How might Japan's macro events overnight impact Yen, Nikkei225, even Cryptos?

Before we look at Japan's scheduled macro events, first a quick recap of the trio of scheduled macro events across major Western economies due in the hours ahead:

Bank of England (BoE) rate decision @ 12:00 PM UTC

Markets now predict a [updated since yesterday's Daily Bits] 98% chance of a 25-basis point cut, with the next UK rate reduction fully expected in April 2026.

European Central Bank (ECB) rate decision @ 1:15 PM UTC

Markets expect the ECB to leave its rates unchanged from now through all of 2026.

US November consumer price index (CPI) a.k.a. headline inflation @ 1:30 PM UTC

Economists predict that the headline CPI rose 3.1% year-on-year (Nov 2025 vs. Nov 2024).

Core CPI (excluding volatile items such as food and energy prices) rose 3% year-on-year.

RECAP: Brace for turbulent Thursday? ECB, BOE, & CPI ahead - published on Wed, Dec 17

PS: Since we already gave you a heads up yesterday; hope you took heed.

WATCH LIVE: How might BTC, Gold, Stocks, etc. move? Post-BOE, live-ECB, live-CPI reaction

At the time of writing, markets appear to be taking some risk off the table ahead of this slew of macro events:

Bitcoin was once again resisted at its 21-day simple moving average (SMA) yesterday, now is trading back below $87,000

Bybit's SP500, which tracks the S&P 500, took another leg down below 6,800, with its own 21-day SMA support now broken.

Gold (Bybit: XAUUSD+) however is holding steady just less than $50 (about 1%) below its all-time intraday high of $4381.44

EURGBP+ (Euro vs. British Pound) remains in a sideways range for most of this week below the psychological 0.880 line, ahead of key rate decisions out of the UK and Eurozone.

NOTE: Gold and EURGBP+ were highlighted among our "3 Assets to Watch" this week - published on Friday, Dec 12

Trade XAUUSD+, SP500, EURGBP+, and more on Bybit TradFi here.

Japan assets in focus heading into the weekend

Coming up, there are 2 major events out of Japan before the weekend arrives:

Japan November national consumer price index (CPI a.k.a. inflation) @ 11:30 PM UTC on Dec 18

Economists predict that the Nov headline CPI eased to 2.9% year-on-year (Nov 2025 vs. Nov 2024), slightly lower than the 3% y/y figure for October.

Last month's core CPI (excluding volatile items such as food and energy prices) also is expected to have eased down to 3% year-on year versus October's 3.1% y/y figure.

Bank of Japan (BoJ) rate decision around 3:00AM UTC on Dec 19

At 99% odds, markets widely expect the BoJ to raise its Target Rate - anything other than a rate hike would be a massive shocker for global markets.

Looking further out, markets predict that the next BoJ rate hike (after this week's) will only occur around mid-2026 (58% chance of BoJ's next rate hike in June)

Hence, the Japanese Yen and the Nikkei 225 - Japan's benchmark stock index - are in focus:

1) USDJPY+ has rebounded (US dollar strengthening against the Japanese Yen) with this FX pair now testing its 21-day SMA as immediate resistance, with the 156.00 psychological level (big, round number) hovering nearby for added resistance.

POTENTIAL SCENARIOS

Should the BoJ shock markets by not hiking its target rate this week, or even pour cold water on the thought of another rate hike by mid-2026, that could see the Japanese Yen weakening against the US dollar i.e. USDJPY+ rising.

On the other hand, if the BoJ signals greater impetus to raise interest rates, that could send USDJPY+ lower i.e. Japanese Yen strengthening against the US dollar.

Of course, today's US CPI release is bound to impact the USD side of the USDJPY+ equation.

According to Bloomberg's FX model, USDJPY is most likely to trade between 154.00 and 157.70 between now through Christmas day.

2) The Nikkei225 - Japan's benchmark stock index - has faltered away from its all-time intraday high of 52,669.50 on Nov 4th.

Since then, this major stock index has only managed lower highs, with the 48,300 set up to be a crucial price level.

NOTE: Historically, USDJPY and the Nikkei225 tend to move in the same direction (have a 'positive correlation'). In other words, when the Japanese Yen strengthens vs. the US dollar (USDJPY goes DOWN), the Nikkei 225 goes DOWN as well, and vice versa.

Hence, given the USDJPY+ scenarios listed above, it remains to be seen whether the Nikkei225 index can:

break above its 21-day and 50-day SMAs and print a higher high above 51,154 - the intraday high from Dec 12th

re-test the 48,300 critical support zone as it last did around mid-November.

Much of the Nikkei225's and USDJPY's fates leading up to Christmas may have to do with the outcome from Japan's CPI and and BoJ events.

How might Japan's macro events this week impact Cryptos?

For historical context, Japan has been the global supplier of "cheap money" for decades.

Japan kept interest rates super low for years, so investors could borrow yen cheaply and use that money to invest all over the world.

Japan even had NEGATIVE interest rates between early 2016 till Q1 2024!

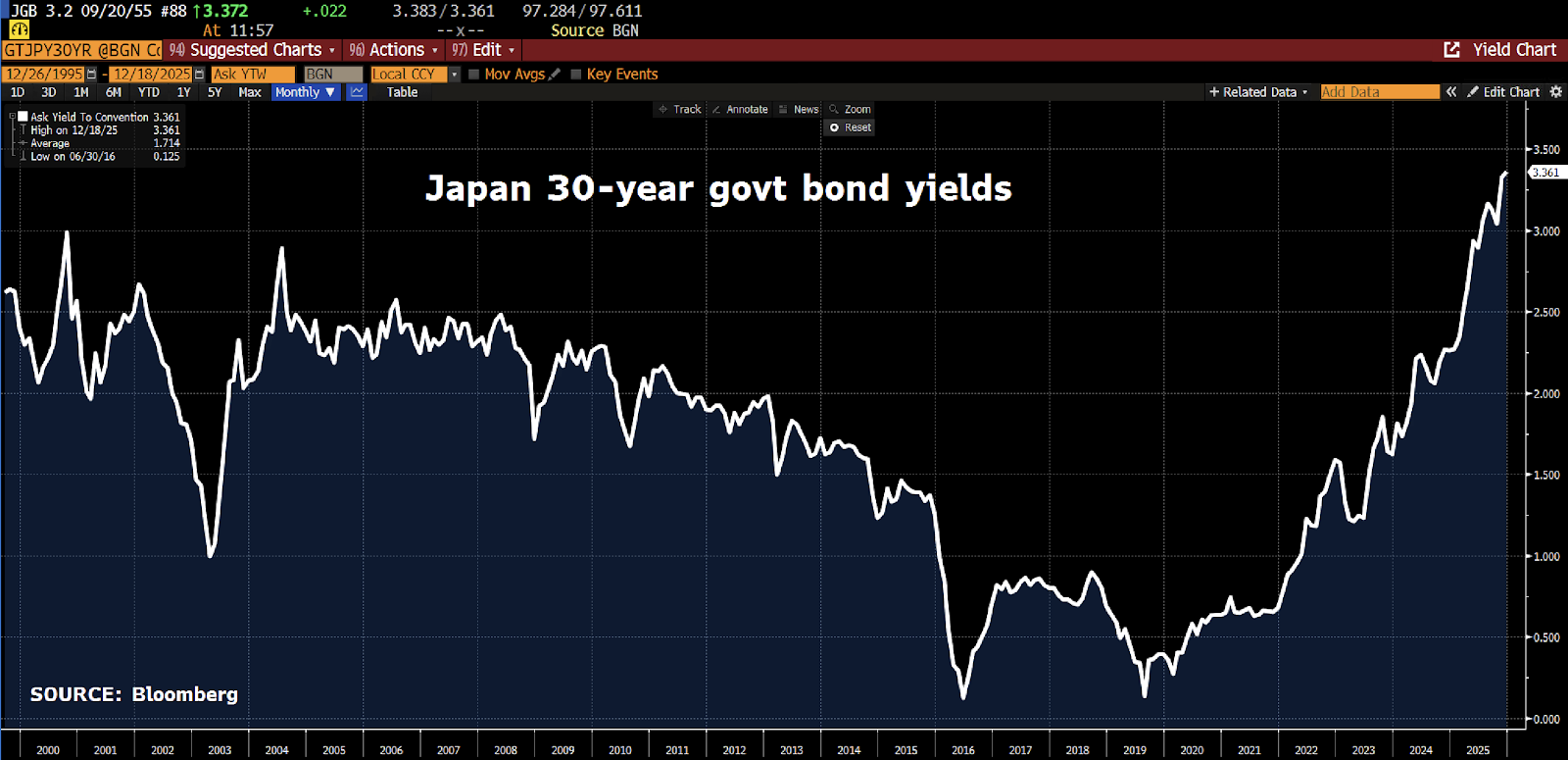

However, since then, Japan has been RAISING its interest rates, even sending yields on 30-year Japanese government bonds to a record high!

10-year JGB yields are also at their highest since mid-2007.

Rising yields may make Japanese government bonds more attractive to global investors, potentially "sucking" money away from various assets classes, including cryptos.

And we know that, historically, cryptos have thrived on higher liquidity levels (i.e. more money available to spend and invest).

Hence, if the Bank of Japan's next policy actions threaten to disrupt global bond markets with an unruly spike in JGB (Japanese government bond) yields ...

that may translate into weaker demand for cryptocurrencies, and potentially another leg down for major crypto prices.