Weekly Institutional Insights: BTC Reaches ATH; Polymarket’s Role in Shaping Future of Betting Markets

Nov 11, 2024: Our weekly Institutional Insights explores the latest market developments — market performance, industry news, exchange-traded fund (ETF) flows, trending topics, upcoming events and token unlocks — to help you supercharge your crypto trading.

Enjoy our weekly take on the market!

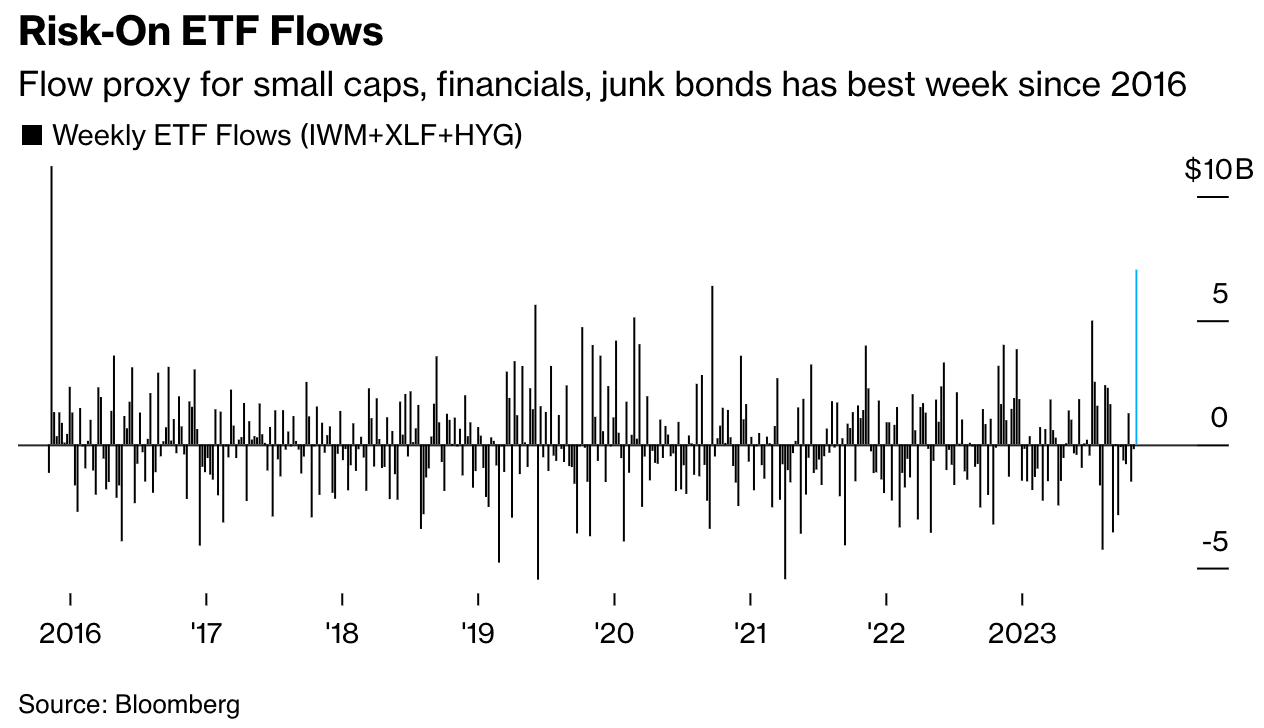

Macro Overview — Small Cap Surge Following Anticipated Tax Cuts and Deregulation

Throughout this year, Wall Street analysts have expressed skepticism about the sustainability of a broad market rally that has driven stock prices up by trillions, boosted Bitcoin and sparked a credit boom. Despite a brief market dip in summer, those concerns have largely proven unfounded. With Donald Trump’s return to the presidency, new worries have emerged: investors may not be bullish enough.

This uncertainty has spurred a buying frenzy across stocks, credit and cryptocurrencies. Over five days, equities gained over $2 trillion, including a remarkable $20 billion inflow into funds on one day alone. Small-cap stocks surged nearly 9%, banks rallied and Bitcoin reached a new high.

This optimism stems from expectations that Trump’s pro-growth agenda — featuring tax cuts and deregulation — will further stimulate an already strong economy, especially as the Federal Reserve shifts toward a more accommodative monetary policy. However, bonds remain a point of caution due to concerns about the fiscal stimulus's cost.

While the current bullish sentiment is palpable, some analysts warn that rapid price increases might overlook underlying economic vulnerabilities. As the market continues to rally, caution about potential risks associated with a Trump presidency remains crucial.

Weekly Crypto Highlight — The Future of Polymarket: A Deep Dive Into Its Impact and Potential

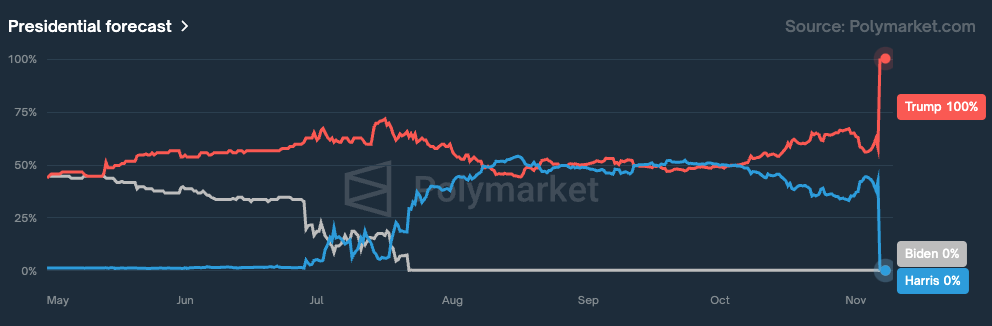

Presidential forecast bets on Polymarket.

Polymarket, a blockchain-based prediction market operating on the Polygon PoS network, has emerged as a significant player in the realm of political forecasting. The platform allows users to place bets on a wide array of events, from sports to politics to pop culture. This flexibility, combined with its crypto foundation, positions Polymarket uniquely against traditional forecasting methods, particularly in light of the recent U.S. election results.

On election day, Polymarket assigned Donald Trump a 62.3% chance of winning, a prediction that sharply contrasted with the mainstream narrative. Legacy media, including prominent analysts like Nate Silver, suggested a tightly contested race, with many forecasts favoring Vice President Kamala Harris. However, Polymarket’s prediction was validated when Trump won convincingly, garnering a significant portion of the popular vote, even as Republicans were taking control of the U.S. Senate and, likely, the U.S. House of Representatives. This outcome highlighted a critical divide between traditional polling and the insights drawn from prediction markets.

Polymarket was not alone in its forecasting. It led among betting platforms, facilitating approximately 12.8 million election-related trades and achieving a lifetime volume exceeding $3.2 billion. The open interest across its election markets reached nearly $398 million, attracting over 282,800 traders. Despite these impressive metrics, many experts dismissed Polymarket as untrustworthy, citing its lack of regulation and concerns about manipulation by large bettors, or "whales."

The Future of Prediction Markets

Critics have failed to recognize the fundamental strengths of prediction markets. Unlike traditional polls, which can be constrained by methodology and sample biases, prediction markets aggregate information from diverse participants, offering a more dynamic and responsive assessment of probabilities. With real money at stake, participants are incentivized to accurately gauge outcomes, creating a robust environment for information synthesis. This principle was evident as Polymarket reacted to electoral developments much faster than legacy media, with reports suggesting that even Trump’s campaign monitored Polymarket for real-time insights.

As the crypto landscape evolves, Polymarket stands at the forefront of a paradigm shift in how events are forecasted. The platform's integration of blockchain technology not only enhances transparency but also attracts a demographic eager for innovative financial solutions. Anticipated expansion into the U.S. market under a potentially more crypto-friendly administration further suggests that Polymarket could capitalize on the burgeoning online gambling and betting sectors.

Looking ahead, Polymarket's future appears promising. With its ability to challenge conventional wisdom and deliver accurate and timely predictions, it’s well-positioned to reshape political betting in America. As public acceptance of market-based information grows, Polymarket may lead the charge in mainstreaming crypto-powered prediction markets, ultimately transforming the landscape of political forecasting and betting. This evolution signifies a broader trend whereby crypto increasingly influences traditional sectors, paving the way for innovative applications across various domains.

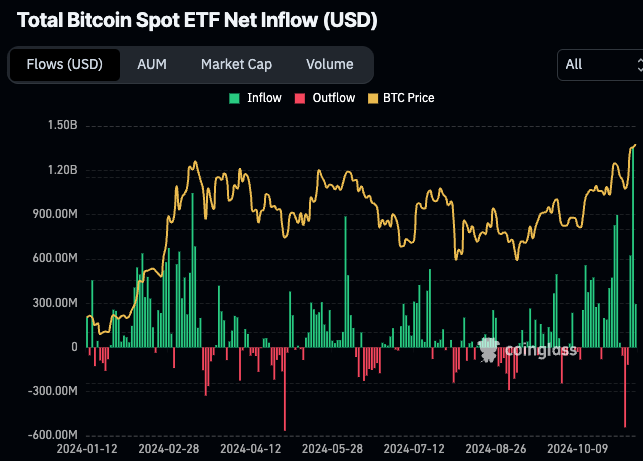

Bitcoin Spot ETF Flows

Total Bitcoin Spot ETF Net Inflows. Source: CoinGlass

As Bitcoin hit a new all-time high of approximately $77,200 following the U.S. presidential election results, the cryptocurrency market is witnessing unprecedented inflows into Bitcoin Spot ETFs. This surge reflects growing investor optimism, driven by expectations of a pro-crypto regulatory environment. Billions of dollars have flowed into these ETFs, highlighting the market’s optimistic anticipation toward the world’s largest cryptocurrency.

Other Top Performing Tokens

Token | Catalyst |

Cetus Protocol (CETUS) | CETUS surged 23.6% following the Cetus upgrade, allowing users to effortlessly switch between multiple Sui wallet addresses. Read more here. |

Ether (ETH) | ETH surged 9.0% after Michigan's pension fund made waves through significant ETF investments. Read more here. |

Dogecoin (DOGE) | DOGE surged 17% amid speculation fueled by Musk’s support for Trump and talk of a potential "D.O.G.E." role. Read more here. |