DeFi vs CeFi Cryptocurrency: What Are The Differences?

Bitcoin prompted the emergence of an entire industry around blockchain technology and digital currencies. Some cryptocurrency market participants argue that decentralized solutions would gradually replace traditional financial services. While it’s too early to make such claims confidently, we can agree that an exciting competition and interaction between decentralized finance (DeFi) and centralized finance (CeFi) is taking place precisely within the cryptocurrency industry. In the present article, we’ll discuss the main contrasts between the two trends.

The main difference between DeFi and CeFi is that the former involves decentralized infrastructures, where the financial services are governed by communities rather than single entities. In CeFi, all operations are managed by a business or a consortium of companies and organizations. Consequently, the mechanisms differ as well.

What Is DeFi in Crypto?

Before understanding the differences between DeFi vs CeFi, we’ll start by defining each approach separately. While CeFi came first to address the Bitcoin adoption, DeFi is the buzzword this year, and we’ll start with it.

In a nutshell, DeFi represents a trend or movement that promotes blockchain-powered infrastructures and open-source software to create all kinds of financial services and products, including traditional ones. You can think about services such as lending, trading, issuance of money, payments, insurance, over-the-counter (OTC) trading, staking, financial data, asset management, and more. To visualize it, DeFi is all about transforming traditional banking services to decentralized architectures. So that communities could manage them instead of banks, governments, or regulators.

DeFi is a formidable trend right now, resembling the craze of initial coin offerings (ICOs) from late 2017. The new ecosystem revolves around financial applications developed on blockchain networks. The decentralized applications (dApps) integrate secure permissionless, trustless networks, and eradicate central authority managing the services.

DeFi Projects

Most DeFi projects currently rely on Ethereum, a public blockchain that offers an open network with intelligent features such as the smart contract. The latter is a critical feature that enables the development of dApps. A smart contract is a blockchain code that can automatically execute and settle whenever predetermined conditions are met. In this way, there is no need for intermediaries like banks and regulators to handle sales, transactions, and other deals involving two or more parties.

What Is CeFi in Crypto?

As the name suggests, in CeFi, users trust centralized companies and institutions that store their funds to provide various services. Currently, most CeFi solutions are related to cryptocurrency trading, though other applications are also popular.

Most CeFi service providers implement Know Your Customer (KYC) and Anti Money Laundering (AML) practices to abide by their respective jurisdictions’ rules. That means users have to share their personal information and make sure the funds are not coming from criminal activities.

Many CeFi services operate with custodial wallets, which store users’ private keys. Custodians would do everything possible to keep and manage clients’ crypto funds conveniently.

Whenever you trade on popular crypto exchanges like Coinbase, Binance, Bybit, you deal with a CeFi service. These are platforms run by centralized entities responsible for matching buyers and sellers, offering the required features, and making sure the rules are followed by everyone accordingly. As with any business, the profits from fees are shared among company stakeholders.

Besides trading services, companies fall under the CeFi umbrella that offers borrowing, lending, margin trading, and other financial services.

Some large companies, such as Binance, merge all these crypto services to access them from a single account. Most of the clients agree with sharing their data or storing funds into the custody of these companies providing that they are trustworthy institutions. However, even the most reputable exchanges have faced hacking attacks or thefts that compromised user funds. So this is a risk that CeFi users must know.

Other CeFi crypto firms providing non-trading services are Cred, BitGo, Crypto.com, and Nexo.

DeFi vs CeFi: Similarities

DeFi and CeFi share some similarities in the sense that they both involve the same financial services. Sometimes the end-user wouldn’t even notice if a crypto service relies on a DeFi or a CeFi infrastructure. At the moment, both CeFi and DeFi enable the same group of financial services, including spot trading, derivatives trading, margin trading, borrowing and lending, payments, and the creation of stablecoins.

Speaking about trading, both CeFi and DeFi platforms can create intuitive interfaces so that newbies could be onboarded effortlessly.

Often, the same people and organizations are involved in the development of both CeFi and DeFi projects. After all, both trends are advocating the use of blockchain and digital currencies.

DeFi vs CeFi: Differences

Even though both trends’ fundamental goals are the same – to promote the adoption of decentralized ledger technologies (DLTs) – several significant differences split DeFi and CeFi into two different worlds. Here are the main aspects that differ:

The Controllability

As mentioned, CeFi projects are controlled by a single entity or group of entities that run every business aspect. Elsewhere, even though distinct groups of people and organizations develop most DeFi projects, the resulting platforms are governed by communities via different mechanisms. Any DeFi project would try to mimic Bitcoin or any other public blockchain in decentralization, though the consensus algorithms differ from case to case.

Some DeFi projects offer governance tokens that enable holders to take part in decision-making processes. An example of a governance token that exploded in the summer of 2020 is Compound (COMP).

Features

CeFi and DeFi services provide various features that are unique for each group. For example, most CeFi projects offer custody solutions and have dedicated customer service teams, generally not available in DeFi.

On the other side, trading on DeFi platforms happens on blockchain as there is no single authority involved. This achievement is possible thanks to several key features, including automated market-making (AMM), liquidity pools and yield farming, and non-custodial swaps. Usually, there are no KYC requirements in DeFi, while the funds are stored in personal wallets until the transaction’s execution. The crypto exchanges built on blockchain infrastructures are called decentralized exchanges (DEX).

While some companies provide both centralized and decentralized exchanges, Binance is one such example. Its DEX platform doesn’t require registration or KYC verification.

Another great feature of DeFi is the tokenization of traditional assets. Thus, blockchain can be used to create digital units of any asset or investment, including commodities, company shares, forex pairs, and stock indexes, among others.

Regulation

Initially, when the first crypto exchanges facilitated fiat conversions, there was no regulation whatsoever, as governments didn’t fully understand Bitcoin and blockchain. Nevertheless, today most jurisdictions try to regulate crypto operations directly or indirectly. So, this is one of the reasons why most CeFi platforms require KYC verification. In the US, Coinbase is registered with the Securities and Exchange Commission (SEC), while other global platforms moved their headquarters to crypto-friendly jurisdictions like Malta or Estonia. Meanwhile, the European Commission is about to create the most comprehensive legal framework aimed at cryptocurrencies. All in all, there are more jurisdictions in correlation to CeFi services.

As for DeFi, this is a new trend, and it is not regulated anywhere given the nature of decentralized networks. However, even if it’s more difficult to impose regulation on DeFi markets, a research paper by BCG Platinion and Crypto.com concluded that the rapid boom in DeFi created conditions for money laundering will attract regulators sooner than later.

Fees

Usually, centralized exchanges charge higher fees to maintain the platform, pay salaries to the staff, improve their products, and more. Elsewhere, DEX platforms are more affordable to trade on, as they don’t provide custody services and don’t have any team involved in the governance process.

Generally, the fee revenue is shared among liquidity providers and token holders that choose to stake their tokens. An example is Uniswap, a crypto swap platform that distributes the funds from fees among liquidity providers.

Liquidity

The way liquidity is achieved in DeFi is very different. In CeFi projects, the platforms match buyers’ and sellers’ orders similarly to forex or stockbrokers. In DeFi, all trading is not carried out automatically on blockchain. Instead, DEX platforms rely on AMMs, an innovative concept in which both sides of a trade are pre-funded by liquidity providers incentivized to locate their funds.

Eventually, the trading fees are shared between liquidity providers, as mentioned in the previous paragraph. Usually, liquidity pools comprise two constituents representing a trading pair, e.g., BTC/ETH. Liquidity providers have to contribute equal values by locking both BTC and ETH based on the current rate.

Security

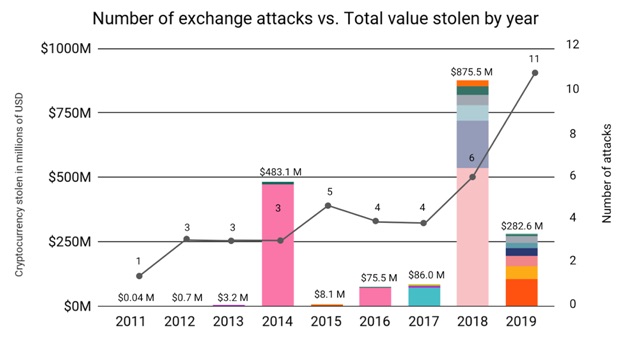

Even though CeFi platforms do their best to maintain a high degree of security, you can regularly find out about some significant exchange being hacked. At the beginning of the year, Chainalysis said that 2019 saw the most hacking attacks ever, though the number of stolen funds had declined drastically compared to 2018.

There is no such risk for decentralized exchanges, as the platform doesn’t store user funds. The only thing users should pay attention to is the code and the consensus algorithm used by the DeFi project. Sometimes the underlying technology may come with bugs and other issues.

Speed

The execution speed is relatively high in both CeFi and DeFi, though it depends on each platform individually. Most exchanges can provide almost instant performance for market orders.

Prospect

CeFi platforms are the simulations of traditional banks, and they have already demonstrated their potential and still do. On the other hand, DeFi is only at its nascent stage. Many industry onlookers predict a vast revolution in which DeFi services would gradually replace traditional ones and threaten the banking system.

Still, as of today, both DeFi and CeFi have their places in the crypto industry. They provide faster transactions, attractive yields, and excellent infrastructure aimed at communities.

DeFi vs CeFi: The Applications

Both DeFi and CeFi can be applied to all kinds of traditional and crypto-related financial services, such as spot trading, derivatives trading, lending and borrowing, and more. Fiat to crypto conversions and vice versa is also available in both ecosystems. Also, both DeFi and CeFi platforms may provide cross-chain services, though the mechanisms differ.

In general, the two trends have similar applications, but the approach is very different. One thing specific for DeFi alone is the tokenization of assets. For example, Synthetix hosts a DeFi ecosystem where users can create so-called synthetic assets (synths), which are ERC20 tokens representing real-world assets. Users can eventually provide liquidity to those synths and trade them on a dedicated exchange. Synthetic assets have great potential, capable of making derivatives trading more flexible, accessible, and transparent.

DeFi vs CeFi: Which to Invest?

There are good projects in both sectors, but DeFi runs the show these days, at least from an investor’s perspective. You can get direct exposure to CeFi projects by investing in the native tokens of cryptocurrency exchanges. At the moment, Binance Token (BNB), Crypto.com Coin (CRO), and Huobi Token (HT) are the most popular CeFi tokens. Arguably, XRP is a CeFi constituent, given that Ripple is a centralized company.

That said, there are way more DeFi options to choose from now. That’s especially when this sector is still at its infant stage.

Potential Risks

DeFi tokens are way more volatile than the rest of cryptocurrencies, which is very telling of the risks. It would be best if you stuck to proper risk management techniques when investing and never deposit more than you’re ready to lose.

Another problem with DeFi is that it hosts an increased number of scams and pump-and-dump schemes, the same as the ICO space did a few years ago. That’s why you should better invest in well-established DeFi projects.

Impact on Profitability

DeFi tokens can boost your profitability, especially if you managed to catch the trend right after Bitcoin’s nosedive back in March 2020. Tokens like UNI, COMP, Maker, SNX, and KNC have demonstrated impressive returns this year. The same is right about projects that benefit from the DeFi boom, such as Chainlink and Polkadot. Here is how the most popular DeFi tokens performed so far this year:

Bitcoin (blue line) has performed better than most DeFi tokens year-to-date as it hit the highest level in almost three years as of November 2020. Still, LINK and KNC have provided impressive yields. Despite Bitcoin domination, DeFi tokens have much room to grow.

What To Expect From DeFi and CeFi in the Future?

The medium-term future is bright for both DeFi and CeFi, as the financial crisis will highlight the importance of refuge assets with low correlation to traditional markets. It will also stress the importance of blockchain solutions for all kinds of financial services that governments should not manipulate.

In the long-term future, DeFi will thrive as it has the potential of making financial services accessible to everyone. Investors should keep an eye on Ethereum’s transition to Proof of Stake and the regulatory changes related to DeFi, which will impact the emerging sector.

REGISTER NOW for up to $90 in bonuses and coupons.

Stay alert with Bybit’s Updates:

Visit our exchange

Social Media – Twitter, Facebook, Instagram, YouTube, and LinkedIn

Join us on Telegram and Reddit

Have any questions? Visit our Help Center