Topics Daily Bits

US jobs report: Here's how Bitcoin, Gold, Stocks and other major assets may react.

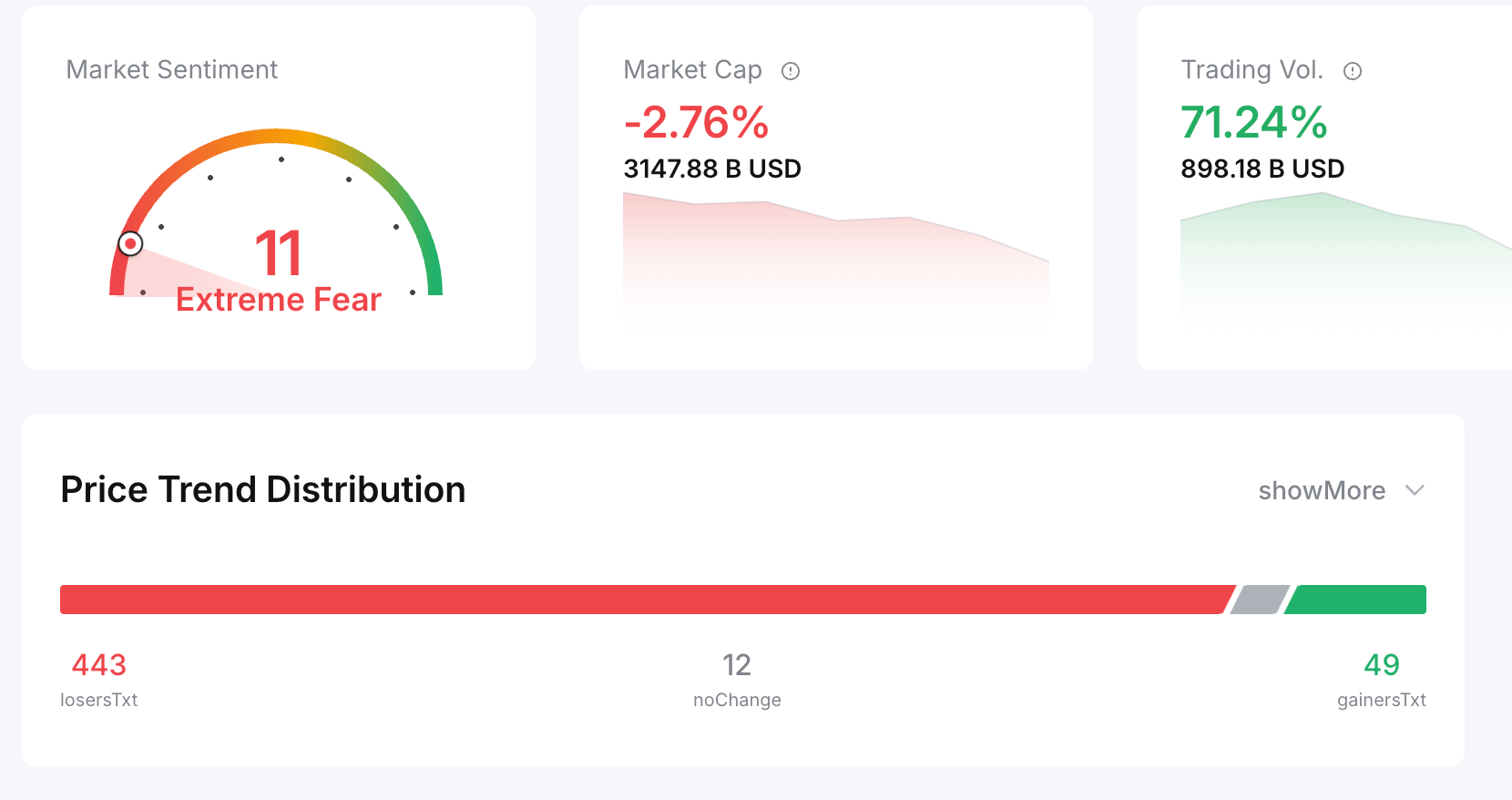

Major assets, both tradfi and cryptos, are easing lower ahead of today's pivotal US jobs data release.

The delayed US November nonfarm payrolls (NFP) report is due at 1:30 PM GMT today (Tue, Dec 16).Here's how markets are faring at the time of writing:

- Having registered a daily close below its 21-day simple moving average, Bitcoin is now headed towards the $84,000 level.

- Bybit's SP500 and NAS100 stock indices have reached a 3-week low respectively.

- Even Gold has slipped back into sub-$4300 levels, pulling away after hitting our $4348 target recently.

No surprise that markets are on tenterhooks, especially ahead of such a pivotal data release out of the world's largest economy that could heavily influence the Fed rate decision at the onset of the new year!

Economists' forecasts for US NFP

Here's what experts predict for the incoming US jobs data for November:- Headline NFP figure (new jobs added to the US labour market): 50,000 If so, this would be half of the 119,000 new jobs added in September 2025

- Unemployment rate: 4.5% If so, this would mark its highest rate in 4 years (since Q4 2021).

Potential Near-Term Scenarios

A US jobs market that's not deteriorating rapidly may be the panacea for recent declines for risk assets such as US stock indices and cryptos. Although there could be many nuances stemming from the incoming NFP report, including an estimate for the previously "cancelled" October report, here are some broad oversimplified scenarios for how markets might react today:- Weaker-than-expected jobs data (lower-than-50k headline NFP figure and/or higher-than-4.5% jobless rate) may initially lead to declines for risk assets. However, if markets can gravitate towards greater odds of a Fed rate cut in January 2026, that should eventually boost the prices of riskier assets.

- Stronger-than-expected jobs data (higher-than-50k headline NFP figure and/or lower-than-4.5% jobless rate) may initially lead to gains for risk assets, such as cryptos and stock indices. However, if markets then dial back the odds of a Fed rate cut in January 2026 and beyond, that could weigh down riskier assets.

Currently, markets predict a 26% chance of a Fed rate cut in January 2026, with 33% odds for 3 rate cuts (75 basis points total) for all of next year.

Market Predictions: How are major assets expected to react to the incoming NFP data?

These % forecasts are for the 6 hours after the NFP release @ 1:30 PM GMT today (Tue, Dec 16):- Bitcoin (BTC): as much as 1.5% up / 2.6% down

- Ethereum (ETH): as much as 1.4% up / 3.8% down

- Ripple (XRP): as much as 2.9% up / 3.4% down

- Solana (SOL): as much as 3.3% up / 3.8% down

- Gold (XAUUSD+): as much as 1% up / 1.3% down

- Silver (XAGUSD): as much as 1.4% up / 2.2% down

- Brent Oil (UKOUSD): as much as 0.6% up / 1.5% down

- EURUSD+: as much as 0.6% up / 0.7% down

- GBPUSD+: as much as 0.5% up / 0.7% down

- USDJPY+: as much as 0.8% up / 0.8% down

- S&P 500 (SP500): as much as 0.6% up / 2% down

- Nasdaq 100 (NAS100): as much as 0.6% up / 2.1% down

.png)