18 Best DApps & Web3 Projects to Use With Bybit Wallet

Decentralized applications (DApps) have been growing in popularity since 2020, with web3 projects such as Uniswap and Illuvium causing widespread ripples in the markets. Many of these projects are hosted on the Ethereum blockchain, and they run through DApps. In this article, we’ll look at some of the best DApps and web3 projects to use with your Bybit Wallet.

What Is a DApp?

A decentralized application (DApp) is a software application that runs on a blockchain. Unlike internet-based applications, DApps don't need a centralized database to function. They run on Ethereum, but they also operate on other blockchains that generate smart contracts, such as EOSIO and TRON.

There are many types of DApps. Some include decentralized finance (DeFi), GameFi and NFT.

What Is the Bybit Wallet?

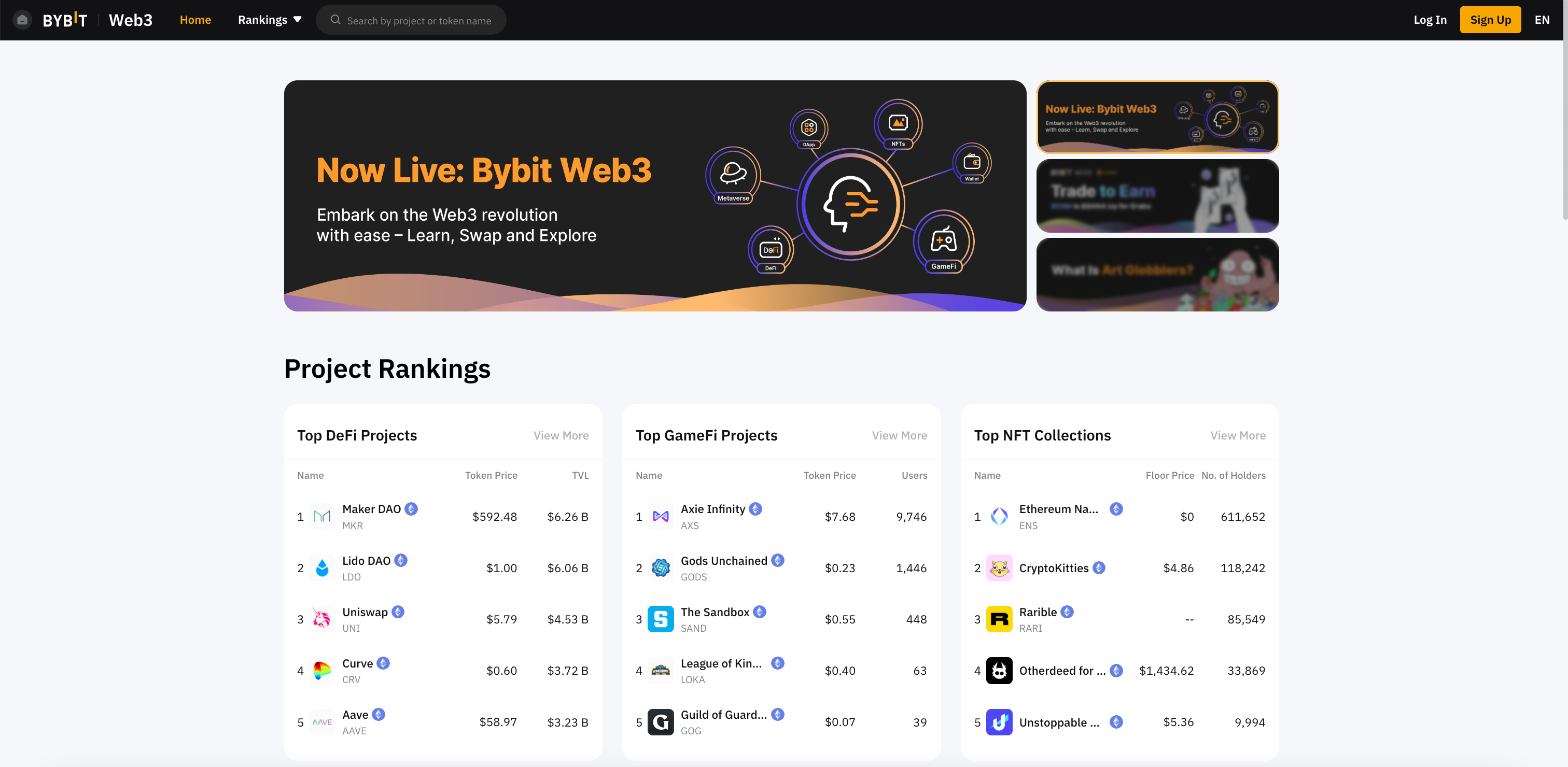

Bybit Wallet is a web3-compatible custodial wallet that aims to provide users with easy access to various DApps on the Bybit Web3 Portal.

With the Bybit Wallet, you can discover all sorts of DeFi DApps, NFT collections, GameFi programs and more. To create your own Bybit Wallet, sign up for a Bybit account, and click on Connect Wallet. As a trusted crypto exchange that prides itself on next-level reliability, Bybit aims to provide a seamless experience that doesn’t require you to have a seed phrase. Bybit will hold the private key to your wallet, and with Bybit’s industry-grade security, rest assured that your funds will be kept safe. Some of the benefits of having a Bybit Wallet are:

- Cross-chain compatibility

- Private key management

- Airdrop management (digital assets collected automatically for you on the blockchain)

- Access to NFT marketplaces

- Access to DeFi products (swaps, earning and lending)

- Decentralized identity management

After your Bybit Wallet is set up, head over to the Bybit Web3 Portal to view all compatible DApps. As Bybit aims to equip its readers with web3 knowledge, they can click on each DApp and view its respective background information. Bybit also offers guides and tips to read up on for web3.

Now that you know how to create your Bybit Wallet, let’s explore the best DApps that will be compatible.

Best DeFi DApps to Use With Bybit Wallet

MakerDAO

MakerDAO was launched on the Ethereum blockchain in 2017. It’s a lending platform on which users can borrow the stablecoin Dai, which is pegged to the U.S. dollar. The key to MakerDAO's success as a lending platform has been its decentralization.

As with all DApps, MakerDAO has no borders. People around the world can use it. No one is subject to identity or credit checks, as they would be if they used a lending service through a bank. As its currency, Dai (symbol: DAI) uses cryptocurrencies as collateral, including ETH and any other Ethereum-based asset approved by MKR holders.

The cryptocurrency is locked until a user repays the loan and any incurred fees. Once they do, the collateral, ETH for example, will be released. However, if the ETH price drops below the price at which it was acquired, it will be sold off to pay the Dai that has been borrowed, plus any penalties. These liquidations, or the threat of them, help to stabilize the governance of the MakerDAO system.

Uniswap

Uniswap, a decentralized exchange (DEX), allows anyone to participate in the transactions of ERC-20 tokens without the governance of a centralized body or intermediary. It gives permissionless access to financial services, thus staying true to the decentralized ideals of the Ethereum blockchain.

Since Uniswap is based on the Ethereum blockchain using smart contracts, it replaces traditional exchange functions — for instance, order books with their own automated and permissionless liquidity pools executed by algorithms. These liquidity pools are pairs of ETH and ERC-20 tokens exchanged by traders. On Uniswap, users are incentivized to provide liquidity to these pools by being rewarded with a trading fee share. In other words, when users supply liquidity, they’re given liquidity provider (LP) tokens that track how much liquidity they contributed.

This method of providing liquidity eliminates the need to rely on market makers. One advantage of using Uniswap, or other DEXs, is that they're inexpensive. They also require minimal maintenance because they’re hosted on a blockchain.

Compound

Compound, another borrowing and lending DApp built on the Ethereum blockchain, allows users to borrow and lend cryptocurrency from each other. All transactions are conducted through a smart contract protocol. Lenders can earn interest from cryptocurrencies by adding to the liquidity pool. To do so, users must first connect an Ethereum wallet, such as MetaMask.

Compound tokens are called cTokens. If a user deposits ETH, they’re given cETH in return. Likewise, if a user deposits USDT, they receive cUSDT in return. The cTokens allow users to track the value of the assets they’ve lent, as well as the interest accrued.

While interest from each token will fluctuate, depending on the supply and demand of its native cryptocurrency, it’s still more than the interest offered by a traditional savings account. And Compound, like other DApps, doesn’t require identity checks; it also offers lower transaction fees. Moreover, the risks in borrowing are minimal, as assets are overcollateralized (a security measure in which borrowers put forward more assets than is needed as collateral).

Curve

Curve is a DEX that quickly became popular. Like Uniswap, it uses automated liquidity pools. But unlike Uniswap, it’s explicitly designed to exchange stablecoins and Bitcoin-backed ERC-20 tokens, such as Wrapped Bitcoin (WBTC). Therefore, its maintenance costs are lower, and so are its fees.

Curve’s interface isn't designed for the mainstream user, as its use is so specific. Hence, not too many investors or traders want or need to exchange stablecoins. Just as with Uniswap, users can earn rewards for adding to the liquidity pool. Curve is also popular with yield farmers because of its high use of stablecoins in yield farming.

Although Curve's creators claim the lack of assets that can be exchanged increases its operating efficiency, the fact that you can only exchange stablecoins (and Bitcoin-backed ERC-20 tokens) can also be a disadvantage, at least from a user's standpoint.

dYdX

Unlike other DEXs based on the Ethereum blockchain, dYdX lets you lend, borrow and trade cryptocurrencies on margin. The two types of margin trading are isolated margin and cross-margin.

Besides margin trading, users can lend assets to accrue interest and conduct regular asset trading. Some minimal miner-taker fees apply to trading.

Furthermore, users can earn interest by lending assets to other users. As with other lending DApps, the risk to the lender is low because of over-collateralization. For borrowing, the minimum collateralization ratio on dYdX is 125%.

Aave

Aave is another borrowing and lending DApp built on the Ethereum blockchain. Its users can lend their assets, and earn interest in the process. To do this, they must connect their Ethereum wallet to the DApp in a process similar to Compound’s.

However, Aave distinguishes itself from the rest through its additional flash loan feature. Practically speaking, these loans are valid for one blockchain transaction, allowing for uncollateralized debt. How is this possible?

The transaction is reversible at any time if the loan isn’t repaid. Assets for flash loans are sourced from smart contract pools. The interest rates on Aave for flash loans are at only 0.30%. And flash loans pave the way for arbitrage opportunities. The way it works, traders can get a loan, make an arbitrage trade, then pay back the loan and any accrued interest.

Yearn Finance (YFI)

Yearn Finance, launched in July 2020, is one of the newer kids on the block, and one of the most popular DeFi DApps. Yearn is a yield aggregator that automatically searches DeFi DApps on the Ethereum blockchain for the best yield returns.

The YFI token saw remarkable price rises after being launched at $739. Over the course of two months, its price shot up rapidly, reaching over $43,000 by September 2020. Analysts chalked it up to the confidence those in the DeFi space have in Yearn Finance, which has an expanding array of products.

Vaults, its main product, enables users to deposit their cryptocurrency and earn yields in return. It employs more complex strategies to get yields than Earn, the first product of Yearn Finance, which is how the term (“yEarn”) was born.

Synthetix

Synthetix allows users to speculate on the price of real-world assets — currencies, stocks and precious metals — as well as other crypto assets, with ERC-20 tokens. The tokens, known as synthetic assets (or “synths), can track the assets' prices.

As with MakerDAO, whose users need to lock up ETH as collateral to create its stablecoin, Dai, users on Synthetix need to lock up Synthetic Network Tokens (SNX) as collateral to create the platform's native stablecoin, Synthetic USD (sUSD).

To acquire the real-world information of the assets' prices, Synthetix has teamed up with Chainlink and its oracle technology to provide decentralized price feeds.

Best NFT Collections/DApps to Use With Bybit Wallet

Ethereum Name Service (ENS)

Ethereum Name Service (ENS) is a naming system launched in 2017 that runs on the Ethereum blockchain. ENS essentially translates crypto wallet addresses that are usually complex and filled with strings of alphanumeric characters into much simpler, more readable wallet names.

ENS domains are built on Ethereum smart contracts which makes them more secure than traditional DNS. As a decentralized, open-source service for the community, ENS focuses on providing a trustworthy domain name for Web3 users of the Ethereum blockchain.

Although ENS domains end with .eth, each one is unique, which results in them being NFTs. And since they’re ERC-721-compliant, you can trade these ENS domains on many NFT wallets and marketplaces. This is also one of the reasons why ENS is one of the best DApps — it’s compatible with many wallets, including the Bybit Wallet.

Bored Ape Yacht Club

Almost everyone has heard of Bored Ape Yacht Club (BAYC) — regardless of whether they spend time in the crypto space — because that’s how popular this NFT collection is. BAYC is a collection of 10,000 unique NFTs on the Ethereum blockchain, featuring profile pictures of cartoon apes with varying accessories and styles. It’s garnered such a strong fan base that celebrities such as Snoop Dogg, Justin Bieber, Madonna and Paris Hilton are in on it.

Additionally, the BAYC team has created an entire ecosystem around the original collection featuring a Mutant Ape Yacht Club (MAYC) collection, Bored Ape Kennel Club (BAKC) collection, Otherdeed as land for their metaverse, and even an ERC20 token known as APE.

BAYC NFTs don’t just make good profile pictures, they also double as a membership card to the Yacht Club, granting holders access to exclusive benefits. As of May 2022, BAYC surpassed $2 billion in sales. BAYC remains one of the most popular NFT collections to date, making it one of the best NFT collections to invest in.

CryptoPunks

CryptoPunks is another highly popular NFT collection built on the Ethereum network. It features 10,000 unique characters in 8-bit style. As one of the first NFT projects on the Ethereum network, CryptoPunks grabbed the attention of investors who wanted to be part of the hype. Furthermore, it was CryptoPunks that introduced the concept of ERC-721 tokens — a standard that dictates each token is unique and non-interchangeable — to the world.

Due to the NFTs’ singularity, demand for them quickly exceeded supply, driving prices up. This resulted in many CryptoPunks holders making windfall profits from trading their NFTs.

CryptoPunks gained even more attention following its collaboration with Tiffany & Co. in August 2022, with the latter turning the NFT collection into physical pieces of jewelry for crypto enthusiasts to purchase. A custom collection of 250 NFTs in this NFTiff collection, priced at 30 ETH each, sold out within 22 minutes. Successful buyers could redeem their NFT for a physical pendant and chain.

Although they launched back in 2017, CryptoPunks NFTs remain in demand and high in value, and are still one of the best NFT collections to consider.

Azuki

Azuki is a collection of anime-themed NFTs launched in January 2022 that quickly amassed $300 million in sales by February 2022. Just like BAYC, Azuki NFTs grant their holders access to an exclusive metaverse called The Garden. This virtual world is where members can look forward to streetwear collaborations, NFT drops, live events and other activities.

Azuki’s popularity is also attributed to its strong relationship with anime, which has gained increasing international attention over the years. As mentioned, Azuki has plans to release streetwear collaborations. Azuki NFT holders can purchase Azuki clothing, merchandise and accessories. This ties in well with existing anime fans, who love purchasing anime collectibles.

Furthermore, Azuki has a strong focus on community ownership. It believes in maintaining a vibrant community for its project to thrive. As such, it provides well-moderated online social channels for fans to interact and discuss the project, to which they all belong.

With its art style, real-world merchandise and emphasis on community ownership, Azuki remains one of the most popular NFT DApps in the crypto market.

OpenSea

OpenSea is the largest peer-to-peer NFT marketplace in the world. The platform was launched in 2017 and allowed users to exclusively buy and sell rare digital collectibles in a quick and trustless manner.

The NFT marketplace managed to close 2020 with roughly $21 million in trade volume but was quickly surpassed within the first two months of 2021, soaring to over $14 billion in the next year. Additionally, OpenSea is integrated with multiple blockchains like Ethereum, Polygon, Solana and Klaytn which could eventually drive even more volume toward the NFT marketplace.

With the launch of Seaport, an open-source smart contract created for OpenSea and NFT fanatics, users can now transact NFTs in bundles even if they are in different token standards (ERC-20, ERC-721, etc). Listings may also choose to support partial fills of offered items or even opt for auction mechanics such as English and Dutch auctions.

Despite the emergence of other NFT markets after OpenSea, the platform continues to hold the title as the greatest NFT marketplace due to its unrivaled trading volume, overall revenue and sheer number of users on the platform.

OpenSea will soon be compatible to use with Bybit Wallet.

Blur

Blur is a brand new NFT marketplace that rose to fame after raising $11 million from renowned investors such as Paradigm. The newly launched platform saw an all-time high volume of $18.8 million in 24 hours within just two months of its release.

The team behind Blur is focused on targeting professional NFT traders and has created a different mechanism compared to other NFT marketplaces. Blur allows traders to set their own royalties easily and does not charge any fees when transacting on the platform. This is great for traders as they get to earn a portion of every sale transacted even after selling the initial NFT while avoiding platform fees from eating into their profits.

The NFT marketplace also has an aggregator that allows you to analyze and purchase a group of NFTs at once from different marketplaces. This allows professional NFT traders to sweep the floor of any collection with a single click rather than buying them up individually on various platforms. Apart from saving time and effort, the aggregator feature will also save them a huge amount of fees as individual purchases come with many hidden costs on top of the gas fees they would have to pay per transaction.

Blur has the ability to expand its user base as NFTs become more widely adopted. The team will also need to find a way to maintain its commitment to NFT traders while making its platform more user-friendly for a larger audience in order to challenge OpenSea in the future.

As with OpenSea, Blur is an NFT DApp that will soon be compatible to use with Bybit Wallet.

LooksRare

LooksRare is one of many NFT marketplaces that run solely on the Ethereum blockchain. Launched in 2022, LooksRare prides itself as a “community-first” NFT marketplace that actively rewards platform users and token stakers with its native token to incentivize participation on the platform.

Since then, LooksRare has managed to gain market share on OpenSea and is averaging around half of its competitors daily volume, amassing more than $26 billion in total trading volume. This was due to several factors: lower fees, a highly incentivized reward system and revenue sharing which allows the NFT marketplace to stand out and differentiate itself from its competitors.

While LooksRare currently does not have an NFT minting function, the platform does offer other interesting features such as the ability to purchase entire collections, purchasing an NFT with specific traits instead of filtering them out, and the option to cancel multiple open orders in a single transaction. With such an impressive entrance into the NFT space and a solid reward system, LooksRare has been able to scale massively in such a short period. It is worth keeping a lookout as the platform has huge potential to grow, filling the gaps created by OpenSea and maybe even outperforming them one day.

Users can expect to use their Bybit Wallet with LooksRare soon.

NFTfi

NFTfi is a decentralized marketplace for users to make the most out of their NFTs by collateralizing them to finance transactions through liquid assets. Due to the illiquid nature of NFTs, the team has combined the idea of DeFi and NFTs to increase the liquidity among NFT traders while trying to attract new users into the space.

Following in the steps of popular lending platforms like Aave and MakerDAO, NFTfi allows for NFT lenders to leverage on their collections to earn yield. Borrowers can also take up loans and borrow ETH or DAI by putting up their NFT as collateral. NFT lending provides the much-needed liquidity to increase activities and volume in the ecosystem.

Additionally, NFTfi provides other features such as NFT fractionalization and NFT derivatives. NFT fractionalization is the process of sharing ownership of an NFT among thousands or millions of users, allowing retail investors to gain exposure to blue-chip NFT collections like BAYC or CryptoPunks. On the other hand, NFT derivatives represent tradable contracts that provide leverage and let users place directional bets on future NFT prices.

With these new instruments offered by the platform, NFTfi remains one of the biggest NFT lending platforms in the space that has helped to unlock a whole new world of liquidity for NFTs for existing and future users.

Do take note that while NFTfi cannot be used with Bybit Wallet at the moment, integration will soon be available.

Best GameFi DApps to Use With Bybit Wallet

Illuvium

Other than hunting Illuvials, players can purchase digital land NFTs, which give them access to in-game assets and benefits that include a source of income. The game has garnered so much attention that by June 2022, Illuvium had reportedly sold over $72 million worth of digital land NFTs. It’s no wonder that Illuvium is regarded as one of the best DApps available.

Decentraland

The metaverse is a hot topic, and more companies are creating projects with state-of-the-art graphics to bridge the gap between the virtual world and the real one. Decentraland is one such project.

Decentraland runs on the Ethereum blockchain and features a virtual world to freely explore. Players can choose to purchase and sell digital real estate (known as LAND NFTs), socialize with other like-minded individuals and play games within the platform. They can also purchase wearable NFTs and LAND NFTs with MANA, the native token of Decentraland.

Unlike other projects owned and managed centrally, Decentraland and its content are owned by its players. This has led to its popularity, resulting in it becoming one of the best DApps available in the GameFi space.

The Bottom Line

As web3 continues to grow, DApps will inevitably become more numerous and prevalent. They have distinct advantages over conventional applications: They never have downtime, users have complete control over their assets, and they feature ultra-low transaction fees. Additionally, as crypto becomes more widely used, people will no doubt be attracted to their use of cryptocurrency as payment, while DApps such as Uniswap can be used for passive income.

Now that you know the best DApps and web3 projects to use with your Bybit Wallet, you can start using them through the Bybit Web3 Portal after signing up for a Bybit account.

.jpg)