Week Ahead Preview (Dec 8-12): 3 assets to watch amid Fed rate decision

Global markets are rising at the onset of a pivotal week that features the highly-anticipated Fed rate decision.

The outcome from the final scheduled FOMC policy meeting of the year is set to shape financial markets not just for the remaining weeks of 2025, but also into the new year.

Be sure to catch our preview of the incoming Fed rate decision, "Decoding the Fed's final call of 2025". The livestream will be held on Tuesday, Dec 9 @ 8:00AM GMT on:

- Bybit website: https://www.bybit.com/en/press/live/fomc-countdown

- YouTube: Bybit Learn Official

- X: @Bybit_Learn

At the time of writing:

- Bybit's SP500, which tracks the benchmark S&P 500 stock index, is a mere 0.5% away from its all-time intraday high of 6928.63.

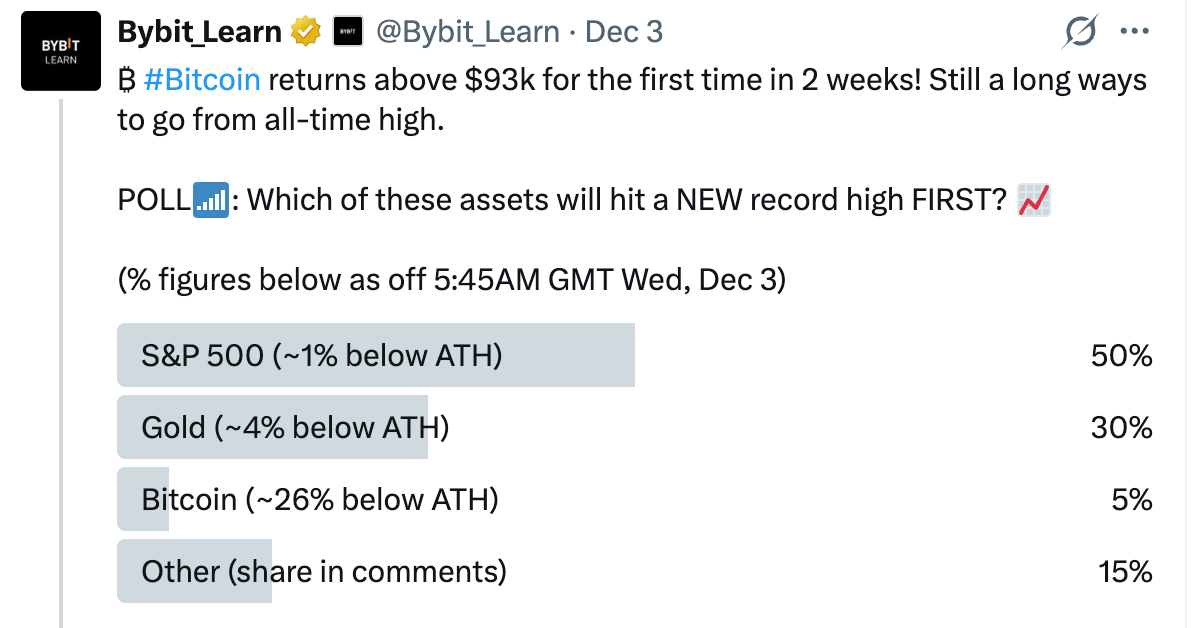

A new record high for the SP500 would validate your votes on Bybit Learn's Dec 3 poll on X:

Elsewhere across major assets:

- Bitcoin has unwound most of its declines from this past Friday, Dec 5 - now trading back closer to the $92,000 level.

- Gold is up 0.4% as China's central bank continued its bullion buying spree for a 13th consecutive month, as of Nov 2025.

- UDSCHF - a forex pair we'd highlight in our Week Ahead Preview livestream last Friday (Dec 5) - is down 0.2% so far on the day. This makes the Swiss Franc (CHF) not just the best-performing G10 currency so far on this Monday, but also the 2nd-best performing G10 currency vs. The US dollar so far this year (USDCHF down almost 13% year-to-date)

Trade SP500, NAS100, EURUSD+, USOUSD, XAUUSD+, and more on Bybit MT5 here.

Fed in full focus this week

While the Fed will kick off its 2-day policy meeting starting tomorrow (Tue, Dec 9), it's the outcomes on Wednesday that could rock global financial markets:

- Dec 10 @ 7:00 PM GMT - FOMC rate decision + policy statement + dot plot

- Dec 10 @ 7:30 PM GMT - Fed Chair Jerome Powell's press conference

Markets currently predict a 92% chance that the Fed will cut its benchmark rates by 25-basis points (bps) this week - anything else would be a shocker.

More about what to expect from this pivotal Fed meeting will be shared during our special preview livestream (details above).

NOTE: Bybit Learn's usual Daily Market Updates livestreams on YouTube and X will be on hiatus - will resume on Thursday, Dec 11.

Assets & Events Watchlist: Dec 8 - 12

1) SP500 - new record high?

Should the Fed signal greater willingness to lower US interest rates at a faster pace in 2026, that should cheer riskier assets, including cryptos and stock indices.

2) Gold (XAUUSD+) bugs may have to wait longer for a new record high

Spot gold is likely to cheer the prospects of more incoming Fed rate cuts. However, "hawkish" signals form the Fed this week may temporarily drag XAUUSD+ below $4200.

Bloomberg model 1-week forecasted trading range: 4115.84 - 4308.42

3) USDCHF+

- Wed, Dec 10: Fed rate decision + Chair Powell's press conference

- Thur, Dec 11: Swiss National Bank (SNB) rate decision - markets widely expect no rate change by the SNB.

Bloomberg FX model 1-week forecasted trading range: 0.7945 - 0.8111