Trump signs executive order allowing US 401k retirement plans to invest into crypto and private equity

Daily top performer — Pendle (PENDLE)

The S&P 500 slipped 0.08% as Trump’s tariffs took effect, but futures rose Friday on chip sector strength and rising Fed cut bets. Gold rose 0.45% to $3,385 on stagflation fears, weak jobs data, and Trump’s tariffs, though it faced resistance near $3,400. The Coindesk Indices, which tracks the broader crypto market, rose 5.67%, with Bitcoin and Ether up 1.95% and 5.30%, respectively in the past 24 hours. Trade these markets and more with up to 500x leverage on Bybit MT5 using this link.

Today’s top performer is PENDLE, up 28.0% after Pendle’s Boros launched onchain trading for floating yield rates and funding rate hedging strategies.

Pendle (PENDLE), launched in June 2021, is a DeFi protocol on Ethereum and Arbitrum that lets users trade tokenized future yields using principal tokens (PT) and yield tokens (YT). Its unique time-decaying AMM allows flexible strategies like fixed yield, long yield, and discounted asset exposure. Boros by Pendle unlocks new yield strategies by letting traders hedge or speculate on perp funding rates using YU positions. It enables delta-neutral and cash-and-carry trades by locking in APRs and bypassing volatile funding rate fluctuations. Long-term, Boros aims to bring floating off-chain yields (like T-bills, REITs, and dividends) onchain for trading and hedging.

Check out the latest prices, charts, and data of PENDLEUSDT perp and PENDLE/USDT spot contracts!

Talk of the town

Trump opens 401(k) retirement plans to crypto and private equity, potentially unlocking trillions in new capital access. The executive order tasks federal agencies with redefining qualified retirement assets under ERISA, paving the way for employers to offer exposure to cryptocurrencies, private equity, and real estate. While implementation will take months, the move rewards the $5T PE industry and crypto players like Coinbase, which backed Trump’s campaign. Bitcoin rose 2% to $116,542 on the news.

Check out the latest prices, charts, and data of BTCUSDT perp and BTC/USDT spot contracts!

Bitcoin spot ETF flows

Category | Flow (millions) |

GBTC | 18.5 |

Non-GBTC | 102.3 |

Total | 120.8 |

Yesterday, BTC spot ETFs saw $120.8M in total inflows, led by $102.3M from non-GBTC funds and $18.5M from GBTC.

Check out the latest prices, charts, and data of BTCUSDT perp and BTC/USDT spot contracts!

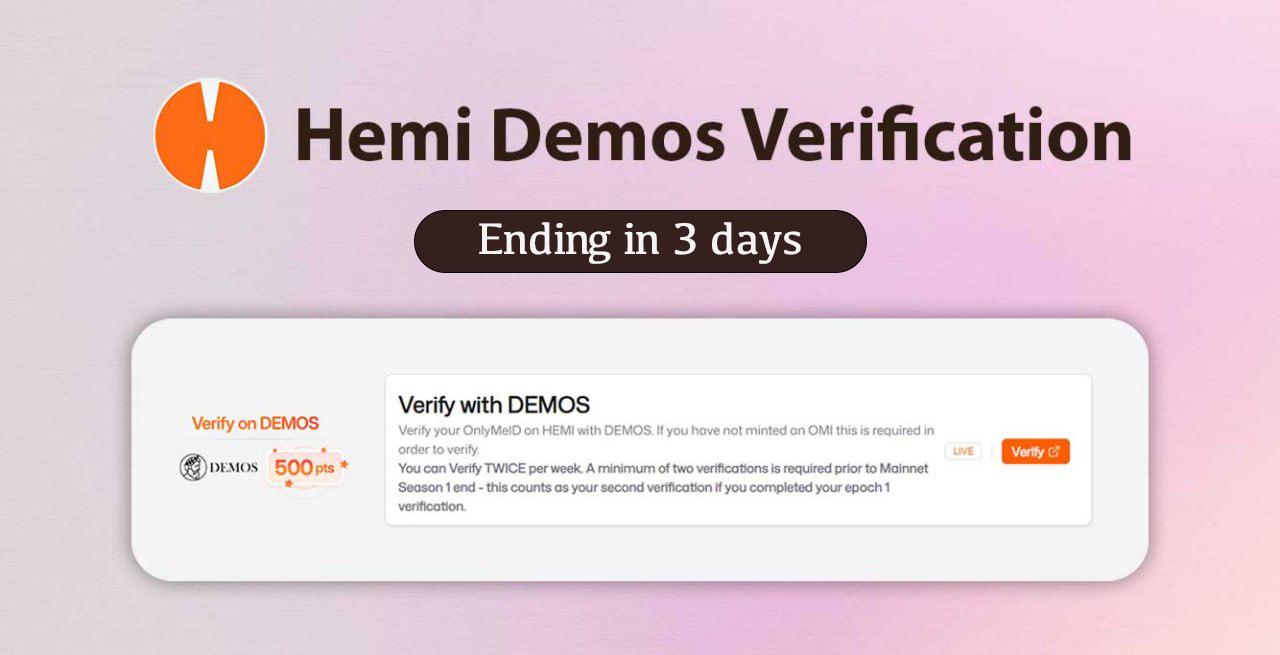

Airdrop to watch

Hemi’s Demos verification period ends on August 11. To remain eligible for upcoming rewards, users must complete at least one verification per period by connecting their EVM wallet, entering a code, and performing a face scan on the Hemi Mainnet Dashboard. Those who verified in both periods are already set. Tokenomics and staking features are coming soon, with more details on the TGE expected shortly.