3 Asset to Watch - Week Ahead Preview (Dec 1-5)

US markets are set to re-open today after yesterday's (Thursday, Nov 27) Thanksgiving break.

But there's been a major outage in the tradfi world!

Trading of futures and options on the Chicago Mercantile Exchange (CME) - one of the world's biggest exchanges for derivatives - has been halted for a few hours, which affected equities, FX, bonds, and commodities.

Still, on this final trading day of what's been a volatile November, perhaps it's opportune to take stock of the big intra-month swings for major assets:

- S&P 500 (Bybit: US500) fell as much as 5.2% before paring month-to-date losses down to 0.4%, pending today's US open

- Nasdaq 100 (Bybit: NAS100) fell as much as 8.7% before paring month-to-date losses down 2.4%, pending today's US open

- EURUSD (Bybit: EURUSD+) - world's most traded FX pair - rose as much as 1.6% intra-month, now on the cusp of sealing month-to-date gains of just 0.3%

- Gold (Bybit: XAUUSD+) moved even closer to the $4200 upside target highlighted in last Friday's (Nov. 21) Week Ahead preview livestream

- WTI crude oil (Bybit: USOUSD) fell as much as 6.67% before paring month-to-date losses down to 1.8%

Note that, in recent days, USOUSD found support at the psychologically-important $58/bbl line - a key price level previously highlighted during the Nov 12th Bybit Learn "Daily Market Update" livestream with Chief Market Analyst, Han Tan (available on Youtube and X - @Bybit_Learn).

Trade SP500, NAS100, EURUSD+, USOUSD, XAUUSD+, and more on Bybit MT5 here.

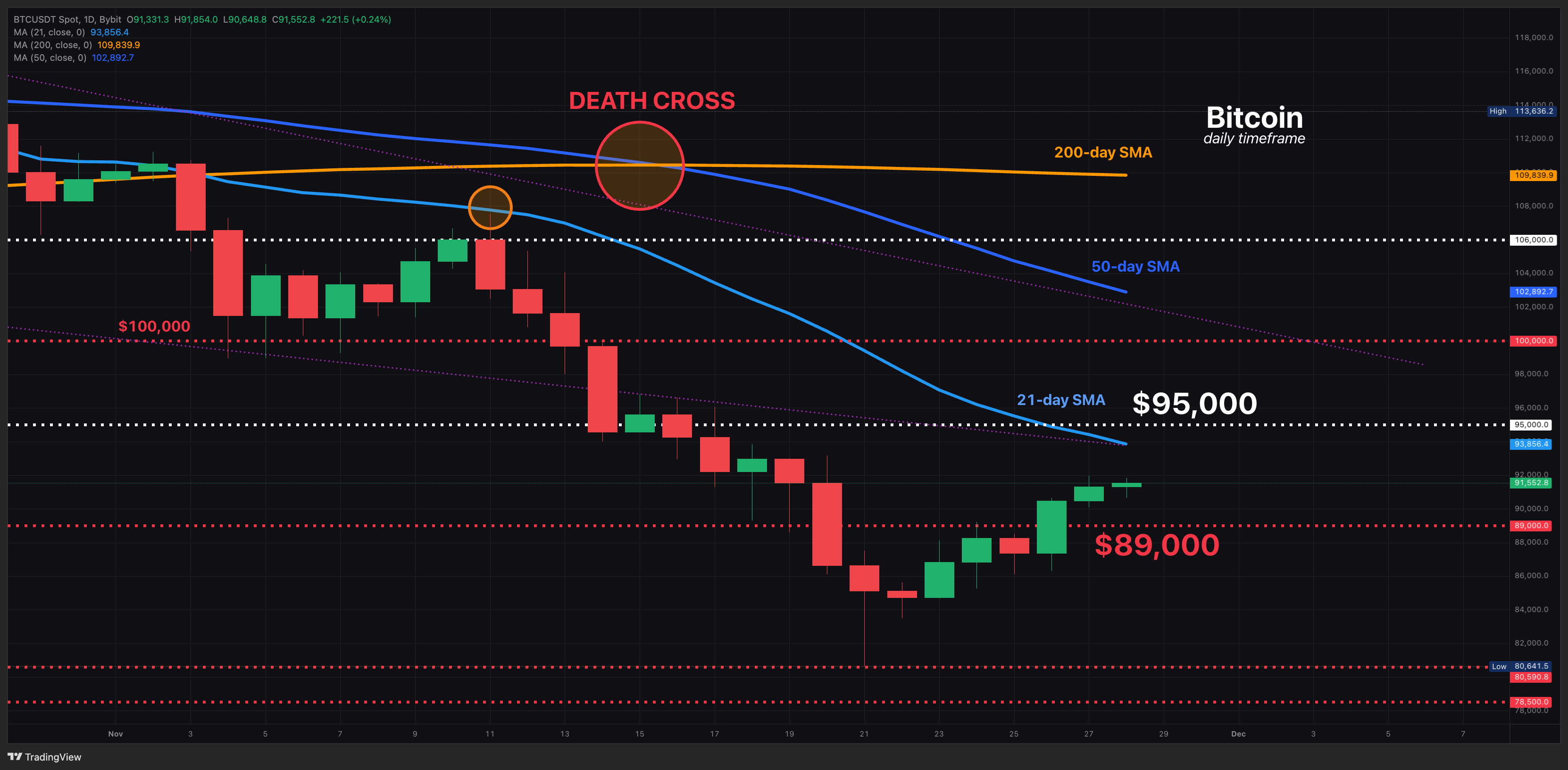

Bitcoin struggling after flirting with $92k

The first-born crypto has teased the $92k handle since yesterday, but is struggling for upside momentum at present.

Still, crypto fears are easing further:

- The CoinDesk 20 Index is easing slightly but still holding just below the 3k elvel - around a one-week high

- The Bitcoin Volmex Implied Volatility 30 Day Index has fallen to almost 50, down 23% from the near-65 figure exactly a week ago.

- Bybit's "Market Sentiment" reader is now at 25 (Fear), more than double 11 figure of "Extreme Fear" from a week ago (Nov. 20).

Assets & Events Watchlist: Nov 29 - Dec 5

The market's shifting expectations surrounding the December Fed rate cut is likely set to dominate market sentiment, even as the Fed enters its "blackout period" leading up to the Dec 9-10 FOMC meeting.

Still, there are bound to be potential trading and investing opportunities across asset classes:

1) UKOUSD

(Brent Crude Oil - the global benchmark for oil prices)

- Sun, Nov 30: OPEC+ meeting - pause on output hikes expected through Q1 2026

- Shock production increase could sink UKOUSD towards $60/bbl when markets reopen Monday, Dec 1

2) EURUSD+

- Tue, Dec 2: Eurozone Nov consumer price index (CPI) a.k.a. inflation and Oct unemployment rate

- Fri, Dec 5: US Personal Consumption Expenditures (PCE) - Fed's preferred inflation gauge

Bloomberg FX model 1-week forecasted trading range: 1.1486 - 1.1677

3) Bitcoin

- Wed, Dec 3: US Nov ADP employment change

- Fri, Dec 5: US Personal Consumption Expenditures (PCE) - Fed's preferred inflation gauge

Lower-than-expected inflation/weakening US jobs markets could firm bets for a December Fed rate cut and boost risk assets, including cryptos

NOTE: Bybit Learn's Daily Bits and "Daily Market Update" livestreams will take a break on Mon-Tue: Dec 1 - 2; will resume on Wed, Dec 3.