can access fixed-rate interest repayments for their debts, enjoying certainty in planning their payments to the platform. Secondly, early finalization of debt doesn’t carry a financial penalty. Importantly, USDa can be put to use across different chains, thanks to its utilization of the LayerZero omnichain protocol.

CeDeFi Lending

CeDeFi Lending is a major component of Avalon Labs' focus on Bitcoin-backed loans. The project claims to have secured access to billions of dollars in USDT and USD Coin (USDC) funds at traditional finance institutions. This allows Avalon users to borrow funds in these popular stablecoins at fixed rates of 8 –10%. As of late January 2025, Avalon's CeDeFi lending component allows you to borrow USDT by providing collateral in Ignition FBTC (FBTC), a Bitcoin-pegged omnichain cryptocurrency. Other collateral and borrowing assets (e.g., USDC loans) might also be introduced in the future.

DeFi Lending

Avalon Labs’ DeFi lending component is represented by three main types of liquidity pools, against which users can lend and borrow assets. The BTC LSD Pools are made up of BTC and BTC-based liquid tokens, with each liquid token isolated to its own independently operating pool. There are also RWA Lending Pools, which consist of RWA tokens and stablecoins. The third type is the General Pool, containing mainstream assets like BTC, ETH, popular stablecoins and more.

The platform separates each asset, such as each liquid token or RWA, into its own isolated pool. Pool isolation helps structure risk mitigation measures carefully tailored to each asset.

What Is the Avalon Token (AVL)?

For the first few months on the market, Avalon has operated without a native token. The project is currently gearing up for the introduction of its governance token, AVL, to be launched sometime in Q1 2025. AVL will support not only governance but also a range of other functions. One of these is staking. By staking AVL, users will be issued sAVL, an asset that will be used directly for governance processes. sAVL holders will participate in votes to decide the rules and future direction of the platform. Staking will also let them accrue crypto rewards in AVL tokens.

Additionally, AVL will provide access to exclusive features, perks and fee rebates on its platform.

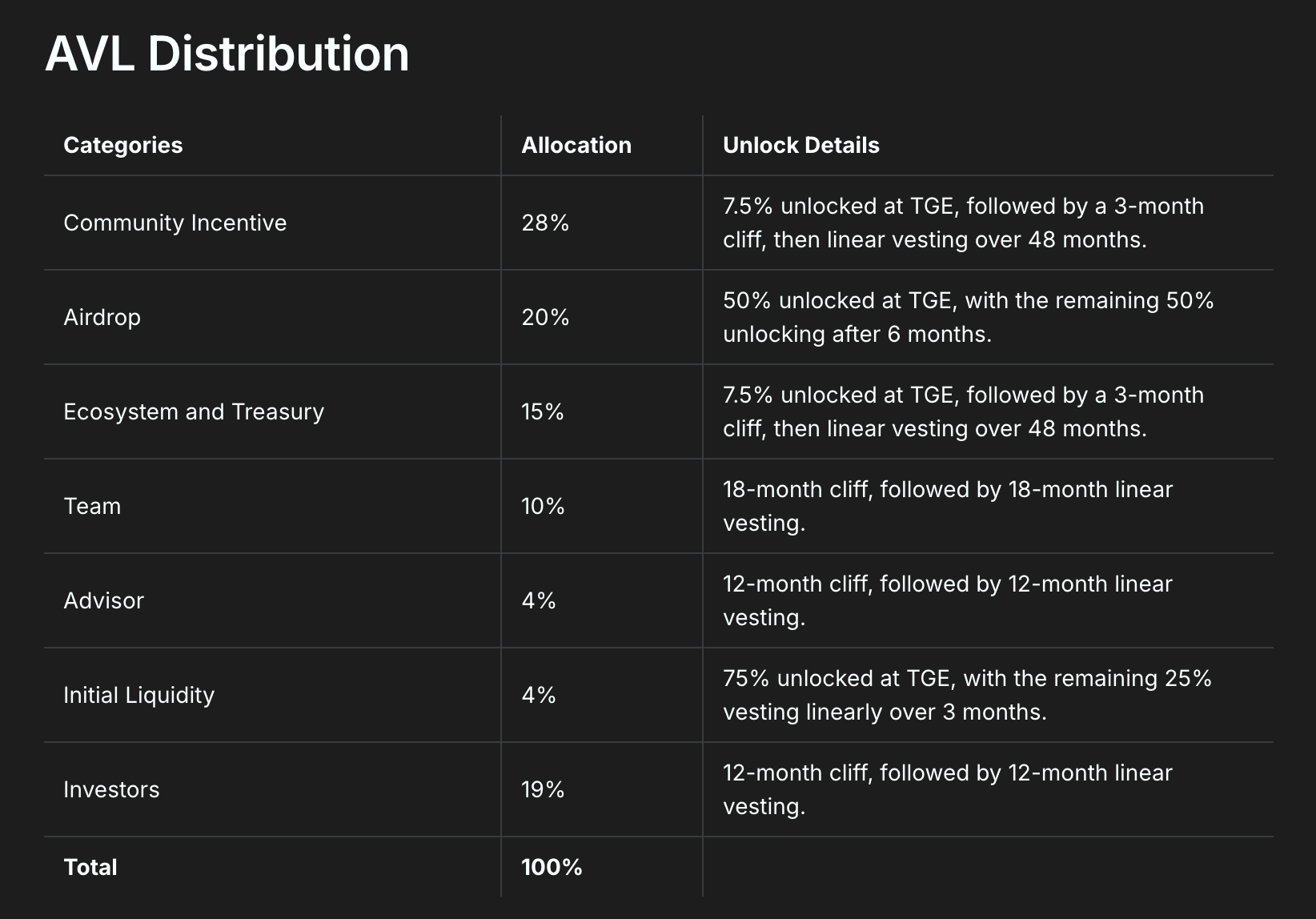

The AVL token will be issued with a total supply of 1 billion. Planned supply allocation shares are as follows:

Where to Buy the Avalon Token (AVL)

The AVL token is already available (before its public release) via Bybit's Pre-Market Spot Trading platform. Bybit Pre-Market Spot is an over-the-counter (OTC) trading platform that allows you to acquire promising new cryptocurrencies before listings on Bybit's main Spot trading market, letting you access these assets at potentially discounted rates.

The AVL listing on Pre-Market Spot lets you speculate on the new token's potential. Naturally, before investing in any asset (whether it's offered via Pre-Market Spot or other trading environments), you’re encouraged to do your own research on the project's background, operational details and future potential.

Closing Thoughts

The sphere of financial solutions for the Bitcoin blockchain is quickly gathering pace, with several projects in the cryptocurrency market aiming to help Bitcoin holders put their funds to active use. Avalon Labs is a key initiative within this niche of the cryptocurrency industry, offering a much-needed service — stablecoin issuance backed by the security of Bitcoin.

Early indicators suggest that this project has significant potential within the Bitcoin ecosystem, as well as within the wider crypto ecosystem. Of particular importance is the project team's claimed access to billions of dollars in USDT and USDC funds at traditional institutional finance providers. A thorough risk management framework — supported by regular audits, AI-driven monitoring, and sound debt collateralization and liquidation mechanisms — also provides further assurances to the user community.

The benefits offered by Avalon Labs are clear-cut, but more details on access to the billions of dollars at traditional finance providers would certainly contribute to user trust in the platform, something that's always helpful for any young web3 startup. Currently, however, the main focus is on the platform's imminent native token launch. AVL's token generation event (TGE) will be a significant evolutionary step in the life of this promising BTCFi project.

#LearnWithBybit