Unichain leads Uniswap v4 activity with rollup-boost upgrade and upcoming flashblocks feature

Daily top performer — THORChain (RUNE)

The S&P 500 jumped 3.26% as US-China tariff easing lifted market sentiment. Investors now await CPI and retail data for signs of inflation trends under the new trade regime. Gold fell near $3,208 as easing US-China trade tensions reduced safe-haven demand. With CPI data ahead, further downside is likely. Technicals suggest bearish momentum, with key support at $3,202. The Coindesk Indices, which tracks the broader crypto market, fell 1.97%, with Bitcoin and Ether down 2.53% and 0.95%, in the past 24 hours. Trade these markets and more with up to 500x leverage on Bybit MT5 using this link.

Today's top performer is RUNE, which surged by 4.4% following the completion of Halborn's security audit for Rujira Network's omnichain DeFi layer on THORChain.

THORChain (RUNE), created in 2018, is a decentralized protocol enabling native asset swaps across blockchains without wrapping. Built on Cosmos SDK and Tendermint, it uses Proof-of-Stake and Byzantine Fault Tolerance for secure cross-chain transactions. Halborn has completed a smart contract security audit for Rujira Network, which is building an omnichain DeFi app layer on THORChain. Rujira enables seamless access to DeFi apps using native assets across connected chains.

Check out the latest prices, charts, and data of RUNEUSDT perp and RUNE/USDT spot contracts!

Talk of the town

Unichain, Uniswap’s L2 network, now handles over 76% of Uniswap v4 volume, driven by UNI incentives and its new Rollup-Boost feature. This upgrade enhances MEV handling, cuts failed transaction gas costs, and sets the stage for Flashblocks—an upcoming 200ms block time system. Despite v4’s growth, Uniswap v3 still leads in total volume. The aim of Unichain is to solve Ethereum mainnet and L2 liquidity fragmentation while improving speed and decentralization.

Check out the latest prices, charts, and data of UNIUSDT perp and UNI/USDT spot contracts!

Bitcoin spot ETF flows

Category | Flow (millions) |

GBTC | (32.9) |

Non-GBTC | (31.3) |

Total | (64.2) |

Yesterday, BTC spot ETFs saw total outflows of $64.2 million, with $32.9 million from GBTC and $31.3 million from all other ETFs combined.

Check out the latest prices, charts, and data of BTCUSDT perp and BTC/USDT spot contracts!

Airdrop to watch

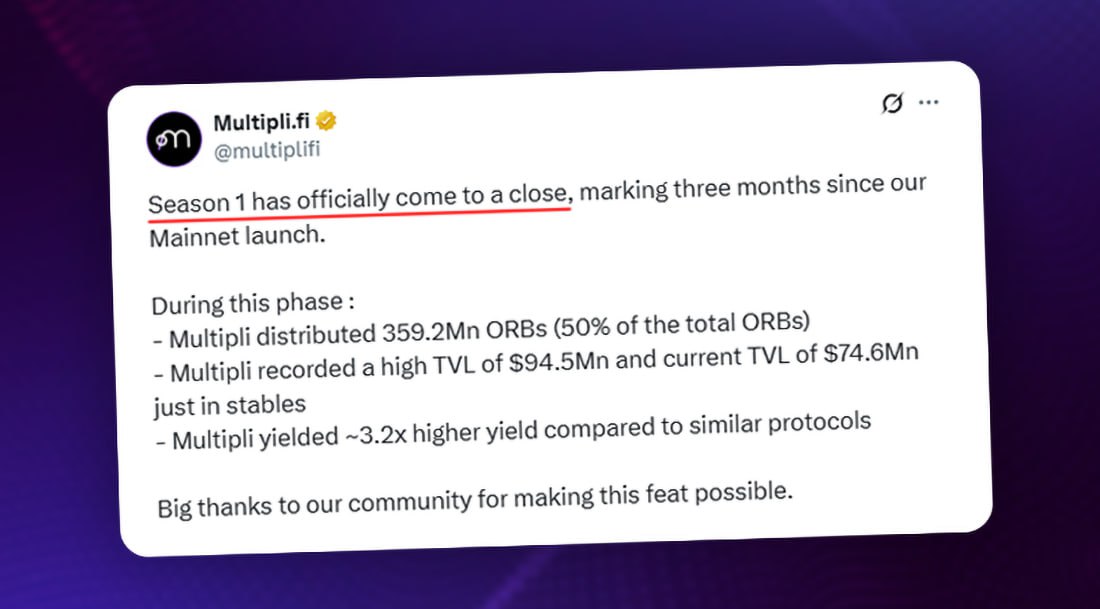

Multipli’s Season 1 has ended with 359.2M ORBs distributed (50% of supply). Season 2 is now live, allocating 30% of ORBs. Users can continue earning by keeping funds on mainnet or testnet—no action required. New users can join via testnet (free) or deposit stablecoins on BSC/Ethereum.