Crypto volatility trading guide: How to manage risk in unstable markets

The volatility of the crypto market is often thought to be on a scale of its own, with Bitcoin (BTC) and other cryptocurrencies frequently going through head-spinning price roller coasters. In the past few years, the world's leading cryptocurrency asset (and the primary gauge of the overall crypto market's performance), the BTC coin, has experienced wild price swings.

Reviewing just the last couple of years of Bitcoin’s price performance reveals a highly volatile pattern. Between early October 2023 and late March 2024, the cryptocurrency appreciated by 174%, a rate of growth that sounds nearly surreal to a stock market investor. By mid-September 2024, Bitcoin had lost around 21% of those March 2024 highs. It then experienced another price surge, rising 80% between mid-September 2024 and late January 2025. Then, yet another plunge followed, taking BTC’s value down 27% by early April 2025.

With a confident recovery following the April lows, Bitcoin was enjoying a strong uptrend — at least until early October 2025, when it pierced the psychologically significant $120,000 barrier. Yet just five weeks later, at the time of our review in mid-November, the world’s premier crypto is bouncing along at the $100,000 level, another sharp decline in a matter of mere weeks.

What drives the volatility of Bitcoin and the overall crypto market — and how can investors shield themselves from it? In this article, we take a closer look at crypto volatility and the best ways to manage it.

Key Takeaways:

Cryptocurrencies have been characterized by much higher historical volatility levels as compared to traditional assets.

Some key ways of managing crypto volatility include portfolio diversification, hedging, market sentiment tracking and emotion-free investing, in addition to using conservative order types such as stop-loss and take-profit.

Understanding crypto volatility

The volatility of a financial asset is defined as the rate of variation in its price over a specific period of time. Assets with high price volatility are characterized by more pronounced and frequent price fluctuations. More volatile assets are also considered riskier from an investment perspective. However, as any market participant knows, higher risk levels also mean higher return opportunities. In fact, in financial markets, volatility is synonymous with risk.

Volatility is typically measured using the coefficient of variation, which shows an asset's typical magnitudes of change within a defined period. Normally, this volatility is expressed as a percentage.

Crypto volatility vs. traditional market volatility

The crypto market's typical volatility is considerably higher than the average volatility of stock markets, and often exceeds the volatility of commodities markets as well. Even Bitcoin, which is considered far less volatile than smaller-cap altcoins, has much higher volatility levels than traditional financial assets. For example, as of mid-November 2025, Bitcoin’s annualized 30D volatility measure stands at close to 40%, whereas the same metric for the stock market’s primary index, the S&P 500, is around 11%.

The key factors contributing to the crypto market's higher volatility in comparison to traditional markets include:

An immature and still developing market

A large proportion of inexperienced and amateur investors, due to the low barriers to entry into the market

Generally, a younger investor population that makes extensive use of social media — a significant source of hype-driven market sentiment

Relatively low liquidity levels and trading volumes for most assets (other than top coins)

Domination by whales, and the relative ease with which they can affect the overall market direction

Relatively little regulation, which makes the cryptocurrency market particularly susceptible to hype-driven cryptos and scams (although various governments have recently increased the number of regulatory measures aimed at crypto)

The availability of 24/7 trading

Factors influencing crypto volatility

Market sentiment

Sentiment plays an important role in any market, but is particularly influential in crypto markets, as they have lower barriers to entry compared to stock markets. For instance, on many decentralized finance (DeFi) platforms, or even some centralized exchanges (CEXs), you can start investing with just a few dollars and no identity or residence verification requirements. As a result, many novice retail investors have joined the crypto market. These investors often lack the expertise to conduct a thorough technical or fundamental analysis of the market. As a result, they’re often driven by sentiment, particularly social media sentiment and online news.

The relatively younger age of crypto investors compared to stock market participants also makes them more prolific social media users, and social media is the primary source where emotions, hype, opinion and other elements of sentiment around crypto assets are forged. Just ask Elon Musk, one social media influencer with a penchant for swaying sentiment around assets like Bitcoin and Dogecoin (DOGE).

Immature market

The first, rudimentary crypto markets began to emerge around 2010–2011. As such, the crypto market is at most 15 years old. In comparison, trading in stocks has been around for a few centuries, while commodities markets have existed for millennia. The immaturity of the crypto market means that its defining properties and rules are still being actively developed.

Regulatory developments

Compared to traditional markets, the crypto market has low levels of regulation, although this is slowly changing. In the aftermath of the FTX exchange fiasco, regulators in the U.S. and across the globe have enacted, or are in the process of enacting, laws that would better regulate crypto trading and investment. For instance, in 2023, the U.S. Securities and Exchange Commission (SEC) declared a large group of cryptocurrency securities, opening the way to bringing investment in these assets under regulatory control. The approval of 11 spot Bitcoin Spot ETFs in the U.S. in early 2024 has also made many analysts confident about the further stabilizing of crypto prices as more mainstream investors get exposed to Bitcoin.

However, the crypto market in general continues to be much less regulated than stock markets, which acts as one contributor to its notorious volatility.

Macroeconomic events

Macroeconomic indicators like inflation rates, central bank interest rates, GDP growth rates, major free trade agreements and more have the potential to significantly affect the volatility of the cryptocurrency market. In part, this is often caused by the reallocations between asset classes initiated by large institutional investors. As a response to macroeconomic data and forecasts, these investors might shift funds between crypto and other asset classes, such as bonds, stocks or commodities. Since the crypto market has much less liquidity than traditional markets, any such reallocations can greatly affect it.

24/7 trading

Unlike the stock market and other traditional markets, the crypto market is open 24/7 and experiences no interruption to its trading processes. The continuous nature of the market also contributes to its volatility.

Managing and trading through crypto volatility

1. Volatility: Threat and opportunity

Volatility is a double-edged sword: it can destroy your positions quickly but also deliver outsized returns. Experienced crypto traders view volatility as a valuable source of information and a strategic tool, rather than a danger to be avoided at all times.

The key to using volatility to your advantage is to know your risk limits, and to never get carried away when volatility exceeds the levels suitable for your trading strategy.

2. Building a risk stack via portfolio diversification and hedging

Certain trading approaches can amplify the risk involved in volatile markets. For example, the use of leverage — which, in itself is known as a relatively risky strategy — exponentially increases the trading risk caused by market volatility. Additionally, if you invest in highly correlated assets, your losses may also rise sharply if they decline in unison.

The trading risk may also be amplified in cases of overexposure to a single asset or a narrow group with insufficient diversification potential.

Fortunately, there are also some techniques to help you deal with market volatility. Among the most popular ones are portfolio diversification and hedging.

Portfolio diversification

Portfolio diversification is another useful method for managing volatility. By splitting your total investment into different asset types or coins that share low or negative correlations with each other, you can protect your overall portfolio from adverse price movements. For instance, under certain market conditions, Bitcoin may exhibit low correlations with the stock market, primarily non-technology stocks. By splitting your overall portfolio between Bitcoin and non-tech stocks, you could, hopefully, expect positive returns from the latter at times when the former enters a period of losses.

Hedging

Hedging is a popular investment risk minimization approach. In its most classic form, hedging is based on opening offsetting or opposite positions to protect yourself from adverse price movements. Earlier, we noted how put options can be used to manage the volatility of the crypto market. One example of hedging would be to buy a put option on an asset on which you're currently going long. Conversely, you would buy a call option on an asset you're currently shorting as part of your hedging strategy.

Diversify smartly: Spread exposure across uncorrelated assets (e.g., BTC, ETH, stablecoins, and non-crypto investments).

Hedge intentionally: Use put options or offsetting futures to reduce downside during turbulent phases. Together, diversification and hedging form the foundation of a controlled risk stack.

3. Position sizing in volatile markets

Position sizing refers to the number of units a trader allocates to a specific position, taking into account their overall portfolio and risk tolerance. In high-volatility markets, position sizing can help you avoid losses resulting from overreliance on a single asset or position.

Trading professionals use various position sizing methods. One highly popular method involves sizing your trades based on the average true range (ATR), a volatility indicator that measures the average price range over a specified period.

Using the ATR-based sizing method, you size your orders so that the maximum loss, based on your stop level (often a multiple of the ATR), doesn’t exceed a fixed percentage of your portfolio, typically 1–2%. For example, if your target asset has an ATR of $1,000, and you’re using a 2x ATR stop level, size your position so that a $2,000 loss would equal no more than 1–2% of your overall trading portfolio value.

By using smart position sizing, you can reduce the impact of high volatility on both your trades and overall position.

4. Core trade protections

Certain order types and instruments are crucial for managing high levels of market volatility. One of these is the stop-loss order, which can limit your losses when the market turns sharply against you. The advantage of such orders is in the ability to specify some predetermined levels and rely on your trading platform to automatically execute them, with no emotional component or hesitation involved.

If you don’t set such automatic stop-loss levels and rely on manual action to close your positions, you run two significant risks:

The first one is simply the inability to react quickly enough to adverse price swings. When volatility increases, prices can decline so rapidly that even the most experienced traders, glued to their screens, may not have enough time to make informed decisions.

The second risk involves the emotional element: when prices start dropping, you might hesitate to exit your positions, hoping that a reversal is just around the corner. The automatic nature of stop-loss orders completely removes this subjective element.

Another order type critical during market volatility is the take-profit order. These orders help you lock in gains at predetermined levels without hesitation. Just like stop-loss orders, take-profit orders are great for removing emotion from your trading, particularly when high volatility makes it hard to predict where prices will move next.

Finally, put options also provide excellent insurance against sudden market reversals.

Stop-loss orders, take-profit orders and put options should be your defaults, rather than optional tools at times of market volatility. Below, we provide the basic definitions of these trading instruments.

Stop-loss orders

Stop-loss orders come with an instruction to buy or sell an asset when it reaches a certain level, known as the stop price. These orders are widely used to minimize potential trading losses, and can be highly useful for limiting losses in the high-volatility environment of the crypto market.

Take-profit orders

Take-profit orders instruct traders to close a trading position when they achieve a pre-specified profit level. While stop-loss orders are used to minimize losses, take-profit orders are designed to protect profits.

Put options

A put option is an options contract that gives you the right to sell a target asset at a specific price within a specified period. Put options can provide valuable protection against price losses when a high-volatility market suddenly turns bearish.

5. Managing your emotions

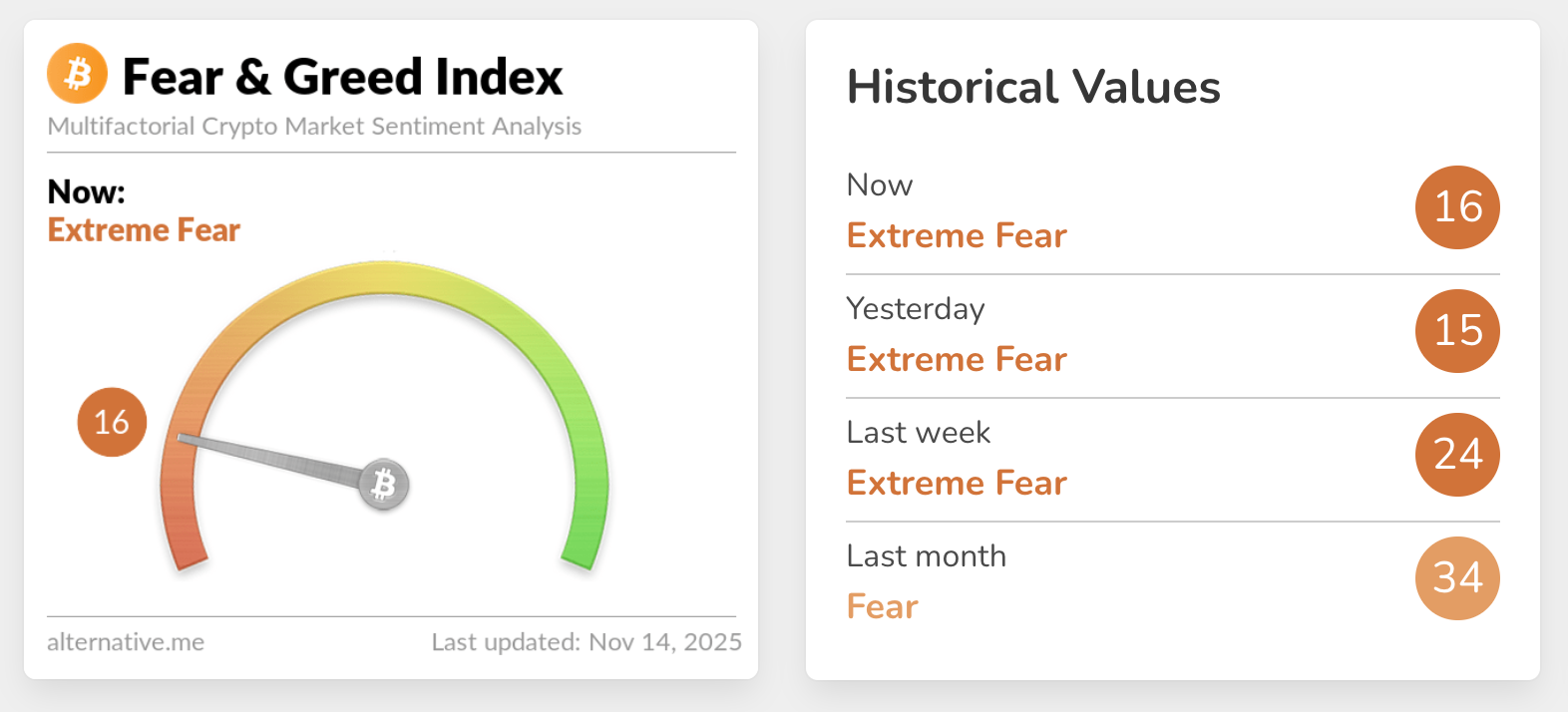

Managing your emotions during trading is a critical skill, particularly in the highly volatile environment of the crypto market. The market is strongly driven by sentiment, and one way to detach yourself from emotion-based trading is to recognize the prevalent sentiment. You can do so by using crypto sentiment indices designed to measure the levels of fear (aversion to buying/predisposition to selling) and greed (aversion to selling/predisposition to buying) dominating the market. One such indicator, the Crypto Fear & Greed Index, is offered by the Alternative.me portal.

Besides using market-wide sentiment measures, strive to base your decisions on thorough research of the crypto of interest to you in order to avoid emotion-based investing. As a minimum, this should include facts about the team behind the project, coin distribution schemes, actual activity on the platform linked to the coin, its road map and white paper, VC capital raised and historical price performance.

6. Pre-trade checklist

To summarize, before you place any trades, ensure that:

You’ve checked whether the current market volatility is above normal (e.g., by using ATR) — and, if so, have properly adjusted your position sizes.

You’ve ascertained that there’s enough liquidity to enter and exit positions safely.

You’ve set appropriate stop-loss and take-profit levels, based on logic and impartial analysis of the market, not on your emotions or hopes.

There are no major geopolitical, regulatory, financial or other notable events currently happening (or about to take place) that can significantly impact the crypto market.

Importantly, you’re in the optimal emotional state to make risky decisions when the market is experiencing high volatility.

Useful trading tools for managing crypto volatility

Volume analysis

Volume analysis involves studying a crypto asset's overall trading volumes (the sum of buying and selling volume) over a period of time, such as 24 hours, 7 days, 14 days, 30 days, 3 months or longer periods. Many analysts believe that volume spikes precede price increases, while volume declines are followed by price losses.

Moving averages (MAs)

Moving averages (MAs) can be an effective visual aid in studying the volatility of crypto assets. The simple MA is derived by calculating the averages for a certain number of the latest price points (e.g., daily closing prices) for a crypto asset. These averages are then plotted along with the main price line on a chart. A typical number for the latest price points used in the calculation is often 5, 10, 20, 50 or 200, and can also vary depending upon the analyst's choice. MA-derived price lines are normally smoother than actual asset price lines, providing a useful visual tool for detecting upcoming trend reversals.

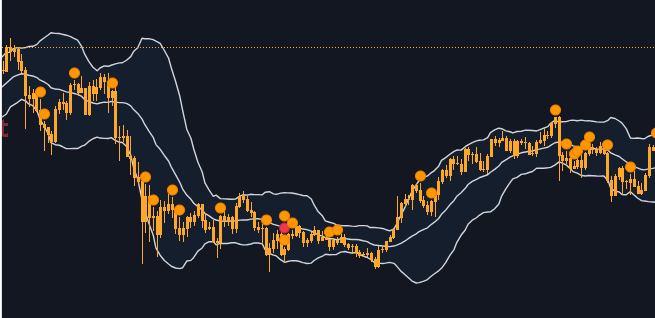

Bollinger Bands

Bollinger Bands® are a visual tool for identifying trends and momentum for an asset. A Bollinger Band chart consists of three lines — a 20-day moving average price line, an upper line set at two standard deviations above the MA line and a lower line set at two standard deviations below the MA line. The number of periods for the MA line and the number of standard deviations used for the upper and lower lines can be modified, depending upon the analyst's preferences.

Average true range

The average true range (ATR) indicator is a 14-day moving average of true ranges for an asset. Each true range value is the largest difference between the asset's most recent high and most recent low. ATR is a useful measure for assessing the price volatility of an asset.

Fibonacci retracement

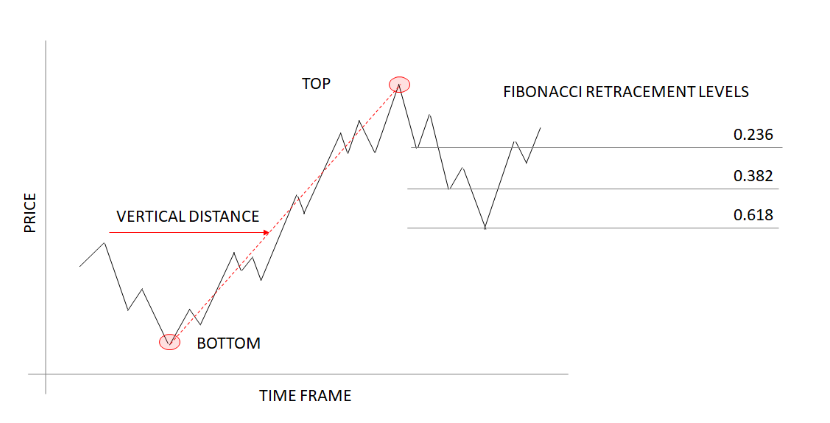

Fibonacci retracement is a valuable tool for assessing price volatility and identifying support and resistance levels. Using Fibonacci retracement, you first consider two price extremes for a given period on the price chart: the swing high and the swing low. You then calculate and plot several price points within the range, as horizontal charts. These price points typically correspond to 23.6%, 38.2%, 50%, 61.8% and 78.6% of the range. The percentages are based on Fibonacci numbers, which occur in many sequences in the natural world. When the asset price touches the horizontal Fibonacci levels on the chart, it provides an indication to traders concerning potential price reversals, consolidations and breakouts.

Relative strength index (RSI)

The relative strength index (RSI) indicator is a technical analysis measure that indicates whether an asset is overbought (due for a correction) or oversold (due for a recovery). RSI represents a value between 0 and 100. Values above 70 indicate that an asset is overbought, while values below 30 signal an oversold asset.

Closing thoughts

Crypto market volatility presents significant challenges and unique profit opportunities for investors who aren't shy of high-risk/high-return environments. The immaturity of the crypto market, alongside its low levels of regulation, 24/7 trading opportunities and high susceptibility to sentiment-driven swings will continue to shape the nature of crypto trading. In this environment, it's critical for traders and investors to manage high levels of volatility using the methods, indicators and order types we've outlined above.

#LearnWithBybit