Gold & Silver set for turbulent Thursday?

Precious metals started off 2026 with a bang, but are now on course for 2 straight days of losses.

If gold & silver end today (Thursday, Jan 8) with another daily drop, this would mark the first time they've each seen back-to-back daily declines in:

Gold: exactly a month (daily declines on Fri, Dec 5 and Mon, Dec 8)

Silver: 7 weeks (daily declines on Thur, Nov 20 and Fri, Nov 21).

However, for proper context, these precious metals are still retaining year-to-date gains respectively:

Gold: +2.5% so far in 2026

Silver: +6.4% so far in 2026

Why are precious metals falling?

Gold and Silver investors may be booking profits after 2026's start seemed to be a continuation of last year's stellar performance.

Recall: for 2025, Gold and Silver respectively posted their biggest annual advance since 1979!

However, there's another major event risk slated for today (Thursday, 8 January 2026).

Gold and Silver could see heightened volatility as the 2 biggest commodity indexes are due for an annual rebalancing!

S&P GCSI (Goldman Sachs Commodity Index)

Bloomberg Commodity Index (BCOM)

According to Citigroup, today's rebalancing could result in US$ 6.8 billion worth of gold contracts and another US$ 6.8 billion worth of silver contracts being sold.

Funds that passively track these huge commodity indexes are set to be "forced" to sell these precious metals contracts in order to stay in line with today's changes to BCOM and the S&P GCSI indexes.

DECODE: An index is a way to measure something. A commodity index measures the performance of a group of commodities; stock indexes measure the performance of a group of stocks; the CPI (consumer price index) measures inflation.

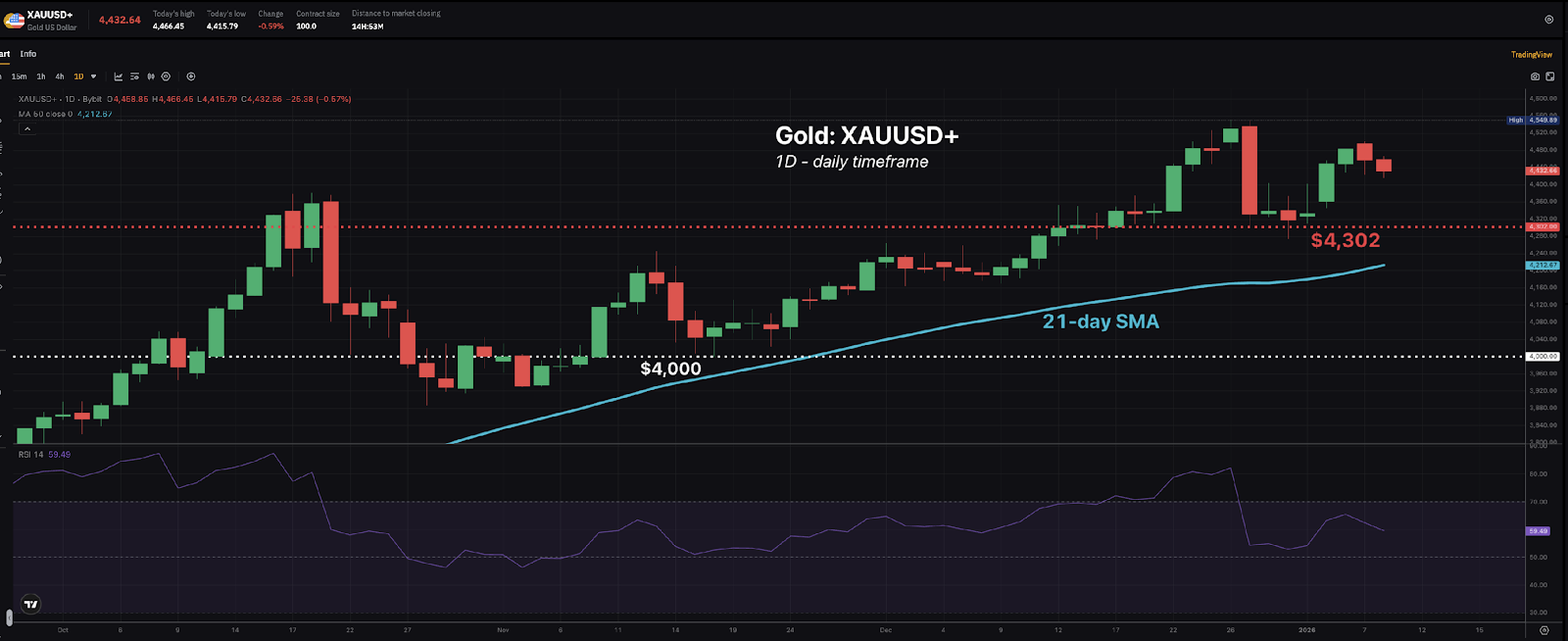

How far could Gold & Silver fall?

According to Bloomberg's forecast model, over the next one-week period (till Jan 15th):

- Gold may fall to as low as $4302

(70.3% chance of XAUUSD trading between $4301.92 - $4575.68 till Jan 15th)

- Silver may fall to as low as $69

(74.2% chance of XAGUSD trading between $69 - $83.44 till Jan 15th)

To be clear, the fundamentals for precious metals appear supportive for 2026, including prospects of more Fed rate cuts and heightened geopolitical fears stoking safe haven demand.

Once Gold & Silver prices can move past the post-rebalancing gyrations ...

Fundamental tailwinds should eventually send precious metals to new record highs in 2026.