Thanksgiving Gifts? Bitcoin rebounds above $91k, SD soars over 50%

With US markets closed today, holiday-thinned liquidity is leaving major assets little changed at the time of writing:

- Bybit's SP500, which tracks the benchmark S&P 500, is still keeping its head above the psychological 6,800 level.

The S&P 500's rebound of as much as 4.75% over the past week now leaves this widely-followed US stock index just 0.4% away from erasing its November monthly decline, and just 1.3% below its all-time intraday record high in late October.

- The US dollar index (DXY) is holding steady after 3 consecutive days of declines

- Gold is holding near a 2-week high, closing in on the $4200 upside target highlighted in last Friday's (Nov. 21) Week Ahead preview livestream with Bybit Learn's Chief Market Analyst, Han Tan - available on Youtube and X.

All of the above price action comes as markets revive expectations for a Fed rate cut in December, with Fed funds futures presently pointing to an 80% likelihood.

Trade US stock indices, FX pairs, and Gold on Bybit MT5 here.

Bitcoin rebounds 14% in a week amid greenshoots of easing fears

Despite the US holiday, the OG crypto is now rebounding to a 1-week high, trading above $91k at the time of writing.

Having secured a daily close above the psychological $89k level, it remains to be seen whether BTC can reach the $95,000 upside target.

That $95k target was also cited in last Friday's (Nov. 21) Week Ahead preview livestream with Bybit Learn's Chief Market Analyst, Han Tan - available on Youtube and X (@Bybit_Learn).

The present BTC rebound comes amid early signs that crypto fears are easing:

1) Market expectations for Bitcoin volatility over the next 30 days have eased lower:

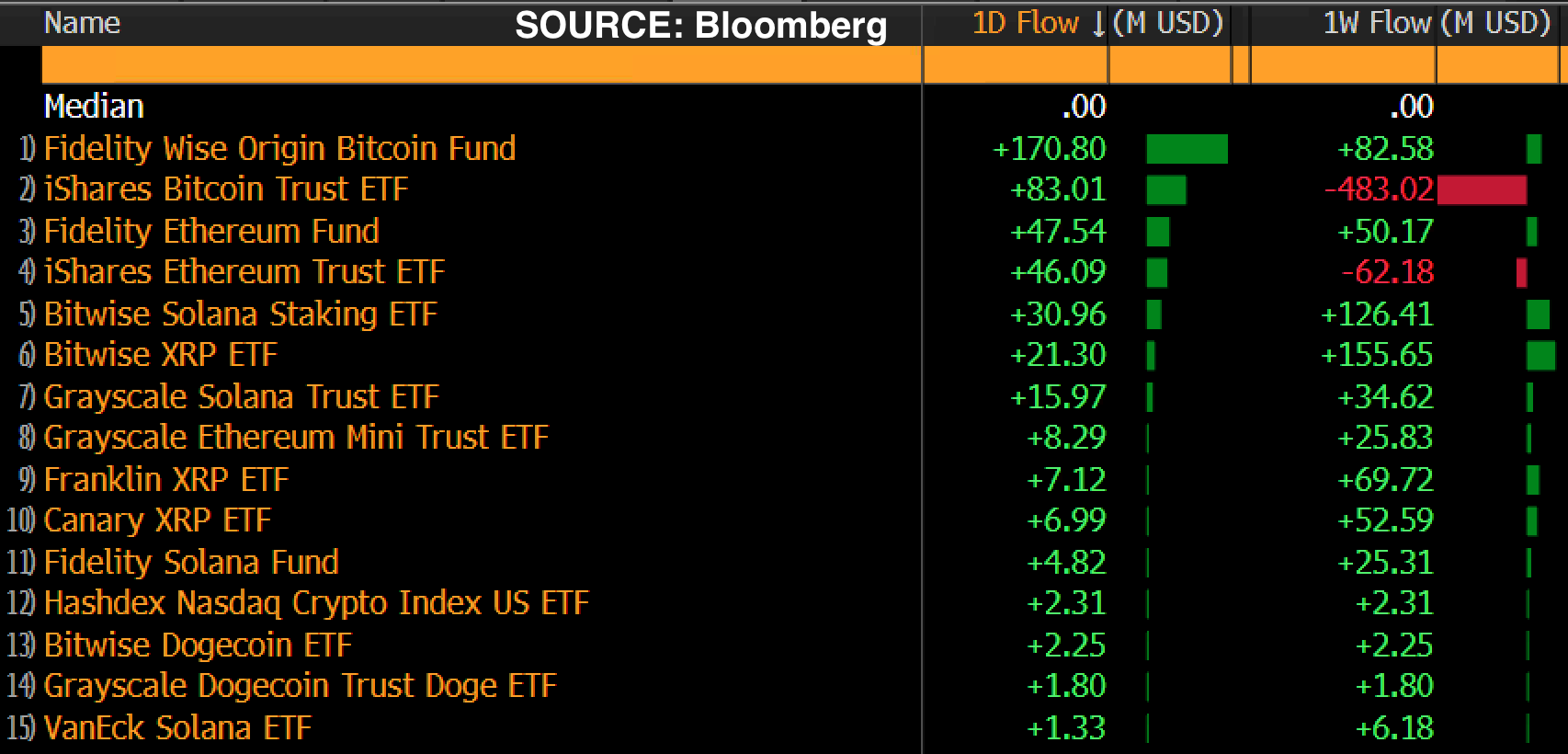

2) Major US-listed crypto ETFs have attracted inflows across the likes of Bitcoin, Ethereum, Solana, XRP, even Dogecoin - even posting a net inflow over the past 1 week according to Bloomberg data.

However, the world's biggest crypto ETF - iShares Bitcoin Trust ETF (IBIT) - still has a net outflow of US$ 483 million from the week leading up to Thanksgiving.

Other initial signs that crypto sentiment may be shifting:

- Positive funding rate for Bitcoin perp futures suggest rising demand for long BTC positions

- Rising open interest for call options at $100k strike price

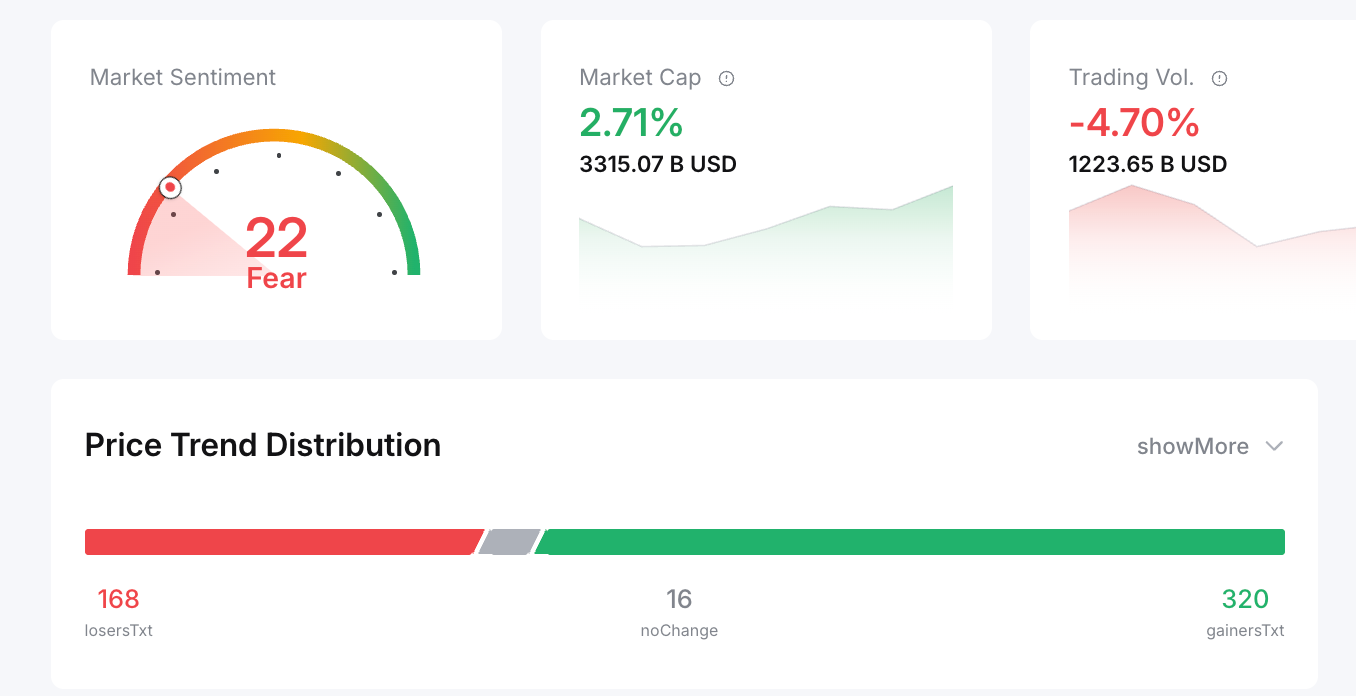

To be certain, the Market Sentiment meter on Bybit.com still reads "Fear":

But this print of 22 on the "Market Sentiment" meter is notably higher than the 11 figure of "Extreme Fear" a week ago (Nov. 20).

Ultimately, Bitcoin has a lot more to do to claw away at the 27% gap between current prices and its all-time high registered back on Oct 6.

READ MORE - JUST PUBLISHED (Nov 27) for Advanced Readers: Slow-but-steady recovery in crypto sentiment

Today's Top Performer: SD hits 2-week high

Since yesterday, SD/USDT has bounced off near 2-year lows to flirt with the 0.40 mark - a price not seen since Nov 12. SD is the token for Stader Labs - a significant entity in the liquid staking domain.

At the time of writing, SD is testing its 50-day simple moving average (SMA) for immediate resistance, with this widely-followed technical indicator refusing to let SD bulls push prices above since early September.

Without an apparent catalyst for its ongoing price surge, beyond the fervent X posts championing SD, it remains to be seen whether this buy-now narrative can be sustained.

At least for now, judging by the CoinDesk 20 index set for its 5th daily advance from the past six days, smaller tokens are perhaps enjoying some lift in what has been scarce bouts of risk-taking activities across crypto markets of late.