APX Finance: Multichain Decentralized Perpetuals

Decentralized crypto derivatives exchanges have witnessed strong growth, both in terms of user activity and volume, during 2024. This can primarily be attributed to the improvement in speed and ease of use of decentralized exchanges (DEXs) as blockchain scaling technology advances.

During the previous two bull markets in 2017 and 2021, derivatives trading was largely possible only on centralized exchanges, due to better execution speed, user experience and liquidity. However, a new generation of DEXs is changing that dynamic.

Key Takeaways:

APX Finance offers advanced on-chain trading, high leverage and an easy-to-use interface.

It provides a permissionless DEX engine that can be used by third parties to create their own derivatives exchange.

The APX token is used for staking and governance through the APX DAO.

What Is APX Finance?

APX Finance is a DEX that specializes in crypto derivatives trading. It’s available on major blockchains like BNB Chain, Ethereum, Arbitrum, zkSync Era, Base and Manta Network.

Unlike typical automated market makers (AMMs), APX Finance utilizes an order book model for futures trading, combining off-chain order matching with on-chain settlement to ensure high transaction performance and security. The platform offers trading with up to 1001x leverage, zero slippage and competitive fees, appealing to both traders and liquidity providers. It provides a dual offering of V1 orderbook and V2 on-chain perpetual trading.

As of December 2024, APX Finance has achieved $327 billion in cumulative trading volume. It has a TVL of approximately $67.7 million, and its latest 24H trading volume is nearly $62 million. The project has a market cap of around $72 million.

Key Features of APX Finance

Order Book Perpetual Contracts With V1

The V1 version of APX Finance uses an order book model that utilizes offchain transaction matching with on-chain fund settlement and custody. This allows the protocol to provide fast response time while keeping users’ funds secure. APX V1 provides perpetual contracts trading across multiple chains, including Ethereum, Base, BNB Chain, Arbitrum, zkSync and Manta Network.

On-Chain Perpetual Contracts With V2:

With the launch of V2, APX also offers users a fully on-chain perpetual derivatives trading platform. It uses its native LP token, ALP, to maximize capital efficiency. The ALP pool acts as a direct counterparty to perpetuals traders, and allows users to purchase the ALP token and act as liquidity providers. The token gets its value from profit and loss of the pool, income from trading fees, funding fees and liquidations.

Permissionless DEX Engine

In addition to the new on-chain trading mechanism, APX has also introduced the Permissionless DEX Engine with its V2 launch. It’s a decentralized derivatives trading service that can be used by other projects to establish their own derivatives exchanges. Since it’s completely permissionless, the use of the engine doesn’t require any setup permission from APX Finance.

The engine allows up to 750x leverage and is designed to use APX’s liquidity and market depth, which guarantees that traders’ orders are always filled. Any new project can use this engine to set up their own exchange. In return, they get into a trading fee revenue sharing partnership with APX.

The exact revenue sharing details are as below:

Partners’ Monthly Volume (USDT) | Percentage Rebate to Partners |

< 10 million | 10% |

10 million–100 million | 20% |

> 100 million | 30% |

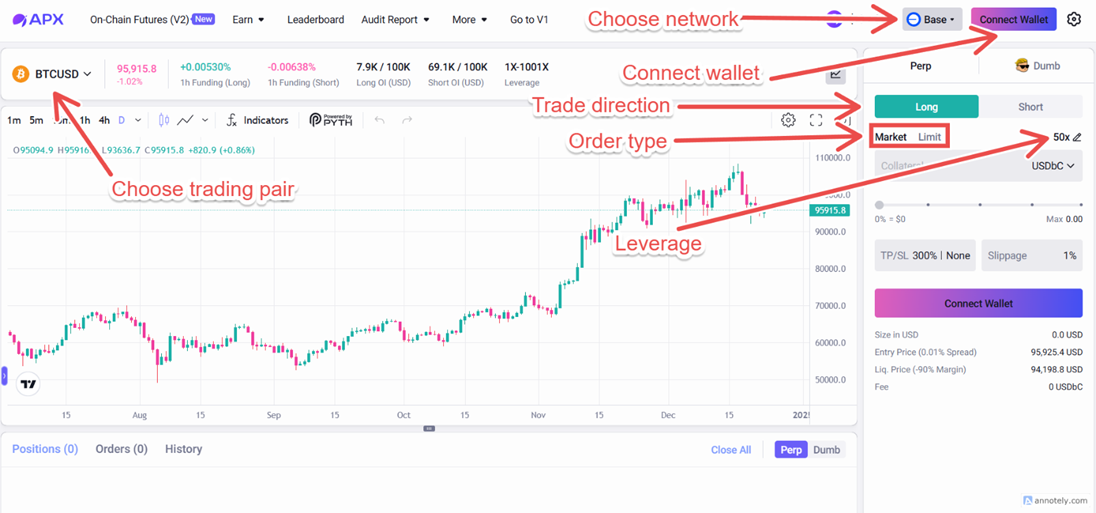

How to Trade on APX Finance V2

Trading on APX Finance V2 is fairly straightforward.

Connect Your Wallet: Access the APX Finance website and connect a compatible wallet, such as MetaMask, by clicking on the Connect Wallet button on the top right.

Choose the Network: Select the appropriate network on which you wish to trade. APX V2 supports BNB Chain, Base and Arbitrum.

Select Trading Pair: Choose a trading pair by clicking on the drop-down menu on the top left above the trading chart.

Set Order Parameters: To the right of the chart is the order section, which allows traders to customize their order per their requirement. Traders have the following options:

Select whether to go long or short

Choose whether to place a market order or limit order

Select leverage

Set take profit, stop loss and slippage details

Execute Trade: Once all the necessary parameters are set, place the order and confirm the transaction in your wallet to execute the trade on-chain.

Manage Positions: Once the order is placed, it can be viewed in the Order section right below the chart. If the order is executed, it can be viewed from the Position section. Once the position is closed, the trade details move to the History section.

APX Token

APX is the native utility token of the APX Finance platform. The token was launched on Dec 21, 2021. As of December 2024, it has a market cap of $72 million and a fully diluted valuation (FDV) of $519 million.

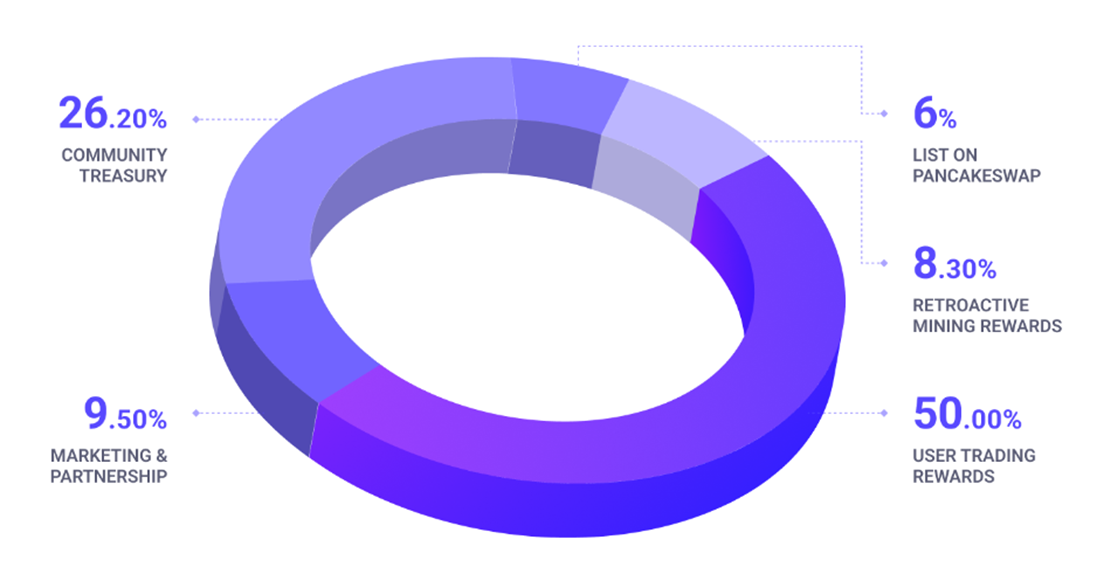

APX Tokenomics and Allocation

The APX token has two primary utilities. It’s used for governance, as APX token holders can vote on proposals that govern the protocol through the APX DAO. Additionally, token holders can stake their APX tokens to earn rewards and support network security and liquidity.

APX has implemented a token burn mechanism that’s designed to reduce supply over time. Through this process, 5.755 billion tokens have been burned so far. Initially, there was also a 1% tax associated on APX token transactions, and the tax amount was also burned to reduce supply. However, this tax mechanism was removed on Jun 23, 2023.

Road Map and Future Plans

APX Finance has established itself as a major player in the decentralized derivatives space by offering an easy-to-use platform with high leverage, and is continuing to innovate and adapt to the ever-changing crypto ecosystem. The current road map includes the launch of the APX DAO ecosystem launchpool and APX V3, and a multichain expansion.

#LearnWithBybit