Gold breaks out! Will it hit upside target? Also, MON soars over 500%!

Today, spot gold (XAUUSD+) has broken above its 9-day simple moving average (SMA) - a key technical resistance for all of last week.

With prices touching $4150 for the first time since Nov. 14th, bulls will be sizing up the $4200 psychological level - the upside target previously highlighted in last Friday's (Nov 21) Week Ahead Preview Livestream (also available on X).

Gold and other TradFi assets are clearly taking comfort from restored bets for a Fed rate cut in December.

Fed funds futures are now pointing to a 77% chance that the Federal Reserve - the world's most influential central bank - will decide to lower US interest rates again at the December 9-10th FOMC meeting.

Those 77% odds are notably higher from the:

- 66% chance we mentioned yesterday (Monday, Nov 24)

- 45% odds accorded just a week ago (Tuesday, Nov 18)

Generally, Gold and US stock indices rise at the thought of US interest rates going down.

Hence, no surprise that these US stock indices within Bybit's TradFi universe are rising to test these major technical indicators as immediate resistance:

- SP500 (tracks benchmark S&P 500 index) gapped up to test 50-day SMA

- NAS100 (tracks tech-heavy Nasdaq 100 index) rebounded to test 14-day SMA

- DJ30 (tracks Dow Jones Industrial Average) rebounded to test 9-day SMA

Trade Gold, SP500, NAS100, DJ30, and more on Bybit MT5 - here.

Today's Top Performer: MON 🚀 over 500% after Bybit Spot listing, as broader crypto fears ease slightly

Monad's token, MON, has skyrocketed 545% since its listing on Bybit's Spot trading platform on Nov 24 @ 3:00PM UTC.

Its price soared from 0.005 at listing to as high as 0.03810, and is still holding on to much of its gains since.

Monad is an Ethereum-compatible Layer-1 blockchain that aims to deliver the benefits of decentralization at scale. Focusing on software optimization over hardware dependence, its globally distributed network effectively allows anyone to run a node.

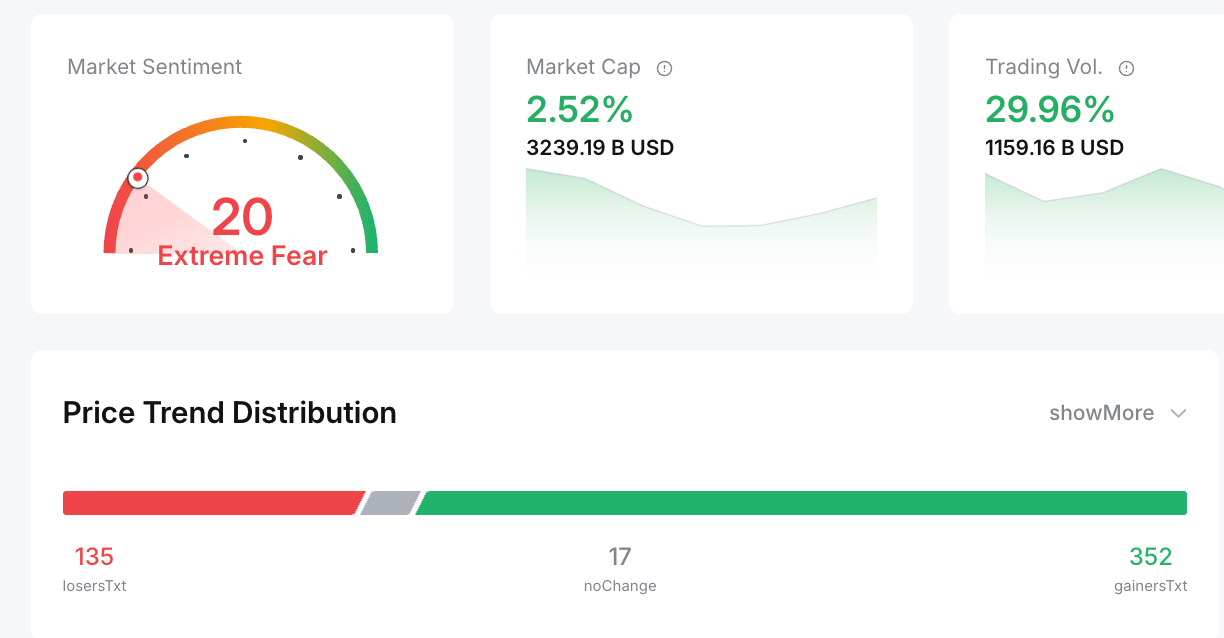

MON's surge was perhaps aided in part due to slight easing of 'extreme fear' levels, per the Market Sentiment meter now reading at 20, as opposed to the 11 figure from Nov 20th.

To be clear, the crypto market sentiment still registers within 'extreme fear' levels, hence Bitcoin's rebound has been tepid in recent days.

Despite breaching $89k briefly earlier today, the world's biggest and oldest crypto has given up much of the day's gains to slide back below the $87k psychological level at the time of writing.