3 Assets to Watch: Jan 5-9, 2026

2025 saw some big wins (triple digit annual gains) for some tradfi and crypto assets, and massive annual declines for others.

Even as the dust settles on the year gone by, markets are already kicking off 2026 on an active note!

Here are 3 key assets to watch in the week ahead (Jan 5 - 9, 2026):

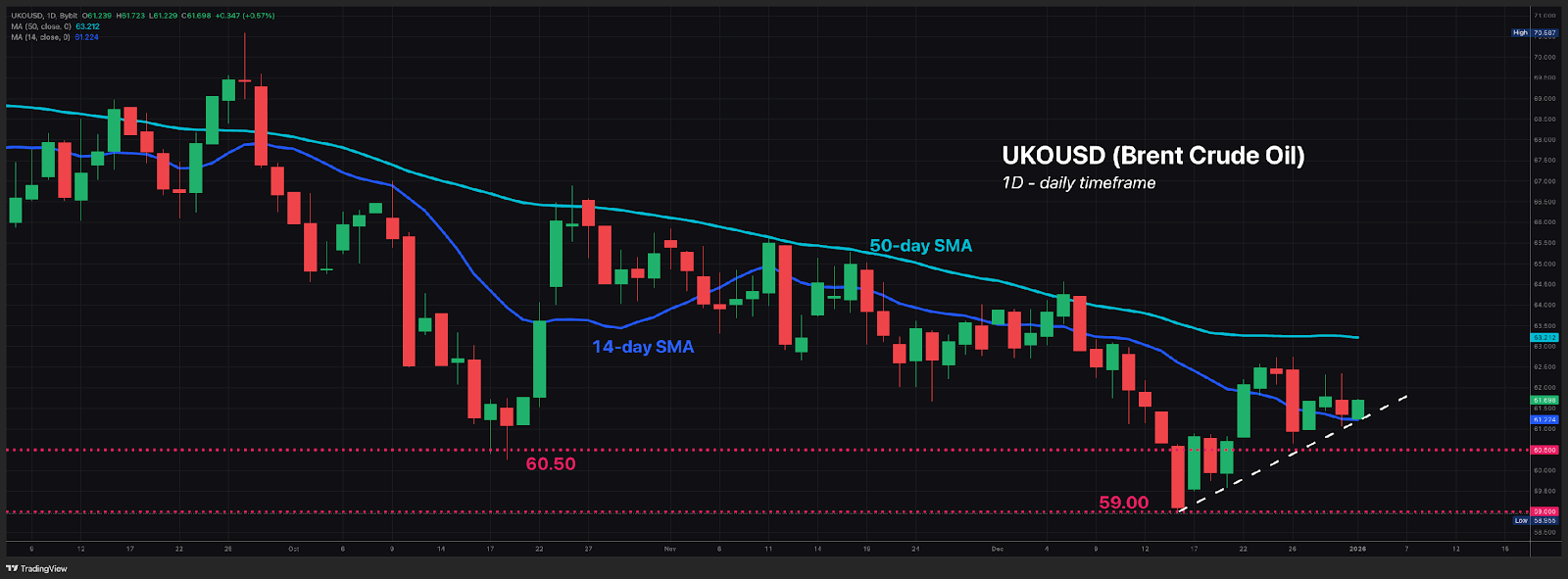

1) Brent Crude Oil (Bybit: UKOUSD)

OPEC+ is set to hold its monthly meeting on Sunday, Jan 4th.

This alliance of major oil-producing nations, led by Saudi Arabia and Russia, had already committed since November 2025 to pausing its output hikes through Q1 2026.

However, if OPEC+ shocks the world (which it has done before) with a surprise plan to raise its production levels sooner than expected, that could send global oil prices tumbling with Brent likely to fall back below $60/bbl when markets resume trading on Monday, Jan 5th.

2) Nasdaq 100 index (Bybit: NAS100)

The Nasdaq 100 index tracks 100 of the biggest non-financial companies on the US stock market.

Nvidia alone, worth over US$4.5 trillion, accounts for almost 10% of the entire Nasdaq 100 index.

On Monday, Jan 5th, NVIDIA CEO Jensen Huang is set to "showcase the latest NVIDIA solutions driving innovation and productivity across industries".

If the company can continue stoking AI enthusiasm, that could send the Nasdaq 100 index back closer towards its record high, which remains some 3% away.

3) BTC go back above $90k?

As always, the monthly US jobs report - now back to its original release schedule of the first Friday of every month - is a closely-watched affair.

On Friday, Jan 9th, here's what economists predict for the December US nonfarm payrolls report (NFP):

Headline NFP number: 55,000 new jobs added in Dec 2025

If so, that would be lower than the 64,000 new jobs added back in November.

Unemployment rate: 4.5%

If so, that would be lower than the 4.6% US jobless rate registered in Nov.

Potential Scenarios:

A weaker-than-expected US jobs report (headline NFP number much lower than 55k and/or jobless rate at 4.6% or higher) may entice the Fed (Federal Reserve = US central bank) to cut interest rates.

And we know that risk assets (e.g. stocks and cryptos) generally love the thought of US interest rates going down.

Hence, a weakening Dec US NFP report may help lift BTC back above $90k - at least for a while.

On the other hand, a stronger-than-expected US jobs report that deters Fed rate cuts may weigh down Bitcoin and crypto prices.

Where's Bitcoin headed in 2026?

Start your year on the right note as Bybit Learn and Block Scholes deliver crypto insights and expected trends for this new year.

Join the livestream on Monday, January 5th @ 8:00 AM UTC as we share:

What will drive cryptos this year?

Key trends to watch in the crypto world

BTC forecast for 2026

Tune in for key analysis and a share of 20,000 USDT in rewards for new Bybit account sign ups.