3 Assets to Watch (Dec 15-19): Gold to hit new record high?

It's the start of the final full trading week of 2025, with traders and investors apparently in "shopping mode".

Major assets are catching a bid after last Friday's (Dec 12) selloff:

- Silver (Bybit: XAGUSD) is punching back towards its record high

- Bybit's SP500 - which tracks the benchmark S&P 500 index - is paring some of its Friday (Dec 12) declines, though having posted a new record high on Thursday, Dec 11 - a scenario we had been waiting for since Dec 5.

- Bybit's NAS100 - which tracks the tech-heavy Nasdaq 100 index - has found critical support at its 50-day and 21-day simple moving averages (SMAs). This stock index is now trying to find a more solid footing after shedding 1.9% last Friday (Dec 12) - it's biggest one-day drop since November 20th.

- EURUSD - the world's most-traded FX pair - is currently holding around its highest levels since early-Oct.

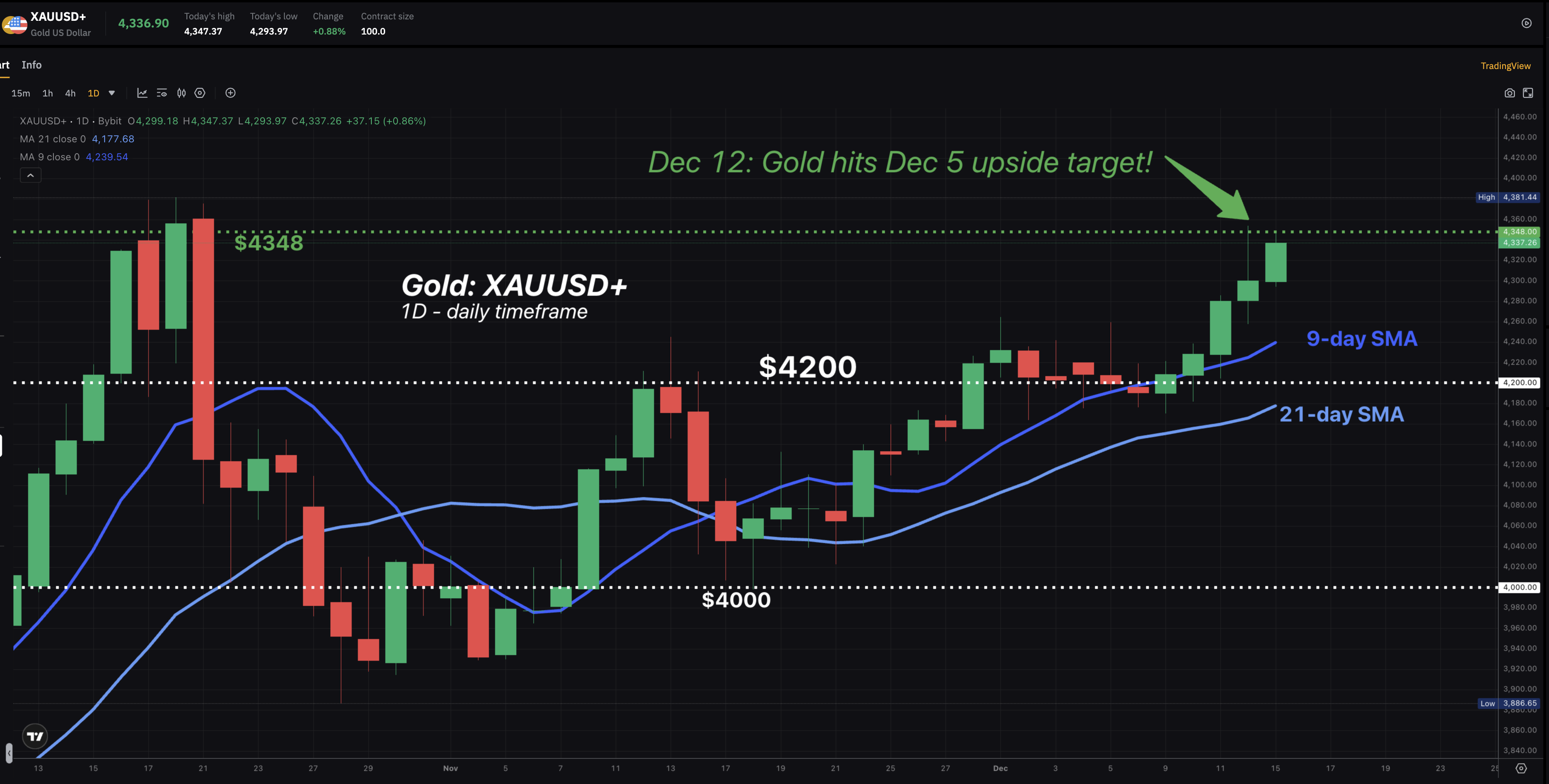

Gold (Bybit: XAUUSD+) is back within a hair of the $4348 target - highlighted during our Dec 5th 'Week Ahead' preview livestream, which was hit exactly a week after (Friday, Dec 12) before tumbling away.

Trade XAUUSD+, XAGUSD, SP500, NAS100, EURUSD and more on Bybit Tradfi here.

Bitcoin finds support from rising lower trendline

The world's biggest crypto was also subject to declines over the weekend, but has found support from a rising lower-bound trendline that began since that Nov 21st intraday low.

We had drawn this critical support line on the Bitcoin chart since last week:

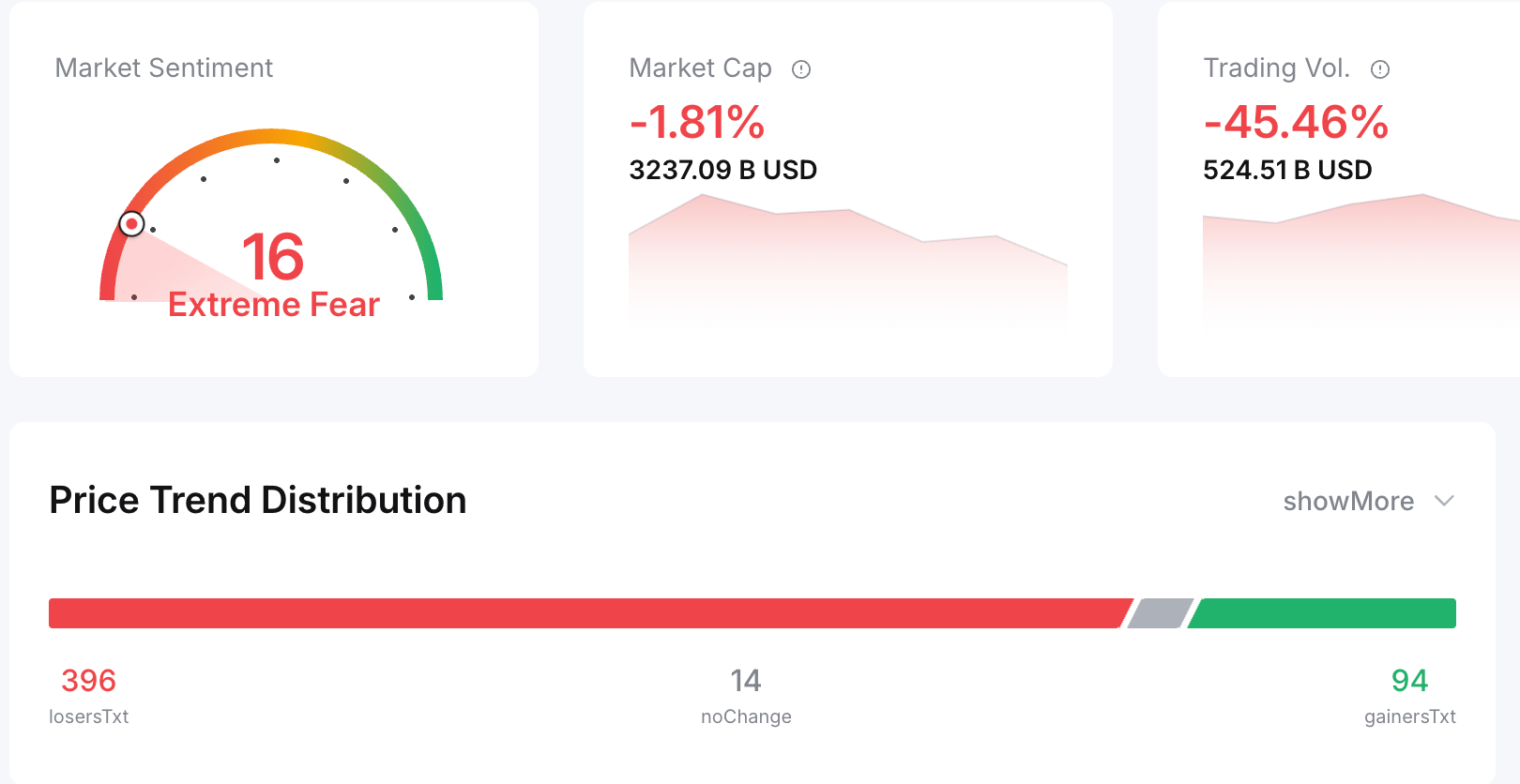

Still, crypto sentiment remains raw, as the "Market Sentiment meter" has fallen back into "extreme fear" territory:

While major cryptos such as BTC and ETH have been printing higher highs, prices must overcome key psychological hurdles at the $95k and $3.3k lines to the upside respectively, in order to give the crypto complex a fighting chance at shrugging off the woes of Q4 2025 going into the new year.

Assets & Events Watchlist: Dec 15-19

The Fed policy outlook for 2026 remains in focus, ahead of delayed major US economic data releases, even as other major G10 central banks make their respective rate decisions this week:

1) Gold (XAUUSD+) - new record high?

- Tue, Dec 16: US Nov jobs report (nonfarm payrolls)

- Thur, Dec 18: US Nov inflation data (consumer price index - CPI)

Bloomberg model 1-week forecasted trading range: $4222 - $4471

2) EURGBP+

- Wed, Dec 17: UK Nov CPI

- Thur, Dec 18: European Central Bank (ECB) rate decision - no rate change expected through 2026

- Thur, Dec 18: Bank of England (BoE) rate decision - 85% chance of a 25-basis point (bps) rate cut

(from past Friday, Dec 12) Bloomberg FX model 1-week forecasted trading range: 0.8700 - 0.8840

3) Nikkei225 - Japan's benchmark stock index

- Fri, Dec 19: Japan Nov national CPI

- Fri, Dec 19: Bank of Japan (BoJ) rate decision

Markets predict a 94% chance the BoJ will RAISE its interest rates this week.

NO RATE HIKE would be a major shocker for markets, which may in turn boost the Nikkei225 towards 52,000.