Brace for turbulent Thursday? ECB, BOE, & CPI ahead

The latest US jobs report came and went yesterday (Tue, Dec 16), with little fanfare across markets:

October headline NFP figure: -105k (more jobs lost than the forecasted -25k number)

November headline NFP figure: +64k (slightly higher than the forecasted +50k number)

November unemployment rate: 4.6% - highest since 2021.

The mixed set of jobs data did little to budge market expectations of a 24% chance for a Fed rate cut in January 2026, with only a 30% chance of 3 US rate cuts (75bps total) for all of next year.

RECAP: Watch how Bitcoin, Gold, and SP500 reacted LIVE to yesterday's US jobs report release.

Today's pockets of gains across TradFi

Still, within the tradfi world, there are pockets of notable gains:

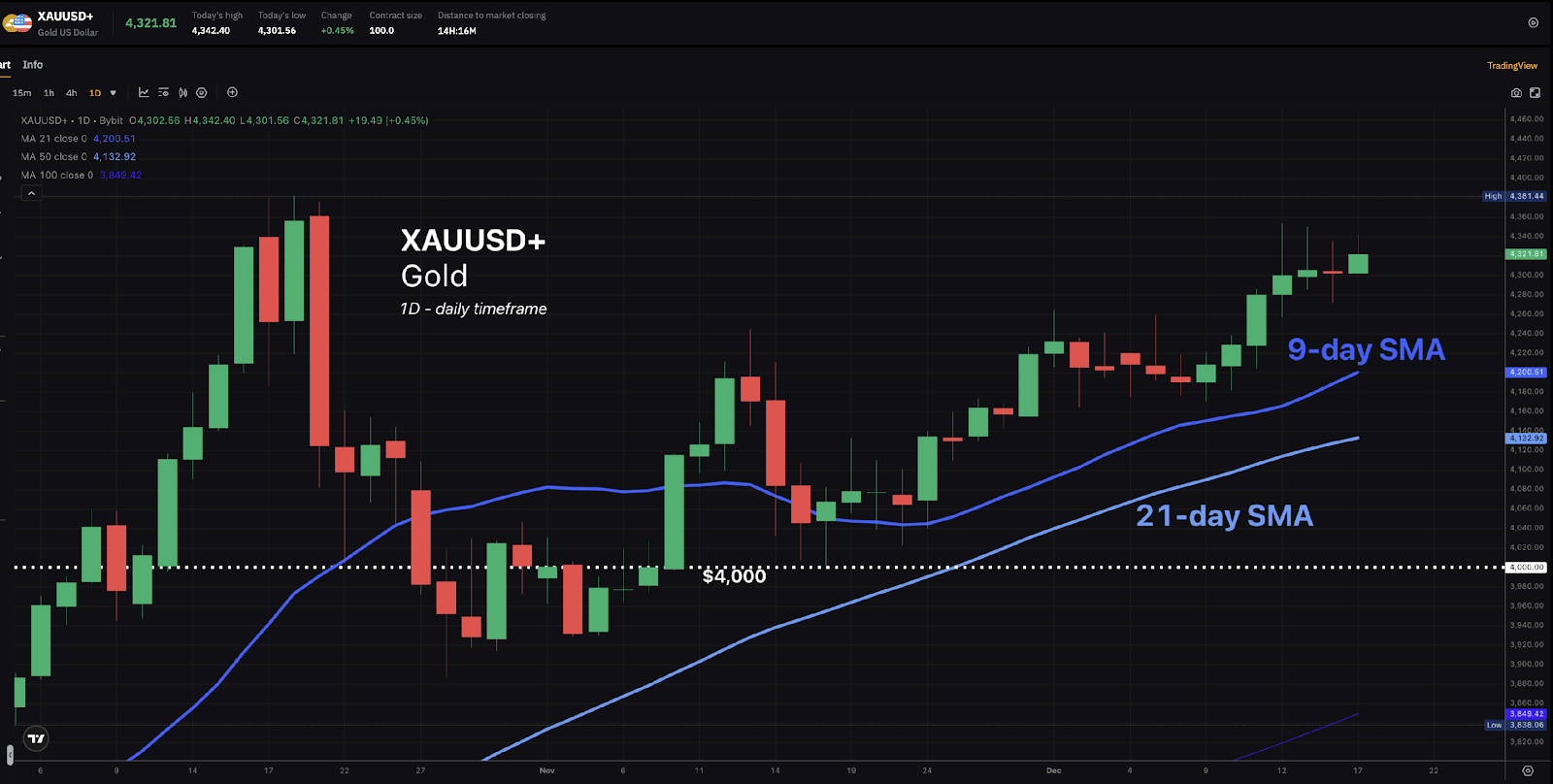

Gold (Bybit: XAUUSD+) is back above $4300 and about 1% away from its all-time high

Silver (XAGUSD) has punched its way to yet another record high

Even Telsa's stock prices hit a new record high on Tue, Dec 16 - its first ATH of 2025!

Bybit's SP500, which tracks the benchmark S&P 500 index, is once again testing critical support at its 21-day simple moving average (SMA) around the 6800 region.

Brent oil (Bybit: UKOUSD) is rebounding slightly to test resistance at the psychological $60/bbl level, after US President Donald Trump ordered a blockade of oil tankers going in and out of Venezuela.

Trade XAUUSD+, XAGUSD, Tesla, SP500, UKOUSD, and more on Bybit TradFi here.

Bitcoin set for 4th yearly drop in its history

Bitcoin continues to meander in sub-$90k territory, with the world's biggest crypto headed for its 4th annual decline in its history - down about 7.4% so far in 2025.

Having secured a daily close below its 21-day simple moving average, bears will be seeing if BTC will fall further and touch the $84k mark to complete the bearish setup outlined since Friday, Dec 5.

For proper context, an annual decline of single digits pales in comparison to the other 3 such occurrences:

2022: -64.3%

2018: -73.8%

2014: -57.5%

Still, with crypto market sentiment still reading 'extreme fear', no surprise that the broader crypto complex has been lifeless of late.

At the time of writing, the CoinDesk 20 index - which measures top digital assets - is now down 0.7% and has been testing crucial support around the 2700 line this week.

Markets to be jolted by Thursday's events?

Even as markets head into the typically quiet year-end period, volatility may yet have a final hurrah before the curtains come down on 2025.

December 18th is set to be jam-packed with macro events:

Bank of England (BoE) rate decision @ 12:00 PM UTC

Markets predict a 92% chance of a 25-basis point cut, with the next UK rate reduction expected in April 2026 (78% odds at present).

European Central Bank (ECB) rate decision @ 1:15 PM UTC

Markets expect the ECB to leave its rates unchanged from now through all of 2026.

US November consumer price index (CPI) a.k.a. headline inflation @ 1:30 PM UTC

Economists predict that the headline CPI rose 3.1% year-on-year (Nov 2025 vs. Nov 2024).

Core CPI (excluding volatile items such as food and energy prices) rose 3% year-on-year.

Assets to Watch:

1) EURGBP+

The Euro should strengthen against the British Pound i.e. EURGBP+ rising towards the 0.8840 upside target upon seeing a "hawkish" ECB that reinforces the idea of no rate cuts in 2026 + a "dovish" BOE that opens the door to faster UK rate cuts in the year ahead, could see

On the other hand, EURGBP+ may fall towards the 0.8700 downside target as the British Pound strengthens against the Euro if markets witness a "dovish" ECB that surprises markets by opening the door to a rate cut + a 'hawkish" BOE that pours cold water on the thought of more UK rate cuts (perhaps to stave off UK inflation risks).

The 0.8840 and 0.8700 targets were highlighted during last Friday's "Week Ahead Preview" livestream with Bybit Learn's Chief Market Analyst, Han Tan.

NOTE: A currency tends to weaken at the thought of its economy's interest rates moving down, and vice versa.

2) Gold (XAUUSD+)

Gold could hit a new record high if the US CPI figures come in below expectations, allowing the Fed to proceed with more rate cuts in 2026.

NOTE: Gold tends to love the idea of US interest rates going down, with bullion also often moving in the opposite direction (inverse relationship) with the US dollar.

READ MORE: 3 Assets to Watch (Dec 15-19) - published Friday, Dec 12