GBPUSD up 5 days in a row. Can it climb higher? XION up 103% in past 24 hours.

Markets are pushing higher in tandem with rising expectations for a December Fed rate cut.

At the time of writing, Fed funds futures point to an 80% chance that the Federal Reserve - the world's most influential central bank - will lower US interest rates by a further 25-basis points next month.

The thought of a 3rd US rate cut in a row is lifting these assets:

- Bybit's SP500 index, which tracks the benchmark S&P 500 index, breached the 6800 mark for the first time in almost two weeks

- Gold (XAUUSD+) posted its highest intraday price since Nov 14th

- All G10 currencies, except the Japanese Yen, are strengthening against the US dollar, today

Trade Indices, Gold, and FX on Bybit MT5 - here.

GBPUSD awaits UK autumn budget announcement

In the US$ 9.6 trillion-per-day global forex markets, many eyes will be on GBPUSD today.

At about 12:30PM GMT time today (Wednesday, Nov 26) ...

The UK Chancellor of Exchequer, Rachel Reeves, will deliver the 2025 Autumn Budget statement.

From the market's perspective, traders and investors are focused on the credibility of the UK government's tax and spending plans, in filling a GBP 20 billion fiscal hole.

Potential GBPUSD scenarios:

- GBPUSD may race towards the 1.324 upper target - previously cited in last Friday's Week Ahead Preview livestream with Bybit Learn's Chief Market Analyst, Han Tan - if Reeves can allay market concerns with a responsible and believable fiscal plan (e.g. not resorting to excessive borrowing).

- GBPUSD may sink below its 21-day simple moving average (SMA) if Reeves mangles what's already a tremendously delicate task between shoring up the government's finances (which is what markets want to see) vs. upholding left-leaning "Labour values" (which is what her party members want to see).

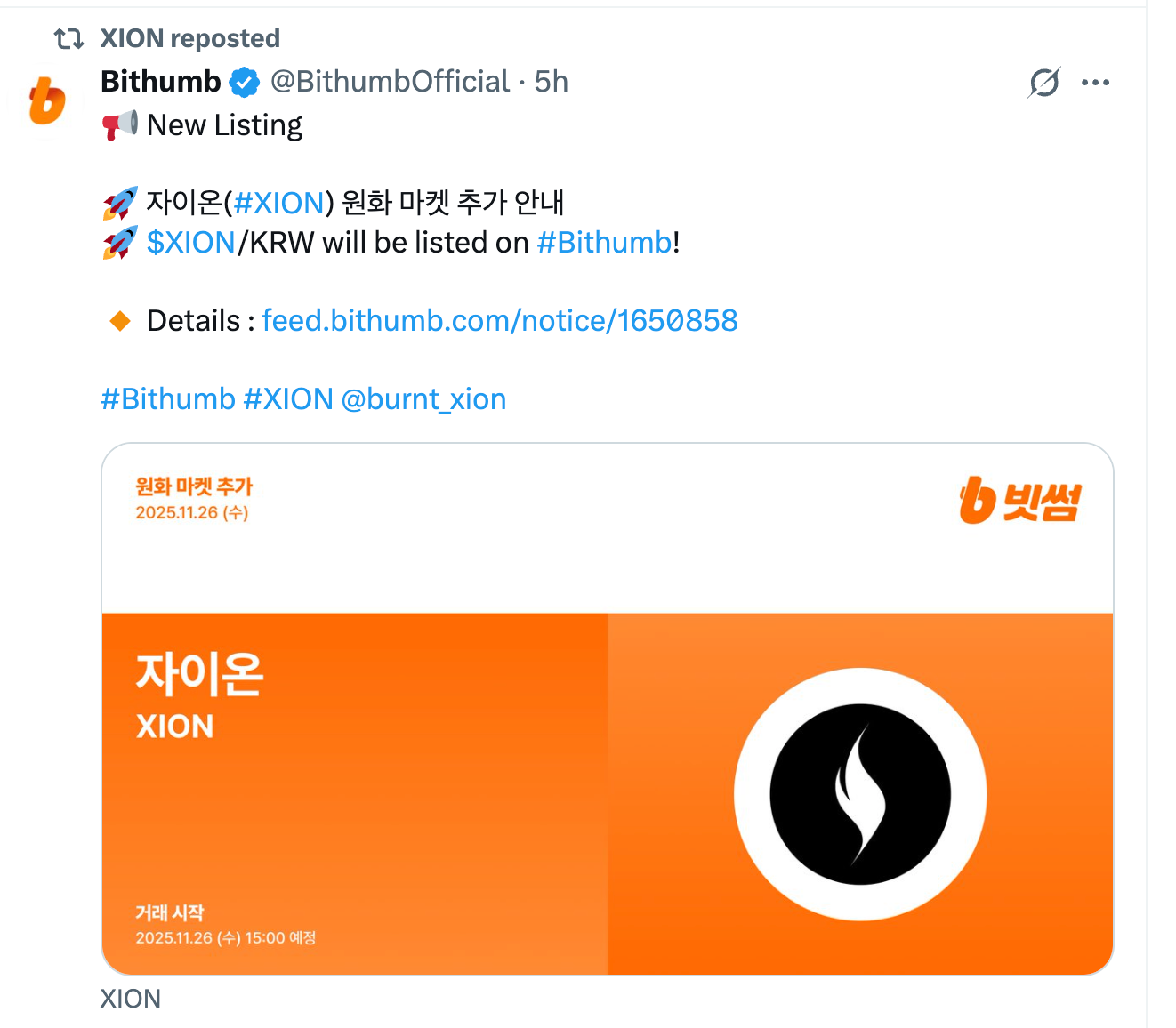

Today's Top Performer: XION 🚀 over 100% on Bithumb listing

XION started the day at 0.3346, before rebounding off near-record-low levels on Bybit's platforms to soar as high as 0.7861.

At the time of writing, XION is now testing its 100-day simple moving average for immediate resistance for the first time since mid-September.

XION's surge was apparently fueled by the excitement surrounding its listing on Bithumb, one of South Korea's leading digital asset exchanges, on its Korean Won market.

This listing appears to add more validity and credibility to the XION project - a Layer 1 blockchain that aims to make dApps accessible to everyday consumers.

With most major cryptos also flashing green at the time of writing, the timing of this news also coincides with ongoing risk-taking activities, in what has been an otherwise dour crypto market since early October.