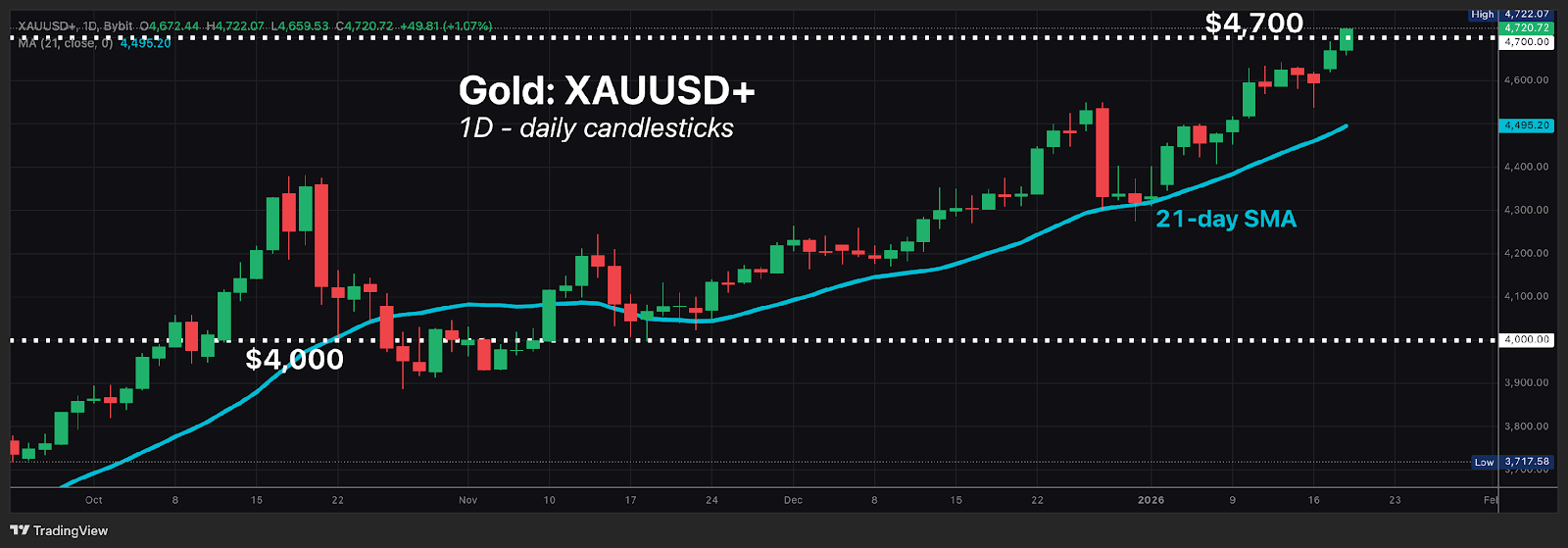

Gold breaches $4700! What's driving today's risk-off moves? We warned you 2 weeks ago

Markets are persisting with yesterday's risk-off moves, as US markets get ready to resume today after the 3-day weekend:

Gold (XAUUSD+) has crossed above $4700 for the first time in its history.

READ MORE: When might we see $5000 Gold?

(since this article was published on Dec 24, 2025, XAUUSD has risen 5.3%. Did you miss out?)

NOTE: Silver (XAGUSD) also posted a new all-time high (using intraday prices) today, though it's only doing so tepidly.

Risk(ier) assets meanwhile are sliding further:

US Stock Index: Bybit's SP500, which tracks the benchmark S&P 500, is set to test its 50-day simple moving average (SMA) for immediate support

Cryptos: Bitcoin has also broken below its 21-day SMA. If it hits the $90,000/50-day SMA, that would fulfill the downside scenario we highlighted in yesterday's article.

The broader coinDesk 20 index is also down 2.6% at the time of writing.

What's driving today's "risk off" moves?

US tariff angst redux: Markets are once more concerned following US President Trump's latest tariff threats aimed at 8 European nations, in his quest to purchase Greenland.

Spike in Japanese govt bond yields: The yields on Japanese government bonds (JGB) soared to record highs! 40-year JGB yields hit 4.2% while 30-year yields breached 3.8% - both for the first time in their respective histories.

This lends credence to a crucial line published on page 22 of our Bybit X Block Scholes 2026 Crypto Outlook:

"One major risk to our 2026 macro outlook is a potential risk-off period triggered by violent moves in Japanese government bond yields ... "

(don't say we didn't warn you)

In the name of transparency, in that 2026 Crypto Outlook report, we cited the risk of an unruly spike in JGB yields stemming from uncertainties surrounding Bank of Japan's rate hikes (BoJ has a rate decision due this Friday, Jan 23).

Instead, today's JGB turmoil instead comes from investors' concerns over Prime Minister Sanae Takaichi's proposal to cut taxes on food - a pitch ahead of Japan's snap elections slated for February 8th.

Netflix earnings: what to look out for?

The streaming giant is set to unveil its latest quarterly financial results after US markets close today (Tuesday, Jan 20).

Here's what Wall Street analysts are forecasting for Netflix's headline figures:

Q4 Revenue: US$ 11.96 billion

Q4 Operating Income: US$ 2.89 billion

Q4 Operating Margin: 24.2%

Q4 Earnings per share (EPS): $0.55

Q1 Revenue: US$ 12.15 billion

Q1 Operating Income: US$ 4.18 billion

Q1 Operating Margin: 34.4%

NOTE: Analysts also forecast Netflix's 2026 revenue to grow by 13% year-on-year (2026 vs. 2025).

NFLX shares are forecasted to move by 7% up/down after this earnings release.

If Netflix delivers better-than-expected Q4 results, while signaling a better-than-expected earnings outlook for Q1 2026 and beyond, that may well send NFLX prices up to 7% higher - assuming market sentiment allows the stock to surge higher, that is (and vice versa).

However, the earnings announcement may be overshadowed by Netflix's plans to take over Warner Bros, along with the latter's streaming business and studios - the home of the Batman and Harry Potter franchises.

This deal is set to the tune of over US$ 80 billion (or US$ 27.75 a share), but doubts are rising whether such an acquisition can sustain double-digit growth for Netflix's financials.

Paramount has since launched a hostile offer of US$30 per share, which Warner Bros. Discovery rejected earlier this month.

Since that WB-Netflix deal's announcement on December 5th, Netflix shares have dropped 14.75%.

Warner Bros. shareholders must decide on whether to accept Paramount's offer by tomorrow's deadline - Wed, Jan 21st.