Bybit launches USDT-based stock trading with CFDs on MT5 platform

Daily top performer — Aave (AAVE)

The S&P 500 closed nearly flat at +0.03% as markets weighed a U.S. credit downgrade and tariff concerns; futures edged higher ahead of Fed remarks and earnings from Home Depot and Toll Brothers. Gold dipped to $3,230 on modest USD strength, but Moody’s US credit downgrade supported safe-haven demand, limiting losses. The Coindesk Indices, which tracks the broader crypto market, rose 3.67%, with Bitcoin and Ether up 1.57% and 5.11%, in the past 24 hours. Trade these markets and more with up to 500x leverage on Bybit MT5 using this link.

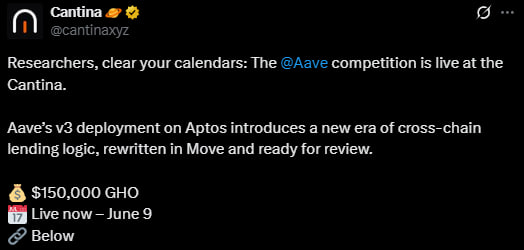

Today's top performer is AAVE, which rose 21.7% after Aave launched a $150K security competition for its v3 deployment on Aptos via Cantina.

Aave (AAVE), founded in 2017, is a DeFi lending platform offering overcollateralized loans, flash loans, and algorithmic interest rates through smart contracts and liquidity pools. Aave has launched a $150,000 GHO security competition on Cantina for its v3 deployment on Aptos, rewritten in Move. Running until June 9, the contest invites researchers to review Aave’s updated lending logic, collateral flows, and incentive mechanisms.

Check out the latest prices, charts, and data of AAVEUSDT perp and AAVE/USDT spot contracts!

Talk of the town

Bybit has become the first major crypto exchange to enable trading of global stocks through Contract for Difference (CFDs) using USDT, offering seamless access to 78 top equities like Apple, Tesla, and Amazon. Part of its expanded Gold & Forex (MT5) suite, this launch allows users to trade traditional assets—stocks, gold, oil, indices, and forex through CFDs—without leaving the crypto ecosystem or converting to fiat. Bybit now bridges crypto and traditional markets under one platform, enabling real-time, crypto-native trading across asset classes.

Bitcoin spot ETF flows

Category | Flow (millions) |

GBTC | 0.0 |

Non-GBTC | 361.5 |

Total | 361.5 |

Yesterday, BTC spot ETFs saw strong inflows of $361.5M, all from non-GBTC funds, while GBTC recorded zero flow.

Check out the latest prices, charts, and data of BTCUSDT perp and BTC/USDT spot contracts!

Airdrop to watch

Succinct has announced its native token, $PROVE, with an initial supply of 1 billion. As an ERC-20 token on Ethereum, $PROVE will be used for payments, staking, governance, and incentivizing provers in the Succinct Prover Network. The supply can expand over time through emissions governed by the community.