Canton Network (CC): Bridging TradFi and DeFi with configurable privacy

Traditional blockchains’ radical level of transparency has never boded well with the way financial institutions operate. In the institutional finance world, the privacy of transactions is of paramount importance, and a typical public blockchain — which lays bare all the data recorded on the ledger in front of any network member — isn’t the optimal model for corporate entities doing finance with each other.

Canton Network (CC) has taken on the task of bridging the worlds of decentralized finance (DeFi) and traditional finance (TradFi) by offering institutional users the decentralization benefits of a public blockchain, but with configurable privacy that’s been proven to be in use with major banks and market infrastructure. Instead of adopting the all-or-nothing approach to on-chain data visibility, Canton lets institutions and app builders program privacy settings, allowing users of the network to transact with verifiability and confidentiality simultaneously.

Canton’s operational model is certainly getting a nod from the business world, with giants like Deloitte, BNP Paribas, Goldman Sachs and Nasdaq already among its users.

Key Takeaways:

Canton is a public permissionless blockchain with configurable privacy controls designed for institutional finance use cases.

At the architectural level, Canton represents a network of networks, with interoperable subnets and applications run by third-party providers.

Canton’s native utility token, Canton Coin (CC), is used primarily for transaction fee payments, as well as to continuously reward network users, builders and validators for the utility they bring to the network. Applications also use the token to incentivize use and drive fee-based revenue.

What is Canton Network?

Canton Network (CC) is a blockchain platform with configurable privacy settings designed specifically for institutional finance. With its highly customizable privacy controls, Canton attracts financial institutions and corporate users who need to maintain transaction confidentiality while ensuring the verifiability of on-chain data. The project’s team describes Canton as a public permissionless blockchain, reflecting its ability to balance openness with the fine-grained privacy required by regulated entities.

Network governance is facilitated by the Canton Foundation with support from the Linux Foundation, and includes both major global financial organizations and DeFi leaders among its membership. This governance structure provides both technical credibility and institutional trust, ensuring the network remains in step with the financial industry’s far-from-trivial expectations.

Features of Canton Network

Canton’s key features include programmable smart contract–level privacy, near-limitless horizontal scalability and atomic interoperability between subnetworks operating on the platform. Architecturally, Canton is a “network of networks” on which institutional users can deploy and operate their own applications and infrastructure while transacting directly, and only sharing data with others on a “need to know” basis. This setup allows for complete atomic transactions, ensuring assets can be exchanged securely and simultaneously by the parties involved, without intermediaries or exposure of sensitive data.

By providing customizable privacy controls, Canton Network aims to fit real-world institutional finance requirements. Asset issuers retain full visibility into the on-chain assets they’ve issued, which is vital for regulatory reporting and operational tracking. Meanwhile, asset owners maintain full visibility into their holdings and direct asset ownership. Regulators and other approved third parties can be granted access through configurable permissions. Anyone outside these authorized participants cannot view the digital asset data, thus preserving confidentiality without compromising compliance.

Canton focuses on practical institutional use cases, such as real-world asset (RWA) tokenization and mobility as collateral, stablecoin transactions with privacy, real-time settlement between DeFi and TradFi assets, on-chain automation of margin processes for crypto derivatives, and the linking of tokenized money market funds (TMMFs) and capital markets, such as repo markets.

Canton Network was first announced in 2023 as a major institutional finance–focused blockchain project. In July 2024, the platform launched its native token, CC, as well as its mainnet operations.

How does it work?

Canton Network operates as a “network of networks,” linking independently run apps and networks. Within this structure, two primary categories of chain-wide actors maintain the network’s functionality: validators and synchronizers.

Validators handle the execution of smart contract logic and the storage of on-chain data, ensuring that transactions and records are processed correctly.

Synchronizers coordinate data exchange between validators within and across subnetworks, ensuring that the entire ecosystem operates on a shared and verified state of consensus.

Unlike traditional public blockchains, whose every transaction and data exchange are visible to all participants, Canton’s synchronizers route only the information needed by each participant to validate the transaction, as defined by the smart contracts. Each part of a transaction is programmed according to the needs of each participant, ensuring precise control over what is shared and what remains confidential. This structure enables secure interoperability without compromising institutional privacy or compliance requirements.

At the center of this architecture is Canton Network's Global Synchronizer, a critical interoperability layer that connects independent apps while preserving their privacy settings. It enables atomic asset exchange and transfer of ownership between institutions in a decentralized and trustless environment.

The Global Synchronizer uses a Byzantine Fault Tolerant (BFT) consensus mechanism to maintain network integrity, allowing multiple independent institutions to interact safely without relying on a central entity. This combination of interoperability, coordinated privacy and security makes Canton Network one of the few blockchain infrastructures capable of supporting real-world institutional finance at scale.

What is Canton Coin (CC)?

Canton Coin (CC) is the network’s native utility token. It was originally minted in July 2024 at the start of Canton’s mainnet operations, and became publicly available on the market on Nov 10, 2025. CC plays a number of critical functions on the network, including for:

paying transaction and synchronization fees across the network

providing Canton Coin rewards to validators and synchronizers for securing and operating the system

incentivizing application providers, network contributors and users

enabling governance participation within the Canton ecosystem

supporting service fee payments within individual Canton apps (application developers may choose to leverage Canton Coin as an asset for in-app fee payments)

Since its public launch in early November 2025, CC has become available on a variety of major exchanges. It trades as a spot pair on popular centralized exchanges (CEXs), such as Bybit, Kraken, MEXC, KuCoin and Gate.io. Most of these are spot pairs with Tether (USDT), although there are also CC pairs with USDC (USDC), the US dollar and the euro.

CC is also widely available via perpetual futures on CEXs, as well as on a number of decentralized exchanges (DEXs), such as Hyperliquid (HYPE), Aster (ASTER) and Lighter.

Canton Coin tokenomics

CC’s token generation event (TGE) in July 2024 was a fair launch, with no pre-mining, pre-sale, VC distribution or allocations to project members.

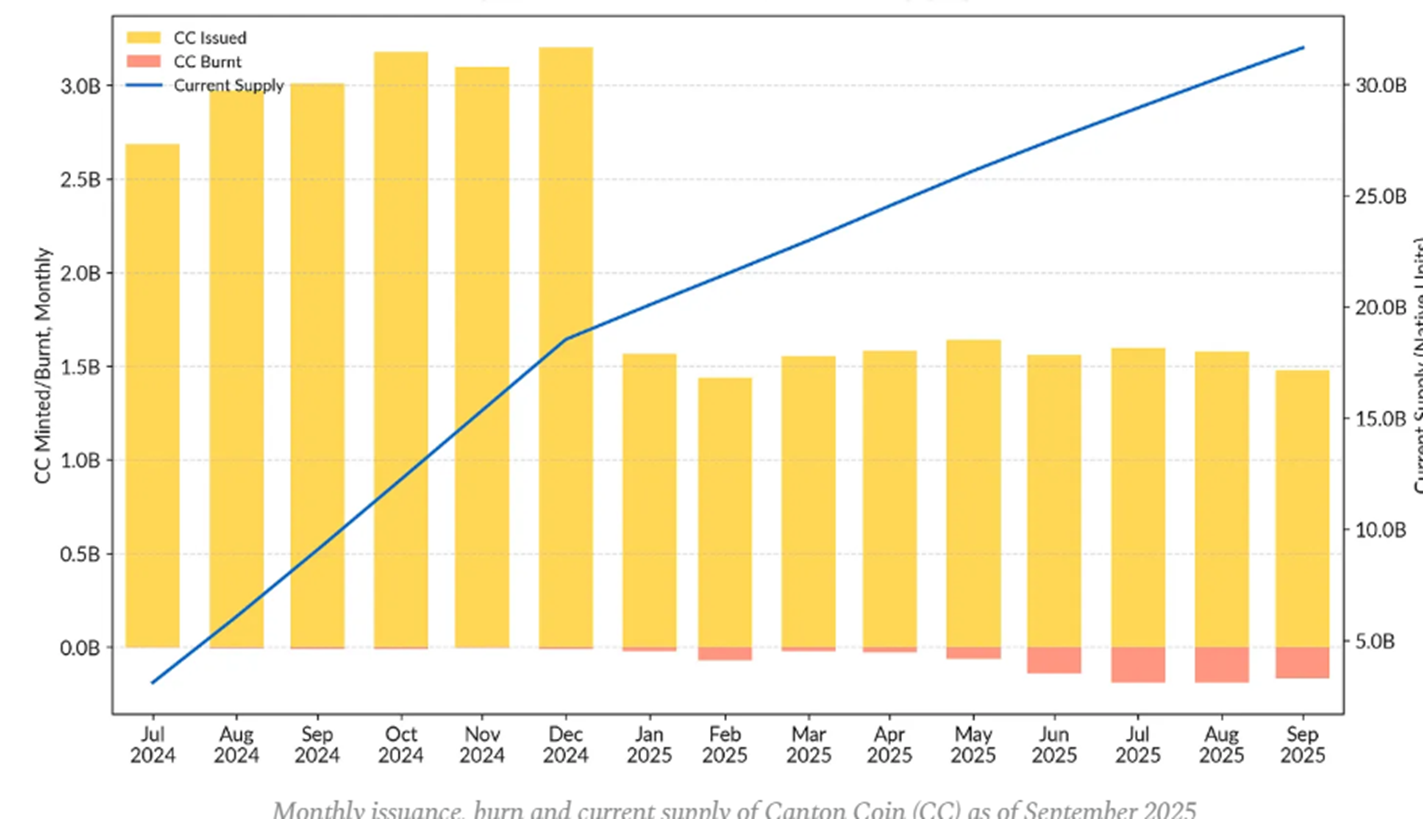

CC’s tokenomics specifies that its supply releases and burns are aligned to the network’s activity. Rewards are minted based on active participation as an incentive mechanism, while transaction fees are burned to maintain a sustainable supply balance over time.

As of the time of this writing (Nov 14, 2025), CC's total and circulating supply is around 35 billion. The token’s supply isn’t capped at a maximum level, as is done with many other cryptocurrencies, including Bitcoin (BTC). However, for the first 10 years since the start of its issuance (July 2024), only up to 100 billion CC can be minted. After that, the issuance rate will be limited to 2.5 billion CC annually, still implying that there’s no final hard cap on the total number of coins that will ever exist.

The chart below shows CC’s monthly issuance, burn and supply levels from July 2024 to the end of September 2025.

Canton use cases

24/7 margin management for crypto derivatives

Canton Network allows automated on-chain margin management for crypto derivatives in real time, 24/7, across different institutions and DeFi platforms. Smart contracts calculate the updated margin, move collateral and settle obligations automatically while respecting privacy rules. This eliminates delays, reduces counterparty risk and keeps derivative positions continuously collateralized without manual input.

24/7 on-chain financing

In TradFi, financial services such as lending, borrowing or collateralizing trades are carried out during business hours, with settlements taking a day or more. Canton Network moves these operations on-chain, where the platform’s smart contracts and tokenized real-world assets can be used to mobilize high-quality collateral and automate settlement in order to execute financing transactions around the clock.

Private stablecoin payments on a public blockchain

Stablecoins are widely used by both decentralized and TradFi entities to make payments, and as a form of collateral. However, the public nature of traditional blockchains makes such payments and transfers visible to any network user. Thanks to Canton’s highly configurable privacy settings, critical stablecoin payments can still be done within a public network environment, now protected by the blockchain's privacy model.

Private tokenization of RWAs

Canton’s privacy-focused nature is an ideal environment for financial institutions to securely tokenize traditional assets and make them available to institutional buyers, many of whom are also highly conscious about transactional confidentiality. It also unlocks the use of such assets as collateral across capital markets. The platform’s privacy controls make it extremely easy for buyers to maintain the requisite levels of ownership confidentiality, while also satisfying regulatory disclosure requirements.

Closing thoughts

Canton Network offers something that has been sorely missing from that corner of the market where DeFi and TradFi mix and mingle: highly customizable privacy controls that satisfy the needs of institutional finance players, comply with regulations and allow corporate entities to transact with peace of mind. With a unique model of this nature, it’s no wonder that Canton is being enthusiastically supported by some of the leading names in the finance and technology spheres. If the likes of Goldman Sachs, DTCC and Circle have deemed this blockchain to be worth using, it’s a clear sign that the future might hold even grander things for the Canton Network project.

#LearnWithBybit