Aerodrome Finance (AERO): The Ultimate Liquidity Solution for Base

Ethereum (ETH) Layer 2 (L2) blockchains have exploded in number due to their ability to securely provide faster transactions at lower gas fees. While these L2 networks may have helped Ethereum scale, they remain fragmented ecosystems. Optimism (OP) aims to tie these L2s together as a cohesive system to streamline services across chains for an improved user experience via its Superchain.

Two main chains are critical for the development of Superchain: Optimism itself and Base (BASE). These two L2s require deep liquidity to thrive, especially from decentralized exchanges (DEXs), which are a critical part of their ecosystem. As such, projects such as Velodrome have emerged to serve these L2s and sustain their growth. Velodrome is dedicated to growing Optimism by acting as its central liquidity hub.

Velodrome has partnered with Base and Aerodrome to create Aerodrome Finance, the next central liquidity hub for the Base ecosystem. Let's take a deeper look at Aerodrome and how it will work to generate liquidity for Base.

Key Takeaways:

Aerodrome Finance, the central liquidity hub and marketplace for Base blockchain, is designed to fuel the platform's growth.

Aerodrome is powered by a dual mechanism of AERO and veAERO tokens, which help fuel the platform's self-sustaining liquidity flywheel.

What Is Aerodrome Finance?

Aerodrome Finance is an innovative DEX designed to act as the primary liquidity hub for Base blockchain. This feature-rich automated market maker (AMM) is built on top of the Velodrome V2 technology stack, which includes advanced features like automated veNFT management, customizable pools and concentrated liquidity.

Launched in August 2023, Aerodrome applies a unique incentivized structure through its native token, AERO, to attract liquidity to Base, a blockchain by Coinbase. Its vote-lock governance model and seamless trading experience have made the platform attractive to traders and liquidity providers.

How Does Aerodrome Finance Work?

Aerodrome has a unique approach to its liquidity mechanics. As it’s an AMM, traders can enjoy pooled liquidity via pricing done through an algorithm without needing order books.

At the heart of Aerodrome’s operations is its robust liquidity incentivization engine powered by AERO tokens. As an AERO token holder, you can lock your tokens on Aerodrome for a period ranging from a week to four years. In exchange, you’ll be given veAERO tokens, which you can use to participate in Aerodrome's governance decisions.

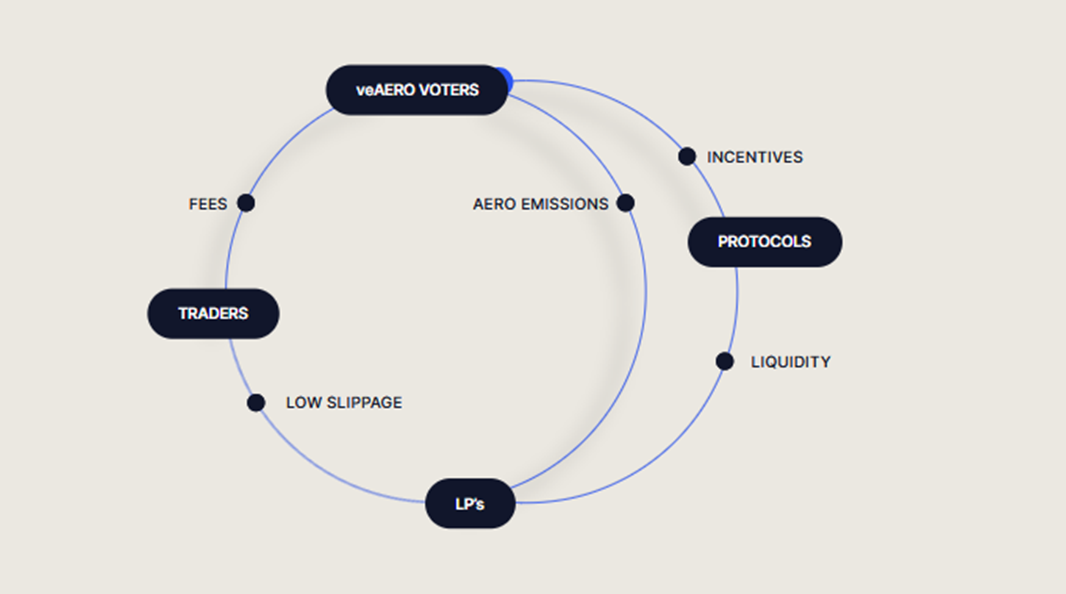

Some of the decisions that token holders assist in making are in determining reward levels to trading pools on the platform. By voting, a token holder receives 100% of the fees generated by the specific pool. This incentivized model ensures a robust liquidity structure, since people become more interested in the liquidity pools they support.

Furthermore, veAERO tokens are NFTs that holders can trade on NFT marketplaces. In this way, non-token holders are also exposed to the Aerodrome ecosystem without needing to own AERO tokens or manage positions.

This self-sustaining cycle deepens liquidity on Aerodrome. Traders enjoy low slippage on swaps and transactions, while liquidity providers receive fees generated by the liquidity pools. Due to the allure of rewards, AERO tokens end up being purchased more frequently, and governance is decentralized through the vote-lock mechanism.

Aerodrome Finance Key Features

As an innovative DEX, some of the key features of Aerodrome Finance include:

Low-slippage token swaps — Traders can swap a wide range of tokens through the AMM, which offers automated trading at minimal slippage. Aerodrome has combined the AMM styles of Uniswap V2, Uniswap V3 and Curve under a single roof to facilitate efficient token swaps. Traders can enjoy low trading fees on both stable and volatile cryptocurrencies while transacting on this user-friendly platform.

Incentivized voters — To promote decentralization and community engagement, AERO token holders who have locked their tokens help make decisions such as the amount of rewards for liquidity pools. In return for voting, voters receive 100% of the protocol’s incentives and fees from the specific pools they support.

Liquid locked NFTs — Holders who lock AERO tokens receive veAERO tokens, which are vested tokens in the form of NFTs. These tokens are tradable and transferable on NFT marketplaces, while still retaining each holder’s vote-escrowed position.

Permissionless pools and gauges — Anyone can become a liquidity provider and create permissionless liquidity pools on Aerodrome, and can also set gauges for staking liquidity and incentives for pools.

Anti-dilution rebases to protect voting power — Holders of veAERO tokens (who constitute the voters) receive a rebase of the AERO emissions based on the ratio of veAERO to AERO supply. This way, the voter power of veAERO token holders isn’t diluted over time, and new AERO holders are incentivized to lock their tokens.

Self-optimizing liquidity flywheel — The permissionless creation of liquidity pools and staking gauges encourages holders to provide liquidity to the pools, initiating a cycle where increased liquidity attracts more traders. This, in turns, leads to the generation of more fees and rewards to the liquidity providers.

What Is the Aerodrome Finance Token (AERO)?

AERO is the ERC-20 utility token for Aerodrome Finance’s ecosystem. It provides incentives (emissions) for liquidity providers on the platform to help boost the liquidity of Base. Aerodrome uses a two-token mechanism to power its ecosystem.

Once you have your AERO tokens, you can stake them to receive NFT-enabled (ERC-721) veAERO tokens, which can be traded on NFT marketplaces. In addition, veAERO tokens power Aerodrome’s vote-lock governance mechanism. Also known as Aerodrome Lock or veNFT, veAERO tokens can be locked for anywhere from a minimum of two weeks to a maximum period of four years.

The longer you lock your veAERO tokens, the higher your weighted voting power of the underlying locked balance, due to the platform’s rebase mechanism, which is designed to prevent dilution. You can also toggle on the Auto-Max Lock feature on Aerodrome to set the locking of your veNFT for the maximum period of four years, thereby ensuring that its voting power doesn’t decay.

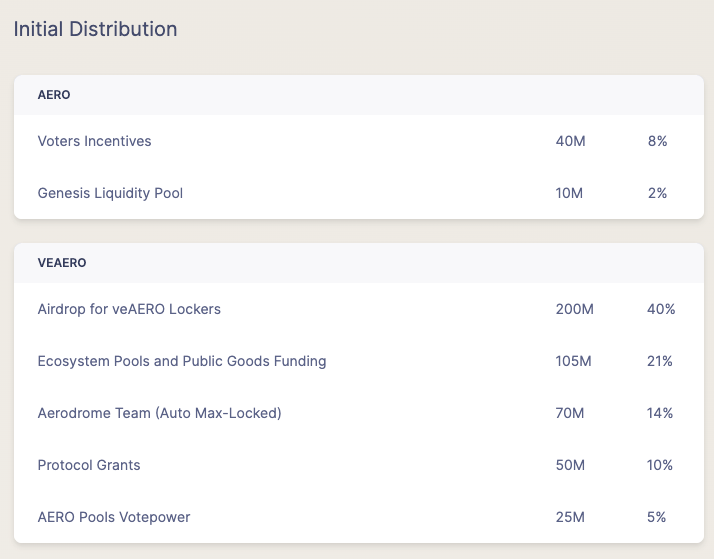

AERO had an initial token supply of 500 million. (Of these, 450 million were set aside as vote-locked veAERO tokens.) The tokens were distributed as follows:

How to Buy the Aerodrome Finance Token (AERO)

Buying the Aerodrome Finance token (AERO) as a USDT Perpetual contract on Bybit is a straightforward process. Follow the steps below to get started.

Step 1: Create and Verify Your Bybit Account

First, sign up for a Bybit account (if you don’t already have one). Visit the Bybit website and complete the registration process. Verify your account by providing the necessary identification documents per Bybit’s KYC requirements.

Step 2: Deposit USDT

Before you can trade, ensure you have USDT (Tether) in your Bybit account. You can deposit USDT directly from your wallet or another exchange. Go to the Assets page, select Deposit and follow the instructions to transfer USDT to your Bybit account.

Step 3: Navigate to the Trading Page

Once your USDT deposit is confirmed, navigate to the trading page. From the main menu, select Trade and then choose USDT Perpetual. In the search bar, type AEROUSDT to find the Aerodrome Finance token trading pair.

Step 4: Place an Order

On the AEROUSDT trading page, you’ll see the order book, price chart and trading options. Decide whether you want to place a market order or a limit order. A market order will execute immediately at the current market price, while a limit order allows you to specify the price at which you want to buy AERO.

Step 5: Manage Your Position

After placing your order, manage your position by setting stop-loss and take-profit levels to mitigate risk. Monitor the market and adjust your strategy as needed to optimize your investment.

Step 6: Withdraw Your AERO Tokens

Once you’ve successfully traded and are ready to withdraw your AERO tokens, go to the Assets page, select Withdraw and follow the instructions to transfer your tokens to an external wallet.

By following these steps, you can easily buy the Aerodrome Finance token (AERO) on Bybit and start trading confidently.

Aerodrome Finance Price Prediction

As of Jul 29, 2024, the price of AERO was $0.90, a 60.8% drop from its all-time high (ATH) of $2.31 on Apr 21, 2014, and a remarkable 4,859,381.3% rise from its all-time low (ATL) of $0.00001861 on Oct 17, 2023.

Price prediction experts are quite bullish on the future price of AERO. According to CoinCodex, the price of AERO could hit a maximum of $4.26 in 2025 and drop slightly to $3.66 by 2030. Another crypto price prediction platform, CCN, believes AERO could grow to $1.75 in 2025 and surge to $5.15 in 2030.

While these price predictions provide a bullish outlook, they aren’t financial advice and shouldn’t be taken as a guarantee of the future price of AERO. We highly recommend that you do your own research before buying AERO or any other altcoins.

Closing Thoughts

Aerodrome Finance’s powerful liquidity incentive engine and its vote-lock governance mechanism are well placed to help provide sustainable growth for Base, a chain to watch in the thriving decentralized finance (DeFi) niche. This innovative DEX approaches liquidity through a self-sustaining approach powered by two tokens. Traders can enjoy low-slippage swaps, while liquidity providers can receive incentives in the form of AERO tokens.

As Layer 2s continue to grow, Aerodrome Finance is strategically placed as the native liquidity hub and marketplace for Base blockchain, which will eventually contribute to the liquidity in Optimism's Superchain ecosystem.

#LearnWithBybit