What Is The Future of Bitcoin? (2023)

Bitcoin and cryptocurrencies in general are slowly but surely encroaching into mainstream public recognition. There are over 20,000 currently in existence, with no telling what this number will be a few years from now. More than a decade since its creation, what does the future hold for Bitcoin?

This much we do know: Bitcoin’s future is bright. It’s by far the world’s biggest cryptocurrency by market cap, and it will take a Herculean effort to snatch away Bitcoin’s crypto throne. But how big can Bitcoin get? Can it realize mainstream adoption? That remains to be seen, but there are some encouraging signs.

Key Takeaways:

With the upcoming Bitcoin halving, expected to take place in April 2024, BTC will become scarcer, which could drive its price to record levels.

Despite Bitcoin’s dominance in the market, various cryptocurrencies, such as Ethereum and Sui, are potential rivals for investors’ interest.

The History of Bitcoin

The financial industry didn’t look back fondly on 2009: It was the year that the credit crunch and the global economic downturn of the late 2000s gripped large parts of the globe. Markets crashed, giving way to doom and gloom.

The reasons for the credit crunch were numerous, but without delving into them here, it’s safe to say the whole saga resulted in a crisis of confidence in the traditional banking systems. The Times ran a headline on Jan 3, 2009, referring to the U.K. Chancellor of the Exchequer, Alistair Darling, as being on the “brink of (a) second bailout for banks.”

Looking back at this headline now, over a decade later, it may look inconspicuous to the casual observer, just another headline highlighting the ungodly mess that the financial industry was in at the time. January 3, 2009 was a Saturday, and as was the norm, The Times was on sale in the U.K. that day for £1.50, or around $2. The following website lists all known copies of the newspaper from that date. According to it, only seven verified copies of the newspaper exist, with a complete newspaper going for as high as $1.3 million. So, why was this headline significant in Bitcoin’s history?

The Genesis Block

Contrary to the larger financial industry's unfavorable view of 2009, the crypto industry holds an entirely different perspective. It was year zero for crypto: On January 3, 2009, the illusive Bitcoin creator whose pseudonym is Satoshi Nakamoto mined the first 50 bitcoins, and the world’s first viable cryptocurrency was founded.

In the very first coin that was mined, embedded in the genesis block was the headline, “Chancellor on brink of second bailout for banks.” This was a direct reference to the reason Bitcoin was created in the first place. At a time of great uncertainty, amidst growing distrust in the major banks in control of the centralized financial systems which had caused so much turmoil, here was the perfect antidote: a digital currency built on decentralization. It was a complete departure from institutional banking and entirely independent from it.

Banks no longer held the power and authority with this new form of currency. It used a distributed ledger and blockchain technology, in which the consensus of every member on the blockchain verifies every transaction. And these weren’t physical assets, but digital assets.

It was a great idea in theory, but would it catch on? As Hal Finney, the first recipient of Bitcoin from Nakamoto, noted soon after this transaction, “One immediate problem of any new currency is how to value it. Even ignoring the practical problem that virtually no one will accept it at first, there is still a difficulty in coming up with a reasonable argument in favor of a particular non-zero value for the coins.”

Of course, there was also the problem of how it could be used in real life.

Adoption and Rise in Value

A significant moment for Bitcoin was the first transaction using the currency for a real-world item — 10,000 BTC for $41 worth of pizza by Laszlo Hanyecz in 2010. This day has been marked every year since by celebrating Bitcoin Pizza Day, a watershed moment signaling to the world that Bitcoin could actually be used in real life.

Subsequently, Bitcoin’s popularity and value took off. Worth virtually nothing until early 2010, it had hit parity with the U.S. dollar by February 2011 — and we all know how the price has skyrocketed since then. Indeed, much is often made of its price. But what about its usage, throughout its history and to the present day, for actual real-world transactions?

This article from the BBC(essentially a “Bitcoin for Dummies” piece) contains this very telling sentence: “Bitcoins are valuable because people are willing to exchange them for real goods and services, and even cash.” Of course, Bitcoin’s price has been extremely volatile at times, such as the spike to nearly $20,000 in late 2017 and its subsequent crash, and more recently the 2022 crypto crash. But in late 2020 and early 2021, its price exploded.

During 2021, Bitcoin hit some of its highest prices yet, forming a double-top price pattern in April and November at over $60,000. However, 2022 proved a tough year for Bitcoin and other altcoins as the bear market encroached. Within the first five months of 2022, Bitcoin lost over 50% of its 2021 ATH to hit a low of $28,913 on May 12, following the crash of Terra’s native coin, Luna, after the depegging of UST. Other Bitcoin price dump triggers that year were the collapse of FTX and increased threat of regulation on the crypto market.

Things slightly recovered in early 2023, with BTC hitting $30,000 briefly before failing to break that resistance level.

Use Cases of Bitcoin

In its early days, Bitcoin’s usage was still quite limited as skeptics expressed doubt over its long-term viability as a currency. But gradually, as its legitimacy grew, more merchants started to accept it as payment. BitPay, a payment service provider enabling merchants to accept Bitcoin, was established in 2011.

However, there is no escaping the fact that in these early years, Bitcoin was largely known for illicit activities, such as money laundering and transactions on the dark web marketplace, the Silk Road. This in turn skewed Bitcoin’s reputation and public perception.

Fortunately, as Bitcoin has continued its meteoric rise in recent years, it’s managed to shake off this association in favor of more widespread acceptance by legitimate merchants.

Uses of Bitcoin

Among the major companies that accept Bitcoin as of 2023 include Tesla, PayPal, Microsoft, KFC, Subway, Shopify and Home Depot. Furthermore, there’s been an increase in the number of institutional investors and crypto whales getting into Bitcoin. It's also increasingly being viewed as a store of value, with many big-time investors joining the action in early 2021.

This unprecedented buying pressure has caused Bitcoin’s price to rise. Cointelegraph said in March 2021 that “Institutions are buying more Bitcoin per month than what’s being mined, and there just isn’t enough for everyone.” As this number grows, the amount of Bitcoin available is becoming more scarce, especially with another Bitcoin halving expected in April 2024.

The Future of Bitcoin

Bitcoin’s future looks promising, but its ultimate fate as a currency could depend on several factors. For starters, crypto’s volatility is well-known, and it needs to shake off this reputation for mainstream adoption to be realized. Merchants will always be reluctant to accept crypto as a form of payment if there’s a good chance its value will decrease. Alternatively, Bitcoin price optimists won’t want to part with it for mundane everyday items, holding onto it instead.

Regulatory Certainty

Because of Bitcoin’s fundamentally decentralized nature, the idea of regulation may seem at odds with what Bitcoin is all about. However, in reality, regulatory certainty is vital for Bitcoin’s mass adoption. While some countries, such as South Korea and Japan, have led the way in providing clear guidelines for the regulation of Bitcoin and other cryptocurrencies, a lot of the world is still lagging behind.

In many countries, the legal status of Bitcoin is still murky. As more governments worldwide introduce regulatory frameworks in the coming years, it will actually give Bitcoin more legitimacy as a mainstream asset.

Furthermore, the anonymous nature of crypto transactions has been a major challenge towards the adoption of digital currencies, due to increased safety and security concerns. However, the addition of Know Your Customer (KYC) protocols on major crypto exchanges — such as Bybit — has helped boost regulatory certainty, making such platforms safer for investors.

User Friendliness

While purchasing goods with fiat currency is straightforward, the same cannot be said for paying with Bitcoin. Despite ubiquitous card payments, the declining use of cash and the convenience of apps like ApplePay (as well as WeChatPay and Alipay in China), the experience of using Bitcoin for transactions remains challenging for most individuals.

Currently, the complexity associated with concepts like hot and cold wallets, as well as understanding public and private keys, poses a significant barrier for the average person. The crypto industry needs to find a way to make buying with Bitcoin more easily digestible.

One way this could be achieved is through increased third-party involvement to expose Bitcoin to a wider mainstream audience through their platforms. For example, PayPal is planning to introduce cryptocurrency sales to its 325 million users. Such a payment gateway could well be a game changer in the mass adoption of Bitcoin and other cryptocurrencies.

Visa and Mastercard have also announced ventures into Bitcoin and cryptocurrency payments, in a sure sign that payment providers are softening their stances.

Blockchain Trilemma: Scalability

Scalability is an ongoing issue for Bitcoin. While a new block on its chain can accommodate around 2,700 transactions (with one block added every 10 minutes), Visa, for example, can accommodate 2,000 transactions per second (TPS). Therefore, it’s obvious that in order to be competitive, Bitcoin’s network needs to make changes in order to improve its scalability. This problem is known as the blockchain trilemma, and several solutions have been put forward, one of which is SegWit.

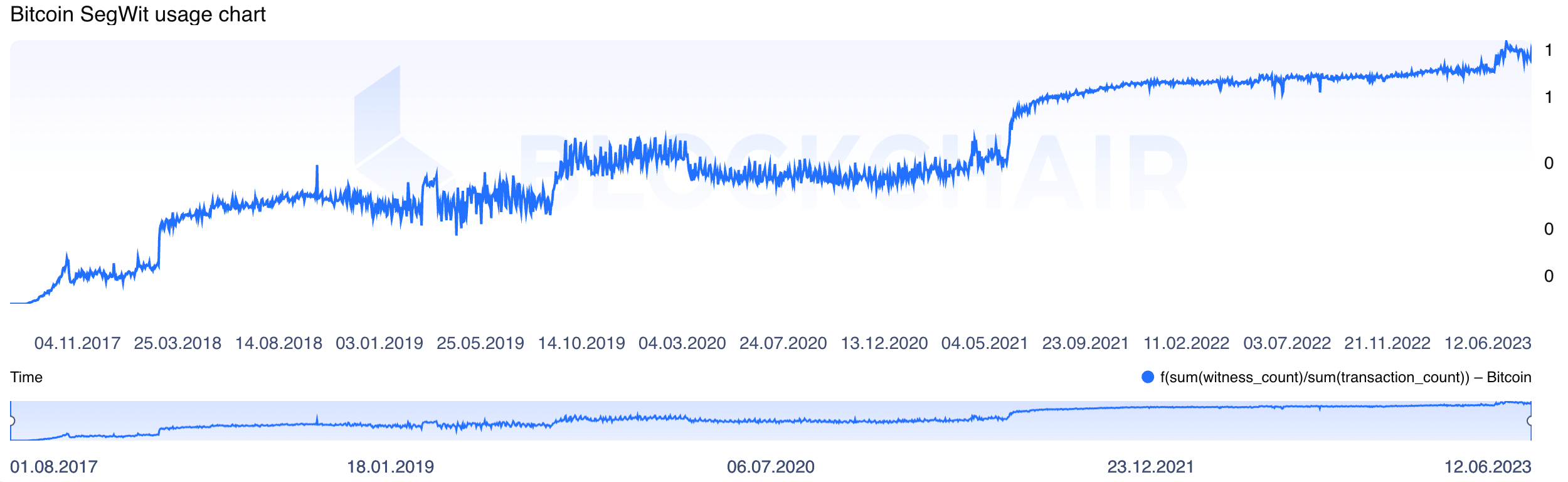

The SegWit soft fork increases the ability to process transactions on a network by segregating the digital signature from transaction data. It’s hoped that eventually, along with other solutions such as the Lightning Network, SegWit will allow millions of transactions per second to be processed on the Bitcoin network. Its usage has steadily increased since its implementation in August 2017.

Digital Gold

Some observers in the crypto industry and beyond proclaim Bitcoin as digital gold. But can this be backed up? It’s certainly limited in supply, like gold, and both assets can be used as mediums of exchange. But it’s arguable as to whether both can serve as a store of value.

Historically, gold has been a trustworthy store of value and a safe haven asset because of its lack of volatility. However, this hasn’t been the case for Bitcoin, which retains its status as a speculative investment. However, its similarities with gold have led some industry analysts to speculate that Bitcoin could well earn this status sooner rather than later.

Bitcoin Price Prediction

As of Jun 12, 2023, Bitcoin’s price was trading around $25,790 with a market cap of $500 billion. This price is a 62% drop from its ATH of $69,044 in Nov 2021, and an increase of over 37,000% from its low price of $67.81 in July 2013.

Over the years, there’s been wide speculation on Bitcoin’s future price, with some crypto believers making highly optimistic BTC price predictions.

According to price analysts at Bitnation, Bitcoin’s price could hit a maximum of $98,090 in 2025 and rise to $227,155 in 2030. Experts at PricePrediction are also highly optimistic about the meteoric rise of Bitcoin price’ predicting it to hit $77,030 in 2025 and jump to $496,845 by 2030.

So, what will $100 of Bitcoin be worth in 2030? If ARK Invest CEO Cathie Wood’s Bitcoin price prediction of $1 million by 2030 comes true, and $100 can buy 0.00388 BTC (based on a current price of $25,790), then your investment will be worth $3,900, a gain of around 3,800% in seven years.

Despite this bullish Bitcoin price outlook, it shouldn’t be taken as financial advice. We highly recommend that you do your own research before buying Bitcoin or any other cryptocurrency.

Potential Rival Cryptocurrencies

From its onset, Bitcoin has reigned king among cryptos when it comes to rankings, remaining at number one based on market capitalization. However, due to various challenges, such as high fees and slow transaction speeds, there’s been a rising number of potential competitors. Some of the digital currencies that investors are turning to instead of Bitcoin include the following.

Ethereum (ETH)

ETH, the native token of the Ethereum blockchain, has grown significantly over the years and is the most popular Bitcoin rival in the cryptocurrency market. Ethereum’s ecosystem is working continuously to upgrade its operations in order to ensure low gas fees and faster transactions.

Some of the significant milestones that Ethereum has implemented recently include its successful migration from a proof of work (PoW) to a proof of stake (PoS) consensus (The Merge). Another catalyst to Ethereum’s growth is the April 2023Shanghai Upgrade, which allows the unstaking of ETH from the Beacon Chain.

At times Ether has outperformed Bitcoin, which crypto enthusiasts consider a sign of alt season (a period when altcoins pump). Based on the continuous improvements to Ethereum, some crypto observers are optimistic that Ether could outperform Bitcoin as the preferred store of value for investors.

SingularityNET (AGIX)

Artificial intelligence (AI) has made its way into blockchain technology.SingularityNET is one of the leading platforms looking to merge AI with blockchain. Built by Hanson Robotics, the team that brought the world the humanlike robot known as Sophia, SingularityNET holds great potential. Its native token, AGIX, continues to rank well amongAI-focused tokens.

The project aims to create a decentralized AI marketplace and eventually open-source artificial general intelligence (AGI). As the AI narrative continues to take the world by storm, we could witness an astronomical increase in the AGIX token due to its utility on the innovative SingularityNET platform.

Sui (SUI)

As one of the latest entrants into the cryptocurrency market,Sui is a Layer 1 blockchain that aims to reduce the latency of executing smart contracts by implementing a fast and secure platform. As one of the most anticipated projects of 2023, Sui is viewed as a major catalyst for the adoption of web3 and its related products.

Created by Mysten Labs, Sui is backed by a leading team of innovators who previously worked for Meta to develop its discontinued digital wallet, Novi.

Sui lets developers get creative without worrying about code. As the native token for the Sui blockchain, SUI is used for staking and paying gas fees for transactions. With innovative products, a thriving ecosystem and a great team behind it, the future of Sui looks bright.

Mantle

Mantle is a leading Layer 2 project built on Ethereum’s secure architecture. It uses a decentralized sequencer to reduce censorship, and optimistic rollup technology to process transactions in batches, leading to low fees.

Mantle’s ecosystem is governed by BitDAO, one of the most popular decentralized autonomous organizations (DAOs). With the passing of the proposal to rebrand the BIT token to MNT, and the expected launch of its mainnet in Q2 2023, Mantle’s use has the potential to explode.

The Bottom Line

Bitcoin is the biggest household name in cryptocurrency. As long as this remains the case, it will always be the major player (market dominance is lower than it was in Bitcoin’s first few years, but is still considerably higher than during the bull run of 2017).

However, several hurdles must be overcome to realize mainstream adoption. The very idea of using it to pay for everyday things is still confusing to the average person on the street, so the industry needs to find a way to simplify matters.

Third-party involvement, such as the alignment with PayPal, could well prove to be the answer. Also, the issue of scalability is something that needs to be overcome.

Thus, how popular Bitcoin actually becomes still remains to be seen. There will be challenges, but the outlook looks good. Exciting times lie ahead, wherever the crypto winds take us.