All You Need to Know: Fed rate decision due Dec 10, 2025

Global markets are on tenterhooks, awaiting the highly-anticipated Fed rate decision and Chair Powell's press conference later today (Wed, Dec 10).

Ahead of such a pivotal meeting, major assets are little changed at the time of writing:

- Bitcoin has jumped since yesterday but is holding around $92,000 at the time of writing

- Bybit's SP500 (which tracks the benchmark S&P 500) is also moving tepidly around 6850

- Gold (Bybit: XAUUSD+) has not strayed far from the psychological $4200 line so far this month

Trade SP500, XAUUSD+, and more on Bybit MT5 here.

Traders and investors are apparently unwilling to trigger massive moves before potentially getting fresh signals on US monetary policy that may well dictate the market's year-end performance and set the stage for 2026.

As we countdown to this potentially seismic market event, here's a quick refresher on the world's most important central bank, and why it's so important for global financial markets.

What is the Fed?

The Federal Reserve is the U.S. central bank that uses interest rates to achieve maximum employment and stable prices in the world's biggest economy.

In short, the Fed is the world's most influential central bank.

What's the Fed about to do?

Markets widely expect (90% chance) the Fed to lower its benchmark rates today by another 25-basis points (bps). If so, this would mark its 3rd consecutive rate cut.

Furthermore, markets predict (94% chance) that the Fed can only cut rates 2 times more (total 50 bps) in 2026.

When's the Fed gonna move markets?

- Wed, Dec 10 @ 7:00 PM GMT: Fed rate decision is announced + "dot plot"

- Wed, Dec 10 @ 7:30 PM GMT: Fed Chair Jerome Powell (the big boss at the Federal Reserve) holds a press conference

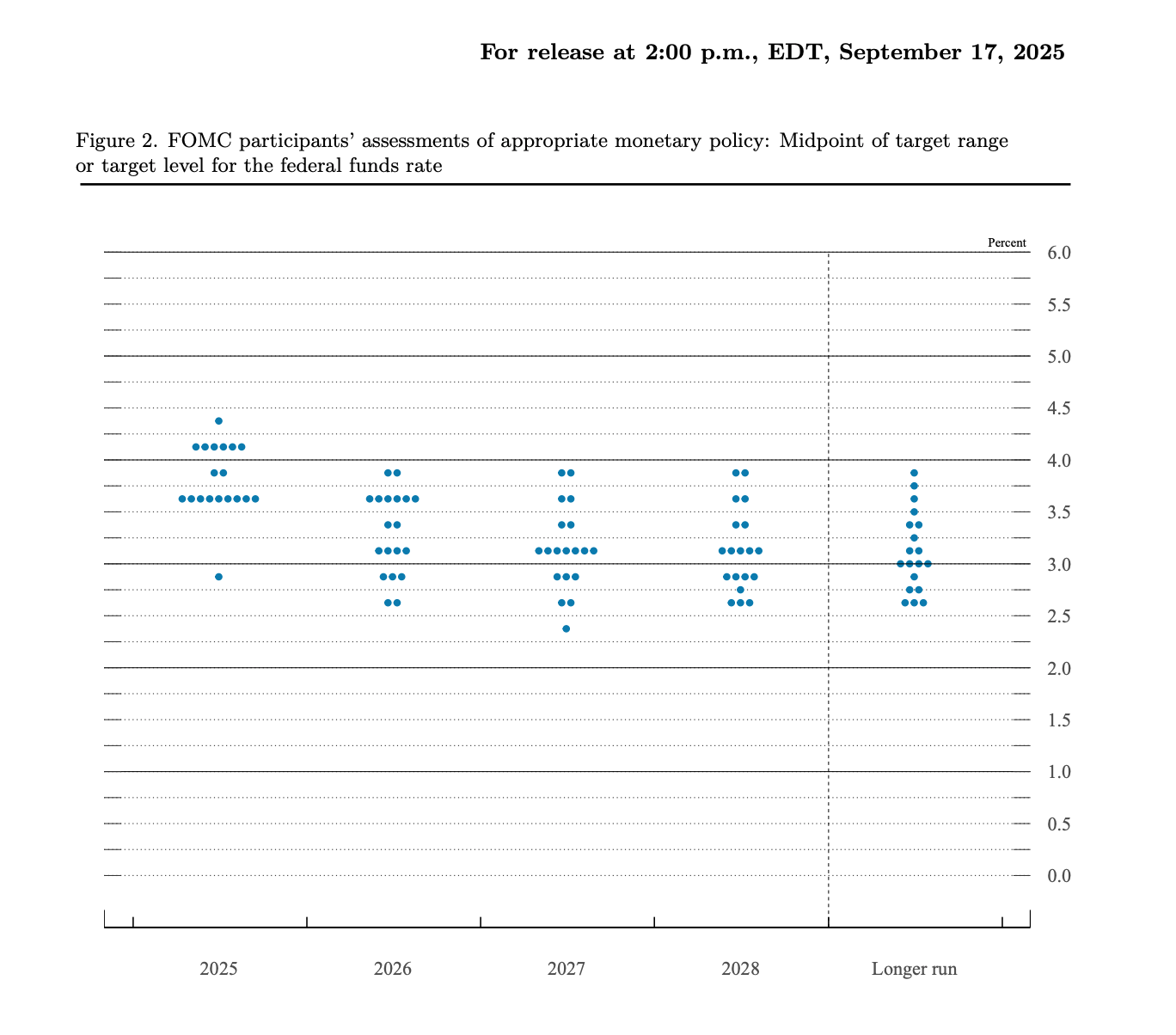

For reference, here's the previous "dot plot" from the September 2025 FOMC meeting:

NOTE: The "dot plot" represents the appropriate rate level over the next few years as deemed by each participant of the Federal Open Market Committee (FOMC) - the group of 12 that actually votes on what to do (hike/hold/cut) with US interest rates.

Why's the Fed so important?

As mentioned earlier, the Fed is the world's most important and influential central bank.

The Fed is also at the epicentre of the global financial system, given the US's stature as the world's biggest economy and the US dollar's role as the world's reserve currency, and the default for global trade.

Hence ...

What the Fed does/says, or not, along with shifts in market expectations for what the Fed might do or say, does move global financial markets - stocks, bonds, FX, commodities, even crypto.

This chart shows how the S&P 500 rebounded in tandem with the odds for a December Fed rate cut, which also helped Bitcoin find a steadier footing.

How might major assets react to the Dec 10 Fed rate decision?

- Stocks, cryptos, gold, and major FX pairs (e.g. EURUSD, GBPUSD etc.) may go UP if the Fed signals greater willingness to cut interest rates by more than 2 times in 2026.

- Stocks, cryptos, gold, and major FX pairs (e.g. EURUSD, GBPUSD etc.) may go DOWN if the Fed signals that future rate cuts will be harder to come by.

If the Fed decides NOT to cut its benchmark rates today, that would be a MAJOR SHOCKER for markets!

Here are the forecasts % moves for the 6 hours after today's Fed rate decision (based off 1 standard deviation of each asset's reactions to Fed rate decisions over the past 12 months: